On this page

Pension Gap Calculator

Estimate your retirement income gap and how much you may need to invest to close it (planning estimate).

Your inputs

Savings & assumptions

*Planning estimate only. Public pension depends on your German insurance record (e.g., Renteninformation), future work, and legislation.

Results

Figuring out your future pension in Germany can feel like a bit of a puzzle. With different systems and factors to consider, it's easy to get lost.

This guide aims to break down how your German pension forecast works, step by step.

We'll look at the public system, how to get an estimate, and what else you might need to think about to make sure you have enough for your retirement years. It's all about getting a clear picture so you can plan ahead.

Financial Advisory for Expats in Germany

In our free digital 1:1 consultation, our independent investment advisors help you develop a plan for your wealth accumulation that fits your financial goals.

Key Takeaways

- The German pension system has three main parts: the public pension, government-backed plans, and private savings.

- Your public pension is calculated using pension points, the access factor, the current pension value, and the pension type factor.

- Pension points are earned based on your salary compared to the German average each year.

- The standard retirement age is 67, but retiring early or late affects your monthly payout.

- A 'pension gap' often exists between your last salary and your public pension, meaning extra savings are usually needed.

- Government-subsidised plans like Riester and Rürup, along with company pensions, can boost your retirement income.

- Private pension solutions, such as ETFs or digital plans, offer ways to build additional retirement funds.

- Regularly checking your predicted pension statement (Renteninformation) and using the official calculator helps create an accurate pension forecast Germany.

Understanding Your German Pension Forecast

Getting a handle on what your future pension might look like in Germany is a pretty big deal, and honestly, it can feel a bit like trying to solve a puzzle. The German pension system is built on a few different layers, and understanding how they all fit together is the first step to figuring out your own financial future after you stop working.

The Three Pillars of German Retirement Planning

Think of German retirement planning as having three main supports. First up is the public pension, the one most people automatically contribute to through their job. Then there are government-sponsored plans, which are basically extra savings schemes encouraged by the state with tax breaks. Finally, you've got private pensions, where you take matters into your own hands with personal investments or savings accounts. It's really important to look at all three to get a realistic picture of your retirement income.

The Role of the Public Pension System

This is the bedrock for most people. When you work in Germany, a portion of your salary automatically goes towards the public pension fund. It's often described as a 'generational contract' – today's workers fund today's retirees, with the expectation that future generations will do the same for you. However, with an aging population and fewer people working, this system faces challenges.

Navigating Government-Sponsored Pension Plans

These are schemes like the Riester or Rürup pensions, and company pension plans (Betriebliche Altersvorsorge). They're designed to give you a boost on top of your public pension. The government offers incentives, usually in the form of tax relief or direct subsidies, to encourage people to save more. They can make a significant difference, but you need to know which ones you're eligible for and how they work.

Exploring Private Pension Solutions

This is where you take direct control. It could be anything from investing in stocks and bonds, perhaps through ETFs, to setting up your own savings account. The idea here is to build up a pot of money that you can draw on in retirement, independent of the state system. It requires a bit more effort and understanding of financial markets, but it offers a lot of flexibility.

The Importance of Early Retirement Planning

Honestly, the sooner you start thinking about this, the better. It's like planting a tree; the earlier you plant it, the bigger it grows. Waiting too long means you'll have to save a lot more aggressively later on to catch up. Even small, consistent contributions early on can make a huge difference thanks to the magic of compound interest.

Assessing Your Current Pension Contributions

To get a clear forecast, you need to know what you've already put in. This means looking at your payslips to see how much has gone into the public pension and checking any statements you receive from the pension provider. It's not just about the money; it's about the pension points you've accumulated, which are key to the calculation.

Identifying Potential Shortfalls in Your Pension

Once you have an idea of what your public pension might provide, you need to compare that to what you think you'll need to live comfortably. Many people find there's a gap – the 'pension gap'. This is the difference between your expected retirement income and your desired retirement lifestyle. Recognising this gap early is the first step to closing it.

Utilising Online Tools for Pension Forecast Germany

Germany's pension authority, the Deutsche Rentenversicherung, provides online calculators. These tools are designed to help you estimate your future pension. You'll typically need information like your contribution history and expected retirement age. While they're a great starting point, remember they provide an estimate, and it's always wise to cross-reference or seek advice.

The German public pension system is a complex structure, and while it provides a safety net, it's increasingly unlikely to be sufficient on its own for a comfortable retirement. Understanding its components and how your contributions translate into future benefits is vital for effective financial planning.

Calculating Your Public Pension Entitlement

Figuring out how much you'll get from the German public pension system can seem a bit daunting at first. It's not just a simple calculation; several factors come into play. Think of it like piecing together a puzzle, where each piece represents a different part of your working life and the system itself. Understanding these components is key to getting a realistic picture of your future income.

Understanding Pension Points (Entgeldpunkte)

Pension points, or Entgeltpunkte, are the building blocks of your public pension. Essentially, for every year you work and contribute to the system, you earn points based on how your earnings compare to the average income of all insured individuals that year. If you earn exactly the average salary, you get one point. Earn more, and you can get more points, up to a maximum of two per year. Earn less, and you'll get a fraction of a point. These points accumulate over your working life.

Determining Your Accumulation of Pension Points

To work out your total pension points, you need to look at your entire contribution history. Each year's earnings are converted into points relative to the average income for that specific year. This means a point earned in an earlier year might have a different 'value' in terms of salary comparison than a point earned more recently. The German Pension Fund (Deutsche Rentenversicherung) keeps track of this for you. You can get an estimate of your accumulated points from your annual pension statement, or use online tools to get a forecast.

The Significance of the Access Factor (Zugangsfaktor)

The access factor, or Zugangsfaktor, is a multiplier that adjusts your pension based on when you start receiving it. If you retire at the standard retirement age, this factor is usually 1.0. However, if you decide to retire earlier, your pension will be reduced by a penalty for each month you claim before the standard age. Conversely, if you choose to work longer and delay your pension, you'll receive a bonus for each month you postpone it past the standard age. This factor can significantly impact your monthly payout.

Applying the Current Pension Value (Aktueller Rentenwert)

The current pension value, or aktueller Rentenwert, is the monetary value assigned to one pension point. This value is adjusted annually, typically increasing to account for inflation and wage developments. It's important to use the most up-to-date value when calculating your pension. The value can differ slightly between the East and West German states, though this difference is gradually being phased out.

Accounting for the Pension Type Factor (Rentenartfaktor)

The pension type factor, or Rentenartfaktor, accounts for the specific type of pension you are receiving. For a standard old-age pension, this factor is typically 1.0. However, other pension types, such as reduced earning capacity pensions or widow's pensions, might have different factors applied. For most people calculating their standard retirement pension, this factor will simply be 1.0.

Calculating Your Gross Monthly Pension

Once you have all the components, calculating your gross monthly pension is straightforward. The basic formula is:

Gross Monthly Pension = Total Pension Points x Access Factor x Current Pension Value x Pension Type Factor

For example, if you have accumulated 40 pension points, retire at the standard age (access factor 1.0), the current pension value is €36.00, and the pension type factor is 1.0, your gross monthly pension would be 40 x 1.0 x €36.00 x 1.0 = €1,440.

Factors Influencing Your Pension Points

Several things affect how many pension points you accumulate:

- Your Salary: Higher salaries relative to the average earn more points.

- Duration of Employment: The longer you contribute, the more points you can earn.

- Periods of Child-Rearing: Time spent raising children can earn you pension points.

- Periods of Unemployment or Sickness: Some of these periods might be credited with points, depending on the circumstances.

The Impact of Salary on Pension Points

Your salary is the most direct influence on your pension points. The German public pension system is designed so that those who earn more contribute more and, consequently, earn more pension points. For instance, earning 100% of the average income in a year grants you one pension point. Earning 50% of the average income grants you 0.5 points, while earning 150% grants you 1.5 points. This system aims to link contributions to future benefits, though it's not a direct one-to-one investment.

It's important to remember that the public pension is a social insurance system, not a private investment. The contributions you make today help fund the pensions of current retirees, and the system relies on future generations to fund yours. This 'generational contract' means that the value of a pension point can change over time due to economic and demographic shifts.

To get a personalised estimate of your future pension, you can use the official public pension calculator. Remember that the statutory contribution rates are set by law and can also influence your earnings and thus your points.

Key Factors in Your Pension Calculation

Calculating your future pension in Germany isn't just about plugging numbers into a calculator and hoping for the best. Several important elements come into play, and understanding them is key to getting a realistic forecast. It's a bit like baking a cake; you need the right ingredients in the right amounts for it to turn out well.

Your Earnings History and Pension Points

This is probably the most significant factor. The German pension system awards you 'pension points' (Entgeltpunkte) based on how your earnings compare to the average income of all insured individuals in a given year. If you earn exactly the average, you get one point. Earn more, and you get a fraction of a point above one, up to a maximum of two points per year. Earn less, and you get a fraction below one. Over your working life, these points accumulate, forming the bedrock of your pension calculation.

The Duration of Your Contributions

Simply put, the longer you contribute to the public pension system, the more pension points you'll likely accumulate. There's a minimum contribution period to qualify for any pension, but a longer track record generally means a higher potential payout. Think of it as building up a savings pot; the more you put in over time, the larger it gets.

Retirement Age and Its Impact

When you choose to retire makes a noticeable difference. Germany has a standard retirement age, which is gradually increasing. Retiring before this age usually means a reduction in your monthly pension, applied as a penalty for each month you retire early. Conversely, delaying your retirement beyond the standard age can result in a bonus, increasing your pension for each extra month you work. This is often referred to as the 'access factor' (Zugangsfaktor).

The Value of a Pension Point Over Time

Each pension point you earn doesn't have a fixed monetary value forever. This value, known as the 'current pension value' (aktueller Rentenwert), is adjusted periodically, usually annually. It's influenced by economic factors and the ratio of contributors to pensioners. So, the value of a point earned today might be different from the value of a point earned 20 years ago when you calculate your final pension.

Regional Differences in Pension Values

Historically, there have been differences in the pension value between the East and West of Germany. While efforts have been made to harmonise these, some regional variations might still exist or be reflected in older contribution periods. It's worth being aware of this if your working life spanned both regions.

The Role of the Access Factor in Your Payout

As mentioned earlier, the access factor (Zugangsfaktor) is directly tied to your retirement age. It's a multiplier that adjusts your calculated pension based on whether you retire earlier or later than the standard age. For example, retiring at the standard age typically means an access factor of 1.0. Retiring early might result in a factor like 0.8, while retiring late could lead to a factor of 1.2, directly impacting your monthly income.

Understanding the Pension Type Factor

Germany offers different types of pensions, not just the standard old-age pension. There are pensions for disability, for example. Each type of pension has a 'pension type factor' (Rentenartfaktor). For the standard old-age pension, this factor is usually 1.0. However, other pension types might have different factors, which will affect the final payout amount.

How Salary Averages Affect Your Pension Points

Your pension points are calculated based on your gross annual income relative to the average gross annual income of all insured persons. The formula is quite straightforward:

Income Category | Pension Points Awarded Per Year |

|---|---|

Exactly average income | 1.0 |

Half of average income | 0.5 |

1.5 times average income | 1.5 |

Double average income (Max) | 2.0 |

Below half of average income | < 0.5 |

This means that consistent earnings around or above the average will significantly boost your pension point accumulation over the years, leading to a higher overall pension.

It's important to remember that the pension system is a form of social insurance. While your individual contributions and earnings history are paramount to your personal calculation, the system also relies on a collective contribution from the working population to support current retirees. This 'generational contract' means that the economic health of the country and the demographics of its population play an indirect role in the long-term sustainability and value of the pension system itself.

Gathering Essential Information for Your Forecast

To get a clear picture of your future pension, you'll need to collect some specific details. Think of it like gathering ingredients before you start cooking – without them, you can't make the dish.

Accessing Your Predicted Pension Statement (Renteninformation)

This is your go-to document. The Deutsche Rentenversicherung (German Pension Insurance) sends out a Renteninformation (pension information statement) to everyone who has contributed to the public pension system for at least five years. It's usually sent around your 27th birthday and then every three years after that. This statement gives you an estimate of your future pension based on your current contributions and projected earnings. It's a really useful snapshot, but remember, it's an estimate and can change.

Requesting Missing Pension Statements

Life happens, and sometimes these statements get lost or you might not have received one. Don't worry, you can request a copy. You'll typically need to contact the Deutsche Rentenversicherung directly. Be prepared to provide some personal details to verify your identity. It's always a good idea to have a complete set of these statements, as they form the basis of your pension calculation.

Understanding Your Annual Pension Information

Beyond the Renteninformation, you might also receive annual updates or specific documents detailing your contributions for a particular year. These can offer a more granular view of your progress. They often break down how many pension points you've earned in that specific year and how your total accumulation is looking. Keep these organised; they're like individual chapters in your pension story.

Locating Your Pension Account Details

Your pension account is where all your contributions and earned pension points are recorded. You can usually access an overview of your account details through the online portal of the Deutsche Rentenversicherung. This portal allows you to see your contribution history, personal data, and sometimes even make changes or update information. It's your central hub for all things related to your public pension.

Identifying Your Contribution History

This is perhaps the most critical piece of information. Your contribution history shows exactly how long you've been paying into the system and how much. It includes periods of employment, periods of unemployment where benefits were paid, and even periods of education or child-rearing that are recognised by the pension system. A detailed contribution history is fundamental for calculating your pension points accurately.

Verifying Your Personal Data with the Pension Provider

Make sure all the personal information the Deutsche Rentenversicherung has on file for you is correct. This includes your name, date of birth, and address. Errors here can cause significant problems down the line, potentially affecting your pension entitlement or the accuracy of your statements. If you find any discrepancies, contact the provider immediately to get them corrected.

Using Your Social Security Number

Your social security number (Sozialversicherungsnummer) is your unique identifier within the German social security system, including the pension insurance. You'll need this number for almost any interaction with the Deutsche Rentenversicherung or your employer regarding your pension contributions. It's like your pension passport.

Consulting Your Employer for Contribution Records

While the Deutsche Rentenversicherung keeps the official records, your employer is responsible for deducting and paying your pension contributions. If you need clarification on specific contribution periods or amounts, especially for recent employment, your employer's HR department or payroll can be a helpful resource. They can provide payslips or confirmation of contributions made during your employment with them.

Here's a quick checklist to help you gather what you need:

- Renteninformation Statements: Collect all statements you've received.

- Contribution Periods: List all your employment periods, including start and end dates.

- Personal Identification: Have your social security number and ID ready.

- Other Relevant Documents: Marriage certificates, birth certificates for children (if applicable for recognised periods).

Gathering this information might seem a bit tedious, but it's a necessary step. Think of it as laying a solid foundation for your retirement planning. Without accurate data, any forecast you make will be guesswork, and you want to be as precise as possible when it comes to your future financial security.

Utilising the Official Pension Calculator

So, you've got your pension statement, and you're trying to make sense of it all. The next logical step is to use the official tools available to get a clearer picture of your future income. The Deutsche Rentenversicherung, Germany's public pension insurance provider, offers an online calculator that's pretty handy for this.

Navigating the Deutsche Rentenversicherung Website

The first hurdle can sometimes be finding the right section on their website. It's a large organisation, and like many government sites, it can feel a bit overwhelming at first. Look for sections related to 'Rente' (pension) or 'Berechnung' (calculation). They do have an English version of their site, but sometimes the most detailed information is in German, so be prepared for that.

Locating the Public Pension Calculator

Once you're on the right track, you'll want to find the specific calculator for your public pension forecast. These tools are designed to take your personal contribution history and project what your monthly pension might look like. You can often find links to various calculators, including ones for estimating your pension amount, on their official website.

Inputting Your Pension Points Accurately

This is where your 'Renteninformation' (pension information statement) or your contribution records become really important. The calculator will ask for your accumulated pension points (Entgeltpunkte). These points are earned based on your earnings relative to the average salary each year you've paid into the system. Getting this number right is key to an accurate forecast.

Ensuring the Current Pension Value is Up-to-Date

Another critical piece of information the calculator needs is the current value of a pension point (Aktueller Rentenwert). This value is adjusted annually, usually in July. The calculator might have a default value, but it's always a good idea to check if it reflects the most recent adjustment. This figure directly impacts the final pension amount calculated.

Understanding Calculator Limitations

It's important to remember that these calculators provide an estimate. They can't account for every single life event or future economic change. Factors like inflation, changes in contribution rates, or personal career breaks might not be fully captured. For a more realistic outlook, consider using an inflation calculator alongside the pension estimator.

Interpreting the Calculator's Output

The calculator will typically show you a projected gross monthly pension amount. Remember, this is before taxes and social security contributions (like health insurance) are deducted. You'll need to factor those in to get a clearer idea of your actual take-home pay in retirement.

Using the Calculator for Pension Forecast Germany

Think of this tool as your personal financial crystal ball, albeit a slightly cloudy one. It helps you see if you're on track for the retirement lifestyle you envision. If the projected amount seems low, it's a clear signal to start thinking about supplementary retirement plans or increasing your contributions.

Troubleshooting Common Calculator Issues

Sometimes, you might encounter error messages or results that don't seem right. This could be due to incorrect data input, an outdated pension value, or simply a glitch. Double-checking your inputs, refreshing the page, or trying a different browser can often resolve these issues. If problems persist, contacting the Deutsche Rentenversicherung directly is the best course of action.

Understanding Pension Points Accrual

Pension points, often called 'Entgeltpunkte' in Germany, are the building blocks of your public pension. Think of them as a way the system measures how much you've contributed relative to the average earner over your working life. The more points you accumulate, the higher your future pension will be. It's a pretty straightforward concept, but how you actually earn them is where things get a bit more detailed.

How Pension Points Are Awarded Annually

Each year you work and pay into the German public pension system, you earn pension points. The number of points you get is directly tied to your income for that year compared to the average income of all insured individuals. If your gross annual salary is exactly the same as the national average, you'll earn one full pension point for that year. If you earn more, you can earn more than one point, up to a maximum of two points per year. Conversely, if your earnings are below the average, you'll receive a proportional fraction of a pension point.

The Impact of Earning the German Average Salary

Let's say you consistently earn the German average salary throughout your working life. In this scenario, you would receive one pension point for each year of contributions. This is the benchmark against which all other earnings are measured. It's a solid foundation for building your pension, but most people's salaries fluctuate, meaning their point accumulation will vary year by year.

Calculating Points for Above-Average Earnings

If you're fortunate enough to earn more than the national average, you'll be rewarded with more than one pension point per year. For instance, if your salary is double the average, you'll earn two pension points for that year. This is the maximum you can achieve in a single year. Earning above-average points consistently can significantly boost your total pension entitlement over time.

Calculating Points for Below-Average Earnings

On the flip side, if your income falls below the national average, you'll earn a portion of a pension point. For example, if your salary is half of the average, you'll earn 0.5 pension points for that year. While this might seem small, these points still count towards your total and contribute to your eventual pension payout. It highlights how important consistent earnings are.

Maximum Pension Points Per Year

As mentioned, the system has a cap: you can earn a maximum of two pension points in any given year. This prevents individuals with exceptionally high incomes from accumulating an disproportionate number of points and ensures a more balanced distribution. Even if your salary is significantly higher than twice the average, you still won't exceed the two-point limit for that year.

The Role of Child-Rearing in Pension Points

Germany recognises that raising children is valuable work, and it impacts your pension contributions. Periods spent raising children can be credited as pension points. There are specific rules and time limits for this, but it's a significant benefit designed to support parents, particularly mothers, who may have taken time out of the workforce.

Applying for Recognition of Child-Rearing Periods

To have these child-rearing periods recognised, you usually need to apply for them. This often involves providing documentation like birth certificates. The Deutsche Rentenversicherung (German Pension Insurance) will then assess your eligibility and credit the relevant points to your pension account. It's important to do this proactively to ensure you receive the full benefit.

How Employment Gaps Affect Pension Points

Periods where you are not employed and not making contributions can affect your pension points. These are known as contribution gaps. While child-rearing periods can be credited, other gaps, like periods of unemployment without receiving benefits or extended breaks for personal reasons, might not earn points. This is why it's important to understand how these gaps are treated and if there are any options for voluntary contributions to fill them.

The Retirement Age in Germany

Deciding when to retire is a big question, and in Germany, the age at which you can start receiving your state pension is a key factor. It's not a one-size-fits-all situation, and it's something that's been changing over the years.

The Standard Retirement Age

The standard retirement age, often referred to as the Regelaltersgrenze, is gradually increasing. For those born in 1964 or later, the target age is 67. This change is being phased in, so if you were born earlier, your standard retirement age might be a bit lower. It's important to know your specific age based on your birth year to plan accurately. This standard age is what you aim for to receive your full pension entitlement without any reductions.

Impact of Birth Year on Retirement Age

Your birth year is the most significant factor in determining your standard retirement age. The German government has been progressively raising this age to account for increasing life expectancy and to ensure the sustainability of the pension system. For instance, someone born in 1950 might have a standard retirement age of 65, while someone born in 1960 might be looking at 66, and those born after 1964 will aim for 67. This gradual shift means you need to check the specific age applicable to you.

Early Retirement Penalties Explained

Retiring before you reach the standard retirement age is possible, but it usually comes with a financial cost. For every month you claim your pension early, a deduction is applied to your monthly payout. This reduction is permanent, meaning it stays with you for the entire duration of your retirement. The penalty is typically 0.3% per month, which can add up significantly over time. So, while early retirement might seem appealing, it's vital to weigh the immediate benefit against the long-term reduction in your pension income. You can find more details on the Deutsche Rentenversicherung website.

Bonuses for Delayed Retirement

On the flip side, choosing to work beyond the standard retirement age can be financially rewarding. For every month you postpone claiming your pension after reaching the standard age, you receive a bonus. This bonus is usually around 0.5% per month. This incentive is designed to encourage people to stay in the workforce longer, which helps support the pension system and provides a higher income for those who delay their retirement. It's a way to increase your pension payout if you're able and willing to continue working.

Calculating Your Personal Retirement Age

To figure out your exact personal retirement age, you'll need to consider your birth year and whether you plan to retire at the standard age, early, or late. The official pension insurance provider, Deutsche Rentenversicherung, offers tools and statements that detail this. You can access your Renteninformation (pension information statement) which provides a forecast of your expected pension and the earliest date you can claim it without penalties. It's a good idea to review this document regularly as you approach retirement.

The Effect of Retirement Age on Your Pension Forecast

Your chosen retirement age has a direct and substantial impact on your projected pension amount. Retiring earlier means a longer period of receiving pension payments, but each payment will be smaller due to the early retirement penalty. Conversely, retiring later means fewer years receiving payments, but each payment will be larger thanks to the bonus for delayed retirement. This calculation is a core part of your overall pension forecast and helps you understand the financial implications of different retirement timing scenarios. Many Germans are concerned about pension adequacy, so understanding this effect is key.

Understanding Different Retirement Scenarios

There are several ways to approach retirement in Germany. You can aim for the standard retirement age to receive your full entitlement. You might consider early retirement if you meet specific criteria (like long contribution periods or disability) and are prepared for the associated reduction in pension. Or, you could opt for delayed retirement to boost your monthly income. Each scenario has its own set of rules, potential penalties, or bonuses that need careful consideration.

Planning for Retirement Before the Standard Age

If you're thinking about retiring before the standard age, it's crucial to plan meticulously. You'll need to assess your financial situation to see if you can manage with a reduced pension. This might involve building up additional private savings or considering other income sources. It's also important to understand the exact date you can start receiving benefits and the precise penalty that will be applied. Consulting with a financial advisor can be very helpful in these situations to ensure you're making an informed decision.

The Concept of the Pension Gap

It's a term you'll hear a lot when people talk about retirement in Germany: the 'pension gap'. So, what exactly is it?

Defining the Pension Gap

The pension gap is essentially the difference between the income you'll need to live comfortably in retirement and the amount you can expect to receive from your state pension. Think of it as the shortfall you might face if you only rely on the basic pension provided by the government.

Why Public Pensions May Not Suffice

Germany's public pension system, while a cornerstone of social security, is facing significant challenges. It operates on a 'pay-as-you-go' principle, meaning current contributions fund current pensions. With an aging population and fewer people entering the workforce, this system is under strain. This means the amount you receive in retirement might not be enough to maintain your current standard of living.

The Average Pension Relative to Salary

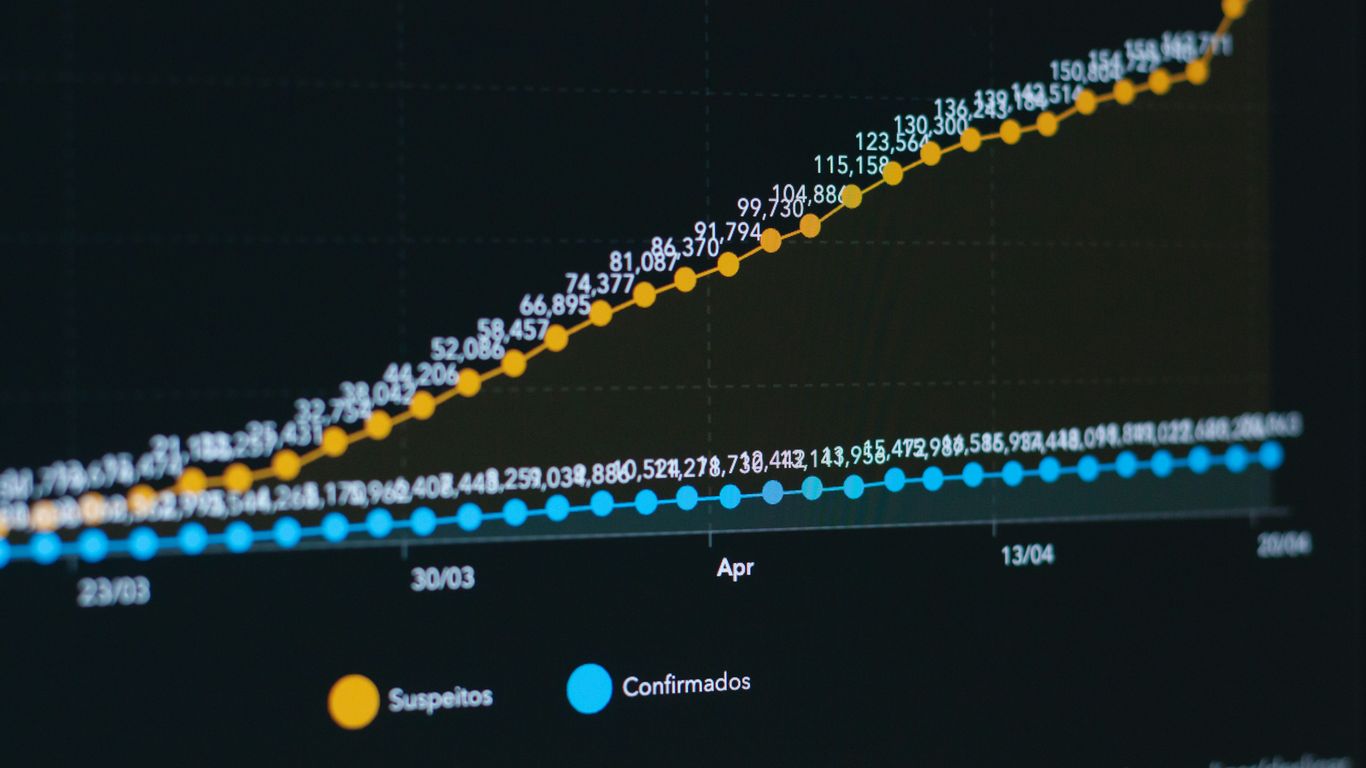

To give you an idea, the average German pension often works out to be around 48% of your final salary. While this sounds like a decent chunk, it's often not enough to cover all your expenses, especially when you factor in things like rent, healthcare, and leisure activities. This percentage is also predicted to drop even lower in the coming years.

The Declining Rentenniveau (Pension Level)

The 'Rentenniveau' is a key indicator that shows the relationship between pensions and average salaries. This level has been gradually decreasing and is expected to continue this trend. This decline is a direct consequence of the system's challenges and a major reason why the pension gap is a growing concern for many.

Risks of Old-Age Poverty

If you don't plan for this potential shortfall, there's a real risk of facing old-age poverty. This isn't just about not having enough for luxuries; it's about struggling to meet basic needs. It's a serious issue that highlights the importance of looking beyond the state pension.

Demographic Change and Its Pension Impact

As mentioned, Germany's demographics are shifting. More people are living longer, and birth rates are lower. This creates an imbalance in the pension system. Fewer workers are supporting a growing number of retirees, putting pressure on the system's ability to provide adequate pensions in the future.

The Generational Contract of Pensions

At its heart, the public pension system is a 'generational contract'. Each working generation pays for the pensions of the older generation, with the expectation that the next generation will do the same for them. However, demographic shifts are making this contract increasingly difficult to sustain.

Strategies to Bridge the Pension Gap

So, what can you do about it? The good news is that there are ways to bridge this gap:

- Government-Subsidised Plans: Look into options like Riester or Rürup pensions, or company pension schemes (Betriebliche Altersvorsorge). These can offer tax advantages and supplement your state pension.

- Private Savings and Investments: Consider private pension plans, investments in ETFs, or other savings strategies. Even small, consistent contributions can grow significantly over time.

- Professional Advice: Talking to a financial advisor can help you understand your specific situation and create a tailored plan.

Understanding the pension gap isn't about being alarmist; it's about being realistic and proactive. By acknowledging the potential shortfall and taking steps to address it early on, you can work towards a more secure and comfortable retirement.

Government-Sponsored Pension Plans

Beyond the basic state pension, Germany offers several government-backed schemes designed to top up your retirement income. These plans often come with attractive tax advantages and subsidies, making them a smart addition to your retirement planning. The idea is to encourage people to save more for their later years, taking some of the pressure off the public system. These schemes can significantly boost your retirement savings, especially if you qualify for the state allowances.

Overview of State-Subsidised Options

Germany has a few main types of government-sponsored pension plans. They all aim to provide extra retirement income, but they work in different ways and are suited to different people. It's worth looking into them to see which, if any, fit your personal circumstances. You might be surprised at how much they can help.

Understanding the Riester Pension

The Riester pension is particularly popular with lower-income earners and families with children. The big draw here is the direct financial support from the state. If you commit to saving at least 4% of your gross annual salary, you can receive annual allowances from the government. These include a base allowance, an allowance per child, and a one-time welcome bonus for younger individuals starting their savings early. These allowances effectively reduce the amount you actually need to contribute out of your own pocket. For instance, if you have a couple of young children, the child allowances can be quite substantial. It's a good way to get a bit of extra money from the government to help with your retirement savings.

Exploring the Rürup Pension (Basisrente)

The Rürup pension, also known as Basisrente, is generally aimed at higher earners and self-employed individuals. Unlike the Riester pension, it doesn't offer child allowances. Instead, its main benefit lies in significant tax deductions. You can deduct a large portion of your contributions from your taxable income each year, which can lead to considerable tax savings while you're still working. This makes it a powerful tool for reducing your current tax burden and building up retirement funds simultaneously. The amount you can deduct increases annually, eventually reaching 100% of your contributions. This plan is a solid choice if you're looking for substantial tax relief now and a reliable income stream later. You can find more information on the Deutsche Rentenversicherung website.

Company Pension Plans (Betriebliche Altersvorsorge)

Company pension plans, or bAV, are offered by employers to their staff. While not mandatory for employees to join, employers are generally required to offer them. These plans often involve contributions from both the employer and employee, and benefit from tax and social security exemptions up to certain limits. This means more of your money goes directly into your pension pot. However, it's important to be aware that company plans can sometimes have higher administrative fees and might not always offer the best returns compared to other options. Also, if you change jobs, you might lose out on employer contributions unless your new employer has a similar scheme. It's a good idea to carefully review the details of any company pension plan offered to you.

Tax Benefits of Government Plans

One of the biggest advantages of these government-sponsored plans is the tax relief they provide. During your working life, your contributions are often tax-deductible, meaning you pay less income tax. Then, when you start drawing your pension, it's taxed at what is usually a lower rate because you're likely to have less income in retirement. This dual tax advantage can make a significant difference to the overall value of your savings over the long term. It's a clever system designed to encourage saving by making it more financially rewarding.

Eligibility Criteria for Subsidised Pensions

Each government-sponsored plan has its own set of rules regarding who can join and benefit. For Riester, being a low-to-middle earner or having children often makes you eligible for the best allowances. Rürup is more geared towards the self-employed and higher earners due to its tax-deduction focus. Company pensions are, of course, dependent on your employer offering one. It's important to check the specific requirements for each plan to see if you qualify. Don't assume you won't be eligible; sometimes the criteria are more flexible than you might think.

How These Plans Supplement Public Pensions

These schemes are not meant to replace the public pension but to add to it. The German public pension system, while important, may not provide enough income for everyone to maintain their desired lifestyle in retirement. Government-sponsored plans help bridge that potential gap. By combining your public pension with savings from a Riester, Rürup, or company plan, you can build a more robust financial foundation for your retirement years. Think of them as building blocks for a more secure future.

Integrating Subsidised Plans into Your Forecast

When calculating your future pension, it's vital to include any expected income from these government-subsidised plans. Your annual pension information statement (Renteninformation) will give you an estimate of your public pension, but you'll need to factor in the projected payouts from your Riester, Rürup, or company pension separately. This gives you a more realistic picture of your total retirement income and helps you identify if you need to save more. Regularly updating your forecast with these additional sources of income is a smart move.

Exploring Private Pension Solutions

While the public pension system provides a foundation, it's often not enough to maintain your lifestyle in retirement. This is where private pension solutions come into play. They offer a way to supplement your state pension and build a more robust financial future.

The Importance of Additional Private Savings

Thinking about retirement might seem distant, but starting to save privately now can make a huge difference later on. The public pension in Germany, while a safety net, is facing pressures from an aging population and changing economic conditions. Relying solely on it could mean a significant drop in your income once you stop working. Private savings act as a buffer, giving you more financial freedom and security.

DIY Investment Strategies with ETFs

One popular route for private pensions is the do-it-yourself (DIY) approach using Exchange Traded Funds (ETFs). ETFs are essentially baskets of stocks or bonds that trade on an exchange, much like individual stocks. They are often seen as a more accessible and potentially profitable way to invest compared to traditional pension products. You can set up a savings plan, contributing a fixed amount each month. This method offers flexibility; you can usually adjust your contributions or even pause them if needed. A key advantage is how gains are taxed. While payouts from state-subsidised plans might be taxed at your income tax rate, ETF gains are typically subject to capital gains tax, which can be considerably lower. For ETFs tracking stock indices, a portion of gains might even be tax-free. This makes them an attractive option for building long-term wealth.

Utilising Digital Pension Solutions

Digital platforms are making private pension planning more straightforward. Some providers combine the benefits of ETFs with the structure of life insurance. This can offer tax advantages, as investment gains might be taxed more favourably within the insurance framework. These plans often allow for early retirement, sometimes as early as age 62, and contributions can be quite flexible, starting from modest amounts like €25 per month. The ability to adjust contributions and access funds under certain conditions provides a degree of control over your retirement savings.

Benefits of Private Pension Investments

Private pension investments offer several upsides. They can potentially yield higher returns than traditional savings accounts or even some state-subsidised plans. This growth is vital for outpacing inflation and ensuring your savings retain their purchasing power over decades. Furthermore, private plans often provide more flexibility in terms of payout options and retirement age compared to the more rigid public system.

Potential Returns from Private Pensions

When comparing private pensions to the public system, the potential returns can be quite striking. While public pensions offer a degree of certainty, private investments, especially those using ETFs, have historically shown the capacity for significant growth over the long term. For instance, investing a consistent amount monthly over several decades could result in a substantial nest egg, potentially far exceeding what one might expect from the state pension alone. This is why many people are looking into private pension plans to supplement their retirement income.

Comparing Private vs. Public Pension Outcomes

It's useful to see how private and public pensions stack up. The public pension is calculated based on your earnings history and contributions. Private pensions, on the other hand, depend heavily on your investment choices, contribution amounts, and the duration of your savings period. While the public pension provides a baseline, private solutions offer the potential for a much higher retirement income, allowing for a more comfortable lifestyle. However, private investments also carry market risk, which is something to consider.

Choosing Reputable Private Pension Providers

When exploring private pension options, selecting a trustworthy provider is paramount. Look for companies that are regulated by German authorities and have a solid track record. Digital platforms and established insurance companies are common choices. It's wise to compare fees, investment strategies, and the terms and conditions of different plans before committing. Understanding the fee structure is particularly important, as high fees can eat into your returns over time.

Securing Financial Independence in Retirement

Ultimately, private pension solutions are about securing your financial independence. They empower you to take a more active role in planning your retirement and aiming for a lifestyle that goes beyond the basic provisions of the public system. By starting early and making informed choices, you can build a substantial financial cushion for your later years.

Seeking Professional Financial Advice

Sometimes, trying to figure out your pension all by yourself can feel like trying to assemble flat-pack furniture without the instructions. It’s a lot to take in, right? The German pension system has its quirks, and honestly, it’s easy to get lost in all the details. That’s where getting some help from a professional can really make a difference.

When to Consult a Financial Advisor

If you’re feeling overwhelmed by pension forecasts, unsure about the best way to supplement your state pension, or just want to make sure you’re on the right track, talking to an advisor is a good idea. It’s especially helpful if you’ve moved to Germany relatively recently or if your financial situation is a bit complex. They can look at your whole picture – your contributions so far, your expected retirement age, and your lifestyle goals – to give you a clearer path forward.

Finding English-Speaking Advisors

Finding someone who speaks your language is pretty important when you’re discussing something as significant as your retirement savings. Luckily, there are advisors in Germany who specialise in helping expats. They understand that you might not be familiar with all the local terms and regulations, and they can explain everything in plain English. It just makes the whole process much less stressful.

Expertise in German Pension Planning

These advisors aren't just general financial planners; they often have a specific focus on the German pension system. This means they know the ins and outs of the Gesetzliche Rentenversicherung (the public pension), as well as the various state-subsidised options like Riester and Rürup, and company pension schemes. They can tell you how these pieces fit together and how they might work for your personal situation.

Personalised Retirement Planning Services

What you get from an advisor isn't a one-size-fits-all answer. They’ll sit down with you, ask about your income, your expenses, your savings, and what you imagine your retirement looking like. Based on all that, they can help you build a plan that’s tailored just for you. This might involve suggesting specific investment products or savings strategies.

Understanding Investment Options

When you look beyond the basic state pension, there are lots of ways to save more. This could be through things like ETFs (Exchange Traded Funds), private pension insurance, or other investment vehicles. An advisor can explain the pros and cons of each, including potential returns and risks, helping you choose what aligns with your comfort level and financial goals.

Navigating Complex Pension Regulations

Germany has rules and regulations for pensions, and they can change. An advisor stays up-to-date with these. They can help you understand things like tax implications, contribution limits, and how different life events (like having children or changing jobs) might affect your pension entitlement. It’s like having a guide through a maze.

The Value of Independent Advice

It’s often best to look for advisors who are independent. This means they aren't tied to selling products from just one company. They can look at the whole market and recommend what’s genuinely best for you, rather than what earns them the biggest commission. Independent advice tends to be more objective.

Making Informed Decisions with Expert Guidance

Ultimately, getting professional advice is about making sure you’re making the best choices for your future financial security. It’s about having peace of mind knowing that you’ve considered all the angles and have a solid plan in place. While it might cost a bit upfront, the potential long-term benefits and the avoidance of costly mistakes can make it a really worthwhile investment.

Example Pension Calculation Breakdown

Let's walk through a hypothetical scenario to make this pension calculation thing a bit clearer. It's not rocket science, but you do need to pay attention to the details. We'll use an example to show how the numbers come together.

Illustrative Scenario: Maria's Pension

Imagine Maria, who's getting ready to retire. She's worked for 40 years and is retiring right at the standard retirement age. Over her career, she's managed to collect a total of 42 pension points. Her salary has varied over the years, sometimes above the German average, sometimes below, but this is her final tally. She's applying for a standard old-age pension, and we'll use the current pension value from July 2023, which was €37.60 per point.

Applying the Pension Formula Step-by-Step

The basic formula for calculating your gross monthly pension looks like this:

Gross Monthly Pension = Pension Points × Access Factor × Current Pension Value × Pension Type Factor

Let's break down each part for Maria:

- Pension Points: Maria has accumulated 42 pension points. These points are a measure of how much you earned relative to the average salary over your working life. The more points, the higher your pension.

- Access Factor (Zugangsfaktor): Since Maria is retiring at the standard retirement age, her access factor is 1. This means there's no penalty for early retirement or bonus for delaying it. If she had retired early, this factor would be lower, reducing her pension.

- Current Pension Value (Aktueller Rentenwert): For July 2023, this value is €37.60. This figure represents how much each pension point is worth in euros. It gets updated annually, so the value used in your own calculation will depend on when you retire.

- Pension Type Factor (Rentenartfaktor): Maria is applying for a standard old-age pension, so her pension type factor is 1. Other types of pensions, like disability or survivor benefits, might have different factors.

Calculating Pension Points in the Example

As mentioned, Maria has 42 pension points. These are earned annually based on your income compared to the average income of all insured individuals. Earning the average salary gets you one point for that year. Earning double the average gets you two points (the maximum), and earning half gets you 0.5 points. Over 40 years, Maria's varied earnings resulted in this total.

Determining the Access Factor Used

Maria's access factor is 1 because she's retiring at the official retirement age. If she were retiring earlier, say at 63, and had to take a penalty, her access factor might be something like 0.928 (a 0.3% reduction per month for each month before the standard retirement age). Conversely, working longer past the standard age would increase this factor, giving her a bonus.

Using the Current Pension Value in the Calculation

We're using the €37.60 value for July 2023. It's important to remember that this value changes. For instance, the value for 2025 might be different. You can find the most up-to-date figures on the Deutsche Rentenversicherung website.

The Role of the Pension Type Factor

For Maria's standard old-age pension, the factor is 1. This is the most common scenario. If she were claiming a reduced pension due to disability, for example, the factor might be lower, affecting the final amount.

Final Gross Pension Calculation

Now, let's plug Maria's numbers into the formula:

Gross Monthly Pension = 42 (Pension Points) × 1 (Access Factor) × €37.60 (Current Pension Value) × 1 (Pension Type Factor)

Gross Monthly Pension = €1,579.20

So, Maria's calculated gross monthly pension is €1,579.20.

Understanding Tax Implications on Pensions

It's vital to remember that this €1,579.20 is the gross amount. Like most pensions in Germany, it will be subject to income tax and potentially social security contributions (like health insurance), depending on the total amount and your individual circumstances. The actual amount Maria receives in her bank account (the net pension) will be lower after these deductions. The exact tax rate depends on various factors, including other income sources and deductions you might be eligible for. For example, if you have a very low pension, you might not pay any income tax at all.

The public pension system in Germany is based on a pay-as-you-go principle. This means that the contributions paid by today's workers are used to fund the pensions of today's retirees. This intergenerational contract is a core feature of the system, but it also means that demographic changes, like an aging population, can put a strain on its sustainability.

This example gives you a solid idea of how the calculation works. Your own forecast will depend on your unique earnings history and retirement plans. It's a good idea to check your predicted pension statement regularly to see how your points are accumulating. You can get an idea of how your income in a specific year, like 2025, will affect your pension points.

Factors Affecting Your Final Pension Payout

So, you've been plugging away, contributing to the German pension system, and you're starting to wonder what that actually means for your future income. It's not just a simple sum, you know. Several things can nudge your final pension amount up or down. Let's break down what really makes a difference.

The Cumulative Effect of Pension Points

Think of pension points (Entgeltpunkte) as your personal score in the pension game. Every year you earn, you get points based on how your salary compares to the average. The more points you rack up over your working life, the higher your pension will be. It's pretty straightforward, really: more points, more money later.

Adjustments Due to Early or Late Retirement

When you decide to hang up your boots is a big one. Retiring before the standard age usually means a permanent reduction in your pension. For every month you retire early, there's a penalty, typically around 0.3%. On the flip side, if you decide to work past the standard retirement age, you can earn bonuses. These are usually around 0.5% for each extra month you contribute, which can add up nicely over time.

Changes in the Current Pension Value

The 'current pension value' (aktueller Rentenwert) is basically what one pension point is worth in euros. This figure gets adjusted annually, usually upwards, to account for inflation and wage developments. So, even if your pension points stay the same, the value of those points can increase over the years, meaning your actual pension payout might be higher than initially forecast.

The Influence of Pension Type Factors

There are different types of pensions in Germany, like the standard old-age pension (Altersrente) or disability pensions. Each type has its own factor (Rentenartfaktor) that affects the final payout. For instance, the standard old-age pension typically uses a factor of 1.0, but other pension types might have different multipliers.

Impact of Contribution Gaps

Life happens, and sometimes there are gaps in your contribution history. These could be due to periods of unemployment, illness, or raising children. While some periods, like child-rearing, are often credited with points, significant gaps without recognised reasons can lower your total accumulated pension points, thus reducing your final pension.

The Role of Inflation on Pension Value

Inflation is a sneaky one. While the current pension value is adjusted annually, the rate of adjustment might not always keep pace with the actual cost of living increases. This means that over time, the purchasing power of your pension could decrease if inflation is high. It's why having supplementary savings is so important for long-term financial planning.

Potential for Pension Adjustments Over Time

Your pension isn't necessarily set in stone forever. Besides the annual adjustments to the pension value, there can be other factors. For example, if you later prove additional periods of employment or child-rearing that weren't initially recognised, your pension could be recalculated and potentially increased.

How Different Life Events Affect Your Pension

Major life events can have a ripple effect. Getting married, divorced, or having children can all influence your pension entitlement, especially concerning survivor's pensions or the recognition of child-rearing periods. It's worth understanding how these personal milestones might interact with the pension system.

Pension Entitlement When Living Abroad

So, you've spent a good chunk of your working life in Germany, paid into the system, and now you're thinking about packing your bags and heading off somewhere else. What happens to your pension then? It's a question many people ponder, and thankfully, it's not as complicated as you might think, especially if you've met the minimum contribution period.

Receiving Your Pension After Leaving Germany

If you've contributed to the German statutory pension insurance for at least five years, you're generally entitled to receive your pension even if you decide to live outside of Germany. This is a pretty significant benefit, meaning your contributions aren't lost just because you change your address. The process is usually smoother if you move within Europe, as pension authorities there tend to communicate well with each other. However, even if you move outside of Europe, most countries have social security agreements with Germany, which helps a lot in claiming your pension. You'll still need to meet Germany's retirement age, which might be different from your new country's retirement age.

Pension Transfers Within Europe

Moving within the European Union or the European Economic Area is often the simplest scenario. Because these countries have agreements in place, your pension contributions and entitlements can be more easily recognised and transferred. When you reach retirement age, you can typically apply for your German pension through the pension authority in your country of residence. They will coordinate with the German pension provider. It's worth noting that each country pays its own pension, rather than combining them into one single sum. This system facilitates international pension arrangements for those who have contributed in multiple countries.

Mutual Social Security Agreements Worldwide

Germany has signed social security agreements with many countries outside of the EU. These agreements are designed to prevent people from being disadvantaged when they move between countries. They often mean that periods of insurance in one country can be counted towards the qualifying period for a pension in another. If you're moving to a country without such an agreement, you might still be able to claim your German pension, but the process could be more direct with the Deutsche Rentenversicherung, or potentially through the German embassy or consulate in your country.

Claiming Your Pension Outside Europe

When you're living outside of Europe, claiming your German pension usually involves applying directly through the Deutsche Rentenversicherung. You'll need to provide all your personal details, your pension insurance number, and bank account information. While the German state might cover some costs associated with transferring money to international bank accounts, you'll likely be responsible for any currency conversion fees or other bank charges. It's a good idea to check with your local pension authorities to see if receiving a German pension affects any pension you might have earned in your country of residence.

Potential Transfer Fees and Costs

It's not just about getting the pension amount; it's also about how you receive it. If you're living abroad, especially outside the Eurozone, you might encounter fees. These can include currency conversion charges when your pension is paid into your local bank account, as well as potential international bank transfer fees. While Germany may cover some basic transfer costs, it's wise to budget for these additional expenses. Understanding these potential costs beforehand can help you avoid surprises when your pension payments start. You can find more details about the taxation of German pensions for individuals living abroad on the Deutsche Rentenversicherung website.

Coordinating with International Pension Authorities

Applying for your pension when you live abroad requires a bit of coordination. If you're in Europe or a country with a social security agreement, you can often start the application process at your local pension authority. They can help you gather the necessary documents and forward them to the relevant German authorities. If you're in a country without a specific agreement, you might need to contact the Deutsche Rentenversicherung directly or seek assistance from the German embassy or consulate. It's important to apply at least three months before you intend to retire to allow ample time for processing.

Understanding Different Retirement Ages Abroad

One of the key things to remember is that retirement ages vary significantly from country to country. Even if you're eligible for your German pension at, say, age 67, your country of residence might have a standard retirement age of 65. You won't receive your German pension until you reach the German retirement age, regardless of your local retirement age. This difference can affect your financial planning, so it's something to factor in when you're considering where to live in retirement.

Ensuring Continuous Pension Payments

To make sure your pension payments are continuous and arrive without a hitch, keeping your personal details up-to-date with the Deutsche Rentenversicherung is vital. This includes your address, bank account details, and marital status. If any of these change, inform the pension provider promptly. For those living outside Germany, especially in countries with social security agreements, maintaining open communication with both your local pension authority and the Deutsche Rentenversicherung is the best way to ensure a smooth and uninterrupted flow of pension payments. This proactive approach helps prevent any potential delays or issues with receiving your hard-earned retirement income.

Maximising Your Future Pension Forecast

So, you've got a handle on how your German pension is calculated, and you've seen the forecast. Now, what can you actually do to make that number a bit bigger? It's not all set in stone, you know. There are definitely ways to give your future pension a boost, and it's worth looking into them sooner rather than later.

Strategies to Increase Pension Points

Your pension points, or 'Entgeltpunkte', are the building blocks of your state pension. The more you have, the better. How do you get more? Well, the most straightforward way is to earn more. If your salary is higher than the average German income, you'll accrue more points each year. It's a simple equation, really: higher earnings mean more points. But it's not just about your current salary; it's about your entire working life. Even small increases in earnings over many years can add up significantly.

The Benefits of Working Longer

This might sound obvious, but working beyond the standard retirement age can have a substantial positive impact on your pension. For every year you continue to work and contribute after reaching the standard retirement age, you'll not only keep earning pension points but also benefit from a bonus added to your pension payout. This bonus is designed to reward those who delay their retirement, effectively increasing your monthly income in later life. It's a direct financial incentive to keep contributing.

Making Additional Voluntary Contributions

If you've had periods where you didn't contribute much, or perhaps you're looking to top up your pension, voluntary contributions are an option. The German Pension Insurance (Deutsche Rentenversicherung) allows you to make additional payments. These can be particularly useful if you've had gaps in your employment, such as during child-rearing or periods of unemployment. By making voluntary contributions, you can retroactively increase your pension points and, consequently, your future pension. It's a way to smooth out your contribution history.

Optimising Government-Sponsored Plans

Germany offers several government-subsidised pension schemes, like the Riester or Rürup pensions, and company pension plans (Betriebliche Altersvorsorge). These plans often come with tax advantages and state subsidies, which can significantly boost your savings over time. Making the most of these schemes means understanding their specific benefits and contribution limits. For instance, Riester pensions are great for families and those with lower incomes due to the state bonuses. Rürup is often favoured by the self-employed and high earners. Company pensions are a fantastic way to save, often with employer contributions, effectively giving you 'free money' towards your retirement. It's about choosing the right plan for your situation and contributing consistently.

Strategic Private Pension Investments

While the state pension provides a foundation, it's unlikely to be enough for most people to maintain their current lifestyle. This is where private pensions come in. Investing in private pension plans, such as through Exchange Traded Funds (ETFs), can offer potentially higher returns than traditional savings accounts. ETFs, especially those tracking broad market indices, can provide diversification and growth over the long term. Setting up a regular savings plan (Sparplan) with ETFs is a popular and accessible way to build wealth for retirement. Remember, the earlier you start, the more time your investments have to grow through compound interest. You can find more information on private pension options.

Regularly Reviewing Your Pension Forecast

Your pension forecast isn't a one-time document. Life happens, circumstances change, and so do pension regulations. It's a good idea to review your predicted pension statement (Renteninformation) at least every few years, or whenever a significant life event occurs (like a change in job, marriage, or having children). This allows you to see how your contributions and any changes in your life are affecting your projected pension. It also gives you a chance to adjust your savings strategy if needed. Think of it as a health check for your retirement finances.

Understanding Tax Advantages for Pensions

Many pension schemes in Germany come with significant tax benefits. Contributions to state-subsidised plans are often tax-deductible, meaning you can reduce your taxable income in the present. While pension payouts are taxed, the tax rate during retirement might be lower than your working-life tax rate, especially if you've planned well. Understanding these tax implications can help you make more informed decisions about where to save and how much. For example, capital gains from certain private investments like ETFs might be taxed at a lower rate than your regular income tax.

Leveraging German State Subsidies

Don't leave money on the table! German state subsidies are a key component of boosting your retirement savings. As mentioned with Riester pensions, these subsidies can take the form of direct payments from the government or tax relief. It's important to understand who is eligible for these subsidies and how to claim them. For instance, if you have children, you might be entitled to additional bonuses with a Riester contract. Taking full advantage of these government incentives can make a noticeable difference to the final amount you accumulate for retirement.

Understanding Pension Contributions

Right, let's talk about how your pension actually gets funded. It's not magic, and it's definitely not just money appearing out of thin air when you hit retirement age. The German public pension system, like many others, is primarily a pay-as-you-go system. This means the contributions paid by today's workers are what pay for today's pensioners. It's a bit of a generational contract, and understanding how it works is key to figuring out your own future pension.

The 18.6% Public Pension Contribution Rate

Currently, the standard contribution rate for the public pension insurance in Germany stands at 18.6% of your gross salary. This rate is applied up to a certain income ceiling, known as the Beitragsbemessungsgrenze. For 2025, this ceiling is €9,050 per month in the western states and €8,750 per month in the eastern states. So, if you earn more than this, your contributions won't increase beyond this limit.

Employer and Employee Contribution Split

This 18.6% isn't all coming out of your pocket, thankfully. It's split equally between you and your employer. So, you each contribute 9.3% of your gross salary (up to the income ceiling, of course). This employer contribution is a significant part of your overall compensation package, even if it doesn't land directly in your bank account each month. It's worth noting that civil servants in Germany have a different system; they don't make direct pension contributions, but their salaries are adjusted accordingly [24b9].

Automatic Deductions from Your Salary

For most employees, these contributions are automatically deducted from your salary each month by your employer. You'll see this deduction clearly on your payslip. This makes contributing straightforward, as you don't have to actively do anything. Your employer handles the transfer to the pension insurance provider.

Contributions During Child-Rearing Periods

Germany recognises that raising children is valuable work, and it impacts your pension contributions. For a certain period per child (typically up to three years), the state makes pension contributions on your behalf. This is a really important aspect for parents, as it helps to prevent significant gaps in their pension accounts. You usually need to apply for these periods to be recognised, so don't assume they're automatically added [5f2a].

Voluntary Contribution Options

If you're not an employee or if you want to boost your future pension, you might have options for voluntary contributions. This could be relevant if you've had periods of unemployment, worked abroad, or simply want to increase your pension points. The rules for voluntary contributions can be a bit complex, so it's often best to check with the Deutsche Rentenversicherung directly.

How Contributions Fund Current Pensioners

As mentioned, the system is pay-as-you-go. This means your contributions aren't being saved in a personal pot for your future retirement. Instead, they're used to pay the pensions of people who are retired right now. This is the core of the generational contract. It works well when the ratio of workers to pensioners is favourable, but demographic changes can put a strain on this model.

The sustainability of this pay-as-you-go system is heavily influenced by demographic trends. A shrinking workforce and an aging population mean fewer contributors supporting a growing number of beneficiaries, which is a challenge the German pension system, like many others globally, must continually address.

The Link Between Contributions and Future Payouts

While your contributions fund current pensions, they also build up your entitlement for your own future pension. The amount you contribute, based on your salary and the contribution period, directly translates into pension points (Entgeltpunkte). These points are a primary factor in calculating your eventual pension amount. The more you earn and contribute over your working life, the more pension points you accumulate, and generally, the higher your future pension will be.

Tracking Your Contribution History

It's a good idea to keep an eye on your contribution history. You'll receive a pension forecast statement (Renteninformation) periodically, which outlines your accrued pension rights. If you notice any discrepancies or missing periods, it's important to address them promptly with the pension provider. You can request a full pension account statement (Kontenklärung) if needed to ensure all your contribution periods are correctly recorded [5f2a].

The Role of Demographic Change

It's no secret that Germany, like many other developed nations, is facing some significant demographic shifts. These changes aren't just abstract statistics; they have a very real and direct impact on the country's pension system, particularly the public one. The core of the German public pension system relies on a 'pay-as-you-go' model. This means that the contributions paid by today's working population are used to fund the pensions of today's retirees. It's a generational contract, essentially.

Aging Population and Pension Sustainability

One of the biggest factors is the aging population. People are living longer, which is fantastic news, but it also means more people are drawing pensions for extended periods. At the same time, birth rates have been declining for years. This creates a double whammy: more pensioners and fewer contributors to support them. The sustainability of the current system is definitely under pressure.

Decreasing Birth Rates and Workforce Size

Think about it: if fewer children are born, there will be fewer young people entering the workforce in the future. This directly shrinks the pool of potential contributors to the pension fund. It's a bit like a company where the number of customers is shrinking while the number of people needing services is growing. That's not a great business model in the long run, and it's a similar challenge for the pension system.

The Strain on the Generational Pension Contract

This imbalance puts a considerable strain on the generational pension contract. The idea that each generation supports the previous one is becoming harder to maintain. As the ratio of workers to pensioners shifts, the system has to adapt, and that often means difficult conversations about contribution rates, retirement ages, and benefit levels.

Future Projections for Pensioner Numbers

Projections show that the number of pensioners in Germany is set to increase significantly over the coming decades. This isn't a sudden shock; it's a gradual trend driven by past birth rates and increasing life expectancy. Planning for this future influx of retirees is a major challenge for policymakers.

Impact on the Rentenniveau (Pension Level)

The 'Rentenniveau', which is the ratio of average pensions to average wages, is directly affected. To keep the system financially viable with fewer contributors supporting more beneficiaries, the Rentenniveau might need to decrease. This means future pensions, relative to previous earnings, could be lower than what current retirees receive. It's a tough reality that many people need to prepare for.

The Need for Supplementary Retirement Planning