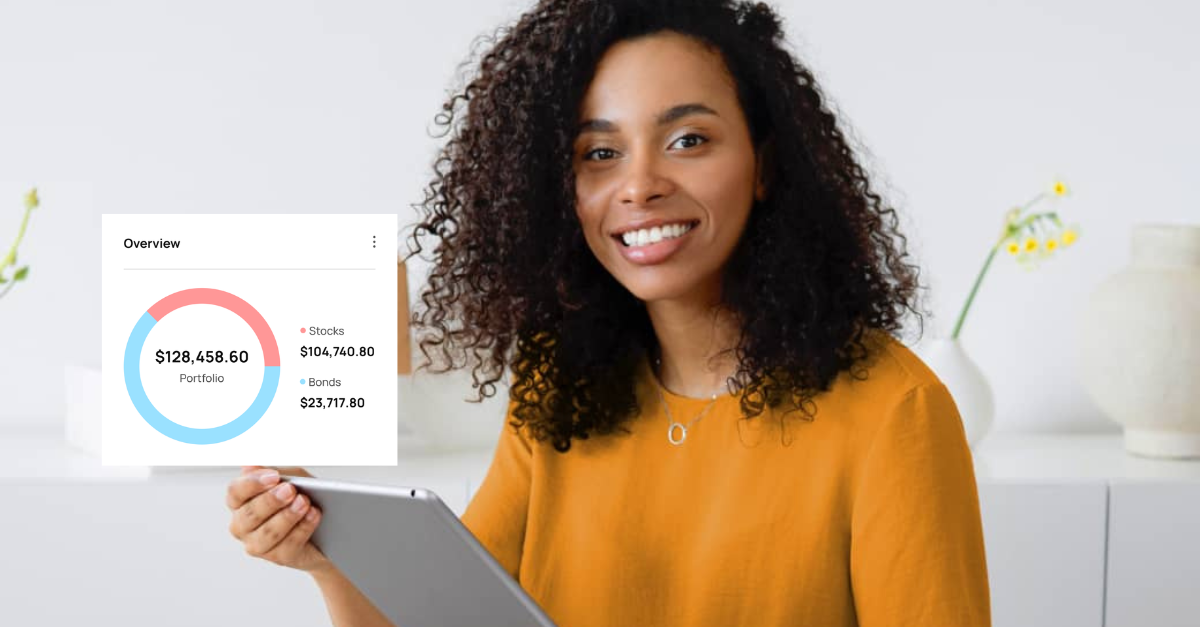

🎥 Watch: Learn how expats in Germany can plan for retirement efficiently with independent advice from Finanz2Go.

Retirement Planning for Expats in Germany

Planning your retirement in Germany as an expat can be challenging — the language, laws, and pension structure are unique. At Finanz2Go, we make it easy for English-speaking professionals to build wealth and prepare for the future. This guide explains how to combine Germany’s state pension system, employer benefits, and private investments to secure long-term financial independence.

📚 This article is part of our Financial Hub for Expats — a learning center covering investing, tax planning, and pensions for internationals living in Germany.

💡 Why Retirement Planning Matters for Expats

Germany’s pension system is reliable but not designed around international mobility. Expats often contribute for only a few years or across several countries, which can leave gaps in future income. Without early planning, you may receive only half of your current salary in retirement — or less.

- 📈 Longevity: Life expectancy in Germany is among the highest in Europe (Eurostat data), meaning longer retirement periods to finance.

- 🇩🇪 Complex System: Understanding how Gesetzliche Rente, company pensions, and private plans interact can be confusing.

- 💶 Inflation & Taxes: Inflation slowly erodes purchasing power; tax-efficient investments help offset this effect.

- 🌍 International Mobility: Many expats move again after a few years; portability of pensions is essential.

That’s where Finanz2Go’s Pension Consulting service comes in — providing independent, bilingual advice that aligns with German law and your long-term international plans.

Expert Tip: The earlier you start, the stronger the compound effect. A one-year delay in saving €300 monthly at 5 % interest can cost you over €25 000 in lost returns by retirement.

📅 Book a Free Retirement Consultation with Finanz2Go

🏛️ The Three-Pillar German Pension System Explained

Germany’s retirement system follows the OECD’s three-pillar model. Each pillar offers unique benefits and can be combined for optimal security and flexibility.

| Pillar | How It Works | Best For |

|---|---|---|

| 1️⃣ State Pension (Gesetzliche Rente) | Funded by social-security contributions (≈ 18.6 % of gross salary shared by employer and employee). Benefits depend on contribution years and income points. | Employees under German contracts contributing to Deutsche Rentenversicherung. |

| 2️⃣ Company Pension (Betriebliche Altersvorsorge) | Employer-sponsored plan; contributions often tax-deductible and may include employer matching (usually up to 15 %). | Expats employed by medium or large companies in Germany. |

| 3️⃣ Private Pension (Private Altersvorsorge) | Voluntary individual savings — typically ETF-based or insurance-linked plans such as Riester and Rürup. Offers flexible investment choices and tax benefits. | Freelancers, entrepreneurs, and mobile professionals who want to close their pension gap. |

Understanding how each pillar interacts is essential for effective long-term planning. Our pension consulting experts evaluate your personal situation — contributions, contracts, and residency — to build a balanced retirement strategy.

📉 Identifying and Closing Your Pension Gap

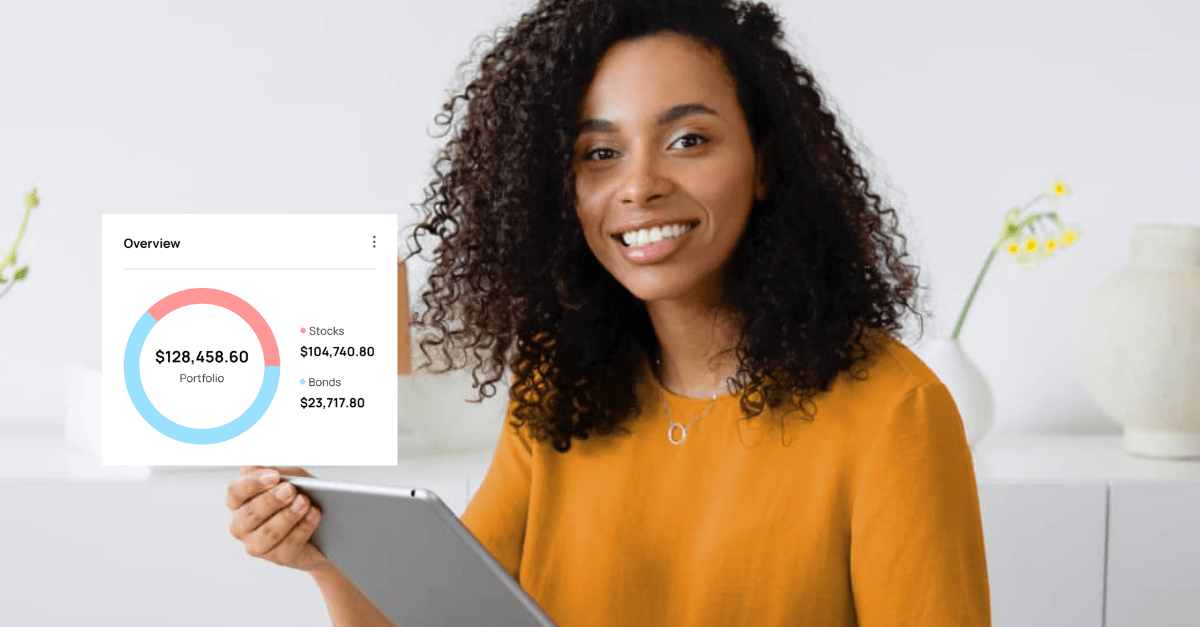

Most expats experience a significant pension gap — the difference between the income needed in retirement and what statutory and company pensions will actually provide.

💡 Use our Pension Gap Calculator Germany to estimate how much extra you should save monthly to maintain your lifestyle.

- 📊 Average replacement rate (state pension): ≈ 48 – 50 % of last income

- 💰 Ideal target replacement rate: ≈ 75 – 80 %

- ⚠️ Typical shortfall for expats: 20 – 30 %

By combining private investment plans, tax-efficient pension products, and disciplined saving, you can bridge that gap. Consistent investing through ETF saving plans is one of the most effective solutions.

Example: A 35-year-old expat earning €70 000 who invests €400 monthly into a tax-advantaged ETF pension could accumulate ≈ €300 000 by age 67 (5 % annual return).

💶 Compare Pension and Investment Fees

💰 Private Pension Options for Expats in Germany

Private pensions complement the state and company systems and offer flexibility, higher growth potential, and important tax advantages. As an expat, you can combine German and international plans to build the right mix of stability and return.

1️⃣ Rürup Pension (Basisrente)

The Rürup pension is designed for self-employed professionals and freelancers in Germany. Contributions are tax-deductible, and funds are invested in a combination of fixed-income and ETF-based portfolios.

- ✅ Up to €26 528 (single) or €53 056 (married) tax-deductible in 2026

- ✅ Flexible investment profiles

- ⚠️ Payments start only at retirement age – no early withdrawal

2️⃣ Riester Pension

Best for employees contributing to the German social-security system. The Riester plan offers annual government bonuses and potential tax refunds.

- ✅ Annual basic bonus €175 + child bonus €185–€300 per child

- ✅ 100 % capital guarantee at retirement

- ⚠️ Less flexible – mainly in EUR-based insurance wrappers

3️⃣ ETF-Based Private Pension

ETF pensions combine long-term growth with flexibility and low cost. Contributions can be adjusted or paused — ideal for mobile expats.

- ✅ Low cost (0.2–0.6 %) and globally diversified

- ✅ Flexible withdrawal and relocation options

- ✅ Transparent — no hidden commissions

See our detailed guide: ETF Investing for Expats.

💶 How Retirement Income Is Taxed in Germany

Understanding taxation is key to maximizing your net income in retirement. Germany taxes pensions progressively, but with allowances that can be optimized.

| Income Type | Tax Treatment | Notes |

|---|---|---|

| State Pension | Gradually taxable up to 100 % by 2040 | Portion exempt depends on year of retirement |

| Company Pension | Fully taxable as regular income | Contributions often pre-tax → deferral benefit |

| Rürup / Riester | Deferred taxation – taxed when received | Large up-front deductions during contribution years |

| ETF / Investment Portfolio | 25 % capital-gains tax + surcharge | Use tax-efficient wrappers to minimize liability |

👉 Learn more about double-taxation relief on the German Ministry of Finance portal.

Example: A retiree with €30 000 in annual pension income may pay only ≈ €2 500 tax after allowances — much lower than during working years.

💰 Estimate Your After-Tax Returns with Our Fee Calculator

🌍 What Happens If You Leave Germany Before Retirement?

Many expats wonder whether they lose their pension rights after moving abroad. The good news — in most cases, you don’t. Your German pension entitlements remain valid and can usually be paid anywhere in the world.

- ✅ Germany has social-security agreements with over 50 countries.

- ✅ EU/EEA citizens receive pro-rated pensions from each member state.

- ✅ Non-EU expats can claim benefits abroad or receive refunds of contributions under certain conditions.

- ⚠️ Private pensions may have country-specific tax rules — always check before relocation.

Planning Tip: If you expect to move countries, choose flexible, portable solutions like ETF-based pensions or international investment accounts that can travel with you.

📅 Book Your Cross-Border Retirement Consultation

🔍 Coming Up Next

In the final part of this guide, you’ll learn how to build a complete retirement strategy, avoid common mistakes, and see real-life expat examples. We’ll also add a dedicated FAQ section and CTAs to help you act on your plan immediately.

📈 Real-Life Retirement Planning Examples

Let’s look at how expats with different goals have built effective retirement strategies with the help of Finanz2Go advisors.

👩💻 Anna from the UK – Freelancer, Age 34

Anna contributes to the Rürup pension for tax deductions while investing €300 monthly in an ETF savings plan. Together, these give her both tax savings today and flexibility for the future.

👨🔬 David from the US – Engineer, Age 42

David combines his German state pension with a company pension and a private ETF-based portfolio. He uses the Pension Gap Calculator yearly to adjust contributions as income grows.

👩🏫 Maria from Spain – Teacher, Age 48

Maria expects to retire partly in Spain. Finanz2Go helped her design a cross-border plan combining German pension benefits with Spanish taxation rules under the Germany–Spain tax treaty.

❓ Frequently Asked Questions (FAQs)

1️⃣ How does the German pension system work for expats?

It’s based on three pillars — state, company, and private pensions. Expats can contribute to one or all three depending on employment type. Read more at Deutsche Rentenversicherung.

2️⃣ Can I combine German and foreign pension rights?

Yes. EU and treaty countries coordinate pension entitlements so your contributions count across borders. Finanz2Go helps ensure your benefits remain portable.

3️⃣ Are private pensions tax deductible in Germany?

Rürup contributions are deductible up to €26 528 in 2026; Riester plans give state bonuses. ETF pensions provide deferred taxation. Learn more via the BMAS guide.

4️⃣ What’s the difference between Rürup and Riester pensions?

Rürup suits self-employed expats with high income; Riester targets employees with social-security contributions. Our pension consulting compares both.

5️⃣ How can I calculate my pension gap?

Use the Pension Gap Calculator to compare expected retirement income to your target lifestyle needs.

6️⃣ What happens to my pension if I leave Germany?

You keep your rights. Germany pays pensions abroad and has social-security treaties with 50+ nations (DRV international).

7️⃣ How do ETF savings help with retirement?

ETF plans build long-term capital at low cost. They complement pensions and are easy to manage using our ETF Saving Plan Calculator.

8️⃣ Can Finanz2Go help me transfer or optimize my existing pension?

Yes. Our team reviews existing contracts and recommends restructuring or consolidation options to improve returns and reduce costs.

✅ Start Planning Your Retirement Today

Whether you plan to stay in Germany or retire abroad, your financial future starts with informed action today. Finanz2Go’s independent advisors create a plan that fits your goals, tax situation, and international lifestyle.

- 🔍 Understand your pension gap with the Pension Gap Calculator.

- 📈 Explore tax-efficient investing via ETF Investing for Expats.

- 💬 Read about Taxes on Investments in Germany.

- 📊 Use the Financial Tools Library for calculators and simulations.

🎯 Ready to Secure Your Retirement?

Book a free, no-obligation consultation with our English-speaking financial advisors today.

← Back to the Financial Hub for Expats