Investment Consulting

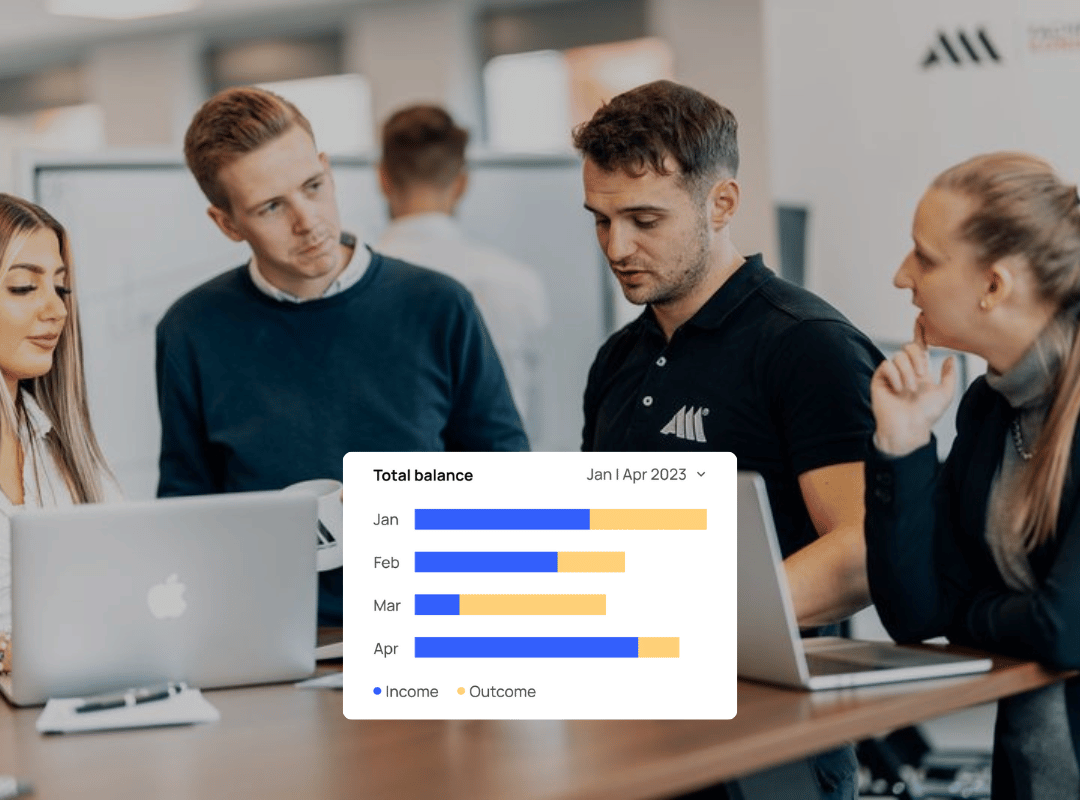

We help you build an investment portfolio that suits your goals.

Book an appointment

1. Investment Strategy Development

We create a long-term plan designed for stability and growth.

Book an appointment

2. A fair all-in-one fee of only approx. 0.7% p.a.*

No performance-based fees, no front-end or back-end loads, very low transaction costs, automated rebalancing & regime change.

Book an appointment

3. Ongoing Portfolio Review & Optimization

We’ll analyze your investment portfolio for diversification, costs, and performance.

Book an appointmentWhy Choose Finanz2Go for Investment Consulting?

At Finanz2Go, we are 100% client-focused, working solely in your best interest.

We’re officially licensed by the IHK (Industrie- und Handelskammer) under §34f GewO, guaranteeing full compliance and transparency.

What Makes Us Different:

- Independent: We receive no commissions from banks or fund providers.

- Data-driven: Your investment plan is built using modern analysis tools.

- Transparent: You see every cost and projection clearly.

- Digital-first: Consult online, from anywhere in Germany or abroad.

- Sustainable options: ESG and ethical portfolios available.

So, 2026 is here, and things in the German economy are a bit… interesting. Inflation's still a thing, and traditional savings aren't really cutting it anymore.

It feels like everyone's looking for ways to make their money work harder, something that isn't tied to all the usual market ups and downs.

We've seen a lot of talk about assets that you can actually touch, like property or energy projects, and even some newer ideas like funding legal cases. It's a shift from just chasing stocks and bonds. Let's break down what investing during inflation in Germany might look like this year. Germany’s strong economy and stable financial system make it an appealing place to grow your money.

For expats and international investors, the challenge is often knowing where to start. As Europe’s largest economy and one of the world’s top exporters, Germany has long been a magnet for investors.

It makes up nearly a quarter of the Eurozone’s GDP and holds a AAA credit rating, giving it a reputation for stability and security. From manufacturing giants to innovative startups, opportunities are backed by reliable infrastructure and strong regulation. Cautious saving is part of the national culture.

German households often save more than 19% of their disposable income, one of the highest rates in Europe. Traditionally this money went into bank accounts or insurance products, but more people are now exploring funds, ETFs and property to secure better long-term returns.

For expats and foreign investors, the country offers a safe and well-regulated environment, with steady opportunities for those willing to navigate the rules. Even if you’ve invested before, navigating the system in Germany can feel quite different.

The paperwork and tax details don’t always match what you know from home, and if you’re brand new to investing, it can seem more confusing than ever. Sitting down with a qualified advisor can take the pressure off and give you the confidence to plan wisely.

Key Takeaways

- Get set up properly: Open a local bank account and secure your German tax ID to access investment platforms and products.

- Stick with trusted providers: Always choose BaFin-authorised banks, brokers, or fund managers to protect your money.

- Start small and diversify: Begin with savings plans or ETFs and spread investments across different assets to manage risk.

- Be mindful of taxes: Learn how the 25% flat investment tax works and use your 1,000 EUR annual allowance to reduce your bill.

- Transfer funds wisely: Use services like Wise for low-cost international transfers at the mid-market exchange rate when moving money to and from Germany.

- Only invest spare funds: Stick to money you won’t need for living expenses. For expats, that matters even more given the chance of sudden costs like relocation or family travel.

- Don’t borrow to invest: Using credit or loans for investments can magnify losses as well as gains. Financial experts generally recommend steering clear of this approach.

- Be wary of “get rich quick” offers: The German financial regulator (BaFin) frequently warns about unlicensed providers and fraudulent investment schemes, warning consumers to always check whether a provider is authorised before sending money.

Why Germany Remains a Top Investment Destination in 2026

Germany, as Europe's largest economy, continues to present a compelling case for investors in 2026. Despite some global economic headwinds, the country's robust financial system and strong regulatory framework offer a sense of security that's hard to find elsewhere. For expats looking to grow their capital, Germany provides a stable environment backed by a AAA credit rating and a significant share of the Eurozone's GDP. This stability is not just theoretical; it's built on a foundation of reliable infrastructure and a diverse industrial base, from established manufacturing powerhouses to burgeoning tech start-ups.

Several factors contribute to Germany's enduring appeal for investment ideas in 2026:

- Economic Resilience: While growth might not be explosive, the German economy has shown a capacity to weather storms. Projections for 2026 indicate a gradual improvement, supported by increasing consumer spending and significant public investment in key sectors.

- Strong Regulatory Oversight: The presence of the Federal Financial Supervisory Authority (BaFin) provides a layer of trust and protection for investors, ensuring that financial institutions operate within strict guidelines.

- Diversified Opportunities: Beyond traditional stocks and bonds, Germany offers a wide array of investment avenues. These range from tangible assets like real estate and commodities to newer, alternative markets.

- Focus on Innovation and Sustainability: Germany is a leader in green technology and sustainable practices, creating opportunities in sectors like renewable energy that offer both financial returns and positive environmental impact.

The economic landscape in 2026 suggests a move towards assets with tangible value and a focus on long-term stability. While market volatility remains a consideration, Germany's underlying economic strength and commitment to innovation position it favourably for those seeking to make their money work effectively.

Overview of the German Investment Landscape

Germany, as Europe's largest economy, presents a robust and stable environment for investors. It's a country known for its strong industrial base, innovative spirit, and a generally cautious approach to finance, which often translates into a secure, albeit sometimes slower-paced, investment scene. For those new to the German market, understanding its unique characteristics is the first step towards successful investing.

The German financial system is highly regulated, with the Federal Financial Supervisory Authority (BaFin) overseeing banks, insurers, and investment firms. This regulatory oversight provides a layer of security for both domestic and international investors. While traditional savings accounts and insurance products have long been popular, there's a noticeable shift towards more dynamic investment vehicles like exchange-traded funds (ETFs) and direct property investments. This evolution reflects a growing desire for better long-term returns, especially among younger generations and the increasing expat community.

Key characteristics of the German investment landscape include:

- Economic Stability: Germany boasts a AAA credit rating and a significant share of the Eurozone's GDP, offering a solid foundation for investments.

- Regulatory Framework: BaFin's strict oversight ensures a high level of investor protection.

- Cultural Tendency Towards Saving: German households traditionally save a substantial portion of their income, indicating a strong domestic capital base.

- Growing Interest in Diversification: While caution remains, there's an increasing adoption of diverse investment strategies beyond basic savings.

The German government is adopting a more expansionary fiscal stance, planning increased spending to stimulate economic growth. This includes significant investment in infrastructure and climate projects, signalling potential opportunities for those looking at tangible assets and long-term development. However, this also means government debt is expected to rise, a factor to consider in the broader economic outlook.

While the overall picture is one of stability and opportunity, expats might find the administrative processes and tax regulations a bit different from what they're used to. Familiarising yourself with these aspects, perhaps with the help of a local financial advisor, can make the process much smoother. The European Central Bank's recent decisions on interest rates also play a role, influencing the cost of borrowing and the returns on various asset classes, which is something to keep an eye on for rate cut implications.

Understanding these nuances is key to making informed decisions and building a portfolio that aligns with your financial goals within the German context.

Stock Market Investments and ETFs in Germany

Germany's stock market offers a solid avenue for growth, with the Frankfurt Stock Exchange (Frankfurter Wertpapierbörse) being a major European hub. For many expats, the most accessible route into this market is through Exchange-Traded Funds (ETFs). These funds are a popular choice because they allow you to invest in a broad range of companies, often tracking major indices like the DAX 40, which represents Germany's largest publicly traded companies. This approach helps spread risk, which is a good thing when you're starting out.

ETF investing Germany has become incredibly straightforward, thanks to numerous online brokers and banks offering low-cost accounts. You can buy and sell ETF shares just like regular stocks, making them quite flexible. Many ETFs also focus on sustainable investing Germany, aligning your financial goals with environmental and social values. This is becoming a significant trend, with more funds dedicated to companies with strong ESG (Environmental, Social, and Governance) credentials.

Here's a quick look at how you might approach stock market investments:

- Direct Stock Purchases: Buying shares in individual German companies like Siemens, SAP, or Volkswagen. This requires more research and carries higher risk if you don't diversify.

- Index ETFs: Funds that track a specific market index, such as the DAX 40, MDAX (mid-cap companies), or even broader European or global indices. This is a common and cost-effective method.

- Sector-Specific ETFs: Funds focusing on particular industries within Germany or Europe, like technology, automotive, or renewable energy.

When considering ETFs, it's wise to look at their expense ratios (fees) and historical performance. Remember, past performance isn't a guarantee of future results, but it gives you an idea of how a fund has behaved.

Investing in the stock market, whether directly or via ETFs, means accepting some level of volatility. Markets can fluctuate, and the value of your investments can go down as well as up. It's important to only invest money you can afford to lose and to have a long-term perspective.

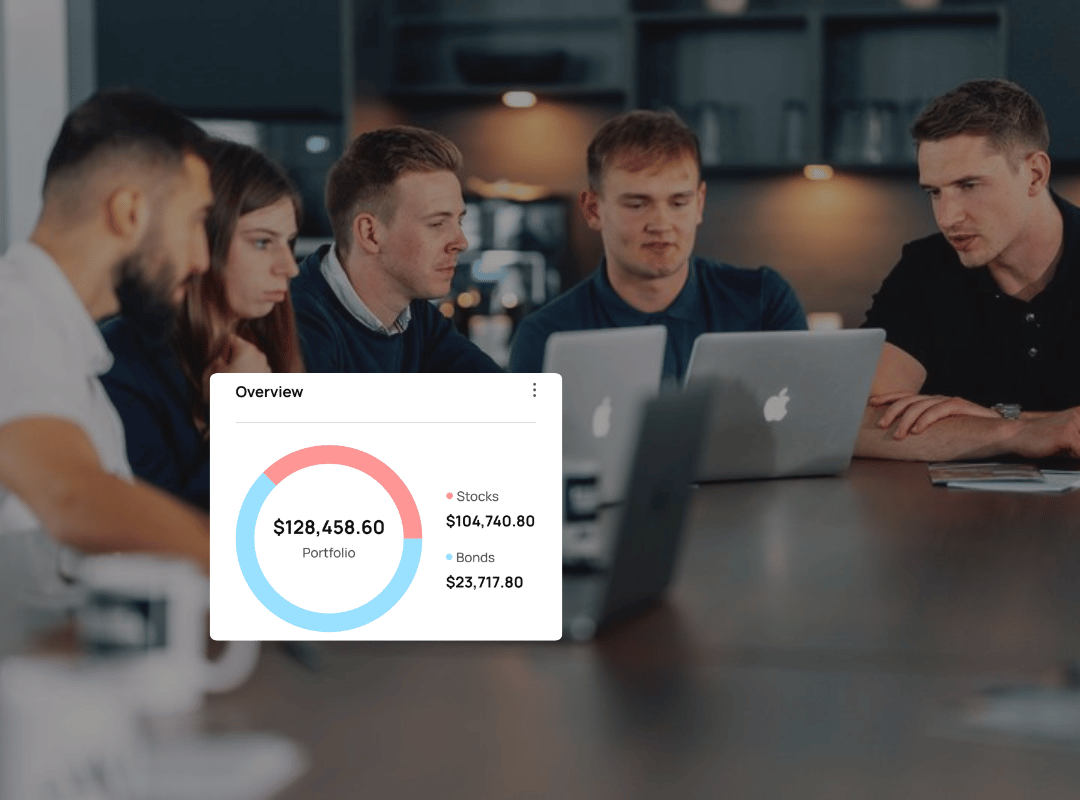

Bonds and Fixed-Income Opportunities

When you're thinking about putting your money to work in Germany, bonds and other fixed-income products are definitely worth a look, especially if you prefer a steadier ride compared to the stock market.

These are essentially loans you make to governments or companies. In return, they promise to pay you back your original amount on a specific date, plus regular interest payments along the way. It’s a pretty straightforward concept, and for many, it offers a sense of security.

Germany has a few main types of bonds that expats often consider:

- German Government Bonds (Bunds): These are issued by the German federal government and are considered some of the safest investments in Europe. Because they're backed by the government, the risk of not getting your money back is very low. The interest rates, or yields, on these tend to be lower than corporate bonds, but they offer that peace of mind.

- Corporate Bonds: These are issued by companies. They usually offer a higher interest rate than government bonds because there's a bit more risk involved. The safety of a corporate bond depends heavily on the financial health and credit rating of the company issuing it. Think of it as a trade-off: a bit more risk for potentially a bit more return.

- Green Bonds: A growing area, these are bonds specifically issued to fund environmental projects, like renewable energy or sustainable infrastructure. They work like regular bonds but have the added appeal of supporting eco-friendly initiatives. They often offer similar yields to conventional bonds.

Here’s a quick look at typical yields you might see, though remember these figures change based on market conditions and when you invest:

Bond Type | Typical Yield (Mid-2025 Estimate) | Risk Level | Issuer |

|---|---|---|---|

10-Year German Bund | ~2.75% | Very Low | Government |

Investment Grade Corp | ~3.50% | Low-Medium | Companies |

Green Bonds | Varies (similar to conventional) | Varies | Gov/Companies |

It's important to remember that while bonds are generally safer than stocks, their prices can still go up and down, especially if interest rates change. If you need your money back before the bond matures and interest rates have risen, you might get back less than you originally invested. Many people choose to hold bonds until they mature to avoid this uncertainty and lock in their return.

For expats, understanding how these bonds fit into your overall financial plan is key. They can provide a stable income stream and help balance out riskier investments in your portfolio. Keeping an eye on the European Central Bank's interest rate decisions is also a good idea, as these have a big impact on bond yields.

Real Estate Investments in Germany

Germany's property market has long been a stable choice for those looking to invest, and for expats, it presents a tangible asset with potential for long-term growth. The buying process here is quite transparent, with every transaction requiring a notary and registration in the land register (Grundbuch), which offers a good layer of security for both buyer and seller. It's not just about apartments in Berlin or Munich, either; opportunities exist across various federal states, from bustling city centres to more tranquil rural areas.

For foreigners, purchasing property in Germany is generally straightforward. You don't need a special permit to buy, though owning a home doesn't automatically grant residency rights. The main steps involve finding a suitable property, signing a notarised contract, and then having your name officially recorded. Banks are usually willing to lend to non-residents, but be prepared for potentially stricter terms, such as a larger initial deposit or a shorter repayment period compared to local buyers. This is one of the more traditional ways of investing, often considered among the best investments in Germany for its perceived safety.

When considering property, think about:

- Location: Proximity to transport links, amenities, and potential for future development.

- Type of Property: Residential for rental income or personal use, or commercial for business purposes.

- Market Trends: Researching local rental yields and property value appreciation.

- Associated Costs: Beyond the purchase price, factor in notary fees, land transfer tax, and potential renovation expenses.

While real estate is a popular option, it's worth noting that it's a less liquid asset compared to stocks or bonds. It requires a significant capital outlay and ongoing management, whether it's a rental property or a commercial space. For those interested in broader investment strategies, exploring options like private equity Germany might offer different avenues for growth, though these typically come with higher risk profiles and longer lock-in periods. Understanding the full scope of property acquisition is key, and resources detailing the legal process and potential hidden costs can be very helpful for anyone buying property in Germany.

Investing in German real estate can be a solid part of a diversified portfolio. It offers a physical asset that can provide rental income and capital appreciation over time. However, like any investment, it comes with its own set of challenges, including market fluctuations, maintenance costs, and the complexities of German property law. Thorough research and professional advice are always recommended before making a commitment.

Alternative and Private Market Investments

Beyond the usual shares and bonds, Germany offers a landscape of alternative and private market investments that can add a different flavour to your portfolio. These aren't traded on the big public exchanges, meaning they often behave differently from the everyday stock market ups and downs. Think of investments tied to real-world projects or businesses that aren't yet, or will never be, publicly listed.

One area gaining traction is private equity and private debt. With private equity, you're essentially investing in companies that aren't on the stock market. The idea is that these businesses, away from the constant pressure of public reporting, can grow and increase in value. It's about spotting potential before it's obvious to everyone else. Private debt, on the other hand, involves lending money to companies. This could be for expansion or other business needs. For investors, it can provide a steadier income stream than equity, often with better interest rates than you'd find in typical bonds. It’s a way to support real economic activity and potentially earn a decent return.

Another option is peer-to-peer (P2P) lending. This is where you lend money directly to individuals or small businesses through online platforms. While the potential returns can be attractive, it's important to be aware of the risks, such as borrowers not repaying their loans. Thorough research into both the platform and the borrowers is key here.

Here's a quick look at how different alternative assets stack up in terms of how easy it is to get your money out:

Asset Type | Typical Liquidity | Notes |

|---|---|---|

Public Equities (ETFs) | High | Traded on exchanges, easily bought/sold. |

P2P Loans | Medium to Low | Depends on platform, secondary markets. |

Private Equity/Debt | Very Low | Capital locked for years. |

Litigation Financing | Low | Tied up until case resolution. |

When considering these types of investments, transparency is really important. You need to know exactly where your money is going and how it's meant to generate returns. If it all feels a bit unclear, it's probably best to look elsewhere. Also, remember that many private market investments are illiquid. This means your money can be tied up for several years, so only invest funds you won't need in the short to medium term. It’s a long-term commitment, and you need to be comfortable with that. For a broader look at what the upcoming year might hold, you can check out PERSPECTIVES 2026.

Evaluating returns in private markets takes more effort than just checking a stock price. You need to look at the whole picture: the initial investment, any fees, how the company or loan is expected to grow, and when you might get your money back. It's a more complex calculation, and past results don't always predict the future. You're looking for a solid business plan and a clear way to make money or get repaid.

Sustainable and ESG Investment Options

It seems like everyone's talking about sustainable and ESG (Environmental, Social, and Governance) investing these days, and Germany is no exception. After a bit of a wobble earlier in 2025, these kinds of portfolios have really bounced back, especially in Europe. People are increasingly looking for ways to make their money work for them while also doing some good for the planet and society.

The focus is shifting from just avoiding harm to actively contributing to positive change. This means looking at investments that tackle climate change, promote social fairness, and adhere to good corporate governance. It’s not just a trend; it’s becoming a core part of many investment strategies.

Here’s a quick look at what’s happening:

- Green Bonds: Germany has been a frontrunner here, issuing its own "twin bonds" that match conventional government bonds but earmark the funds for climate and environmental projects. In 2022 alone, billions were raised this way, supporting everything from renewable energy to sustainable transport. These are a solid way to put money into projects making a real difference.

- ESG Funds: Major players like Deutsche Bank and Allianz offer ESG-focused funds, and there are also smaller firms specialising in impact investing. It’s important to check how these funds are classified, as standards can vary. The EU’s Sustainable Finance Disclosure Regulation (SFDR) helps ensure that funds marketed as sustainable actually meet clear criteria.

- Climate Solutions: Beyond just green bonds, there's growing interest in investments that directly address climate challenges and biodiversity loss. This could involve companies developing new technologies for a low-carbon economy or those focused on conservation efforts.

It’s great that Germany makes it possible for expats and residents alike to get involved in sustainable finance. You can combine the potential for long-term growth with the satisfaction of supporting projects that align with your values. For those looking to explore options that might behave differently from traditional markets, considering things like litigation financing could be an avenue worth investigating, as it's often independent of broader market movements.

Key Risks and Tax Considerations for Expats

Moving to Germany as an expat is exciting, but it brings a unique set of financial considerations, especially when it comes to investing. It's not quite as straightforward as investing back home, and understanding the potential pitfalls is half the battle. One of the biggest hurdles for US citizens living in Germany is navigating the dual tax system. You're generally liable for taxes in both countries, which can feel a bit overwhelming. Thankfully, there are mechanisms like the U.S. Foreign Tax Credit that can help prevent you from being taxed twice on the same income, but you'll want to make sure you're claiming everything you're entitled to. It's worth looking into US tax obligations abroad to get a clearer picture.

When you're an expat, you might be tempted to invest in familiar US-based funds or accounts. However, European regulations can sometimes make this tricky. On the flip side, investing in German or other non-US funds, particularly mutual funds, can lead to complications with the IRS. These are often classified as Passive Foreign Investment Companies (PFICs), and they come with a hefty reporting burden and potentially higher tax rates. It often makes more sense for American expats to stick to US-domiciled funds or individual stocks, ideally with guidance from a specialist.

Currency exchange is another factor to keep an eye on. Whether you're sending money to Germany to invest or planning to draw on investments back in the US, currency fluctuations can eat into your returns. Minimising conversion fees and understanding how exchange rates might affect your portfolio's value is important. Your financial advisor can help you manage this currency exposure.

Here are a few points to keep in mind:

- Dual Taxation: Be aware that both Germany and the US may tax your worldwide income. Utilise tax treaties and credits to avoid double taxation.

- PFICs: Understand the implications of investing in non-US mutual funds, as they can trigger complex US tax rules.

- Retirement Accounts: German tax law doesn't recognise the tax advantages of US retirement accounts like IRAs or 401(k)s. Seek advice on how best to save for retirement.

- Reporting Requirements: You'll need to report foreign bank and investment accounts to the IRS.

The German tax system can feel quite different, and for someone earning around €70,000, the effective tax rate can be noticeably higher than in some other countries. This means that careful planning is needed to make sure your investments work efficiently for you, rather than being significantly eroded by taxes.

It’s also worth noting that Germany doesn't typically have a special tax regime for expats, though certain relocation expenses might be deductible. For many, the complexity of these tax rules and cross-border investment issues makes seeking professional help a sensible step. A financial advisor experienced in expat matters can be invaluable in helping you plan your investments effectively.

Building a Diversified Portfolio as a Foreigner

As an expat in Germany, creating a robust investment portfolio means looking beyond just one country or asset type. The goal is to spread your money around so that if one area isn't doing so well, others can help balance things out. It’s about making sure your hard-earned cash isn't all tied up in one basket, especially with global markets constantly shifting. Think about diversifying across different currencies, geographical regions, and types of investments.

Here’s a breakdown of how to approach this:

- Geographical Spread: While Germany offers many opportunities, don't overlook investments in your home country or other stable economies. This can help mitigate risks associated with any single country's economic or political climate. For instance, considering investments in both Germany and the US might be a sensible approach, depending on your long-term plans.

- Asset Class Variety: Mix it up. Instead of just stocks, consider bonds, real estate, and perhaps even some alternative investments. Each asset class behaves differently under various economic conditions, providing a natural hedge.

- Currency Diversification: Holding assets in different currencies can protect you from significant currency fluctuations. If your primary income is in Euros, having some investments in other major currencies can be a smart move.

Building a diversified portfolio is not just about reducing risk; it's also about capturing opportunities across different markets and economic cycles. It requires a thoughtful approach that considers your personal financial situation, your tolerance for risk, and your long-term objectives.

When thinking about diversification, it’s also wise to consider investments that have tangible value, especially in times of inflation. Assets like commodities or real estate can sometimes hold their value better than purely financial instruments when the cost of living is rising. This is a key strategy for protecting your purchasing power over time. Remember, the global economy is projected to accelerate in 2026, driven by expected interest rate cuts from the Federal Reserve and a weakening US dollar [b840]. This kind of global economic outlook is precisely why a well-diversified approach is so important for expats looking to grow their wealth securely.

How a Financial Advisor Can Help You Invest in Germany

Moving your money and making it work for you in a new country like Germany can feel like a puzzle, especially when it comes to investments. You've got your own financial history, and now you need to understand German rules, taxes, and what's even available. That's where a good financial advisor really comes into their own. They're not just there to sell you something; they're meant to help you figure out the best path forward based on your personal situation.

Think about it: you're trying to balance your current living costs with your future goals, maybe saving for a house, retirement, or just building a bit of a safety net. A professional can help you see the bigger picture. They can explain the different types of investments available, from the well-known ETFs and stocks to perhaps some more niche options you might not have come across before. They'll also be up-to-date on the latest regulations and tax implications, which can be a minefield for expats.

Here’s what a good advisor can do for you:

- Personalised Strategy: They'll take the time to understand your income, your savings, your risk tolerance, and what you want to achieve with your money. This means they won't just suggest a generic plan; it'll be tailored to you.

- Navigating German Regulations: Germany has its own way of doing things, and understanding the paperwork, tax allowances (like the 1,000 EUR annual allowance), and legal requirements can be tricky. An advisor can simplify this, making sure you're compliant and not missing out on any benefits.

- Product Selection: With so many funds, stocks, and other financial products out there, choosing the right ones can be overwhelming. An advisor can help you select investments that align with your strategy and are offered by trusted providers authorised by BaFin.

- Ongoing Support: Investing isn't a one-off event. Markets change, your circumstances change, and your advisor can help you adjust your portfolio over time to stay on track.

It's important to find someone who is properly qualified and transparent about their fees. Don't be afraid to ask questions upfront about how they are paid and what their qualifications are. For Americans looking to invest in Germany, finding advisors who understand cross-border financial management can be particularly helpful Experts for Expats.

When you're looking for an advisor, remember that their main job is to help you make informed decisions. They should be able to explain complex financial concepts in simple terms and provide clear reasons for their recommendations. It's about building confidence in your investment journey.

FAQs – Common Questions About Investment Options in Germany

Investing in a new country can feel a bit like learning a new language, especially when it comes to your finances. Many expats have questions, and that's perfectly normal. Let's clear up some of the most common ones.

What are the most popular ways for expats to invest in Germany?

For many, starting with investment funds and Exchange-Traded Funds (ETFs) is a sensible approach. ETFs, in particular, are favoured for their low costs and ease of trading on the stock exchange, making them accessible even for those new to investing. They often track major indices like the DAX or the global MSCI World. Beyond these, real estate remains a solid, long-term option, and some expats also explore alternative assets like gold, though these require more specialised knowledge. It's always wise to check that any provider you consider is authorised by BaFin, the German financial regulator.

- Investment Funds & ETFs: Diversified, often low-cost, track indices.

- Real Estate: Traditional, long-term asset.

- Savings Accounts: Secure, but typically lower returns.

- Alternative Assets: Gold, collectibles (require expertise).

How does taxation work for expats investing in Germany?

Generally, if you're a resident in Germany, you'll be taxed on your worldwide investment income. This includes things like dividends, interest, and capital gains. There's a flat tax rate of 25% on investment income, plus any solidarity surcharge and, if applicable, church tax. However, everyone gets an annual allowance (Sparer-Pauschbetrag) of €1,000 for single individuals and €2,000 for married couples, which is tax-free. It's also worth noting that the US-Germany tax treaty can affect your obligations, especially if you have income or investments in both countries. Always check your specific situation, as rules can be complex.

Should I use a German bank or an international broker?

Opening a local bank account is often the first step to accessing German investment products. Many German banks have their own asset management arms, like DWS or Union Investment, and offer a range of funds. Alternatively, you might consider international brokers or online platforms that offer access to the German market. The key is to ensure whichever platform you use is regulated and trustworthy. Some expats find it easier to manage their money across borders using services that specialise in international transfers, helping to keep costs down when moving funds to fund your investments.

What are the main risks I should be aware of?

Like any investment, there are risks. Market volatility means the value of your investments can go down as well as up. For ETFs and equity funds, this is particularly true. Alternative investments like cryptocurrencies, while potentially offering high returns, also carry significant risk due to their volatility and the possibility of scams. It's also important to be wary of 'get rich quick' schemes, which are often fraudulent. Always do your homework and only invest money you can afford to lose.

It's a good idea to start with simpler, well-understood investments if you're new to the German market. Don't feel pressured to jump into complex products straight away. Building your knowledge and confidence gradually is a much safer path to growing your wealth over time.

Can I transfer my existing investments from my home country to Germany?

Yes, you can often transfer investments, but the process can vary depending on the type of asset and the countries involved. Some expats choose to sell their existing investments and reinvest the proceeds in Germany, while others look into specific transfer mechanisms. It's a good idea to speak with a financial advisor who understands cross-border regulations. They can help you understand the tax implications and any potential costs associated with transferring assets, which can be quite significant. This is where understanding the US-Germany tax treaty becomes particularly relevant for American expats.

Got questions about investing in Germany? Our "FAQs – Common Questions About Investment Options in Germany" section has the answers you need. We break down complex topics into easy-to-understand advice. Ready to take the next step? Visit our website today to learn more and start planning your financial future!

Wrapping Up Your Investment Journey in Germany

So, you've looked at the different ways to invest your money here in Germany. It's a solid place to put your cash, no doubt about it, but like anything, it pays to be a bit careful. Remember to get your paperwork sorted, like your tax ID, and always stick with places that are properly approved by BaFin. Starting with something simple like savings plans or ETFs is a good shout, and don't put all your eggs in one basket – spread things out. And yes, taxes are a thing, so get to grips with that 25% flat rate and use your allowance if you can. If it all feels a bit much, especially with moving money around or understanding the tax side of things, don't be afraid to ask for help. A good advisor can save you a lot of hassle down the line. Happy investing!

Frequently Asked Questions

What's the best way for a foreigner to start investing in Germany?

For newcomers, it's often smart to begin with simpler options like savings accounts or exchange-traded funds (ETFs). Make sure you have a German bank account and your tax ID ready. Always pick banks and investment companies that are approved by BaFin, Germany's financial watchdog, to keep your money safe.

Can foreigners buy property in Germany?

Absolutely! Foreigners can buy homes and other properties in Germany just like locals. You don't need a special permit to buy, but owning a property doesn't automatically grant you the right to live there. The process involves a notary and registering the sale, which offers good protection for everyone involved.

What are ETFs, and why are they popular in Germany?

ETFs, or Exchange Traded Funds, are like baskets of investments that follow a specific market index, such as the German DAX or global stock markets. They're popular because they're usually low-cost, easy to buy and sell on the stock market, and offer a simple way to spread your money across many companies at once.

How does the German tax system affect my investments?

If you live in Germany, you'll generally pay a flat tax of 25% on your investment earnings, plus a small extra charge called the solidarity surcharge. There's also a tax-free allowance of 1,000 EUR per year for individuals, which can help reduce the amount of tax you owe.

Are there any special retirement savings plans for expats in Germany?

Germany has private pension plans like the Riester and Rürup pensions. The Riester plan is good for employees and comes with government support and tax breaks. The Rürup plan is often favoured by self-employed people or those with higher incomes, offering significant tax deductions. Many also use investment funds for retirement.

What are 'green bonds' and why are they relevant in Germany?

Green bonds are special loans where the money raised is used specifically for environmental projects, like renewable energy or climate protection. Germany has been a leader in this area, issuing 'twin bonds' that are similar to regular government bonds but fund green initiatives. It's a way to invest your money while supporting sustainability.

Is it safe to invest in cryptocurrencies in Germany?

Cryptocurrencies are becoming more common in Germany, and the country has clear rules overseen by BaFin. This helps build trust. However, it's important to remember that crypto values can change very quickly, and there's always a risk of scams. It's best to only invest money you can afford to lose.

What should I do if I'm unsure about investing in Germany?

If you feel lost or confused, it's a great idea to talk to a financial advisor. Look for someone who understands both German rules and international investing. They can help you figure out the best plan for your situation and make sure you follow all the necessary paperwork and tax laws.

How can I transfer money to Germany for investments easily?

When you need to move money between countries, services like Wise can be very helpful. They often offer better exchange rates than traditional banks and have lower fees, meaning more of your money can go into your investments.

What is the 'Mittelstand' and should I consider investing in it?

The 'Mittelstand' refers to Germany's strong base of small and medium-sized businesses. These companies are often leaders in their fields and can be very stable investments. Investing in them might involve buying shares or through specialised funds, but it's a key part of the German economy.

Are savings accounts still a good option in Germany?

While interest rates on savings accounts were very low for a long time, some banks now offer better returns, especially for fixed-term deposits where you lock your money away for a set period. Easy-access accounts are still convenient but usually pay less interest. Remember that savings are protected up to 100,000 EUR per bank.

What does 'diversification' mean for my investments in Germany?

Diversification means spreading your money across different types of investments, like stocks, bonds, and property, and even across different countries or industries. This way, if one investment doesn't do well, others might, helping to reduce your overall risk and protect your money.