On this page

Planning for your retirement in Germany can feel a bit like trying to solve a puzzle, especially with all the different options out there.

The state pension is a good start, but it often doesn't cover everything you might want or need later on.

That's where pension optimization comes in. It's all about making smart choices now to boost your future income, so you can enjoy your retirement without worrying about money. Let's break down how to make your pension work harder for you.

Financial Advisory for Expats in Germany

In our free digital 1:1 consultation, our independent investment advisors help you develop a plan for your wealth accumulation that fits your financial goals.

Key Takeaways

- Start saving for retirement as early as possible to benefit from compound interest, which significantly increases your savings over time.

- Don't rely only on the statutory pension; combine it with occupational and private pension plans for a more secure financial future.

- Take full advantage of employer matching contributions in occupational pension schemes – it's essentially free money for your retirement.

- Consider Riester and Rürup pensions, as they offer significant tax advantages and government subsidies, especially for specific income groups.

- Regularly check your pension statements to track your progress and adjust your contributions if you're falling short of your retirement goals.

- Diversifying your pension investments across different types of plans helps spread risk and protect against market fluctuations.

- Be mindful of inflation and administrative fees, as they can reduce the real value and growth of your pension savings over the years.

- Seek advice from financial professionals to navigate the complexities of pension planning and make informed decisions tailored to your situation.

Understanding the Pillars of German Pension Provision

The German pension system is built on a foundation of three distinct pillars, each playing a role in securing your financial future during retirement. It's not just about the state pension; understanding how these different parts work together is key to optimising your income.

The Foundation: Statutory Pension Insurance

This is the bedrock of retirement provision for most people working in Germany. It's a compulsory system, meaning contributions are automatically deducted from your salary. Both you and your employer contribute a percentage of your gross earnings to this fund.

The idea is that current contributions pay for current pensions, a principle known as solidarity. While it provides a basic safety net, it's often not enough on its own to maintain your pre-retirement lifestyle. The contribution rate is currently 18.6% of gross wages, split equally between employee and employer. This system is managed by the Deutsche Rentenversicherung, which is the statutory pension insurance provider.

Enhancing Security: Occupational Pension Schemes

Often referred to as 'Betriebliche Altersvorsorge' (bAV), these are employer-sponsored pension plans. They offer a way to build additional retirement savings on top of your statutory pension. Many employers offer matching contributions, meaning they'll contribute to your pension pot if you do. This is a significant benefit, essentially free money towards your retirement. Vesting periods and payout options can vary, so it's important to understand the specifics of your employer's scheme.

Personalised Growth: Private Pension Plans

This pillar is all about individual initiative. It includes voluntary savings and investments made through private insurance companies or investment funds. Plans like Riester and Rürup pensions fall into this category, often with government subsidies or tax advantages. These plans offer flexibility and the potential for higher returns, allowing you to tailor your retirement savings to your specific needs and risk tolerance. They are a vital component for bridging any potential gaps left by the statutory pension.

The Interplay Between Pension Pillars

No single pillar works in isolation. The statutory pension provides the base, occupational schemes add a valuable employer-backed layer, and private plans offer personalised growth and flexibility. A well-rounded retirement strategy involves understanding how these three pillars complement each other. For instance, maximising employer matching contributions in an occupational scheme can significantly boost your savings with minimal personal outlay. Similarly, using tax-advantaged private plans can make your savings grow more efficiently. It's about creating a robust financial structure that can support you comfortably throughout your retirement years.

Assessing Your Current Pension Entitlements

Before you can optimise, you need to know where you stand. Regularly checking your pension statements from the Deutsche Rentenversicherung is a good start. These statements provide an overview of your accumulated pension points and an estimate of your future pension. For occupational and private plans, you'll receive statements from your employer or the respective provider. Understanding these figures allows you to identify any shortfalls early on.

Forecasting Future Pension Benefits Accurately

Predicting your future pension income involves looking at several factors: your current contribution history, expected future earnings, potential changes in contribution rates, and the performance of any private investments. Online calculators and consultations with financial advisors can help you create a more accurate forecast. Remember that inflation can erode the purchasing power of your future pension, so it's wise to factor this in. Understanding your pension is the first step to a secure future.

The Role of Pension Contributions Over A Career

Your pension benefits are directly linked to how much you contribute and for how long. Consistent contributions throughout your working life are generally more beneficial than sporadic large contributions. Even periods of lower earnings or career breaks can impact your final pension amount. Understanding how these contributions accumulate and affect your overall entitlement is fundamental to effective pension planning. The longer you contribute, the more secure your retirement income will likely be.

Maximising Your Statutory Pension Contributions

The statutory pension insurance forms the bedrock of retirement provision for most people in Germany. While it offers a reliable foundation, it's often not enough on its own to maintain your pre-retirement lifestyle. Therefore, understanding how to maximise your contributions to this system is a smart move for boosting your future income.

Understanding Pension Point Accumulation

Your statutory pension is calculated using pension points, which you earn based on your income relative to the average earnings of all insured individuals in a given year. Earning more pension points directly translates to a higher pension payout. The key is to consistently earn as many points as possible throughout your working life.

- Earning Points: You gain points for every year you contribute. If your income matches the average, you get one point for that year. Earning more or less than the average adjusts the points accordingly.

- Impact of Income: Higher earnings mean more points, up to the contribution ceiling. Lower earnings result in fewer points.

- Child-Rearing Credits: Time spent raising children also earns you pension points, which can significantly boost your overall accumulation, especially if you took career breaks.

The Impact of Contribution Duration

Beyond the amount you earn, the sheer length of time you contribute to the statutory pension system plays a vital role. Each year of contributions adds to your pension entitlement. A longer contribution history generally leads to a more substantial pension.

- Minimum Contribution Periods: There are minimum periods required to be eligible for certain benefits.

- Increased Benefits: Every additional year contributes to your pension calculation, meaning longer careers result in higher payouts.

- Early Retirement: While possible, retiring early often means a reduced pension due to fewer contribution years and a longer payout period.

Calculating Your Future Pension Value

Estimating your future pension can seem complex, but it's based on a straightforward formula: your total accumulated pension points multiplied by a pension value factor and your current pension contribution rate. While the exact figures change annually, understanding the principle helps you see the direct impact of your contributions.

The statutory pension is calculated using your accumulated pension points, the current pension value, and a factor reflecting the contribution rate. It's a system designed to reward consistent contributions over a long period.

Voluntary Contributions for Enhanced Benefits

If you're in a financial position to do so, making voluntary contributions can be a strategic way to increase your pension. This is particularly useful if you have gaps in your contribution history or want to accelerate your pension accumulation. You can find more information on how to transfer your pension here.

The Influence of Lifetime Earnings

Your total earnings over your entire working life are the primary driver of your pension points. Higher lifetime earnings mean a higher average income, leading to more pension points and, consequently, a larger pension. This underscores the importance of career progression and maximising your earning potential.

Navigating Contribution Limits

There are limits to how much income is subject to pension contributions, known as the contribution assessment ceiling (Beitragsbemessungsgrenze). Income above this limit does not earn additional pension points. Understanding these limits helps you focus your efforts on earnings within the relevant bracket.

Tax Implications on Statutory Pensions

While contributions to the statutory pension are tax-deductible up to a certain limit, the pension payments you receive in retirement are taxable. The extent of this taxation depends on when you started contributing and when you begin receiving your pension. It's a pay-as-you-go system with evolving tax rules.

Leveraging Occupational Pensions for Growth

Occupational pensions, often called company pensions, are a really important part of building a solid retirement fund in Germany. They're basically pensions set up by your employer, and they can make a big difference to how much money you have when you stop working. It's not just about getting a bit extra; these schemes can significantly boost your overall retirement income, especially when you consider the benefits they offer.

The Advantage of Employer Matching Contributions

This is where things get interesting. Many employers offer to match a portion of your contributions. This means for every euro you put in, your employer might put in another euro, or a percentage of it. It's essentially free money towards your retirement. This employer matching can dramatically speed up the growth of your pension pot. For example, if you contribute €100 per month and your employer matches 50%, that's an extra €50 going into your pension each month, completely on top of your own savings. It’s a smart way to get more out of your pension savings without having to dig deeper into your own pocket.

Choosing the Right Occupational Pension Scheme

There are a few ways these schemes can work. The most common is 'Direktversicherung' (direct insurance), where the employer takes out a life insurance policy for you. Another is 'Pensionskasse' (pension fund), which is a separate legal entity. Then there's 'Direktzusage' (direct commitment), where the employer promises a pension directly. Each has its own rules regarding contributions, payouts, and flexibility. It's worth understanding which type your employer offers and how it aligns with your personal financial situation. The Second Occupational Pension Strengthening Act (BRSG II) is a recent development aimed at improving these schemes, making them a more foundational part of retirement planning in Germany.

Integrating Occupational Pensions with Other Plans

Your company pension doesn't exist in a vacuum. It should work alongside your statutory pension and any private plans you have. Think of it as a key piece of a larger puzzle. By coordinating these different streams, you can create a more robust and balanced retirement income. For instance, if your statutory pension looks a bit light, a strong occupational pension can help fill that gap. It’s about making sure all your retirement savings are working together efficiently.

Understanding Vesting Periods and Payouts

When you join an occupational pension scheme, there's usually a 'Vorratszeit' or vesting period. This is the minimum time you need to be employed or contribute before the employer's contributions are fully yours. Once vested, the money is yours even if you leave the company. Payouts can typically be taken as a lump sum or as a lifelong monthly pension. The choice often depends on your personal needs and tax implications at the time of retirement. It’s important to know these rules so you aren't caught off guard.

The Role of Company Pension Funds

Company pension funds are managed by the employer or a third party. They invest the contributions to grow your retirement savings. The performance of these investments directly impacts your final pension amount. While employers are responsible for setting them up, employees benefit from the potential for growth. It’s a good idea to understand how your fund is invested and its historical performance, though direct control is usually limited.

Maximising Employer Contributions Effectively

To really make the most of your occupational pension, you need to understand your employer's matching policy. Always aim to contribute enough to get the full employer match. If your employer matches up to 50% of your contributions, and you can afford to contribute 4% of your salary, do it. That 4% from you becomes 6% from the combined contributions. It’s a straightforward way to increase your savings significantly without extra personal cost. Don't leave that employer match on the table; it's one of the most effective ways to boost your pension.

Assessing Employer-Sponsored Pension Benefits

Regularly check your statements for occupational pensions. These statements will show your current accumulated value, any employer contributions, and projected future benefits. Understanding these figures helps you gauge how well your occupational pension is contributing to your overall retirement goals. If you're planning for retirement, it's wise to consider options like a private pension fund to supplement the statutory pension. It's also important to remember that life events, like career breaks or lower lifetime wages, can affect your pension accumulation, so keeping an eye on your employer-sponsored benefits is key.

Strategic Use of Private Pension Plans

Right then, let's talk about private pension plans. While the state pension and workplace schemes are important, they often don't quite cover everything you'll need when you stop working. This is where private plans really come into their own. They're basically voluntary savings accounts specifically for your retirement, and they can make a big difference to your future income. The key is to pick the right one for you.

Riester Pensions: Government Subsidies and Eligibility

Riester pensions are a bit special because the government throws in some extra money, which is always nice. They're designed to encourage people to save for retirement, and you can get state subsidies if you qualify. Generally, if you're paying into the statutory pension system, you're likely eligible. This could be through your job, or if you're a stay-at-home parent or receiving certain benefits. The government subsidies come in two main forms: a basic allowance and child bonuses. These can really boost your savings without you having to put in extra yourself. It's worth checking the exact rules to see if you can benefit, as it's essentially free money towards your retirement.

Rürup Pensions: Benefits for Self-Employed and High Earners

Now, Rürup pensions, also known as 'Basisrente', are a bit different. They're particularly good for people who are self-employed or those on higher incomes. The main draw here is the tax relief. You can deduct a significant portion of your contributions from your taxable income each year. This can really cut down your tax bill, especially if you're in a higher tax bracket. Think of it as getting a tax break now in exchange for saving for later. While you can't usually get your money out as a lump sum before retirement, it provides a secure, lifelong income, which is a big plus for long-term financial planning.

German Life Insurance Policies for Retirement

Beyond Riester and Rürup, there are also traditional German life insurance policies that can be used for retirement savings. These often come with guarantees, meaning you're promised a certain return. However, this guarantee usually means they invest in safer, lower-return assets, so the overall growth might not be as high as other options. They can offer a degree of certainty, but it's important to weigh that against potentially lower returns compared to, say, an investment-focused private pension plan. It's a trade-off between security and growth potential.

Tailoring Private Plans to Individual Needs

This is where it gets interesting. Private pension plans aren't one-size-fits-all. You can often choose how your money is invested. Some plans are more conservative, focusing on capital preservation, while others are more aggressive, aiming for higher growth through investments like stocks or ETFs. You need to think about your own risk tolerance and when you plan to retire. If you're young and have decades until retirement, you might be comfortable with a bit more risk for potentially higher returns. If you're closer to retirement, you might prefer something more stable. It’s about matching the plan to your personal circumstances and goals.

The Flexibility of Private Pension Investments

One of the big advantages of many private pension plans is their flexibility. Unlike some other pension types, you might have more control over how your money is invested. For example, you could opt for plans that invest in Exchange Traded Funds (ETFs). These are generally low-cost and track a market index, offering diversification. Over the long term, stock markets have historically provided good returns, and investing in ETFs within a private pension plan can offer a tax-efficient way to benefit from this growth. You can often choose from a range of ETFs, allowing you to build a portfolio that suits your investment strategy.

Understanding Tax Advantages of Private Plans

Tax is a big consideration when saving for retirement, and private pension plans often come with significant tax benefits. During the savings phase, contributions to certain plans, like Rürup, can be tax-deductible. For other plans, like ETF-based private pensions, the growth of your investments within the plan is often tax-deferred. This means you don't pay tax on the profits each year; instead, you only pay tax when you start withdrawing the money in retirement. This 'tax shield' effect can make a substantial difference to how much your savings grow over time.

Choosing Between Different Private Pension Providers

With so many options out there, picking a provider can feel a bit overwhelming. It's not just about the advertised returns; you need to look at the details. Consider the costs involved – management fees, administration charges, and any other hidden costs can eat into your returns over time. Also, look at the provider's reputation and financial stability. Reading reviews and comparing different providers side-by-side is a good idea. Don't be afraid to ask questions about the terms and conditions. Getting this right means your money works harder for your retirement.

Here's a quick look at some common types:

- Riester Pension: Good for subsidies, especially for families.

- Rürup Pension: Excellent for tax relief, particularly for the self-employed.

- ETF-Based Private Pension: Offers flexibility and potential for higher growth through stock market investments.

- Traditional Life Insurance: Provides guarantees but often with lower returns.

When choosing a private pension plan, it's not just about the headline figures. You need to look closely at the fine print, especially regarding fees and investment strategies. A plan that seems attractive on the surface might end up costing you more in the long run if the fees are too high or the investment approach doesn't align with your goals. Always compare different providers and understand exactly what you're signing up for.

Optimising Pension Contributions Through Early Action

When it comes to building a solid retirement fund, there's one piece of advice that consistently comes up: start early. It might sound simple, but the impact of beginning your pension contributions sooner rather than later is quite profound. It’s not just about putting money away; it’s about giving that money the best possible chance to grow.

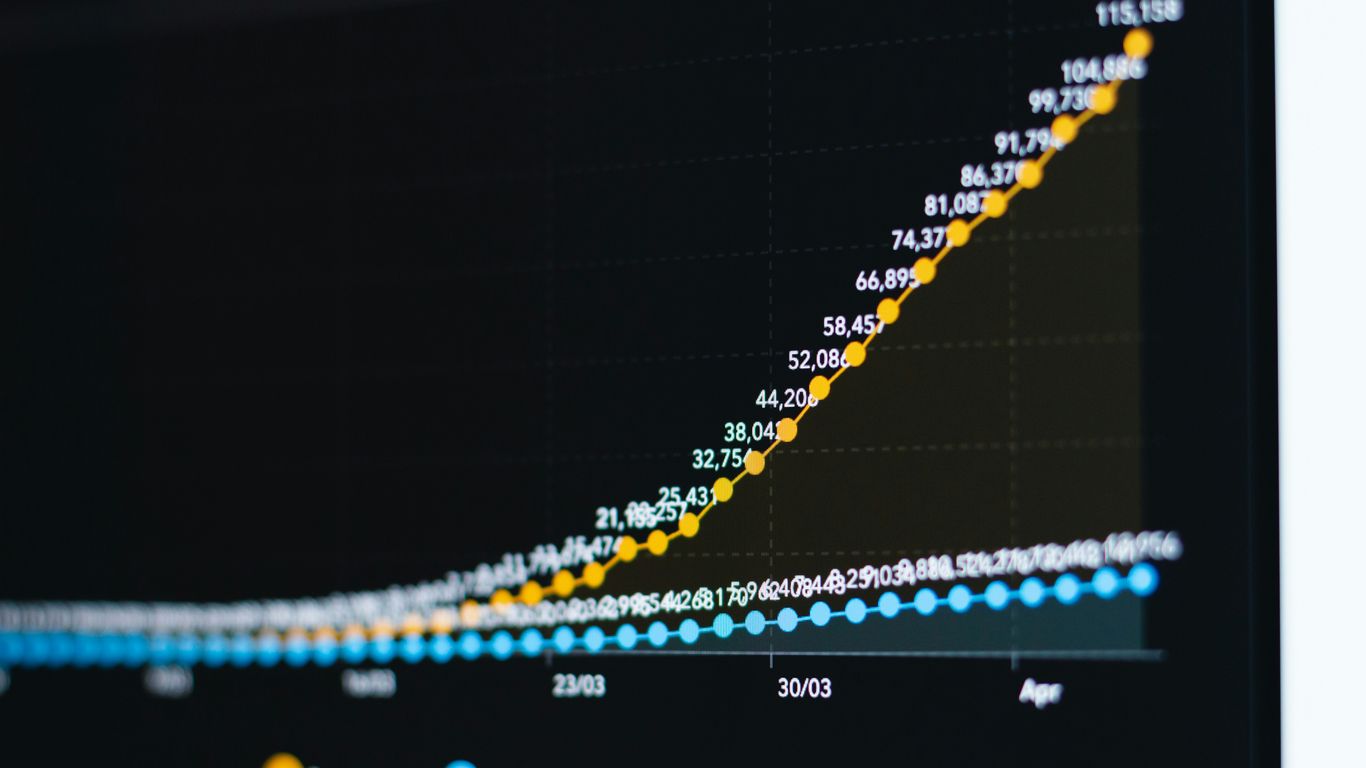

The Power of Compound Interest in Pension Growth

Compound interest is often called the eighth wonder of the world, and for good reason, especially when it comes to pensions. Essentially, it’s interest earning interest. The money you contribute, plus the returns it generates, then starts earning its own returns. The longer your money is invested, the more time compounding has to work its magic. This means that even modest contributions made early in your career can snowball into a significantly larger sum by the time you reach retirement age. It’s a powerful force that’s hard to replicate with later, larger contributions.

Minimising the Impact of Delayed Contributions

Conversely, delaying your pension contributions can have a noticeable effect. Waiting even a few years can mean missing out on crucial growth periods. Trying to catch up later often requires much larger contributions to achieve the same outcome, which can put a strain on your finances. It’s a bit like trying to catch a train that’s already left the station – you can run, but you’ll never quite make up the lost time.

Starting Early: A Cornerstone of Pension Optimization

Starting early is arguably the most effective strategy for pension optimisation. It’s the bedrock upon which a secure retirement is built. By getting started in your 20s or 30s, you give yourself a substantial head start. This allows you to benefit from the full power of compounding over several decades. It’s about making time your greatest ally in the quest for a comfortable retirement.

The Long-Term Benefits of Consistent Saving

Consistency is key. Regular, even if small, contributions made over a long period are far more beneficial than sporadic, larger ones. This steady approach helps to smooth out market fluctuations and ensures a consistent build-up of your pension pot. It creates a reliable savings habit that pays dividends in the long run, contributing to a more stable and predictable retirement income.

Calculating the Cost of Waiting to Save

It can be eye-opening to see the financial difference waiting makes. For example, if you delay starting your pension by 10 years, you might need to contribute significantly more each month to reach the same retirement fund as someone who started earlier. This calculation often highlights the true cost of procrastination. It’s not just about the money you don't save, but also the potential growth you miss out on.

Early Investment Strategies for Retirement

When you start early, you have more flexibility with your investment strategy. You can afford to take on a little more risk, as you have time to recover from any market downturns. This might involve investing in assets with higher growth potential. As you get closer to retirement, you can then gradually shift towards more conservative investments to protect your accumulated capital. This strategic approach helps to maximise growth while managing risk effectively.

Securing Future Financial Stability Through Early Planning

Ultimately, starting your pension contributions early is about securing your future financial stability. It’s a proactive step that provides peace of mind, knowing you are actively working towards a comfortable retirement. By taking advantage of time and compounding, you can build a robust pension that supports your lifestyle and financial goals for years to come. It’s a smart move that pays off immensely over your lifetime, and it’s never too late to start, though earlier is always better. For those considering early retirement, understanding the implications of retiring before the standard age is also vital, as deductions can apply.

Diversifying Your Pension Investments

It might seem a bit much to think about, but putting all your retirement savings into one pot isn't the smartest move. The German pension system has a few different parts to it, and spreading your money across them can really help protect your future income. It’s all about not having all your eggs in one basket, you know?

Spreading Risk Across Multiple Pension Types

Think of it like this: if one area of your savings takes a hit, the others can hopefully keep things steady. This means looking at the statutory pension, any occupational schemes your employer might offer, and then your own private plans. Each has its own way of working and its own risks. By having a bit of everything, you're less exposed if one particular type of investment or pension plan doesn't perform as expected. It’s a sensible way to build a more secure financial future.

Balancing Statutory, Occupational, and Private Pensions

So, how do you actually balance these? Well, the statutory pension is your base, the foundation. Then, you've got occupational pensions, which can be a great boost, especially if your employer contributes too. Finally, private plans offer flexibility and can be tailored to your specific needs. The trick is to figure out how much you need from each to reach your retirement income goals. It’s not a one-size-fits-all situation, and what works for one person might not be right for another. You might find that German corporate pension funds are a good option to explore for the occupational side.

Protecting Against Market Fluctuations

Markets can be a bit wild sometimes, can't they? One day things are up, the next they're down. Diversification helps smooth out those bumps. If you've got money in different types of investments – say, some in bonds which are generally more stable, and some in stocks or ETFs that have more growth potential but are also more volatile – then a downturn in one area might be offset by stability or growth in another. This approach helps to shield your overall savings from sudden market shocks.

The Benefits of a Mixed Pension Portfolio

A mixed portfolio means you're not relying on just one thing to provide your retirement income. It gives you options. For instance, you might have a steady income from your statutory pension, a growing pot from your occupational scheme, and then flexible access to funds from your private plans. This variety can make your retirement income more predictable and reliable. It’s about building a robust financial safety net.

Ensuring a Stable Retirement Income Stream

Ultimately, the goal is to have enough money coming in each month when you stop working. Diversifying your pension investments is a key strategy to make sure that income stream is as stable as possible. It reduces the chances of a single problem wiping out a significant portion of your retirement funds. This careful planning means you can look forward to your retirement with more confidence.

Avoiding Over-Reliance on a Single Pension Source

It’s easy to get comfortable with one type of pension, but that can be risky. If you only rely on the statutory pension, for example, and it changes or doesn't provide enough, you're in a tough spot. Similarly, if your employer's occupational pension scheme runs into trouble, or if your private investments perform poorly, you'll feel the pinch. Spreading your focus across different sources is a much safer bet for long-term financial security.

Strategies for Diversified Pension Holdings

So, what are some practical ways to diversify? Consider contributing to a private pension plan that invests in a mix of assets, like Exchange-Traded Funds (ETFs), which themselves are diversified. Also, look into how your occupational pension is invested. If you have flexibility, choose options that spread risk. It’s about making conscious choices at each stage to build a varied and resilient pension pot. Remember, starting early with any of these options really helps, thanks to the power of compound interest.

Maximising Tax Benefits on Pension Savings

Saving for retirement is a big deal, and thankfully, Germany offers several ways to make your pension contributions work harder for you through tax advantages. It’s not just about putting money away; it’s about doing it smartly to keep more of your hard-earned cash. Let's break down how you can make the most of these benefits.

Deducting Statutory Pension Contributions From Income

Good news here: the money you pay into the statutory pension system is tax-deductible. This means you can reduce your taxable income each year by the amount you contribute. For 2024, you can deduct up to 100% of your contributions. This is a straightforward way to lower your tax bill while building up your future pension. It’s a win-win, really.

Optimising Riester Pensions for Tax Savings

Riester pensions are a popular choice, partly because of the government subsidies you can get. On top of that, your contributions can be claimed as a special expense deduction on your tax return. This means you can effectively get some of your money back from the tax office. It’s a good idea to check if you’re eligible for the full benefits, especially if you have children, as there are extra allowances for parents.

Leveraging Rürup Pensions for Tax Efficiency

For those who are self-employed or have higher incomes, the Rürup pension (also known as the basis pension) can be incredibly beneficial. You can deduct a significant portion of your contributions from your taxable income. This deduction increases each year, eventually reaching 100%. It’s a powerful tool for reducing your current tax burden, especially if you're in a higher tax bracket. This plan is often seen as a solid option for self-employed individuals.

Tax-Advantaged Retirement Accounts Explained

Beyond Riester and Rürup, Germany has other avenues for tax-efficient saving. Think about private pension insurance policies. While the specifics vary, many offer tax advantages during the accumulation phase, meaning your investments can grow without being taxed year on year. When you start receiving payouts, there are also favourable tax rules, often involving a reduced tax rate or tax-free portions, depending on the plan. It's worth looking into these options to see how they fit your personal situation.

Reducing Your Tax Burden Through Pension Contributions

Essentially, any contribution you make to a recognised pension scheme can potentially reduce your taxable income. This applies to statutory, Riester, and Rürup pensions, as well as some occupational schemes. The key is to understand the limits and rules for each type of pension. By strategically allocating your savings, you can significantly lower the amount of tax you owe each year.

Understanding Tax Implications for Different Pension Types

It's not just about contributions; the payout phase also has tax implications. Statutory pensions are taxed as income in retirement, but at a reduced rate. Riester pensions have a 'tax-free withdrawal' (or 'end-use tax') at the start of the payout, meaning you pay tax on a portion of the income. Rürup pensions are taxed similarly to statutory pensions, with a progressively increasing taxable portion. Private pension insurance payouts often benefit from a reduced tax rate if you opt for a lifelong pension, or a partial tax exemption if you take a lump sum after a certain period.

Maximising Tax Relief on Voluntary Contributions

If you decide to make voluntary contributions to your statutory pension, these can also be tax-deductible, subject to certain limits. For private pension plans, the tax relief comes primarily from the deductibility of contributions and the favourable taxation of payouts. Always check the current regulations and consult with a tax advisor to ensure you are claiming all the benefits you are entitled to.

Here's a quick look at how contributions can affect your taxable income:

Pension Type | Deductibility of Contributions | Tax Treatment on Payouts |

|---|---|---|

Statutory Pension | Up to 100% (2024 limit) | Taxed as income, but at a reduced rate |

Riester Pension | Contributions deductible | 'Tax-free withdrawal' (end-use tax) on a portion of income |

Rürup Pension | Increasing deductibility | Taxed as income, with a progressively increasing taxable portion |

Private Pension Plans | Varies, often deductible | Favourable tax rates or partial exemptions often apply |

The Role of Financial Advisors in Pension Planning

Pension planning in Germany can feel like a bit of a maze, can't it? With all the different types of pensions – statutory, occupational, private – and all the rules and regulations, it's easy to get lost. That's where a good financial advisor comes in. They're like your personal guide through the pension jungle.

Navigating Complex Pension Options

Trying to figure out which pension plan is best for you can be a real headache. Should you go for a Riester pension because of the government subsidies, or is a Rürup pension a better bet for your income level? A financial advisor can break down these options, explaining the pros and cons in plain English. They can help you understand things like vesting periods, employer matching contributions, and how different plans interact with each other. They help you make sense of the complexity so you can make informed choices. For expats, especially Americans relocating to Germany, understanding cross-border financial planning is key, and an advisor can shed light on potential risks and solutions.

Personalised Advice for Your Financial Situation

What works for one person might not work for another. Your income, your family situation, your future plans – all these things affect your pension needs. A financial advisor will look at your specific circumstances. They won't just give you generic advice; they'll tailor recommendations to your life. This means considering things like how much you can realistically afford to save each month and what your retirement income goals are. For instance, if you're an expat, an advisor can help you with specific needs, like those of French expatriates in Germany.

Optimising Contribution and Investment Strategies

It's not just about how much you save, but also how you save it. Advisors can help you figure out the best way to contribute to your various pension pots. They can also guide you on investment strategies. Should you be putting more into stocks, bonds, or perhaps ETFs? They'll consider your risk tolerance and time horizon to suggest a balanced approach. This is especially important when you're trying to maximise your pension in Germany.

Ensuring You Are On Track for Retirement Goals

We all have an idea of what we want our retirement to look like. Do you want to travel? Pursue hobbies? Live comfortably without financial worries? An advisor helps you quantify these goals and then works backwards to create a savings plan. They'll regularly review your progress, checking if you're on track and suggesting adjustments if needed. It’s about making sure your pension savings are actually going to get you where you want to be.

Understanding Tax Benefits with Expert Guidance

Germany has various tax advantages related to pensions, but they can be tricky to navigate. From deducting statutory pension contributions to optimising Riester and Rürup pensions for tax savings, there's a lot to consider. An advisor can help you make the most of these benefits, potentially saving you a significant amount of money over time. They can explain the tax implications for different pension types and how to maximise tax relief on voluntary contributions.

Making Informed Decisions About Your Pension

Ultimately, a financial advisor empowers you to make better decisions about your future. They provide clarity, context, and a clear path forward. Instead of feeling overwhelmed, you'll feel more confident about your pension planning. This proactive approach can make a big difference in securing a comfortable retirement.

The Value of Professional Pension Consultation

Think of it like this: you wouldn't try to perform surgery on yourself, right? Pension planning is complex, and while you can read up on it, getting professional advice is often the smartest move. It saves time, reduces stress, and can significantly improve your retirement outcome. It's an investment in your future financial security.

Addressing Inflation and Fees in Pension Planning

When you're thinking about your pension, it's easy to get caught up in the big numbers – how much you're putting in, how much you might get out. But there are two sneaky factors that can really chip away at your future income: inflation and fees. They might seem small, but over the long haul, they can make a surprising difference.

The Erosion of Purchasing Power by Inflation

Inflation is basically the rate at which prices for goods and services go up over time. What seems like a decent amount of money today won't buy as much in 10, 20, or 30 years. Think about it: the cost of groceries, energy, and even a simple cup of coffee tends to rise. If your pension income doesn't keep pace with this rise, you'll effectively be able to afford less and less as you get older. This is why it's so important to consider how your pension savings will grow relative to inflation. Some pension plans might offer protection against this, but it's not always standard.

It's not just about how much money you have, but what that money can actually buy. A pension that sounds generous today might feel quite tight in the future if inflation isn't properly accounted for.

Choosing Low-Cost Pension Products

Fees are another big one. Different pension products come with different charges – management fees, administration fees, fund fees, and sometimes even upfront costs. These might seem small, perhaps a percentage point or two, but they add up. Imagine two identical pension plans, one with a 0.5% annual fee and another with a 2% annual fee. Over 30 years, the difference in your final pot could be substantial, potentially doubling the amount you'd have if you chose the cheaper option. It's worth doing your homework to find providers that offer competitive fees without compromising on the quality of the investment. For instance, ETF-based plans often have lower costs compared to traditional managed funds.

The Impact of Administrative Fees on Savings

Administrative fees cover the day-to-day running of your pension plan. While necessary, they can still impact your overall returns. It's wise to understand exactly what these fees cover and how they are calculated. Some providers are more transparent than others. Always ask for a clear breakdown of all charges before committing to a plan. This is especially true when looking at occupational pensions, where employer contributions might seem like a bonus, but the underlying fees can sometimes be surprisingly high.

Considering Inflation-Indexed Pension Plans

Some pension plans are designed to adjust with inflation. These are often called inflation-indexed or inflation-linked plans. The idea is that your pension payments will increase over time to match the rising cost of living. While these plans can offer greater certainty about your future purchasing power, they might sometimes come with slightly lower initial returns or higher fees compared to non-indexed plans. It's a trade-off to consider based on your personal risk tolerance and long-term financial goals.

Safeguarding Your Future Income Against Rising Prices

To protect your future income, a multi-pronged approach is often best. This includes:

- Understanding the fee structure: Know what you're paying for and compare it across different providers.

- Prioritising low-cost investment options: Look into options like ETFs where fees are generally lower.

- Considering inflation protection: Evaluate if inflation-indexed plans or other hedging strategies are suitable for your situation.

- Regularly reviewing your plan: Check your statements to see how fees and inflation are affecting your savings over time.

Strategies to Mitigate Inflationary Effects

Beyond choosing specific plan types, there are other ways to combat inflation's impact. Investing in assets that historically tend to outperform inflation, such as equities, can be a good strategy, though this comes with its own risks. Diversifying your investments across different asset classes can also help spread risk. For example, global pension funds are increasingly looking at more sophisticated investment approaches to balance returns and risk.

Understanding Fee Structures in Pension Products

When comparing pension products, pay close attention to the total expense ratio (TER) for funds, as well as any additional administrative or advisory fees. A small difference in fees can mean a significant difference in your retirement nest egg over decades. Don't be afraid to ask providers to explain their fee structure in plain English. Remember, the goal is to maximise your retirement income, and high fees are a direct obstacle to that. While some countries are debating freezing pension adjustments, understanding fees remains a constant concern for savers.

Pension Optimisation Strategies for Couples

Planning for retirement as a couple in Germany involves looking at your combined financial picture. It's not just about individual savings; it's about how you can work together to build a more secure future. This means coordinating your contributions, understanding shared benefits, and making the most of joint financial planning tools.

Coordinating Pension Contributions and Plans

When you're a couple, you have a unique opportunity to align your pension savings. This isn't just about putting money away; it's about strategic planning. Think about how your individual contributions to the statutory pension, occupational schemes, and private plans fit together. Are both partners contributing enough? Are there ways to balance contributions if one partner earns more or takes time off for family?

- Reviewing current contributions: Understand where both partners stand with their statutory, occupational, and private pension pots.

- Setting joint contribution goals: Agree on a combined savings target that works for your household budget.

- Balancing contributions: If one partner has a lower income or takes a career break, the other can potentially compensate or explore options like spousal contributions to private plans.

Maximising Spousal Benefits in Pension Schemes

Many occupational and private pension schemes offer benefits for spouses. This could include survivor's pensions, where your partner continues to receive a portion of your pension if you pass away. It's important to understand the specifics of your employer's pension fund or private plan to see what provisions are in place for your spouse.

Utilising Joint Tax Returns for Pension Savings

Germany's tax system can offer advantages for married couples or registered civil partners. By filing a joint tax return (Zusammenveranlagung), you can often reduce your overall tax burden. This can indirectly boost your pension savings, as more of your income remains available for contributions or investments. Some private pension plans, like Riester, also allow for spousal contributions, which can be particularly beneficial when filing jointly.

Making Riester Contributions for a Partner

One of the smart ways couples can optimise their savings is through the Riester pension. If one partner has a lower income or doesn't qualify for direct state subsidies, the higher-earning partner can often make contributions on their behalf. This allows both individuals to benefit from state subsidies and tax advantages, effectively doubling the potential for government support for your retirement savings.

Ensuring Equitable Retirement Provisions

It's vital that both partners feel secure about their retirement. This means having an open conversation about your combined retirement income and ensuring that provisions are fair, especially if there's a significant difference in earnings or career paths. Planning together helps to avoid one partner being significantly more financially vulnerable in retirement.

Joint Financial Planning for a Secure Future

Beyond just pensions, couples should consider their overall financial picture. This includes savings, investments, property, and potential inheritances. A joint financial plan helps to ensure that all your assets are working together towards your retirement goals. It's about creating a shared vision for your future and making collective decisions to achieve it.

Maximising Combined Pension Savings Potential

By working together, couples can often achieve more than they could individually. This might involve taking advantage of employer matching contributions more effectively, choosing complementary private pension plans, or simply having a shared commitment to saving. The synergy of joint planning can significantly increase your overall retirement nest egg.

When planning pensions as a couple, remember that flexibility is key. Life events can change your circumstances, so regular reviews of your joint strategy are important. This ensures you remain on track and can adapt your plans as needed to secure a comfortable retirement for both of you.

Pension Considerations for Freelancers and Self-Employed

Being your own boss in Germany comes with a lot of freedom, but it also means you're in charge of your own retirement planning. Unlike employees who often have statutory contributions automatically deducted, freelancers and the self-employed need to be more proactive. It's vital to actively manage your retirement savings to build a solid fund for the future.

Voluntary Contributions to Statutory Pensions

While not automatic, you can choose to make voluntary contributions to the statutory pension insurance (Gesetzliche Rentenversicherung). This can be a good way to top up your future pension, especially if you've had periods of lower earnings or want to increase your pension points. It's a way to maintain a connection to the state system and potentially boost your basic retirement income.

The Advantages of Riester and Rürup for Freelancers

For those working for themselves, the Riester and Rürup pension schemes are particularly beneficial.

- Riester Pensions: These are government-subsidised plans, offering state bonuses and tax advantages. They are accessible to most people, including freelancers, and can be a great way to save for retirement with state support.

- Rürup Pensions (Basisrente): This option is often favoured by the self-employed and high earners. Its main draw is the significant tax deductibility of contributions during your working life, which can substantially reduce your current tax burden. However, it's generally less flexible regarding payouts compared to Riester.

Actively Managing Retirement Savings

Because you don't have an employer automatically contributing on your behalf, you need a clear plan. This involves:

- Assessing your current situation: How much are you earning now, and what can you realistically set aside?

- Setting retirement goals: What kind of income do you envision in retirement?

- Choosing the right products: Deciding between voluntary statutory contributions, Riester, Rürup, or other private pension plans.

- Regularly reviewing: Checking your progress and adjusting your contributions as your income or circumstances change.

Building a Solid Retirement Fund Independently

Your future financial security rests on your own shoulders. This means not just saving, but saving smartly. Consider how different investment vehicles might grow your money over time. Real estate, for example, can be a way to reduce future living expenses if you own your home outright, which is a significant saving in retirement.

Understanding Pension Options Outside Employment

Beyond the statutory and government-backed private plans, there are other avenues. German life insurance policies can be structured for retirement, and depending on your financial situation, investing in stocks or funds might be an option, though this carries more risk. It's about creating a diversified approach to your retirement income.

Maximising Pension Potential Without Employer Schemes

Without employer matching contributions, every euro you save needs to work harder. This is where understanding the tax benefits of plans like Rürup becomes really important. Also, consider the power of compound interest – the earlier you start, the more time your money has to grow. Even small, consistent contributions can add up significantly over decades.

The sustainability of the German pension system is a topic of ongoing discussion. With an aging population, statutory pensions alone may not provide the level of income many people expect or need. Therefore, for freelancers and the self-employed, taking personal responsibility for supplementary retirement planning is not just advisable, it's practically a necessity for a comfortable future.

Seeking Tailored Financial Advice for Self-Employed

Given the complexity and the personal nature of retirement planning, especially for the self-employed, professional advice is highly recommended. A financial advisor can help you understand the nuances of Riester vs. Rürup, calculate potential tax savings, and build a strategy that fits your unique income patterns and long-term goals. They can help you avoid common mistakes and make informed decisions to maximise your pension potential.

The Impact of Life Events on Pension Accumulation

Life rarely follows a straight line, and the twists and turns it takes can significantly affect your pension savings. Unexpected events can disrupt your earning potential and your ability to contribute consistently, making it harder to build the retirement fund you envisioned. It's important to be aware of these potential impacts and plan accordingly.

Addressing Lower Lifetime Wages

Sometimes, despite your best efforts, your overall earnings over your working life might be lower than anticipated. This could be due to various factors, including industry shifts, economic downturns, or personal circumstances. Lower lifetime wages directly translate to lower contributions to your pension, both statutory and private. This means you might need to rely more heavily on supplementary savings or adjust your retirement lifestyle expectations.

The Effect of Part-Time Employment

Choosing to work part-time, perhaps for better work-life balance or family reasons, often means a reduced income and, consequently, lower pension contributions. While the benefits of part-time work are clear, it's vital to understand its long-term implications for your retirement fund. You might need to compensate for these lower contributions through other means, such as increasing voluntary contributions to private plans.

Managing Career Breaks and Pension Contributions

Taking time out of your career, whether for further education, travel, or family care, can create gaps in your pension accumulation. During these breaks, contributions typically cease, meaning you miss out on potential growth and the accumulation of pension points. It's often possible to make voluntary contributions to bridge these gaps, but this requires careful financial planning.

Health Issues and Their Impact on Work and Savings

Ill health can unfortunately impact your ability to work and earn, directly affecting your pension savings. Extended periods of sickness or disability might lead to reduced income or an inability to work altogether, halting contributions. Planning for such eventualities, perhaps through disability insurance, can provide a safety net and help maintain some level of financial security.

Ensuring Financial Security Despite Unforeseen Circumstances

Life throws curveballs, and it's wise to have a strategy that accounts for the unexpected. This might involve building an emergency fund, maintaining adequate insurance coverage, and regularly reviewing your pension plans to see if adjustments are needed. The goal is to create a resilient financial plan that can weather life's storms.

Strategies for Rebuilding Pension Savings

If life events have set back your pension accumulation, don't despair. Strategies like increasing your savings rate once your circumstances improve, making use of any available government subsidies for private pensions, or even considering a slightly later retirement age can help you get back on track. It's about making informed choices to recover lost ground.

The Importance of Flexible Pension Planning

Given the unpredictability of life, a flexible approach to pension planning is key. This means regularly reviewing your situation, being open to adjusting your savings goals, and understanding the various pension options available in Germany. Flexibility allows you to adapt your strategy as your life circumstances evolve, helping you stay closer to your retirement objectives.

ESG Investments and Sustainable Pension Planning

The Rise of Sustainable Pension Investments

It's becoming increasingly common for people to think about where their money is going, not just in terms of returns, but also its impact. This is where Environmental, Social, and Governance (ESG) investments come into play for your pension. Essentially, you're looking at funds that consider sustainability and how companies behave. This approach aims to align your retirement savings with your personal values, ensuring your money contributes positively to the world. It's a growing trend in Germany, with more and more people wanting their investments to do good while still growing.

Aligning Investments with Personal Values

Many of us want our pension pots to reflect our beliefs. If you care about climate change, for instance, you might look for funds that actively invest in renewable energy or companies with strong environmental policies. Similarly, if social fairness is important, you'd seek out companies that treat their employees well and have ethical supply chains. This isn't just about feeling good; it's about making conscious choices about where your money is invested. The landscape of sustainable investments is always changing, with new ideas popping up regularly, influencing how pensions are managed globally [02a8].

Financial Growth Through Social Responsibility

Some might think that focusing on ESG means sacrificing financial returns. However, research increasingly shows that companies with strong ESG credentials can actually be more resilient and better managed in the long run. This can translate into solid financial performance. Think of it this way: a company that's mindful of its environmental impact might be better prepared for future regulations, and one that treats its staff well might have lower turnover and higher productivity. It's about looking at the bigger picture of a company's health. There's a push to pool significant pension capital, aiming to direct it towards productive investments in areas like climate protection and digital transformation [f9cd].

The Impact of Corporate Governance on Investments

Corporate governance is a key part of ESG. It looks at how companies are run, the transparency of their decision-making, and the rights of shareholders. Good governance means a company is likely to be more accountable and less prone to scandals or mismanagement. When choosing pension funds, it's worth checking how they assess corporate governance. Some pension products might even offer inflation protection, adjusting payouts to keep pace with rising prices, which is a smart move to safeguard your future income.

Choosing ESG-Focused Pension Funds

When you're looking at pension options, you'll find more and more funds that highlight their ESG focus. It's important to look beyond just the label. Check the fund's specific investment strategy. Does it exclude certain industries you're uncomfortable with? Does it actively invest in companies making a positive difference? For example, Germany has made a significant commitment to supporting tropical forest conservation [7a71]. Understanding these details helps you pick a fund that truly matches your goals. A private pension plan invested in broad stock indices, for instance, can offer good long-term returns and tax advantages, making it a promising addition to your retirement plan.

Ensuring Positive Societal and Environmental Impact

Ultimately, choosing ESG investments for your pension is about more than just your own financial future. It's about contributing to a more sustainable and equitable world. Even small choices, when made by many, can have a significant impact. It’s a way to make your retirement savings work harder for both you and society.

The Dual Benefit of Financial and Ethical Returns

So, you get the best of both worlds: the potential for solid financial returns and the satisfaction of knowing your money is supporting companies and practices that are better for the planet and its people. It’s a win-win situation for your future and the future of the world around us. When considering your pension, especially if you're self-employed, looking into options like Riester or Rürup pensions can be particularly beneficial for building a solid retirement fund independently.

Monitoring and Adjusting Your Pension Strategy

It's easy to set up your pension plans and then just forget about them, but that's really not the best way to go about it. Think of it like tending a garden; you can't just plant the seeds and expect a perfect harvest without any further attention. Your pension strategy needs regular check-ups to make sure it's still growing as it should and heading towards the retirement you're dreaming of.

Regularly Reviewing Pension Statements

This is probably the most straightforward step. You'll get statements from your statutory pension provider, any occupational schemes, and your private plans. Take a moment to actually read them. They show you how much you've saved, how your investments are performing, and what your projected income might look like. Don't just file them away without a second glance. It's your financial future we're talking about here.

Tracking Progress Towards Retirement Goals

Are you on track? It's a simple question, but the answer can be quite revealing. Compare what your statements say you're likely to receive with what you actually need to live comfortably in retirement. Many people underestimate how much they'll need, especially when you factor in things like inflation and potential healthcare costs later in life. If there's a shortfall, it's better to know now than when you're already retired.

Identifying and Addressing Contribution Gaps

Life happens, doesn't it? Maybe you had a period of lower earnings, took some time off work, or perhaps your income just didn't grow as much as you'd hoped. These things can create gaps in your contribution history. Reviewing your statements helps you spot these gaps. Once identified, you can look into options like making voluntary contributions to the statutory pension or increasing contributions to your private plans to make up for lost ground.

Adjusting Contributions as Circumstances Change

Your income might go up, or perhaps you'll have a new financial responsibility like a mortgage or children. Whatever the change, your pension strategy should adapt. If your income increases, consider putting a bit more into your pension. If things get tight, you might need to temporarily reduce contributions, but try to make up for it later if possible. Flexibility is key here.

Staying Informed About Pension System Updates

Pension laws and regulations in Germany can change. Governments sometimes adjust contribution rates, tax rules, or benefit calculations. It's important to keep a general awareness of these changes, as they could affect your long-term plans. While you don't need to be an expert, knowing about significant shifts can help you make informed decisions.

The Importance of Proactive Pension Management

Proactive management means taking action before problems arise. It's about anticipating potential issues and making adjustments along the way. This could involve rebalancing your investment portfolio within your private pension plans, checking if your chosen funds are still performing well, or even seeking advice if you feel your strategy is no longer suitable.

Ensuring Your Strategy Remains Aligned with Long-Term Objectives

Your retirement goals might evolve over time. Maybe you want to retire a bit earlier, or perhaps your desired lifestyle in retirement has changed. Regularly revisiting your overall pension strategy ensures it still matches these objectives. It's about making sure all the different parts of your pension provision – statutory, occupational, and private – are working together effectively to get you where you want to be.

It's not a 'set it and forget it' situation. Your pension plan is a living document, in a way. It needs your attention periodically to ensure it's still serving its purpose effectively. Think of it as a long-term project that requires ongoing care and occasional adjustments to stay on course for a secure retirement.

Understanding Pension Rights When Living Abroad

So, you've spent a good chunk of your working life contributing to the German pension system, but now you're thinking about packing your bags and moving somewhere else. It's a common question, and rightly so: what happens to your pension entitlements when you're no longer living in Germany? The good news is that your contributions don't just vanish into thin air. Generally speaking, you're still entitled to your pension benefits, no matter where you choose to settle down later in life.

Entitlement to German Pension Benefits Internationally

This is probably the most important thing to get straight. If you've paid into the German statutory pension scheme (the gesetzliche Rentenversicherung), those contributions count towards your future pension, even if you decide to live abroad. The German pension insurance institution, the Deutsche Rentenversicherung, has agreements with many countries. This means your German pension rights can be recognised and paid out to you in your new country of residence. It's not automatic, mind you; you'll need to inform the Deutsche Rentenversicherung of your move and provide your new address. They'll then sort out how your pension gets to you.

Navigating Double Taxation Agreements

Now, here's where it can get a bit tricky. You don't want to end up paying taxes on your pension in both Germany and your new country of residence, do you? Thankfully, Germany has signed double taxation agreements with over 90 countries. These agreements are designed to prevent exactly that – you being taxed twice on the same income. For example, if you're an American moving back to the US, you can typically use the Foreign Tax Credit to avoid double taxation, as per IRS guidance on foreign pension taxation. It's always a good idea to check if a treaty exists between Germany and your chosen country and understand its specifics.

Transferring Pension Benefits Between Countries

Sometimes, you might have paid into pension systems in multiple countries. In such cases, international agreements can help combine periods of insurance from different countries to meet minimum eligibility requirements for a pension. This is particularly relevant if you've worked in several EU countries or countries with specific bilateral agreements with Germany. The process can involve coordinating with pension authorities in each country. It's not always straightforward, and you might need to apply for your pension in each country separately, providing proof of your contributions elsewhere.

Considering Alternative Retirement Savings Options

While your statutory pension rights generally travel with you, it's worth thinking about other pension provisions. For instance, if you have a Riester pension, leaving Germany might mean you lose out on the government bonuses, making it less attractive. Private pension plans, however, are often more flexible and can be managed from abroad, sometimes even offering worldwide tax benefits as long as you have a European bank account. It's wise to review all your pension pots and consider if they still serve your needs once you're living outside Germany.

The Impact of Residency on Pension Payouts

Your residency status can influence how your pension is taxed and sometimes even how it's paid out. While the entitlement usually remains, the administrative side might differ. For example, if you're receiving a German pension while living outside the EU, the payout process might involve different banking channels or require specific forms to be completed periodically. It's about making sure the money gets to you reliably and that you're compliant with the tax laws of your new home.

Seeking Advice on International Pension Transfers

This whole international pension thing can feel like a maze. It's not something you want to get wrong, especially when it concerns your future income. Getting professional advice is highly recommended. Financial advisors who specialise in expat finances or international pension planning can help you understand your specific situation, the implications of tax treaties, and the best way to manage your pension entitlements across borders. They can help you avoid costly mistakes and ensure you receive the income you're entitled to.

Ensuring Continuous Pension Coverage Abroad

When you move abroad, you might also consider how to maintain or build pension coverage in your new country. Depending on your employment status and the country's system, you might be able to contribute to a local pension scheme. This could provide an additional layer of security and potentially offer benefits that complement your German pension. It's about building a robust retirement income from all available sources, wherever you are in the world.

Avoiding Common Pitfalls in Pension Optimisation

It's easy to get caught up in the excitement of planning for retirement, but sometimes we can stumble into common traps that might not be obvious at first. Let's talk about a few of these and how to steer clear of them.

The Danger of Relying Solely on Statutory Pensions

Many people assume the state pension will cover all their retirement needs. While it provides a base, it's often not enough to maintain your lifestyle. The statutory pension alone is rarely sufficient for a comfortable retirement. It's designed as a foundation, not the entire building. You really need to think about adding other layers to your pension plan.

The Consequences of Ignoring Inflation

Inflation is like a slow leak in your savings. Over time, the money you've saved will buy less than it does today. If you don't factor this in, your projected retirement income might fall short of what you actually need. It's important to consider how rising prices will affect your purchasing power. Some pension products offer inflation protection, which can be a smart move.

The Detrimental Effect of High Fees

Fees can quietly eat away at your pension pot. Whether it's administrative charges, fund management fees, or other costs, they all add up. Over decades, high fees can significantly reduce the amount you have available in retirement. Always check the fee structure of any pension product you consider. Opting for low-cost options where possible can make a big difference to your final savings. This is particularly relevant when looking at European pension systems which sometimes have lower allocations to riskier assets, potentially impacting growth and fee efficiency.

The Mistake of Delaying Pension Contributions

Starting to save for retirement is a bit like planting a tree; the sooner you start, the more it grows. Delaying contributions means missing out on the power of compound interest. Even small amounts saved early can grow substantially over time. Catching up later is much harder and requires significantly larger contributions to achieve the same result.

Failing to Diversify Pension Investments

Putting all your retirement savings into one type of pension plan is risky. If that particular plan or investment performs poorly, your entire retirement fund could suffer. A diversified approach, combining statutory, occupational, and private pensions, spreads the risk. This way, you're not overly exposed to the performance of a single investment. It helps create a more stable income stream for your later years.

Not Seeking Professional Financial Advice

Pension planning can be complex, with many options and rules to understand. Trying to figure it all out alone can lead to mistakes. A qualified financial advisor can help you understand your options, tailor a plan to your specific situation, and ensure you're making the most of tax advantages. They can also help you avoid some of the common pitfalls mentioned here. For instance, understanding the nuances of company pension plans in Germany is something an advisor can clarify.

Overlooking Tax-Advantaged Savings Opportunities

Germany offers various tax benefits for pension savings. Not taking advantage of these can mean leaving money on the table. Whether it's through Riester, Rürup, or other tax-deductible contributions, understanding and utilising these opportunities can significantly boost your retirement fund. It's worth exploring how different plans can reduce your tax burden during your working life and in retirement.

Child-Rearing Credits and Pension Accumulation

Pension Credits for Time Spent Raising Children

When you take time off work to look after your children, it can have an impact on your pension contributions. In Germany, however, the statutory pension system recognises this and awards pension credits for periods spent raising children. These credits are automatically applied and can help to boost your future pension benefits, especially if you've had significant breaks from employment due to family responsibilities. It's a way the system tries to account for the time you've dedicated to raising the next generation.

Boosting Statutory Pension Contributions Automatically

These child-rearing credits aren't just a small token; they can actually add up and make a noticeable difference to your final pension amount. For each child, you can receive credits for up to three years (or even longer for children born before 1992). These credited years are treated as contribution years, which can help you meet minimum contribution periods for certain pension benefits and increase the overall number of pension points you accumulate. This automatic crediting means you don't need to actively apply for them; they are generally processed based on your child's birth registration.

Enhancing Retirement Benefits Through Family Time

Think of these credits as a form of 'investment' in your future pension, made by the state in recognition of your role as a parent. They can be particularly beneficial if you've had a career with periods of lower earnings or part-time work alongside raising a family. By filling in the gaps where regular contributions might have been lower, these credits help to smooth out your contribution record and can lead to a more substantial retirement income than you might otherwise expect. It's a practical aspect of the German pension system that supports parents.

Understanding How Child-Rearing Affects Your Pension

It's important to understand how these credits are calculated and how they integrate with your overall pension record. The number of credits awarded per child varies, and they are generally applied for the first three years of a child's life. For children born before 1 January 1992, there are different rules, often allowing for longer crediting periods. These credited periods count towards your total contribution duration and influence the calculation of your pension points. The system aims to ensure that time spent on child-rearing doesn't unfairly penalise your long-term pension security.

Maximising Pension Benefits While Raising a Family

While the credits are automatic, it's still wise to be aware of them. If you're planning your finances, understanding these benefits can help you gauge your future pension more accurately. For instance, if you're considering returning to work part-time or taking a longer career break, knowing that child-rearing credits are in place can offer some reassurance about your long-term pension accumulation. It's part of a broader strategy to ensure that family responsibilities are factored into retirement planning.

The Automatic Application of Child-Rearing Credits

The German pension insurance automatically records child-rearing periods based on information from the registry offices. This process is designed to be straightforward for parents, ensuring that these valuable contribution periods are recognised without requiring extensive personal effort. However, it's always a good idea to check your pension statement periodically to confirm that all periods, including child-rearing credits, have been correctly recorded.

The Future Sustainability of the German Pension System

Let's talk about the big picture for pensions in Germany. It's a topic that gets a lot of airtime, and for good reason. The system we have now, built on solidarity, is facing some serious headwinds. It's not exactly a secret that Germany's population is getting older, and fewer babies are being born. This creates a bit of a squeeze, you see, with more people drawing pensions and fewer people paying into the system.

Demographic Challenges Facing Pension Provision

This shift in demographics is probably the most talked-about challenge. The ratio of contributors to beneficiaries is changing, and not in a good way for the future. It means that younger generations might find themselves needing to rely more heavily on their own savings to top up what the state pension provides. It's a bit of a generational balancing act, and frankly, it's causing some political friction.

The Imbalance Between Contributors and Beneficiaries

As mentioned, the core issue is this growing gap. The principle of solidarity means current workers fund current retirees. When that balance tips too far, the system comes under strain. It's a mathematical reality that's hard to ignore. This imbalance is a key reason why discussions about pension reform are always on the table, sometimes leading to political instability.

The Need for Younger Generations to Supplement Pensions

Given the demographic trends, it's becoming increasingly clear that relying solely on the statutory pension might not be enough for a comfortable retirement. Younger workers will likely need to build up additional retirement funds through private savings or investments. It’s about taking personal responsibility for your future financial well-being.

Investment Returns and Pension Fund Stability

Pension funds don't just rely on contributions; they also depend on investment returns to stay healthy. If those returns are consistently low, it puts pressure on the funds. This could mean a pause in payments or, in a worst-case scenario, a need for government intervention. It highlights the importance of sound investment strategies for long-term pension fund health.

Potential Government Interventions for Pension Funds

When the system faces significant financial pressure, governments sometimes step in. This could take various forms, from adjusting contribution rates to changing benefit calculations or even providing direct financial support. These interventions are often complex and can have wide-ranging effects on pensioners and contributors alike.

Adapting to an Aging Population

An aging population presents a multi-faceted challenge. It's not just about the number of retirees but also about healthcare needs and the overall economic impact. Adapting the pension system to this reality requires careful planning and potentially rethinking how retirement is structured and funded.

Ensuring Long-Term Financial Security in Retirement

Ultimately, the goal is to ensure that everyone can have a financially secure retirement. This involves a combination of a stable statutory pension system, effective occupational schemes, and robust private savings. It's about building a multi-layered approach to retirement income. Understanding the current pressures on the system is the first step towards making informed decisions about your own future pension income.

The sustainability of the German pension system is a complex issue, influenced by demographics, economic factors, and policy decisions. While the statutory pension remains a cornerstone, individuals are increasingly encouraged to supplement it with private savings to secure their desired retirement lifestyle.

Assessing and Optimising Your Retirement Income Streams