Investment Consulting

We help you build an investment portfolio that suits your goals.

Book an appointment

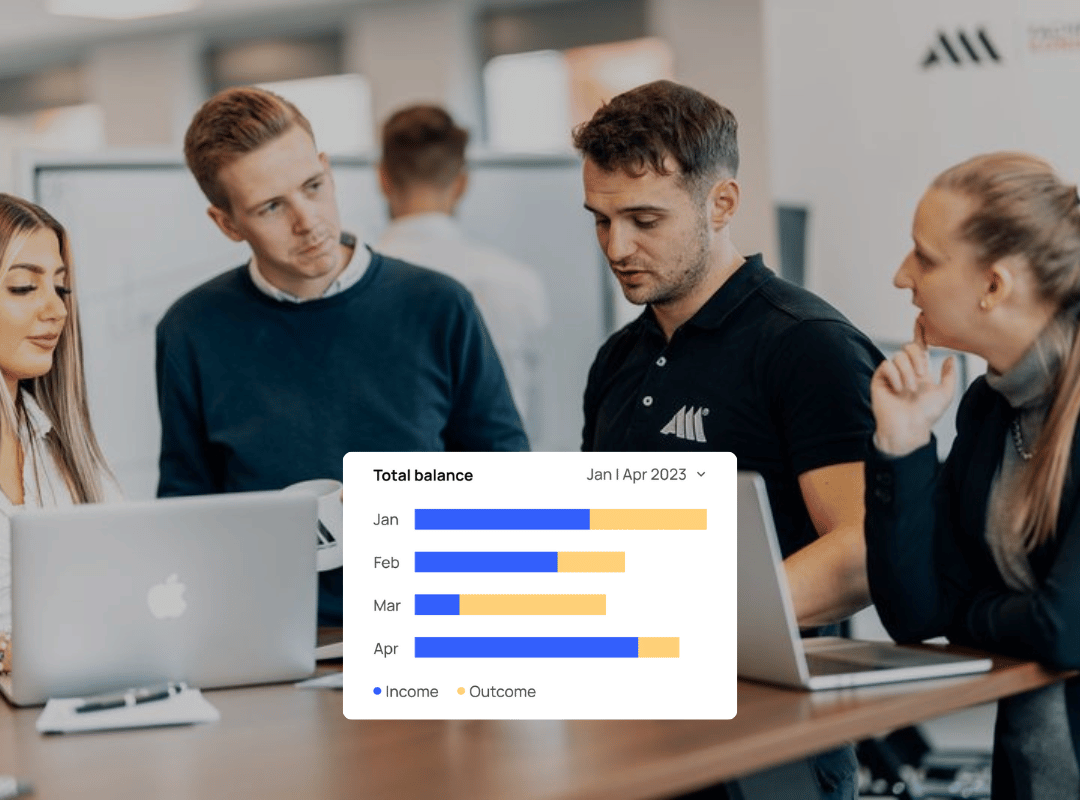

1. Investment Strategy Development

We create a long-term plan designed for stability and growth.

Book an appointment

2. A fair all-in-one fee of only approx. 0.7% p.a.*

No performance-based fees, no front-end or back-end loads, very low transaction costs, automated rebalancing & regime change.

Book an appointment

3. Ongoing Portfolio Review & Optimization

We’ll analyze your investment portfolio for diversification, costs, and performance.

Book an appointmentWhy Choose Finanz2Go for Investment Consulting?

At Finanz2Go, we are 100% client-focused, working solely in your best interest.

We’re officially licensed by the IHK (Industrie- und Handelskammer) under §34f GewO, guaranteeing full compliance and transparency.

What Makes Us Different:

- Independent: We receive no commissions from banks or fund providers.

- Data-driven: Your investment plan is built using modern analysis tools.

- Transparent: You see every cost and projection clearly.

- Digital-first: Consult online, from anywhere in Germany or abroad.

- Sustainable options: ESG and ethical portfolios available.

Thinking about putting your money to work in Germany? It's a solid idea, especially with the country's stable economy.

Lots of people moving here are wondering how to get started with investing, and honestly, it's not as complicated as it might seem. This guide is here to break down how to invest in Germany as a foreigner, covering the basics so you can feel more confident about your financial future.

Key Takeaways

- Germany offers a stable economic environment that's attractive for long-term investments.

- Foreigners can invest in Germany, but understanding the rules and requirements is important.

- You'll need a tax identification number and will likely open specific bank accounts.

- BaFin oversees financial providers, offering a layer of security for investors.

- Options range from safe savings accounts to riskier stocks and real estate.

- ETFs and funds are popular for diversification, making them a good starting point.

- Be aware of German tax laws on investment income and capital gains.

- Planning your goals and choosing the right platform are the first practical steps.

Why Expats Are Choosing Germany for Long-Term Investment

So, you're thinking about putting down roots, or at least some serious cash, in Germany? It's not just the bratwurst and beer, you know. A lot of folks moving here, or even just looking from afar, are seeing Germany as a solid place for their money to grow over time. It’s a country that’s been a bit of a powerhouse in Europe for ages, and that stability is a big draw.

Economic Stability & Forecast for 2026

Germany's economy is known for being pretty steady. It’s not usually a place of wild booms and busts. For 2026, the outlook suggests continued, albeit perhaps moderate, growth. This predictability is gold for investors. You’re not looking for a lottery win; you’re looking for your savings to be safe and to increase reliably. The country has a strong industrial base and a focus on high-quality manufacturing, which helps keep things on an even keel. This economic resilience makes it an attractive destination for those seeking long-term financial security.

Regulatory Environment & Investor Protections

When you're putting your money somewhere new, you want to know it's protected. Germany has a well-established legal and regulatory framework. The government takes investor protection seriously, which is a big plus. You'll find that financial markets are overseen by bodies like BaFin (the Federal Financial Supervisory Authority). This means there are rules in place to keep things fair and transparent. It’s not a free-for-all, and that’s exactly what you want when you're investing for the long haul. This structured approach provides a sense of security for anyone looking to invest in Germany, whether they're already living there or investing from abroad Germany offers opportunities for individuals to make their money work harder.

The German market offers a blend of stability and opportunity, underpinned by a strong regulatory system that safeguards investor interests. This environment is particularly appealing to those seeking dependable growth for their capital.

Can Foreigners Invest in Germany? Rules & Requirements

Yes, absolutely. Germany welcomes foreign investment and has a fairly straightforward process for non-residents looking to put their money into the German market. You don't need to be a German citizen or even a resident to open investment accounts or buy assets here. The country has a stable economic outlook and a regulatory framework designed to protect investors, which is a big draw for people from abroad. It's all about understanding the basic steps and requirements.

Opening Accounts & Tax Identification

To start investing, you'll generally need to open a bank account and a brokerage account in Germany. Many German banks and online brokers allow non-residents to open accounts, though you might need to provide extra documentation. This often includes proof of identity (passport), proof of address (utility bill or bank statement from your home country), and sometimes a visa or residence permit if you live in Germany. You'll also need a German tax identification number, known as a Steueridentifikationsnummer (Steuer-ID). If you don't have one, you can usually apply for it through your local registration office (Bürgeramt) if you're a resident, or through the Federal Central Tax Office (Bundeszentralamt für Steuern) if you're not. This number is essential for tax purposes on any investment income you generate.

Authorized Financial Providers (BaFin Oversight)

When choosing where to invest, it's wise to stick with providers authorised by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht), or BaFin. This government agency oversees banks, insurance companies, and investment firms, offering a layer of security for investors. Checking if a financial institution is regulated by BaFin is a good first step in ensuring you're dealing with a legitimate and reputable company. You can usually find this information on the provider's website or directly on the BaFin website. This oversight is part of what makes Germany an attractive place for international investors looking for stability and protection.

It's important to remember that while Germany is open to foreign investment, understanding the specific rules for non-residents is key. This includes knowing how to get the necessary tax IDs and choosing regulated financial institutions.

Here’s a quick rundown of what you might need:

- Identification: Passport or national ID card.

- Proof of Address: A recent utility bill or bank statement.

- Tax Identification Number: Your German Steuer-ID.

- Residency Status (if applicable): Visa or residence permit.

For US citizens, it's worth noting that mechanisms like the Foreign Tax Credit and tax treaties are in place to prevent you from being taxed twice on the same income by both Germany and the US, which is a common concern for expats living in Germany.

Top Investment Options Available to Expats

So, you've decided Germany is the place to be for the long haul, and now you're thinking about putting your money to work. That's a smart move. Germany offers a solid range of investment avenues, and understanding them is key to building your financial future here. Let's break down some of the most popular choices for expats.

Savings & Fixed-Income Instruments

For those who prefer a more predictable path, savings accounts and fixed-term deposits (Festgeld) are straightforward options. While interest rates have been a bit low historically, they can offer a safe place to park your cash, especially for short-term goals or emergency funds. Think of them as the reliable, no-fuss members of your investment portfolio. They won't make you rich overnight, but they provide stability.

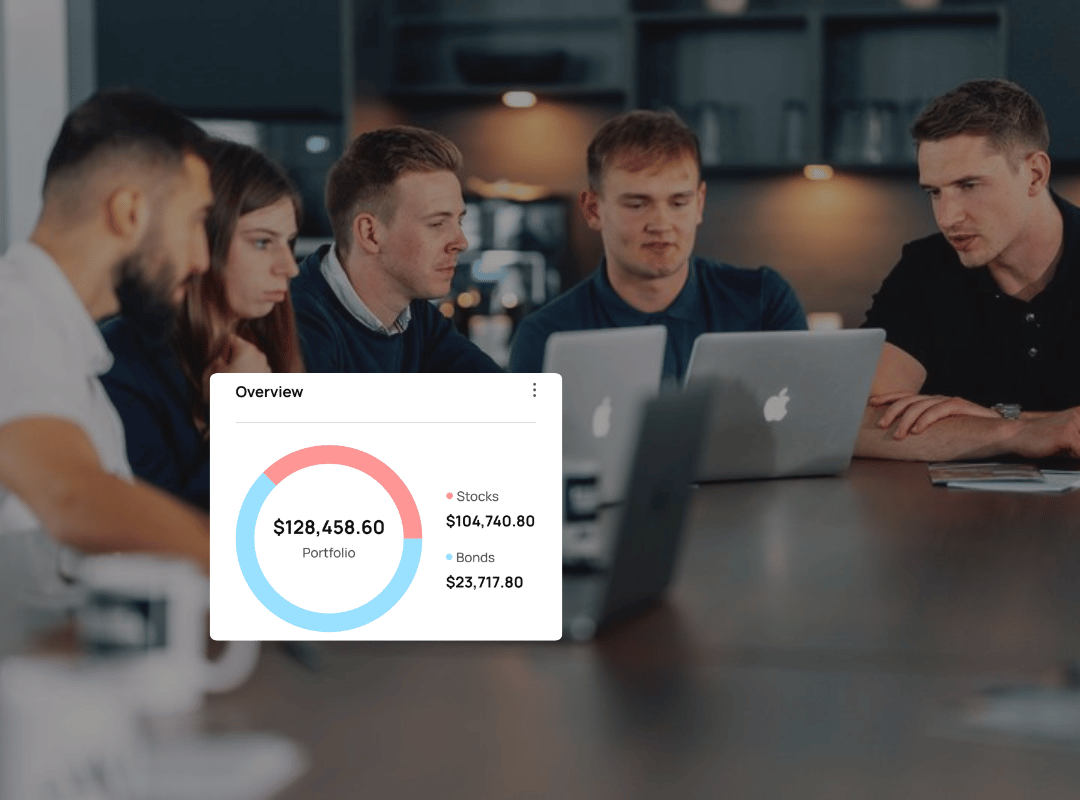

Funds & ETFs (Diversification)

This is where things get interesting for many. Funds and Exchange Traded Funds (ETFs) are fantastic for spreading your risk. Instead of buying shares in just one company, you're buying a slice of many. ETFs, in particular, have become really popular because they're generally low-cost and track a specific index, like the DAX. It's a way to get broad market exposure without needing to pick individual winners. Many expats find ETFs for beginners a good starting point.

Stocks & Direct Equity Investment

If you're feeling a bit more adventurous and have done your homework, buying individual stocks directly might be for you. This involves purchasing shares in specific German companies. It can offer higher potential returns, but it also comes with higher risk. You'll need to research companies, understand market trends, and be prepared for price fluctuations. It’s not for the faint-hearted, but for some, the thrill and potential reward are worth it. For insights into potential market opportunities, you might find discussions on equities and bonds helpful.

Real Estate Investing for Foreign Buyers

Germany's property market is generally stable, making it an attractive option for long-term investment. As a foreigner, you can buy property here, whether it's for rental income or personal use. However, it's a significant undertaking. You'll need to consider location, property type, financing, and the associated costs like taxes and fees. It's a big commitment, but owning a piece of the German property market can be a very rewarding experience.

When considering any investment, it's always wise to think about your personal financial situation, your comfort level with risk, and what you hope to achieve. Don't just jump in; take the time to understand what you're investing in.

Here's a quick look at some common investment types:

- Savings Accounts: Low risk, low return, good for immediate access funds.

- Fixed-Term Deposits (Festgeld): Slightly higher interest than savings, money locked for a set period.

- ETFs: Diversified, low-cost, track market indices.

- Stocks: Higher potential return, higher risk, requires research.

- Real Estate: Tangible asset, potential for rental income and capital appreciation, significant capital required.

Tax Implications for Expat Investors

When you start investing in Germany, you'll need to get your head around the tax rules. It's not as complicated as it might sound, but it's definitely something to be aware of. The German tax system applies to your investment income and any profits you make.

Capital Gains & Investment Income Tax

In Germany, investment income, which includes interest, dividends, and profits from selling assets, is generally subject to a flat tax rate of 25%, plus a solidarity surcharge and, if applicable, church tax. This is often referred to as Abgeltungsteuer (flat-rate withholding tax). However, there's an annual tax-free allowance, known as the Sparer-Pauschbetrag, which allows a certain amount of income to be received tax-free. For single individuals, this allowance is €1,000 per year, and for married couples filing jointly, it's €2,000.

Here's a quick look at the tax rates:

Income Type | Tax Rate |

|---|---|

Capital Gains & Investment Income | 25% |

Solidarity Surcharge | 5.5% of the tax owed |

Church Tax | 8% or 9% of the tax owed (if applicable) |

It's important to note that this flat rate applies to most investment income, but there can be specific rules for certain types of investments, like rental income from properties.

Double Taxation Agreements

If you're an expat, you might be wondering if you'll be taxed twice – once in Germany and again in your home country. Fortunately, Germany has double taxation agreements (DTAs) with many countries. These agreements are designed to prevent this double taxation and clarify which country has the primary right to tax certain types of income. You'll need to check the specific DTA between Germany and your country of residence or citizenship to understand how it affects your investments. This can be a bit of a maze, so getting advice is often a good idea.

Understanding the specifics of double taxation agreements is key to managing your international tax obligations effectively. Don't assume you know how it works; always verify the details relevant to your situation.

Tax Allowances & Exemptions

Germany offers a few ways to reduce your tax burden. The most common is the Sparer-Pauschbetrag (saver's allowance) mentioned earlier. You can submit an 'application for exemption' (Freistellungsauftrag) to your bank or broker to ensure that income up to this allowance is not taxed at source. Beyond this, certain investments might have specific exemptions, though these are less common for typical expat investment portfolios. For instance, if you're buying property, you'll encounter property transfer taxes, which vary by state. In Berlin, for example, the Real Estate Transfer Tax is currently 6.0%, and it's advisable to complete your purchase before any potential increases in 2026.

When planning your investments, it's wise to factor in these tax implications. Consulting with a tax advisor who understands expat situations can help you make informed decisions and optimise your financial strategy.

Practical Steps to Start Investing in Germany

So, you've decided Germany is the place for your long-term financial goals. That's great! Now, how do you actually get started with investing? It might seem a bit daunting at first, especially in a new country, but breaking it down makes it much more manageable.

Risk & Goal Planning

Before you even think about picking stocks or funds, the most important thing is to figure out what you're trying to achieve and how much risk you're comfortable with. Are you saving for a house deposit in five years? Or perhaps planning for retirement in thirty? Your timeline and your comfort level with potential losses will shape your entire investment strategy.

Think about it like planning a trip. You wouldn't just jump in the car without knowing your destination or how much fuel you have, would you? Investing is similar.

Here’s a quick way to think about it:

- Short-term goals (1-5 years): Generally, you'll want lower-risk options. Think savings accounts or short-term bonds. The main aim here is capital preservation.

- Medium-term goals (5-15 years): You can afford to take a bit more risk. A balanced portfolio with a mix of stocks and bonds might be suitable.

- Long-term goals (15+ years): This is where you can typically take on more risk for potentially higher returns. A higher allocation to stocks or equity funds is common.

It's also worth considering your current financial situation. Do you have an emergency fund in place? Are you managing any debts? It's generally advised to have these sorted before committing significant funds to investments. For those new to investing abroad, understanding potential pitfalls like Passive Foreign Investment Companies (PFICs) is also a good idea, as Americans relocating to Germany can safeguard their wealth by understanding and mitigating risks associated with them [945b].

Choosing the Right Investment Platform

Once you have a clear idea of your goals and risk tolerance, you need to choose where to invest. Germany offers several avenues, from traditional banks to online brokers.

For many expats, using an online broker can be a straightforward and cost-effective way to access the German market. These platforms often provide a wide range of investment products, including stocks, ETFs, and funds. When selecting a platform, look at:

- Fees: What are the trading fees, account management fees, and any other charges?

- Investment Options: Does the platform offer the types of investments you're interested in?

- User Experience: Is the platform easy to use and understand, especially if you're new to investing?

- Customer Support: Is support available in English, and what are their response times?

Some platforms might be better suited for beginners, while others cater to more experienced investors. It's worth doing some research to find one that aligns with your needs. For instance, understanding how the German stock market works can be a helpful starting point for expats [f64c].

Remember, investing is a marathon, not a sprint. It's about consistent effort over time, rather than trying to get rich quick. Start small, learn as you go, and stay focused on your long-term objectives. Don't be afraid to seek professional advice if you feel unsure about any aspect of your investment journey.

Thinking about investing in Germany? It might seem tricky at first, but getting started is easier than you think! Our guide, "Practical Steps to Start Investing in Germany," breaks down everything you need to know into simple, easy-to-follow steps. We cover how to set up your accounts, choose the right investments, and understand the basics without any confusing jargon. Ready to make your money work for you? Visit our website today to learn more and take the first step towards a secure financial future.

Wrapping Up Your German Investment Journey

So, we've covered quite a bit about getting your money working for you in Germany as a foreigner. It might seem like a lot at first, with all the different options and rules. But really, it boils down to understanding what you want to achieve with your money and then picking the right tools to get there. Whether you're looking at stocks, bonds, or property, Germany offers solid opportunities. Don't forget to look into things like company pensions and ethical investing too, as they can really shape your financial future. Taking the time to sort this out now will make a big difference down the line. It’s not about getting rich quick, but about building a stable financial life here in Germany.

Frequently Asked Questions

Why are so many people choosing Germany to invest their money for the long run?

Germany is known for being a stable place for money. The economy is strong and expected to stay that way. Plus, there are clear rules for investors, making it a safe bet for your cash.

Can someone from another country, like me, actually invest in Germany?

Absolutely! Germany welcomes foreign investors. You'll need to get a tax ID number and open a bank account, but it's quite straightforward.

What are the best ways for a foreigner to invest in Germany?

There are many options! You can look at safe bets like savings accounts or fixed-term deposits. For more growth, consider funds, Exchange Traded Funds (ETFs), stocks, or even buying property.

Are there any special rules for foreigners wanting to buy property in Germany?

Not really, the rules are pretty much the same for everyone. You can buy apartments or houses, but you'll need to understand the buying process and any associated costs.

How does investing in Germany affect my taxes?

You'll pay tax on any profits you make from your investments. However, Germany has agreements with many countries to avoid paying tax twice on the same money.

Are there ways to pay less tax on my investments in Germany?

Yes, there are certain tax breaks and allowances you might be able to use. It's a good idea to look into these or speak to a tax expert.

What's the difference between a fund and an ETF?

Think of a fund like a basket of different investments picked by a manager. An ETF is similar, but it usually tracks a specific market index (like a group of big companies) and you can buy and sell it easily on a stock exchange.

Is it risky to invest in stocks directly?

Investing in individual company stocks can be riskier because the value of one company can go up or down a lot. Spreading your money across many stocks, often through funds or ETFs, is usually a safer approach.

Who checks if financial companies in Germany are safe?

The German Federal Financial Supervisory Authority, known as BaFin, keeps an eye on banks and other financial service providers to make sure they follow the rules and protect customers.

How do I get a tax identification number in Germany?

You usually get this automatically after you register your address in Germany. If not, you can request it from your local tax office (Finanzamt).

What's the first step I should take before investing?

Before you put any money in, think about how much risk you're comfortable with and what you want to achieve with your money. Do you want to save for a house, retirement, or just grow your money over time?

Where can I go to actually start investing my money in Germany?

You can use online platforms, banks, or work with an independent financial advisor. Look for ones that are easy to use and understand, and that offer the types of investments you're interested in.