Welcome to your complete guide on investing in Germany as an expat. Whether you’re new to Germany or have lived here for years, building a structured investment plan is key to long-term financial independence. At Finanz2Go, we help English-speaking expats navigate the German financial landscape — from ETFs to pensions, taxes, and smart portfolio strategies.

📚 This page is part of our Financial Hub for Expats — your central knowledge base for building wealth in Germany. Explore investing, retirement planning, tax efficiency, and risk management — all written in clear, actionable English.

💡 Why Should Expats Invest in Germany?

Germany offers one of the most stable, transparent, and accessible investment environments worldwide. As an expat earning in euros, investing locally helps you grow wealth efficiently and reduce unnecessary currency risks.

| 🏦 Reason | 💬 Benefit for Expats |

|---|---|

| Economic Stability | Europe’s strongest economy — consistent GDP growth and investor protection. |

| Secure System | Highly regulated banks and transparent investment products. |

| Accessibility | Most brokers welcome international clients with standard documents. |

| Tax Efficiency | Use ETFs and pension products to reduce taxable income. |

| Currency Alignment | Invest in euros where you earn and spend to avoid FX fluctuations. |

Even if you plan to move again, starting early means your money works for you instead of sitting idle. Our advisors create tailored strategies balancing flexibility and long-term growth.

📅 Book a Free 30-Minute Consultation with Finanz2Go

📊 Main Investment Opportunities for Expats

Germany offers a broad range of options. Understanding each helps you design a balanced, goal-oriented portfolio.

1️⃣ Exchange-Traded Funds (ETFs)

ETFs are the backbone of modern portfolios — low cost, transparent, and globally diversified. Learn more in our ETF Investing for Expats guide.

- ✅ Average cost: 0.1–0.4 %

- ✅ Diversified across regions & sectors

- ✅ Perfect for monthly saving plans

2️⃣ Mutual Funds

Prefer professional management? Mutual funds may suit you — though with higher fees. Our Asset Management service helps you combine the best funds with your ETF core.

3️⃣ Private Pension Plans

Tax-advantaged and flexible, ideal for long-term expats. Explore pension consulting or read our Retirement & Pension Planning guide.

4️⃣ Real Estate Investments

Germany’s housing market remains strong. Owning property provides tangible value and inflation protection. Many expats balance property with ETF and pension investments for diversification.

5️⃣ Company Shares & Bonds

Direct stock and bond investments provide control but carry more volatility. Keep these as a smaller, complementary part of your diversified plan.

6️⃣ Sustainable / ESG Portfolios

Invest with purpose. ESG funds align your portfolio with ethical and environmental values. Ask our team how to include them in your investment consulting strategy.

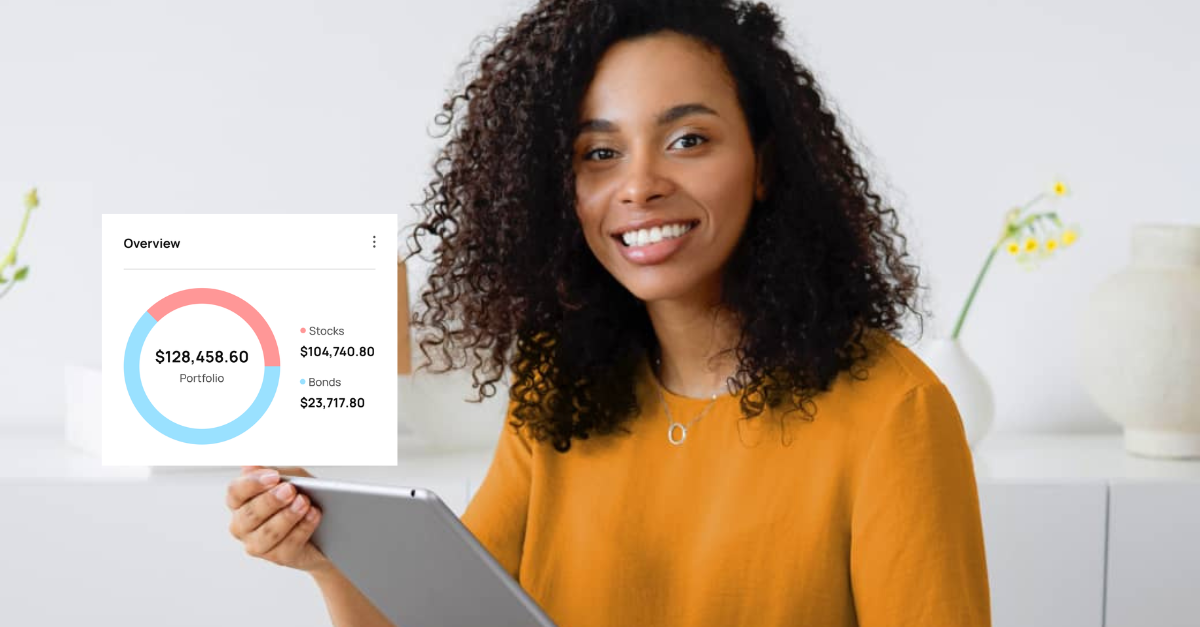

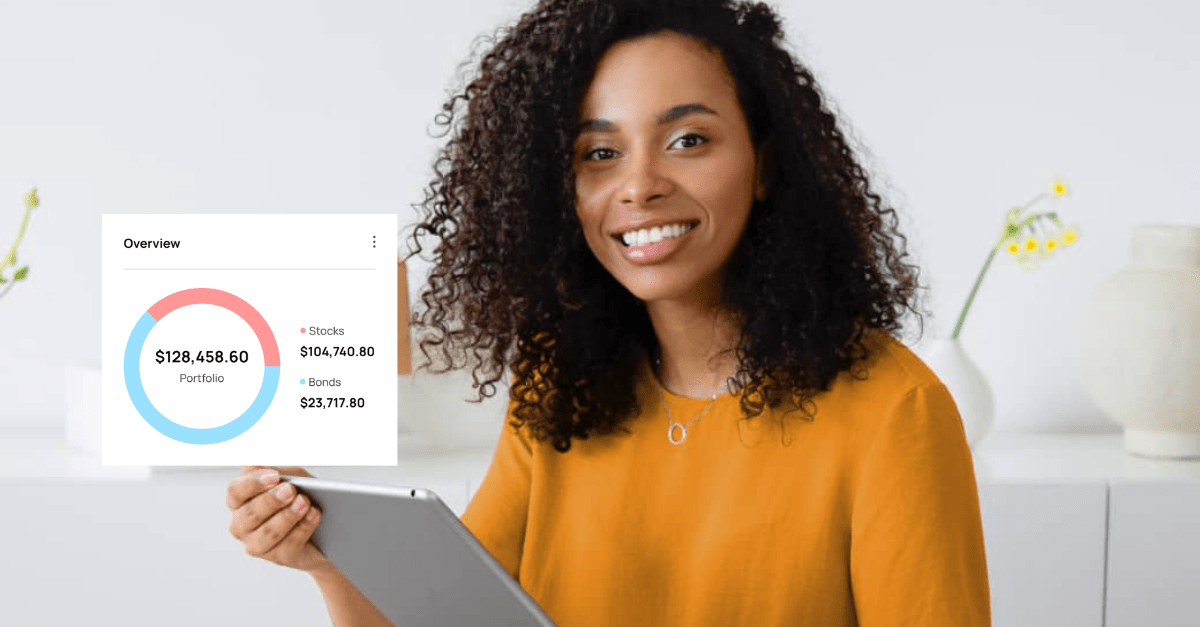

🌍 Building a Diversified Portfolio as an Expat

Diversification means spreading investments to manage risk and capture global opportunities. Germany gives easy access to both domestic and international ETFs — perfect for expats.

| Asset Class | Role in Portfolio |

|---|---|

| Equities | Growth potential through global ETF exposure. |

| Bonds | Stability and predictable income. |

| Real Estate | Inflation hedge and tangible security. |

| Cash | Liquidity for short-term needs and opportunities. |

🔧 Use our financial tools to simulate outcomes:

For many expats, blending euro-based assets with global exposure offers the best balance of growth, safety, and simplicity.

Need help designing your mix?

Our insurance consulting and investment advisory services ensure you’re protected while growing wealth efficiently.

👉 Start Your Free Investment Consultation with Finanz2Go

💶 Understanding Taxes on Investments in Germany

Taxes are a critical part of investing in Germany. Knowing how they work helps you make smarter, more efficient decisions. While the German tax system may seem complex at first, it’s transparent and consistent once you understand the basics.

📘 Key Tax Components

- Capital Gains Tax (Abgeltungssteuer): 25% on investment profits, plus small surcharges.

- Solidarity Surcharge: 5.5% of your capital gains tax amount.

- Church Tax: 8–9% (if applicable to your region).

- Tax-Free Allowance: €1,000 per year for individuals (€2,000 for couples).

💡 Pro Tip: Submit a Freistellungsauftrag (tax exemption order) to your bank or broker to use your annual allowance automatically.

Expats also benefit from Double Taxation Agreements (DTAs), which prevent income from being taxed twice between Germany and your home country. If you file tax returns in two countries, Finanz2Go can help you structure investments accordingly.

Example: A 10,000 € profit from ETF sales would incur a flat 25% tax (2,500 €) plus minor surcharges, leaving ~7,400 € net. With a tax-advantaged pension wrapper, taxes could be deferred for decades — letting compounding work longer.

💶 Try the Fee & Tax Calculator to Estimate Your Net Returns

🚀 How to Start Investing in Germany as an Expat

Getting started is easier than most expect. With the right guidance, you can open an investment account, choose ETFs, and automate your monthly plan in just a few steps.

| Step | Action | Tools / Links |

|---|---|---|

| 1️⃣ Define Your Goals | Clarify why you’re investing — retirement, wealth growth, or education fund. | 🎯 Investment Goal Calculator |

| 2️⃣ Assess Risk Tolerance | Know how much volatility you can handle without stress. | ⚖️ Portfolio Risk Calculator |

| 3️⃣ Choose Investments | Select a diversified mix of ETFs, pensions, and possibly real estate. | 📊 ETF Investing for Expats |

| 4️⃣ Open an Account | Use a reliable online broker or bank that supports expats. | 🏦 Investment Consulting |

| 5️⃣ Automate Contributions | Set up a monthly ETF saving plan or pension contribution. | 📈 ETF Saving Plan Calculator |

| 6️⃣ Review Annually | Adjust investments and risk profile once a year or after major life events. | 📅 Book Review Meeting |

Need assistance? Our investment consulting service guides you through every step — from choosing ETFs to opening accounts and optimizing taxes.

⚠️ Common Investing Mistakes Expats Should Avoid

Even experienced investors can fall into traps when dealing with a new country’s financial system. Avoiding these errors can significantly improve your long-term outcomes.

- ❌ Keeping savings in cash: Inflation quietly erodes your purchasing power every year.

- ❌ Ignoring taxes: Not understanding withholding taxes or DTAs can reduce returns.

- ❌ Over-concentrating: Don’t invest too heavily in your employer’s stock or one sector.

- ❌ Not using tax-advantaged plans: Pension wrappers or insurance-linked investments can boost efficiency.

- ❌ Timing the market: Waiting for “perfect” moments leads to missed growth opportunities.

Smart Move: Automate monthly ETF contributions. This builds discipline and takes emotion out of investing — one of the key success factors in long-term wealth building.

💬 Schedule Your Personal Investing Session with Finanz2Go

🧭 How Finanz2Go Helps Expats Invest Successfully

At Finanz2Go Consulting, we provide independent, English-speaking financial advice specifically tailored for expats in Germany. Our holistic approach combines all aspects of financial planning — investments, pensions, insurance, and taxes — under one clear strategy.

| Service | What You Get | Learn More |

|---|---|---|

| 💼 Investment Consulting | Portfolio design, ETF selection, and asset allocation tailored to your goals. | Visit Page |

| 🏦 Asset Management | Ongoing portfolio management and performance monitoring by our experts. | Visit Page |

| 🧓 Pension Consulting | Private and corporate pension optimization with tax advantages for expats. | Visit Page |

| 🛡️ Insurance Consulting | Comprehensive coverage solutions to protect your income and investments. | Visit Page |

| 🧮 Financial Tools | Use calculators for investment goals, risk tolerance, and fees to plan effectively. | Visit Page |

Each service is fully transparent, commission-free, and designed to empower expats to make confident financial decisions. Our philosophy is simple: educate first, advise second — because informed clients achieve better outcomes.

📈 Real-World Examples of Expat Investors in Germany

Let’s look at how different expats have successfully built wealth while living and working in Germany.

👩💻 Case 1 – Anna from the UK (IT Consultant, Age 32)

Anna wanted to save for early retirement but wasn’t sure where to start. We created a euro-based ETF portfolio combined with a private pension plan. By investing €350 per month, she’s on track for a portfolio of €270 000 in 25 years (5 % annual growth).

👨🔬 Case 2 – David from the US (Engineer, Age 40)

David wanted tax efficiency and income generation. We helped him combine dividend ETFs with a German real-estate fund for balanced returns. Using the Fee & Tax Calculator, we optimized his strategy and improved net returns by 12 % after tax.

👩🏫 Case 3 – Maria from Spain (Teacher, Age 45)

Maria needed flexible savings for university fees. A low-risk bond ETF portfolio and an insurance-based investment solution allowed steady growth while keeping access to funds.

❓ Frequently Asked Questions (FAQs)

1️⃣ Can foreigners invest in Germany?

✅ Yes. Expats can open investment accounts with major German or online brokers using a residence permit and passport.

2️⃣ What is the minimum amount required to start investing?

Many brokers allow ETF saving plans from as little as €25 per month — ideal for building discipline and consistency.

3️⃣ How are investments taxed in Germany?

Capital gains and dividends are taxed at 25 % plus surcharges, but you can reduce this through pension wrappers and tax-free allowances. See our Taxes Guide.

4️⃣ Which platforms are best for expats?

Choose brokers with English support, low fees, and access to global ETFs. We recommend reviewing options via Investment Consulting.

5️⃣ How often should I rebalance my portfolio?

Review once per year or after major life changes to keep your risk profile aligned with your goals.

6️⃣ Can I withdraw investments when leaving Germany?

Yes. Your accounts remain yours. You can keep them active or transfer assets to a new country while staying tax-compliant.

✅ Take the Next Step: Invest Smarter with Finanz2Go

Investing in Germany as an expat doesn’t have to be complicated. By understanding the local rules and using the right tools, you can create a strategy that grows your wealth and protects your future.

- 📊 Plan with our interactive calculators and financial tools.

- 💬 Read related guides: Retirement Planning and ETF Investing for Expats.

- 🔎 Optimize your tax strategy via Investment Tax Guide.

- 🧭 Get personalized support from our Investment Consulting team.

🎯 Start Your Personal Investment Plan Today

Book a free consultation with our English-speaking advisors and discover how to build a smart, tax-efficient portfolio in Germany.

← Back to the Financial Hub for Expats