Portfolio Risk & Allocation Builder

Answer a few questions to get a suggested stock/bond split and a simple risk score (educational estimate).

Inputs

Optional fine-tuning

*Educational tool only. This does not consider your full situation, taxes, or product constraints.

Results

Portfolio Risk Calculator for Expats in Germany

Understanding your portfolio risk is one of the most important steps in building a successful long-term investment strategy — especially if you’re an expat living in Germany. Whether you’re saving for retirement, investing in ETFs, or managing a diversified portfolio, knowing how much risk you can afford helps you make smarter, more confident decisions.

At Finanz2Go Consulting, we’ve designed the Portfolio Risk Calculator to help English-speaking expats assess their risk tolerance, understand asset allocation, and align their investments with personal goals and time horizons.

Why Portfolio Risk Matters for Expats

Every investment carries some level of uncertainty — known as risk. The key is not to eliminate risk, but to understand and manage it. For expats living in Germany, managing portfolio risk can be even more complex due to foreign income sources, currency differences, and unfamiliar tax systems.

Here’s why assessing portfolio risk is essential:

- 📈 Long-Term Stability: The right level of risk allows your investments to grow steadily without emotional overreactions during market downturns.

- 🧭 Personal Alignment: Your age, financial goals, and comfort with volatility determine your optimal risk profile.

- 💶 Tax Efficiency: Understanding how risk affects your taxable returns can optimize net performance. Learn more in our Taxes on Investments Guide.

- 🌍 Cross-Border Relevance: As an expat, your financial structure may include accounts in multiple countries — understanding total exposure helps avoid unwanted concentration risks.

What Is Portfolio Risk?

In simple terms, portfolio risk measures the likelihood that your investments will fluctuate in value over time. Higher risk means higher potential returns — but also larger short-term losses. Lower risk provides stability but can limit long-term growth.

For expats managing their own investments, risk assessment can be difficult. That’s why the Portfolio Risk Calculator simplifies this process by estimating your ideal stock-bond allocation based on your profile.

Tip: The calculator is educational and offers an indicative split — not investment advice. For a detailed, personalized analysis, book a free consultation with a Finanz2Go advisor.

How the Portfolio Risk Calculator Works

The Finanz2Go Portfolio Risk Calculator uses your inputs — age, investment horizon, goals, and emotional response to volatility — to estimate a suitable mix of stocks and bonds. This model aligns with international investment research and Morningstar’s risk framework.

Inputs You’ll Provide

- 🧓 Age: Helps define your investment horizon and risk capacity.

- ⏳ Time Horizon: The number of years until you need the money.

- 🎯 Investment Goal: Growth, balance, or capital preservation.

- 📉 Market Reaction: How you respond to potential short-term losses.

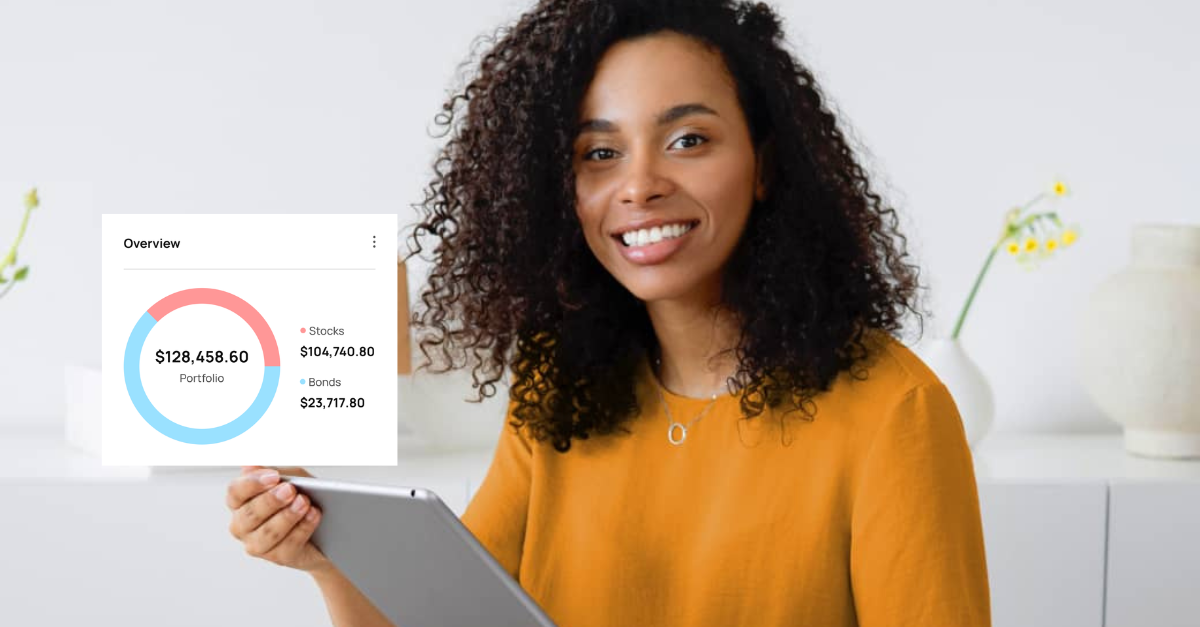

What You’ll Receive

- 📊 A recommended stock-bond split (e.g., 60% equity / 40% bond).

- 📈 An indicative risk score from 1 (conservative) to 10 (aggressive).

- 💬 Insights on how to improve diversification and balance risk vs reward.

Try it now: Portfolio Risk Calculator

Understanding Risk Tolerance vs Risk Capacity

One of the most misunderstood aspects of investing is the difference between risk tolerance and risk capacity.

- Risk Tolerance: Your emotional comfort with market ups and downs. If a 20% drop keeps you awake at night, your tolerance is lower.

- Risk Capacity: Your financial ability to take on risk based on income, savings, and time horizon.

For example, a 30-year-old engineer with 35 years until retirement typically has high risk capacity, even if their risk tolerance is moderate. Conversely, a 60-year-old expat nearing retirement might have low capacity for volatility even if they’re comfortable with it psychologically.

The Portfolio Risk Calculator helps bridge these two dimensions to produce a balanced allocation suited to your personal situation.

How Diversification Reduces Risk

Diversification is one of the most effective tools for managing portfolio risk. Instead of trying to predict which asset will perform best, diversification spreads your investments across multiple asset classes, sectors, and regions — reducing the impact of any single loss.

In Germany, ETFs make diversification easier and more cost-efficient than ever before. By combining global equity ETFs with bond ETFs and perhaps some REIT exposure, you can create a well-balanced portfolio that fits your goals and risk tolerance.

- 🌍 Global diversification: ETFs like MSCI World or MSCI ACWI offer exposure to thousands of companies worldwide.

- 💶 Eurozone bonds: Provide income stability and offset equity volatility.

- 📈 Emerging markets: Add growth potential (but also higher volatility).

- 🏠 Real assets: Optional exposure to property or commodities for inflation protection.

Pro Tip: Try our ETF Saving Plan Calculator to test how different risk profiles affect long-term outcomes.

Example Portfolio Risk Levels

Below are simplified examples showing how different allocations affect portfolio volatility and growth potential:

| Profile | Stock Allocation | Bond Allocation | Expected Volatility | Potential Long-Term Return |

|---|---|---|---|---|

| Conservative | 30% | 70% | Low | ~3–4% p.a. |

| Balanced | 60% | 40% | Medium | ~5–6% p.a. |

| Growth | 80% | 20% | High | ~6–8% p.a. |

The Portfolio Risk Calculator helps identify where you fit best — balancing growth ambition with your ability to withstand short-term fluctuations.

Case Studies: Expats Managing Portfolio Risk

Case Study 1 – The Long-Term Planner

Mark, 34, from Canada, works in Munich and plans to stay in Germany for the next 15 years. Using the calculator, he discovered his optimal risk score was **7 out of 10**, suggesting a 70/30 stock-to-bond portfolio. He set up a monthly investment plan with Finanz2Go Asset Management to automate his strategy. After one year, he reports feeling more confident and less emotional about market changes.

Case Study 2 – The Family-Focused Saver

Maria and Thomas, both 42, are expats from Spain living in Frankfurt with two children. Their goal is to save for education and retirement, so they opted for a **balanced 60/40** allocation. They use both the Pension Gap Calculator and the Investment Goal Calculator to project long-term needs. By understanding their risk capacity, they were able to avoid overexposure to equities and focus on steady progress.

Case Study 3 – The Risk-Aware Professional

Kevin, 50, from Singapore, recently relocated to Berlin for work. He wanted to maximize returns but was unsure about the German tax implications of ETF investments. After using the Portfolio Risk Calculator, Kevin consulted Finanz2Go’s Investment Consulting team to fine-tune his portfolio. Together, they created a 50/50 mix of ETFs and bonds optimized for tax efficiency and lower volatility.

Risk Management Strategies for Expats

Even after determining your ideal risk level, ongoing risk management is essential. Here are key strategies used by Finanz2Go when advising expats:

- 🔁 Periodic Rebalancing: Adjust portfolio weights annually to maintain your target allocation.

- 🛡️ Emergency Fund: Keep 3–6 months of expenses in cash or a savings account.

- 🌍 Currency Diversification: Combine EUR-based and USD-based ETFs to reduce exchange-rate exposure.

- 💬 Tax-Optimized Instruments: Use accumulating ETFs for deferred taxation.

- 📅 Long-Term Discipline: Stay invested — avoid emotional reactions to short-term volatility.

Learn more about how these strategies fit into your personal plan through a free session with an advisor: Book a consultation.

How to Use the Portfolio Risk Calculator

The Portfolio Risk Calculator is designed to be intuitive, quick, and educational — helping you assess your comfort level with different investment risks in just a few minutes.

Step-by-Step Guide

- Enter your age and investment horizon (in years).

- Choose your investment goal: wealth accumulation, balanced growth, or capital preservation.

- Indicate how you’d react to a market decline (e.g., –10% or –20%).

- View your personalized risk score and suggested stock/bond allocation.

- Use this result as a starting point to optimize your overall investment strategy.

The calculator uses principles of **modern portfolio theory** and **volatility modeling** to align risk with your financial profile — all in plain English, without financial jargon.

It’s fully integrated into the Finanz2Go Tools Suite, allowing you to cross-reference results with:

This ecosystem helps expats make confident financial decisions in a complex regulatory environment like Germany’s.

Frequently Asked Questions (FAQ)

What is portfolio risk?

Portfolio risk is the potential variability in your investment returns. It reflects how much your portfolio value might fluctuate over time due to market changes.

How do I know my risk tolerance?

Your risk tolerance is determined by your comfort with market volatility, financial goals, and personal situation. The Portfolio Risk Calculator helps estimate this balance for you.

Can my risk profile change over time?

Yes — as your income, age, and financial goals evolve, your ability to take risk also changes. Reassess your profile regularly, especially after major life events.

Are the calculator results the same as professional advice?

No. The calculator offers a starting point. For personalized advice based on your full financial picture, consult with Finanz2Go’s certified advisors.

Is this calculator free to use?

Yes. The tool is completely free and developed for expats in Germany who want to better understand their investment strategy before committing capital.

Optimizing Your Portfolio With Finanz2Go

Understanding your risk profile is just the beginning. With Finanz2Go Consulting, you can turn that insight into a comprehensive, tax-efficient investment strategy — built for your life in Germany.

We combine advanced portfolio analytics with human expertise, offering:

- Personal Investment Consulting

- Independent Asset Management

- Pension & Retirement Planning

- Insurance Risk Consulting

Example: Many expats find their portfolios are overly weighted toward their home country. Finanz2Go helps create balanced global allocations — mitigating currency risk and optimizing tax efficiency under German regulations.

Want to see how your portfolio risk translates into long-term results? Try combining the Portfolio Risk Calculator with the Investment Goal Calculator for deeper insight.

Final Thoughts

Managing risk isn’t about avoiding volatility — it’s about controlling it in a way that supports your goals and lets you sleep well at night. As an expat, balancing multiple financial systems can feel daunting, but with clear data, structured tools, and trusted advice, you can make informed decisions confidently.

Use the Portfolio Risk Calculator today to understand your ideal investment balance — and take the first step toward financial independence in Germany.

Continue learning in our Financial Hub for Expats or explore related tools: