DIY Investing vs Finanz2Go (All-in Comparison)

Compare estimated monthly all-in costs and what’s included. This tool highlights the difference between a DIY setup and a guided, managed approach.

Inputs

DIY assumptions

Time & complexity (optional)

Finanz2Go fee

*Educational estimator. “Time cost” is optional and depends on your own valuation.

Results

What’s included

Neobroker vs Finanz2Go – Fee & Value Comparison for Expats in Germany

The rise of Neobrokers like Trade Republic, Scalable Capital, or eToro has made investing more accessible than ever — offering low-cost, do-it-yourself trading directly from your smartphone. At the same time, Finanz2Go Consulting provides personalized, English-speaking financial advice for expats in Germany who want a structured, goal-oriented approach.

Both approaches can work — but the key question is: What’s better for you — managing everything yourself or working with a trusted financial advisor?

This in-depth comparison will help you understand the real differences between DIY investing via Neobrokers and working with Finanz2Go. You’ll see how costs, time commitment, risk management, and long-term outcomes differ — based on objective data and real-world examples.

What Is a Neobroker?

Neobrokers are digital trading platforms that let you buy and sell ETFs, stocks, and other securities at low cost. They’re ideal for self-directed investors who want full control and are comfortable making their own financial decisions.

- ✅ Low transaction fees: Some Neobrokers offer €1 trades or free ETF saving plans.

- ✅ Fast digital onboarding: Accounts open within minutes.

- ✅ Modern apps: Great user interfaces and mobile experiences.

Popular Neobrokers in Germany include Trade Republic, Scalable Capital, and JustETF.

However, while Neobrokers make investing easier, they don’t provide personal guidance or tailored portfolio management. That’s where Finanz2Go offers an alternative.

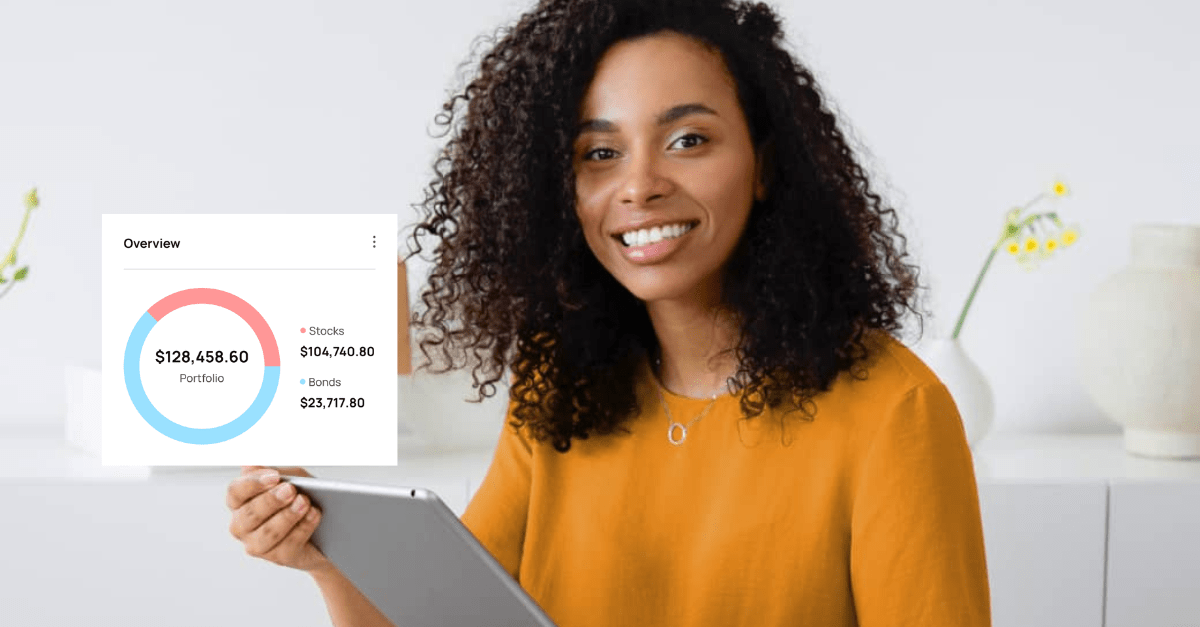

What Is Finanz2Go Consulting?

Finanz2Go Consulting is an independent financial advisory firm specializing in helping expats in Germany manage their wealth, investments, and pension plans — fully in English. Our approach combines digital tools with personal guidance, helping clients make informed, tax-efficient financial decisions.

Unlike Neobrokers, Finanz2Go offers:

- ✅ Personalized investment consulting tailored to your goals.

- ✅ Professional portfolio management with clear transparency.

- ✅ Long-term retirement planning and pension strategy for expats.

- ✅ Insurance consulting and risk analysis for comprehensive coverage.

Finanz2Go bridges the gap between do-it-yourself investing and expensive private banking — combining independent advice, transparent fees, and personal support.

Neobroker vs Finanz2Go – Key Comparison at a Glance

| Feature | Neobroker | Finanz2Go Consulting |

|---|---|---|

| Investment Control | Full DIY – you make every decision | Guided by certified advisors |

| Fees | Low transaction fees (e.g., €1–€5/trade) | Transparent all-in advisory fees |

| Tax Optimization | DIY responsibility | Integrated tax-efficient investment strategies |

| Portfolio Design | Self-directed ETF choice | Tailored portfolio based on goals and risk profile |

| Time Commitment | High – requires research and monitoring | Low – managed and monitored by experts |

| Human Support | None / Online Helpdesk | Dedicated English-speaking advisor |

| Regulation | BaFin-regulated broker | BaFin-regulated advisor |

Both approaches can succeed — but for many expats, **the right choice depends on their time, experience, and confidence** in managing German tax and investment systems.

Tip: Use our Investment Goal Calculator to see how your savings might grow with different strategies.

Understanding the Real Cost of Investing – Neobroker vs Finanz2Go

At first glance, Neobrokers seem unbeatable in terms of price. Trading ETFs or stocks for just a few euros sounds like a great deal. However, the **real cost** of investing isn’t just about transaction fees — it’s about time, opportunity cost, mistakes, and taxes.

1️⃣ Transaction Fees vs Advisory Fees

| Cost Category | Neobroker (DIY) | Finanz2Go Consulting |

|---|---|---|

| Trade Fees | €1–€5 per trade | Included in management fee |

| ETF Costs (TER) | 0.1%–0.5% | 0.1%–0.3% (optimized selection) |

| Management Fee | None (DIY) | Transparent advisory fee (all-in) |

| Hidden Costs | Possible bid-ask spreads, execution delays | None – institutional access and execution |

Neobrokers may appear cheaper, but poor diversification, emotional trading, or timing errors can erode performance over time. Finanz2Go’s structured investment approach minimizes such risks and optimizes total net returns — even after advisory fees.

To estimate the difference, try our ETF Saving Plan Calculator to see how small cost or return differences compound over time.

2️⃣ Time and Complexity

Managing investments yourself requires continuous attention:

- Market monitoring and portfolio rebalancing

- Understanding taxation under German law

- Staying disciplined during market downturns

Many expats underestimate the time cost and complexity of managing portfolios across countries and tax systems. Finanz2Go provides long-term structure, ensuring your investments stay on track without constant manual involvement.

Example: A busy engineer in Munich might spend 30–40 hours annually researching ETFs and managing rebalancing. With Finanz2Go, that time is replaced by a quarterly portfolio review and an annual strategy meeting — in English, tailored to your goals.

Performance and Behavioral Impact

Several independent studies, such as those by Morningstar, show that individual investors underperform markets by 1–2% per year due to emotional decision-making — buying high and selling low. Finanz2Go’s data-driven approach helps clients avoid these pitfalls by focusing on long-term strategy, not short-term market noise.

Over a 20-year horizon, even a 1% annual difference in return can mean tens of thousands of euros in lost growth. That’s why guided investing can often outperform low-cost DIY portfolios when risk, behavior, and taxes are factored in.

Tax Efficiency and Compliance

Taxes play a significant role in real net returns. With Neobrokers, you’re responsible for managing your own tax reports and understanding complex German investment rules. Finanz2Go integrates tax optimization into every investment plan.

How Finanz2Go Helps You Save Taxes

- 📊 Selection of ETFs eligible for Teilfreistellung (30% partial tax exemption)

- 📈 Use of accumulating ETFs to defer taxation

- 🧾 Annual performance reports formatted for your tax advisor

- 🌍 Cross-border tax coordination for international expats

For detailed rules, you can refer to official guidance from BaFin or the German Ministry of Finance.

Case Study: Neobroker vs Finanz2Go – Two Expat Scenarios

Case 1 – The DIY Investor (Neobroker)

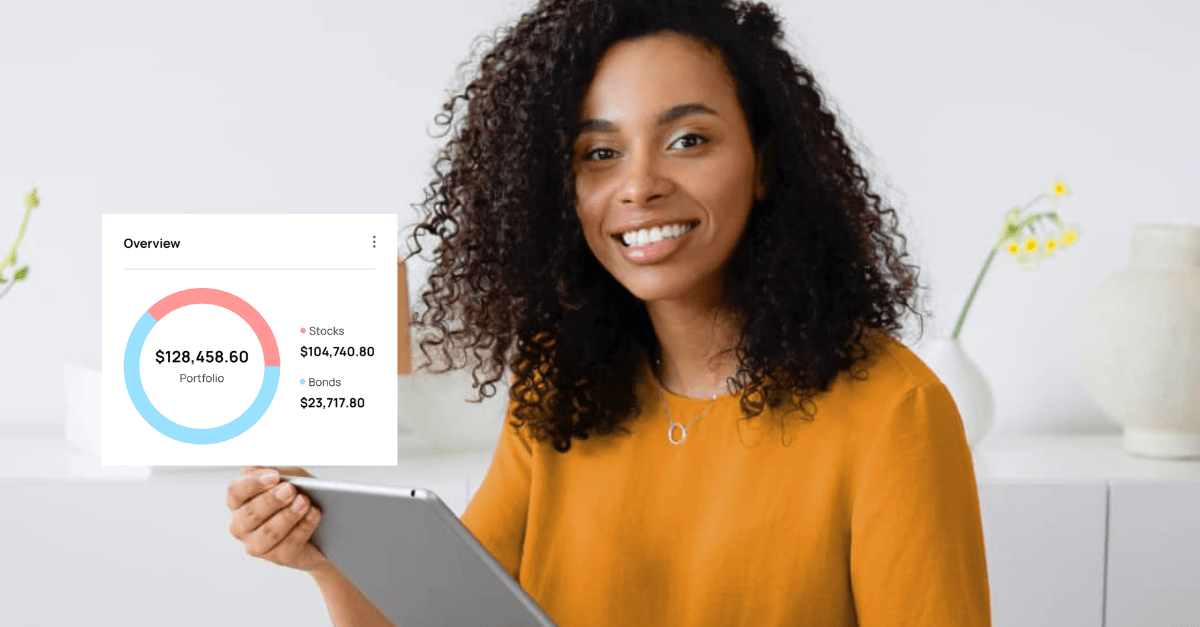

James, a 32-year-old expat from the UK, uses a Neobroker to invest €400/month into ETFs. He enjoys the flexibility but struggles to stay consistent. During market volatility, he pauses contributions several times and sells during downturns, losing roughly 1.5% per year compared to market returns. After 15 years, his portfolio is worth €120,000.

Case 2 – The Guided Investor (Finanz2Go)

Sophia, a 35-year-old engineer from the U.S., invests the same €400/month through Finanz2Go. Her portfolio is automatically rebalanced and optimized for taxes. She stays invested through all market cycles. After 15 years, her portfolio grows to approximately €145,000 — a difference of €25,000 simply through discipline and optimization.

While both approaches can work, **Finanz2Go’s professional structure and behavioral guidance** often lead to more consistent results and peace of mind — especially for long-term expats balancing multiple priorities.

Summary – Which Option Fits You Best?

Both Neobrokers and Finanz2Go offer legitimate paths to investing success in Germany. The right choice depends on your experience level, time availability, and comfort with financial decision-making in a new tax and regulatory environment.

| Aspect | Neobroker | Finanz2Go Consulting |

|---|---|---|

| Ideal For | DIY investors who enjoy managing portfolios | Expats seeking structured, long-term financial planning |

| Fees | Low per-trade costs | Transparent all-in advisory fee |

| Time Commitment | High – requires regular research | Low – managed and reviewed for you |

| Risk & Behavior | High potential for emotional decisions | Guided discipline and diversification |

| Tax Optimization | Manual reporting | Integrated into strategy |

| Language & Support | German interfaces, automated help | English-speaking human advisors |

| Best For | Active traders, hobby investors | Professionals and families planning long-term wealth |

In short: Neobrokers are a cost-effective starting point for self-starters. But if you prefer long-term clarity, personalized strategies, and professional oversight, Finanz2Go Consulting delivers measurable value far beyond trading fees.

Frequently Asked Questions (FAQ)

Is a Neobroker cheaper than working with Finanz2Go?

Per-trade costs are lower with Neobrokers, but advisory services often generate higher net results through tax efficiency, disciplined investing, and professional diversification.

Can I use both a Neobroker and Finanz2Go?

Absolutely. Many clients keep a small DIY portfolio for learning while letting Finanz2Go manage their core, long-term investments.

Are Neobrokers regulated in Germany?

Yes – most operate under BaFin oversight.

However, investor protection and personal advice differ from licensed financial consulting services like Finanz2Go.

What languages does Finanz2Go support?

All advisory sessions, reports, and tools are provided in English – ideal for expats navigating German financial systems.

Does Finanz2Go charge hidden fees?

No. All costs are disclosed upfront and remain transparent throughout the advisory relationship.

Plan Your Investment Journey

Whether you invest independently or with professional support, using the right tools helps you make informed, data-driven decisions. Explore our free calculators and learning resources for expats in Germany:

- ETF Saving Plan Calculator

- Pension Gap Calculator

- Investment Goal Calculator

- Portfolio Risk Calculator

These tools link directly to personalized guidance available through Finanz2Go – ensuring your numbers turn into actionable strategies.

Final Thoughts

Digital Neobrokers revolutionized access to investing in Germany. Yet, for expats facing new tax systems, pension challenges, and long-term financial goals, professional support adds stability, structure, and clarity.

At Finanz2Go Consulting, we empower English-speaking expats with independent advice, data-driven planning, and transparent costs – combining the efficiency of modern fintech with the trust of personal guidance.

Continue learning in our Financial Hub for Expats or explore related guides: