Financial Hub for Expats in Germany | Independent Financial Consulting | Finanz2Go

Welcome to the Finanz2Go Financial Hub — your one-stop guide to independent financial consulting in Germany. Whether you’re new to Berlin or have lived here for years, this hub helps you understand investing, pensions, ETFs, and German taxes — all explained in clear English.

Below you’ll find quick links to every major area of expat finance. Click a topic to begin or scroll down for detailed guidance.

| Topic | Description |

|---|---|

| Investing in Germany | How to invest smartly as an expat and grow your wealth efficiently. |

| Retirement Planning | Understand the pension system and secure your financial independence. |

| ETF Investing | Discover how ETFs simplify investing and build long-term wealth. |

| Investment Taxes | Learn how to minimize taxes and increase your net returns. |

Why Expats in Germany Need a Financial Hub

Germany offers strong job prospects and social stability — but its financial system can be confusing. Expats must deal with local tax laws, insurance rules, and pension systems that differ from their home countries. This Financial Hub centralizes everything you need: investing, retirement, ETFs, and taxation — all adapted for international professionals.

- Build and manage investments confidently

- Close your pension gap and plan for the future

- Use ETFs for efficient, diversified growth

- Understand and optimize your tax situation

Need personal guidance? Book a free consultation with one of our English-speaking advisors.

1. Investing in Germany for Expats

Germany’s strong economy and transparent markets make it ideal for investors, but regulations and taxation differ from other countries. Our guide on Investing in Germany for Expats explains all available options and how to use them efficiently.

Main Investment Choices

- ETFs (Exchange-Traded Funds): Low-cost, globally diversified funds — see our ETF guide.

- Private Pension Plans: Flexible long-term savings — explore details in Retirement Planning.

- Mutual Funds & Portfolios: For investors preferring professional management.

- Real Estate: Stable, tangible investment for inflation protection.

Start with the Right Tools

Estimate outcomes before investing using our calculators:

- Investment Goal Calculator – define your savings targets.

- Portfolio Risk Calculator – assess your risk tolerance.

- ETF Saving Plan Calculator – see long-term growth potential.

Combine these insights with expert advice by scheduling a free 30-minute consultation.

Tax-Efficient Investing

Germany applies a 25 % capital-gains tax plus surcharges. Proper structuring — like using accumulating ETFs — can minimize the impact. Read more in Taxes on Investments in Germany.

Pro Tip: Regular monthly ETF contributions can outperform lump-sum timing strategies over time.

Quick Financial Calculators

| Investment Goal Calculator | Pension Gap Calculator | ETF Saving Plan | Fee & Tax Calculator | Risk Calculator |

→ Book Your Free Investment Consultation

2. Retirement & Pension Planning for Expats

Planning your retirement early ensures long-term security. Our Retirement & Pension Planning Guide shows how the German system works and how to strengthen it with private solutions.

The Three Pillars of Retirement in Germany

- State Pension (Gesetzliche Rentenversicherung): based on mandatory salary contributions.

- Company Pension (Betriebliche Altersvorsorge): offered by employers with tax advantages.

- Private Pension Plans: flexible and portable — perfect for expats.

Use our Pension Gap Calculator to estimate how much you should save to reach your target income. Combine it with ETF strategies for growth and flexibility.

Building a Secure Retirement Strategy

Expats often face interrupted contribution histories and multiple pension systems across countries. That’s why strategic retirement planning is so important. Our advisors at Finanz2Go help you evaluate your income streams, align them with German tax law, and choose products that offer both flexibility and stability.

When you combine regular ETF contributions with a private pension structure, you can benefit from tax deductions, compound growth, and currency diversification. We also explain how to transfer or coordinate pension rights if you have worked in other EU countries or outside Europe.

Example: A 35-year-old expat investing €400 per month into a balanced ETF-based private pension could reach a projected value above €300 000 by retirement, assuming 5 % annual growth after fees.

If you plan to retire outside Germany, you can still receive German pension payments abroad. Our Retirement & Pension Planning page explains transferability, taxation in other countries, and the impact of bilateral agreements.

→ Discuss your retirement plan with a Finanz2Go advisor

3. ETF Investing for Expats in Germany

ETFs (Exchange-Traded Funds) are among the most powerful tools for expats to build wealth in Germany. They combine the diversification of mutual funds with the flexibility of stocks and are highly cost-efficient.

Why ETFs Work Well for Expats

- Diversification: A single ETF can hold hundreds of companies worldwide.

- Low Costs: Average management fees are 0.1–0.4 % per year versus 1.5 % for active funds.

- Transparency: ETFs publish their holdings daily, so you always know what you own.

- Liquidity: They trade like stocks and can be bought or sold anytime.

- Flexibility: Perfect for monthly savings plans or lump-sum investments.

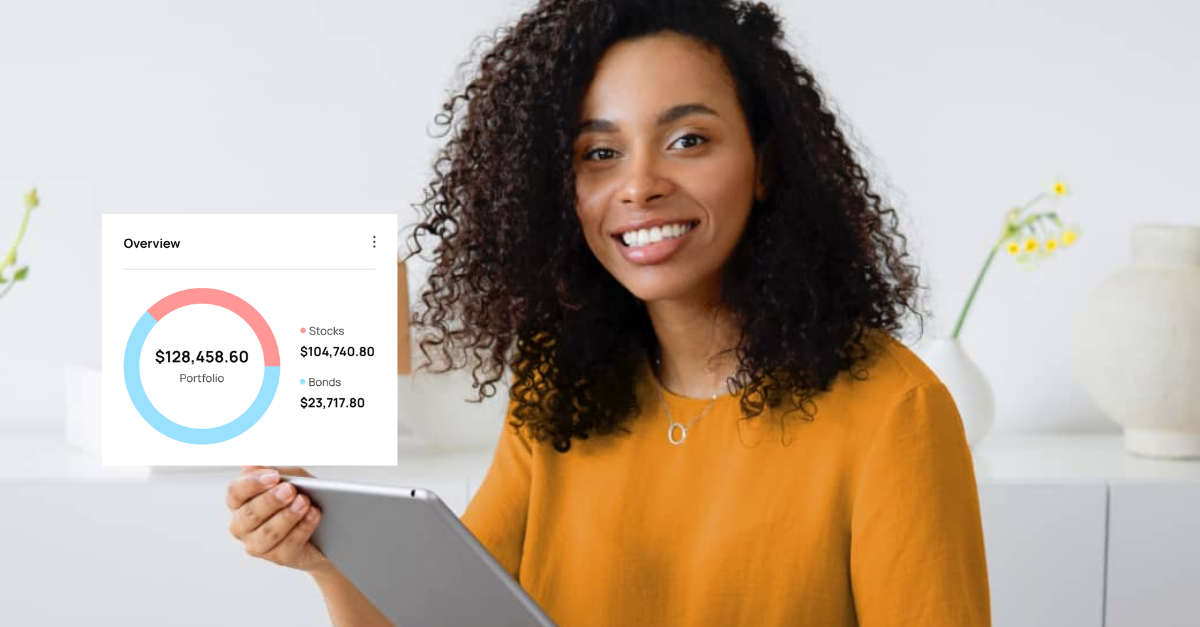

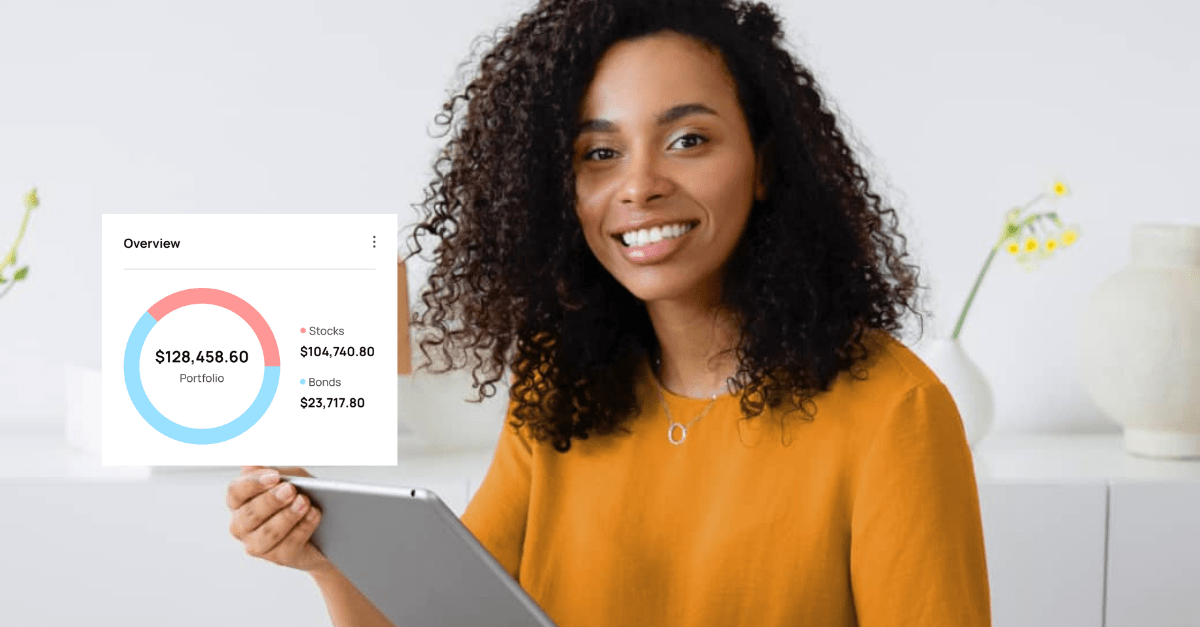

Creating an ETF Savings Plan

One of the simplest ways to invest in ETFs is through a regular savings plan. You choose a monthly amount and the broker automatically buys ETF shares for you. Use our ETF Saving Plan Calculator to see how your portfolio could grow over time.

Even small contributions can create meaningful wealth. At 5 % annual growth, €200 per month for 25 years could reach about €118 000. Double that to €400 and the result exceeds €236 000. Consistency matters more than timing the market.

Choosing the Right ETFs

- Global Equity ETFs (e.g., MSCI World, FTSE All World) for broad diversification.

- Bond ETFs for stability and lower volatility.

- Sector or Thematic ETFs for targeted exposure such as technology or green energy.

- Dividend ETFs if you prefer regular payouts.

Want personalized help picking ETFs? Read our ETF Investing for Expats guide or book a free consultation.

Taxation of ETFs in Germany

ETFs are subject to a flat 25 % capital-gains tax plus solidarity surcharge (and church tax if applicable). However, the system distinguishes between:

- Accumulating ETFs (Thesaurierend): Reinvest profits automatically and are more tax-efficient long term.

- Distributing ETFs (Ausschüttend): Pay dividends regularly that are taxed each year.

For most expats, accumulating ETFs reduce paperwork and defer taxes until you sell. Learn more in our Taxes on Investments in Germany guide.

Integrating ETFs into Your Retirement Plan

ETFs fit perfectly within a long-term retirement strategy. They can serve as the growth engine for your private pension. By combining ETFs with a tax-advantaged insurance-based wrapper, you can defer taxes and maintain liquidity. Explore how this works on our Retirement Planning page.

Tip: Rebalance your ETF portfolio once per year to keep your risk level stable. Avoid trading too frequently to reduce tax events and costs.

→ Book Your Free ETF Strategy Session

4. Taxes on Investments in Germany

Understanding taxes is crucial for any investor living in Germany. Even though the system may seem complex, it’s logical once you know the rules. With the right setup, you can keep more of your returns and stay fully compliant.

Main Taxes on Investments

- Capital Gains Tax (Abgeltungssteuer): 25 % on profits from selling securities.

- Solidarity Surcharge: 5.5 % of the capital-gains tax amount.

- Church Tax (if applicable): 8–9 % of the capital-gains tax.

- Tax-Free Allowance (Sparer-Pauschbetrag): €1 000 per year for single taxpayers, €2 000 for married couples.

How to Reduce Your Tax Burden

- Prefer accumulating ETFs to defer taxation.

- Use your tax-free allowance by submitting an “Exemption Order” (Freistellungsauftrag) to your bank.

- Hold investments long term to benefit from compound growth and avoid frequent realizations.

- Combine tax-efficient investments with pension products that offer deductions or deferrals.

Double Taxation Agreements (DTAs)

Germany has treaties with many countries to avoid taxing the same income twice. These agreements define where you pay tax on dividends, interest, and capital gains. If you file taxes in more than one country, a Finanz2Go advisor can help interpret the correct allocation.

Practical Example

Imagine you sell ETF shares with a €10 000 gain. Germany’s flat tax would take €2 500 plus small surcharges, leaving roughly €7 400 net. However, if part of your profits were inside a tax-advantaged pension wrapper, the tax could be postponed for decades, increasing compound returns.

Tools to Calculate Your After-Tax Returns

- Fee & Tax Calculator – estimate the impact of costs and taxes on your portfolio.

- Investment Goal Calculator – plan how tax affects your timeline.

Expert Insight: Smart tax planning can increase net returns by 15 % or more over time. Taxes should be an integral part of your financial strategy — not an afterthought.

Need personalized advice? Book a free consultation to review your current setup and identify tax-saving opportunities.

5. Why Work With Finanz2Go

At Finanz2Go we focus exclusively on helping expats make smart financial decisions in Germany. Our English-speaking advisors translate the complexity of German finance into clear, actionable strategies. We combine independence, transparency, and personal support to ensure that you remain in control of your financial life.

Our Core Principles

- Independent Advice: We are not tied to any bank or insurance provider. Our only commitment is to your goals.

- Transparent Fees: You always know what you pay and what you receive. No hidden commissions, ever.

- Personalized Strategies: Every expat has different needs—whether you plan to stay long-term or move again.

- Education First: We believe informed clients make better decisions, so we teach you the “why” behind every recommendation.

- Digital & Flexible: Meetings and planning tools are available online anywhere in Germany.

Hundreds of expats—from engineers to teachers, consultants, and researchers—trust Finanz2Go for transparent, multilingual, and data-driven advice.

Discover our most visited resources:

- Investing in Germany for Expats

- ETF Investing for Expats

- Retirement & Pension Planning

- Taxes on Investments in Germany

→ Book Your Free Independent Consultation Now

6. Frequently Asked Questions

What are the best investment options for expats in Germany?

For most expats, ETFs and diversified index portfolios are the most efficient solutions. They offer global diversification, low fees, and full flexibility. Adding a private pension helps combine growth with tax advantages.

How are ETFs taxed in Germany?

ETFs fall under Germany’s capital-gains regime. Profits are taxed at 25 % plus surcharges. Using accumulating ETFs delays taxation until sale, improving long-term compounding. For details, see Taxes on Investments in Germany.

Can expats receive German pension benefits abroad?

Yes. You can receive payments from the German state pension even if you retire outside Germany. Use the Pension Gap Calculator to estimate your expected income and learn how to transfer entitlements.

Do I need a financial advisor as an expat?

While you can manage finances yourself, an independent advisor helps you avoid costly mistakes, optimize taxes, and choose the right investments. Finanz2Go offers objective, commission-free advice tailored to expat situations.

How can I calculate my investment returns and fees?

Our Fee & Tax Calculator and Investment Goal Calculator let you project net returns after costs and taxes. They provide clarity on how small fee reductions can lead to large long-term differences.

What about double taxation?

Germany has double-taxation agreements with most countries. These treaties prevent income from being taxed twice and define which country has the right of taxation. Your Finanz2Go consultant can help you apply the correct treaty articles when filing your tax return.

Can I open investment accounts as a foreigner in Germany?

Yes. Most online brokers and banks allow non-German citizens to open accounts with a valid residence permit and ID. An advisor can help you select cost-efficient and compliant platforms.

What’s the simplest way to start saving as a new expat?

Start a small, automated ETF savings plan as soon as possible. Even €150 per month can build a significant portfolio over time. Use automation to build consistency — your most powerful ally.

7. Take the Next Step — Build Your Financial Future in Germany

Your financial success in Germany depends on clarity, structure, and discipline. Whether you want to invest, plan retirement, or reduce taxes, you now have the tools and knowledge to act. Our advisors can transform that knowledge into a personalized strategy.

Get Started in Three Simple Steps

- Estimate your pension gap and future income.

- Plan your investments with the investment goal calculator.

- Simulate long-term growth using the ETF saving plan tool.

Then, book your complimentary consultation to discuss your situation directly with a Finanz2Go expert.

📅 Book Your Free Consultation Now

At Finanz2Go Consulting, we help you make confident decisions, achieve financial independence, and enjoy life in Germany knowing your money is working efficiently.