Investment Consulting

We help you build an investment portfolio that suits your goals.

Book an appointment

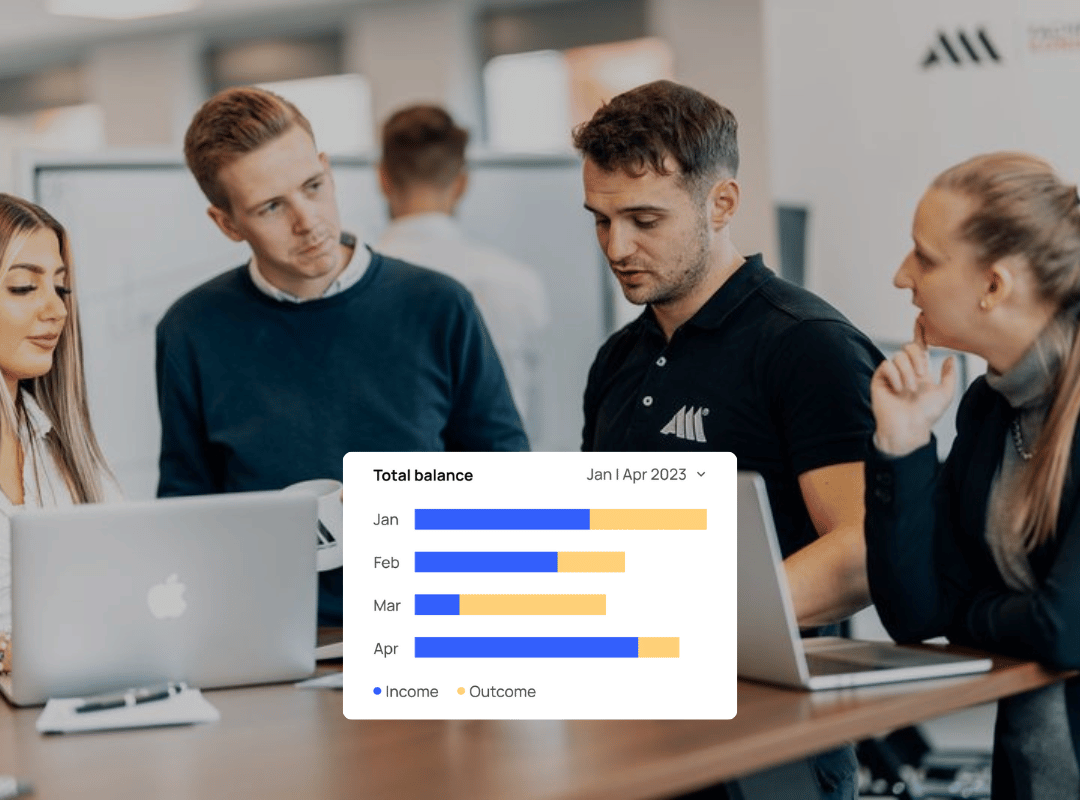

1. Investment Strategy Development

We create a long-term plan designed for stability and growth.

Book an appointment

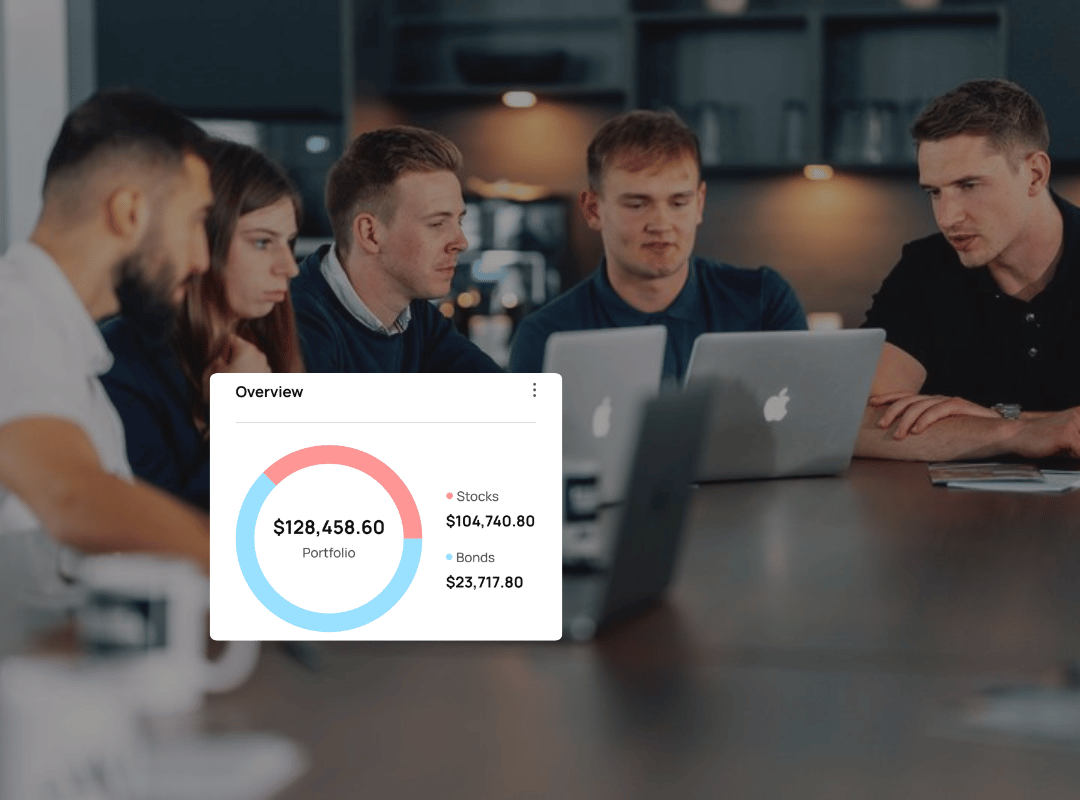

2. A fair all-in-one fee of only approx. 0.7% p.a.*

No performance-based fees, no front-end or back-end loads, very low transaction costs, automated rebalancing & regime change.

Book an appointment

3. Ongoing Portfolio Review & Optimization

We’ll analyze your investment portfolio for diversification, costs, and performance.

Book an appointmentWhat are your financial goals?

Investment Goal Calculator

See how much you need to invest to reach your goal — and how your result splits into contributions vs growth.

Inputs

Optional: simplified Germany tax view

*Planning estimate only. Taxes can differ (e.g., distributions, Vorabpauschale, loss offsets, broker handling). This tool applies a simplified “tax at the end” approach.

Results

Moving to Germany is a big step, and sorting out your finances here can feel like a whole other challenge. Especially when it comes to planning for retirement, it's easy to get lost in the details.

That's where Finanz2Go comes in. We're here to make Investment Advisory Germany straightforward and personal, helping you build a secure future without all the usual stress.

Financial Advisory for Expats in Germany

In our free digital 1:1 consultation, our independent investment advisors help you develop a plan for your wealth accumulation that fits your financial goals.

Key Takeaways

- Understanding the German pension system is key for expats, and Finanz2Go breaks it down for you.

- Get personal pension plans made just for your future needs in Germany.

- Finanz2Go offers advice that's completely independent, focusing only on what's best for you.

- We help you learn about German finances so you feel more confident about your retirement.

- Finanz2Go is your go-to for Investment Advisory Germany, making sure your retirement is safe and sound.

Navigating German Pension Planning For Expats

Moving to Germany is exciting, but figuring out your retirement plans here can feel like a puzzle. The German pension system has a few parts to it: the state pension, workplace pensions, and private savings. It’s a solid system, designed to give people a decent income when they stop working. The state pension is the main one, funded by what you and your employer pay in from your salary. Then there are company pensions, which add a bit more, and finally, private plans you can set up yourself for extra security. Understanding how these pieces fit together is key to a comfortable retirement.

For expats, it can be a bit confusing at first. Language barriers and different rules can make it tricky. That’s where we come in. We help you make sense of it all, looking at your personal situation and what you want for your future. We can help you understand how the German system might work with any pensions you have from back home, which is a big consideration for many. It’s about building a plan that works for you and your life here in Germany.

Here’s a quick look at the main pillars:

- State Pension (Gesetzliche Rentenversicherung): The foundation, based on your earnings and years worked.

- Occupational Pension (Betriebliche Altersvorsorge): Often offered by employers, adding to your retirement pot.

- Private Pension (Private Altersvorsorge): Your personal savings and investments for extra income.

We also help you consider things like how long you plan to stay in Germany and how your pension contributions might be treated if you move again. It’s all part of making sure your retirement is secure, no matter what life throws your way. We can help you get a clearer picture of your potential retirement income and how to plan for it effectively. You can find more details about the German pension system and how it works.

Planning for retirement in a new country requires careful thought. It's not just about saving money; it's about understanding the local system and how it aligns with your long-term goals. We aim to simplify this process for you.

We can help you create a personalised strategy that takes into account your unique circumstances, ensuring you’re on the right track for a secure future. This involves looking at your current age, how many years you have until retirement, and your comfort level with investment risk. We can also discuss how to manage your pension planning effectively as an expat.

Personalised Investment Advisory Germany

Bespoke Financial Plans For Your Goals

When you move to a new country like Germany, figuring out your finances can feel like a puzzle. We get that. That's why we focus on creating financial plans that are made just for you. It’s not about a one-size-fits-all approach; it’s about understanding what you want to achieve, whether that’s buying a home, saving for your children’s education, or planning for a comfortable retirement. We look at your current situation, your income, your savings, and importantly, what your dreams are for the future. Based on all this, we build a plan that makes sense for your life here in Germany. We want to help you make your money work for you, so you can reach those personal milestones without unnecessary stress. It’s about building a solid financial foundation that supports your ambitions.

Independent And Unbiased Recommendations

One of the most important things for us is that the advice you get is completely impartial. As an independent financial consultancy, we aren't tied to any particular banks or investment companies. This means we don't get any special deals for recommending certain products. Our only focus is on finding the best solutions for your financial situation and goals. We look at a wide range of options available in the German market and suggest what we genuinely believe is the most suitable path for you. This independence is key to building trust, and we want you to feel confident that the recommendations we make are solely in your best interest. We aim to provide clear, straightforward advice so you can make informed decisions about your investments.

Ongoing Support For Evolving Needs

Life changes, and so do financial needs. What works for you today might need a tweak in a few years. That’s why our service doesn't stop once the initial plan is in place. We believe in providing continuous support. We’ll schedule regular check-ins to review how your investments are performing and discuss any changes in your personal circumstances or financial goals. Perhaps you’ve had a change in income, or your retirement plans have shifted. We’re here to adjust your financial strategy accordingly. This ongoing relationship means your plan stays relevant and continues to support your journey towards financial security. Think of us as your long-term financial partner, helping you adapt and stay on track. We can help you create customised investment solutions designed to meet your specific financial goals.

Here’s a look at how we approach building your plan:

- Initial Consultation: We start by listening. We want to hear about your financial background, your immediate needs, and your long-term aspirations.

- Plan Development: Using the information gathered, we create a detailed financial plan tailored to your unique profile.

- Implementation: We guide you through the process of putting the plan into action, explaining each step.

- Regular Reviews: We schedule periodic meetings to assess progress and make necessary adjustments.

Building a secure financial future in Germany requires a clear strategy. Our aim is to simplify this process, offering guidance that is both practical and aligned with your personal objectives. We focus on clarity and actionable steps, making financial planning accessible for everyone.

Empowering Expats Through Financial Education

Moving to a new country like Germany is exciting, but it also brings a whole new set of things to figure out, especially when it comes to your finances and planning for the future. It's easy to feel a bit lost with unfamiliar systems and rules. That's why we believe that good financial education is key for expats.

Workshops On German Financial Planning

We regularly host workshops designed to make the German financial landscape clearer. These sessions cover topics like understanding the state pension system, exploring occupational pension options, and looking at private savings plans. We aim to break down complex information into easy-to-digest parts. Our goal is to give you the knowledge you need to make informed decisions about your money. You can find a directory of financial advisors in Germany that might be able to help with specific questions here.

Demystifying Retirement In A New Country

Retirement might seem a long way off, but planning for it now is important. The German pension system has several layers, and understanding how they work together can be tricky. We help explain these different pillars – the state pension, company schemes, and personal savings – so you can see how they fit into your overall retirement picture. It's about making sure you know what to expect and what steps you can take.

Building Confidence In Your Financial Future

Financial confidence doesn't just happen; it's built through understanding and planning. We want to help you feel secure about your financial future in Germany. This includes looking at your personal situation, your goals, and how much risk you're comfortable with. We also provide resources that address the unique financial planning hurdles American expatriates might face here.

Financial planning in a new country can feel overwhelming. Our educational approach is about providing clarity and practical steps, helping you build a solid foundation for your retirement and overall financial well-being in Germany. We want you to feel in control of your financial journey.

Here's a look at what we cover in our educational sessions:

- Understanding the State Pension: How contributions work and what you might expect.

- Occupational Pensions (Betriebliche Altersvorsorge): Exploring employer-sponsored plans.

- Private Savings Options: Looking at personal investments and insurance for retirement.

- Tax Implications: How your savings and pension income are taxed in Germany.

- Planning for Different Scenarios: Considering factors like potential relocation or changes in income.

Your Trusted Partner For Retirement Security

Securing Your Golden Years In Germany

Planning for retirement when you're living abroad can feel like a big task. Germany has a solid system, but understanding all the bits and pieces, especially when you're new here, is a challenge. That's where we come in. We help expats like you get a clear picture of their retirement options. Our aim is to make sure your later years are comfortable and free from financial worry. We look at your personal situation, what you want from retirement, and how much risk you're comfortable with. We build a plan that fits you, not a generic one.

Comprehensive Planning For Peace Of Mind

Retirement planning isn't just about putting money aside; it's about creating a secure future. Germany's pension system has a few parts:

- State Pension (Gesetzliche Rentenversicherung): This is the main pension, funded by your contributions and your employer's. It's based on how long you've worked and what you earned.

- Occupational Pensions (Betriebliche Altersvorsorge): Many companies offer these, often with contributions from both you and your employer. They add an extra layer of security.

- Private Pensions (Private Altersvorsorge): These are voluntary plans you can set up yourself to boost your retirement income. They can come with tax advantages.

We help you understand how these all work together for your specific circumstances. It's about having a clear roadmap so you can relax knowing your future is sorted.

Thinking about retirement shouldn't be a source of stress. It's a positive step towards enjoying the fruits of your labour. We simplify the process, making it understandable and manageable for everyone, regardless of their background.

Achieving Your Retirement Aspirations

Your retirement dreams are unique. Maybe you want to travel, spend more time with family, or pursue a new hobby. Whatever your aspirations, we help you plan financially to make them a reality. We don't just set up a plan and leave you to it. We provide ongoing support, reviewing your plan regularly to make sure it still matches your life as it changes. We're here to guide you through the complexities, offering unbiased advice tailored to your life as an expat in Germany. Let's work together to build the retirement you deserve.

Finanz2Go's Approach To Investment Advisory

Assessing Your Unique Financial Situation

We start by really getting to know you. It's not just about numbers; it's about your life here in Germany, your hopes for the future, and what makes you tick financially. We look at where you are right now, what you're aiming for, and how comfortable you are with potential ups and downs in the market. This initial chat helps us build a clear picture.

Crafting Plans Aligned With Your Risk Tolerance

Once we understand your situation, we build a plan. This isn't a one-size-fits-all deal. We consider how much risk you're happy to take. Some people are fine with a bit more fluctuation for potentially higher returns, while others prefer a steadier, more predictable path. Our recommendations are designed to match this – no more, no less.

Here's a simplified look at how we might consider risk:

Factor | Low Risk Tolerance | Medium Risk Tolerance | High Risk Tolerance |

|---|---|---|---|

Potential Return | Lower | Moderate | Higher |

Potential Volatility | Lower | Moderate | Higher |

Investment Horizon | Shorter | Medium | Longer |

Reaction to Market Drops | Seek Stability | Balanced Approach | Opportunity Focus |

Leveraging Deep Market Knowledge

Germany's financial landscape has its own quirks, especially for those new to the country. We keep a close eye on market trends, regulatory changes, and the specifics of German financial products. This means we can guide you with up-to-date information, helping you make choices that make sense for your long-term goals. We aim to simplify complex financial matters, making sure you feel confident about your financial future here.

Our process is built on understanding your personal circumstances thoroughly. We believe that the best financial advice comes from a place of genuine insight into your individual needs and aspirations, not from generic templates.

At Finanz2Go, we make investing simple and clear. We help you understand how to make your money grow over time, creating a plan that fits your goals. Whether you're just starting or looking to boost your savings, we're here to guide you. Ready to take the next step towards a brighter financial future? Visit our website today to learn more!

Your Future, Secured

So, planning for retirement in Germany might seem a bit much at first, especially if you're new here. There are a few different ways to save, and figuring out what works best for you can be tricky. That's really where Finanz2Go steps in. They're set up to help people like us, who are living and working in Germany but might not know all the ins and outs of the pension system. They look at your personal situation and give advice that's just for you, not some generic plan. It’s good to know there’s a place you can go for clear, straightforward help to make sure your later years are comfortable. Don't leave your retirement to chance; getting some expert advice now could make a big difference down the line.

Frequently Asked Questions

What is the German pension system like?

Germany has a pension system with a few parts. There's the main state pension that most people get, which is based on how long you've worked and how much you earned. Then, many jobs offer a company pension, which is extra money for when you retire. Finally, you can also set up your own private savings plan for retirement. It's a bit like having different pots of money to live on when you stop working.

Why is pension planning tricky for expats in Germany?

Moving to a new country means learning new rules. The German pension system can be complicated, especially if you don't speak the language fluently or understand all the paperwork. Finanz2Go helps make it easier by explaining everything and showing you how it all fits together for your specific situation.

Does Finanz2Go only help with pensions?

While pensions are a big focus because they're so important for your future, Finanz2Go also helps with other financial planning. They create personal money plans to help you reach all your money goals, not just retirement. Think of it as a complete money roadmap for your life in Germany.

Is Finanz2Go biased towards certain pension products?

No, Finanz2Go is completely independent. This means they don't get paid extra to recommend specific pension plans or investments. Their only job is to give you advice that's best for *you* and your financial future, based on what you need and want.

What happens after my pension plan is made?

Your life and financial situation can change, so your pension plan needs to be flexible. Finanz2Go doesn't just set up a plan and leave you. They offer ongoing support, checking in regularly to make sure your plan is still the right fit for you as your life in Germany evolves.

Can Finanz2Go help me understand my investment choices?

Absolutely. Finanz2Go believes in helping people feel confident about their money. They offer workshops and clear explanations to help you understand things like investments and how they can help you build wealth. They want you to feel informed and in control of your financial journey.