Investment Consulting

We help you build an investment portfolio that suits your goals.

Book an appointment

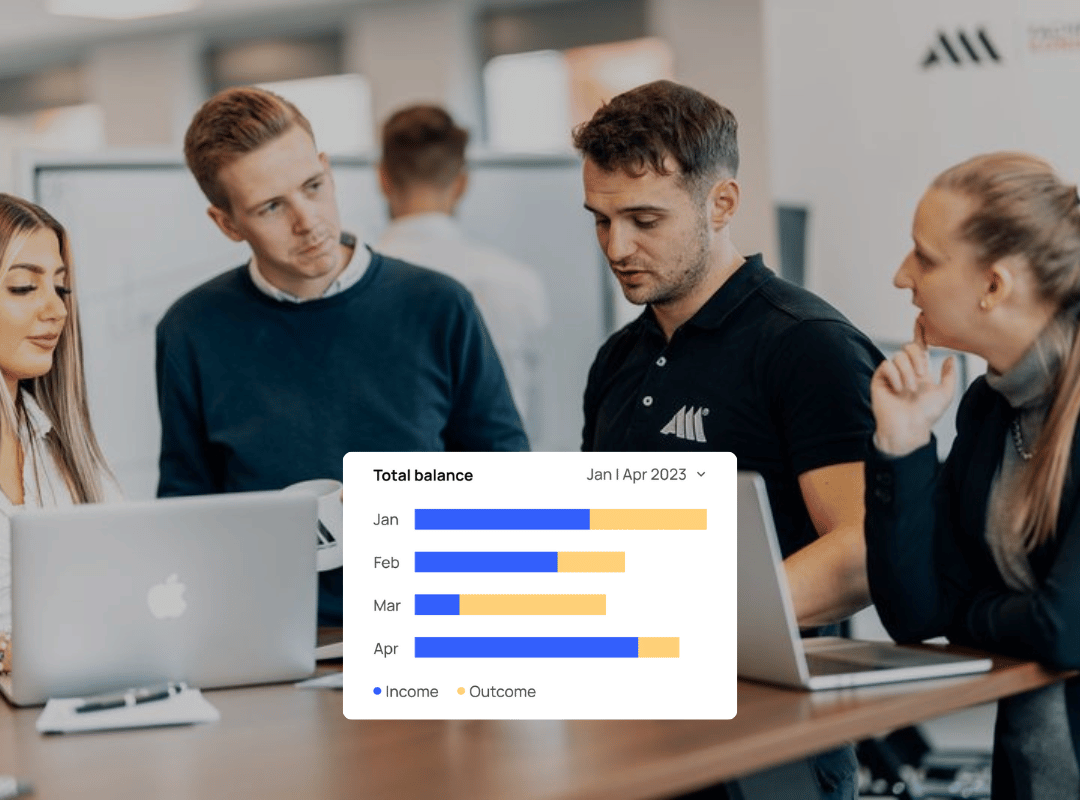

1. Investment Strategy Development

We create a long-term plan designed for stability and growth.

Book an appointment

2. A fair all-in-one fee of only approx. 0.7% p.a.*

No performance-based fees, no front-end or back-end loads, very low transaction costs, automated rebalancing & regime change.

Book an appointment

3. Ongoing Portfolio Review & Optimization

We’ll analyze your investment portfolio for diversification, costs, and performance.

Book an appointmentWhy Choose Finanz2Go for Investment Consulting?

At Finanz2Go, we are 100% client-focused, working solely in your best interest.

We’re officially licensed by the IHK (Industrie- und Handelskammer) under §34f GewO, guaranteeing full compliance and transparency.

What Makes Us Different:

- Independent: We receive no commissions from banks or fund providers.

- Data-driven: Your investment plan is built using modern analysis tools.

- Transparent: You see every cost and projection clearly.

- Digital-first: Consult online, from anywhere in Germany or abroad.

- Sustainable options: ESG and ethical portfolios available.

Thinking about your finances in Germany can feel a bit much, especially if you're new here. It's not just about day-to-day spending; it's about planning for the future, making sure you're covered with insurance, and getting your investments sorted.

This is where Financial Consulting in Germany comes in. It's about getting some help to make sense of it all, so you can feel more in control of your money and your future.

Key Takeaways

- Financial consulting in Germany helps you sort out your money matters, from daily budgeting to long-term goals.

- Getting the right insurance, like health and disability cover, is a big part of financial planning here.

- Pension planning is key for a secure retirement; understanding state and private options is important.

- Investing your money wisely can help it grow, and there are various options available in Germany.

- For expats, finding advisors who speak English and understand international situations is a real plus.

- BaFin is the German authority that keeps an eye on financial services, so you know things are regulated.

- Building a solid financial future involves planning for the unexpected and growing your wealth over time.

- Independent advice means you get recommendations that are best for you, not for the advisor's commission.

Understanding Financial Consulting in Germany

The Role of Financial Advisors for Expats

Moving to a new country like Germany brings a lot of changes, and managing your money is a big part of that.

A good financial advisor can really help smooth out the process. They're there to guide you through the German financial system, which might be quite different from what you're used to. Think of them as your personal guide to German finance.

They can help you understand things like setting up bank accounts, figuring out taxes, and making sure you're saving for the future. For expats, finding a financial advisor Germany who speaks your language and understands your specific situation is key. They can help you avoid common pitfalls and make informed decisions right from the start. It's about building a solid financial foundation so you can focus on settling in and enjoying your new life.

Navigating Financial Advice in Germany

Germany has a well-established financial landscape, but it can seem a bit complex at first. This is where professional advice comes in handy. Whether you're looking to invest, plan for retirement, or just get your day-to-day finances in order, getting the right guidance makes a difference. It’s not just about knowing the products available, but understanding how they fit into the German regulatory framework and your personal circumstances.

An advisor can explain the differences between various savings accounts, insurance policies, and investment options, helping you choose what’s best for you. They can also help you understand the tax implications of your financial decisions, which is particularly important when you're new to the country. Getting this sorted early can save a lot of hassle down the line.

Key Services Offered by Financial Consultants

Financial consultants in Germany provide a range of services designed to help individuals and families manage their money effectively. These services often include:

- Investment Planning: Helping you choose and manage investments to grow your wealth.

- Retirement Planning: Calculating your future pension needs and setting up savings plans.

- Insurance Advice: Recommending suitable insurance policies for health, life, disability, and liability.

- Tax Optimisation: Structuring your finances to minimise tax liabilities within legal limits.

- Budgeting and Savings Strategies: Developing plans to help you save more effectively.

These services are tailored to your individual goals and risk tolerance. An investment advisor Germany can be particularly helpful in navigating the complexities of the German stock market and other investment vehicles.

Benefits of Professional Financial Guidance

Working with a financial consultant can bring several advantages. Firstly, it provides clarity and confidence in your financial decisions. Instead of guessing, you get advice based on your specific situation and the German market.

This can lead to better financial outcomes, such as higher investment returns or more effective savings. It also saves you time and reduces stress, as the advisor handles much of the research and planning. Having a professional by your side means you're less likely to make costly mistakes. For expats, this guidance is invaluable for understanding a new financial system and avoiding potential issues, like those related to international investments [61c3].

Choosing an Independent Financial Advisor

When looking for a financial advisor in Germany, independence is a key factor. An independent advisor isn't tied to selling specific products from particular companies. This means their recommendations are more likely to be based on what's genuinely best for you, rather than on commission incentives. Look for advisors who are transparent about their fees and how they are paid. Checking their registration with BaFin (the Federal Financial Supervisory Authority) is also a good step. Many expats find it helpful to seek out advisors who have experience with international clients and can communicate effectively in English, such as those at firms like Faller Finance [e207].

Understanding Financial Consulting Fees

Financial consulting fees can vary. Some advisors charge a flat fee for their services, while others work on a commission basis, earning money when you buy certain products. A common model is a fee-based approach, where you pay an hourly rate or a fixed project fee. Some may also charge a percentage of the assets they manage for you. It’s important to have a clear conversation about fees upfront so you know exactly what you’re paying for and how the advisor is compensated. This transparency helps build trust and ensures you understand the total cost of their advice.

The Importance of Regulatory Compliance

Financial services in Germany are regulated to protect consumers. The Federal Financial Supervisory Authority (BaFin) oversees many aspects of the financial industry. Advisors and consultants must adhere to strict rules regarding conduct, transparency, and client protection. This regulatory framework is designed to ensure that financial advice is sound and that investors are treated fairly. Compliance with these regulations is not just a legal requirement; it's a sign of a professional and trustworthy advisor. Understanding this helps you feel more secure about the advice you receive and the products you invest in, contributing to the overall stability of the financial market [3fd8].

Comprehensive Insurance Consulting Services

Getting insurance sorted in Germany can feel like a maze, especially when you're new to the country. It's not just about ticking a box; it's about making sure you and your family are properly protected against life's unexpected events. We help you sort through the options, from the basics like health insurance to more specific needs.

Public vs Private Health Insurance Options

Germany has a dual system for health insurance, which can be confusing. You've got the statutory health insurance (Gesetzliche Krankenversicherung or GKV) and private health insurance (Private Krankenversicherung or PKV). The GKV is the standard for most people, funded by contributions from both employees and employers. PKV, on the other hand, is an option for certain groups, like the self-employed or civil servants, and often offers more tailored benefits, though it can be more expensive as you get older or if your health needs change. Understanding which system best suits your circumstances is the first step.

Selecting the Right Health Insurance Plan

Choosing the right health insurance plan involves looking at a few things. What level of cover do you need? Are you looking for a plan that covers pre-existing conditions? What about dental care or alternative therapies? It's worth comparing the different providers and their specific packages. Some plans might seem cheaper initially but could have higher co-pays or limited coverage later on. We can help you look at plans that fit your budget and your health requirements.

Understanding Disability Insurance (BU)

Disability insurance, known as Berufsunfähigkeitsversicherung (BU) in Germany, is really important. It pays out a monthly sum if you become unable to work due to illness or injury. This isn't just for manual labour jobs; office workers can also become disabled. Without BU insurance, you might have to rely on the state's basic pension, which is often not enough to cover your living expenses. It's a key part of protecting your income. We can help you find a BU policy that matches your profession and your financial needs.

Optimising Life Insurance Policies

Life insurance is there to provide financial support for your loved ones if you pass away. There are different types, like term life insurance, which covers you for a set period, and whole-life insurance. The best choice depends on your personal situation, like whether you have dependents or outstanding debts. We can review your current policies or help you find new ones to make sure your family is financially secure.

Liability Insurance for Personal Protection

Personal liability insurance (Haftpflichtversicherung) is another must-have. It covers you if you accidentally cause damage to someone else's property or injure someone. Think about things like breaking a valuable item in a shop or causing an accident while cycling. Without this cover, you could be personally liable for significant costs. It's a relatively inexpensive way to protect yourself from major financial setbacks. We can help you find a policy that offers good cover for everyday risks.

Comparing Insurance Products in Germany

With so many insurance companies and products out there, comparing them can be a real headache. We use our knowledge to look at policies from different providers, checking not just the price but also the terms and conditions. This way, you can be sure you're getting a policy that offers good value and the right level of protection. It’s about finding the best fit for you, not just the cheapest option. You can explore insurance solutions for expats to get a head start.

Tailoring Insurance to Your Needs

Ultimately, insurance isn't one-size-fits-all. What works for one person might not be right for another. We take the time to understand your personal circumstances, your family situation, your job, and your financial goals. Based on this, we can recommend a package of insurance policies that truly fits your life. This might involve combining different types of cover or adjusting existing policies. Our goal is to make sure you have the right protection in place without paying for cover you don't need. We can also help you review your insurance portfolio to see if there are ways to optimise it.

Here's a quick look at common insurance types:

- Health Insurance: Covers medical costs, hospital stays, and treatments.

- Disability Insurance (BU): Provides income if you can't work due to illness or injury.

- Life Insurance: Offers financial support to your beneficiaries upon your death.

- Liability Insurance: Protects you against claims for accidental damage or injury to others.

- Household Contents Insurance: Covers your belongings against theft, fire, and water damage.

Making informed decisions about insurance is vital for financial stability. It's about peace of mind, knowing that you and your loved ones are protected, no matter what life throws your way. We aim to simplify this process for you.

Strategic Pension Planning and Consulting

Planning for retirement in Germany can feel a bit like trying to assemble flat-pack furniture without the instructions – confusing and potentially leading to a wobbly outcome. But don't worry, that's where strategic pension planning comes in. It's all about figuring out how you'll support yourself financially once you stop working, and Germany has a few different systems to consider.

Calculating Your Future Pension Entitlements

First things first, you need to get a handle on what you might receive. This involves looking at your contributions to the state pension system. You can request a statement from the Deutsche Rentenversicherung (German Pension Insurance) which will give you an idea of your projected pension. It's not always straightforward, especially if you've worked in multiple countries or had periods of unemployment. Understanding these figures is the bedrock of any good retirement plan.

Navigating State Pension Schemes

Germany's state pension, the Gesetzliche Rentenversicherung, is a pay-as-you-go system. This means current workers' contributions fund current retirees' pensions. It's a fundamental part of the social security net, but it's also subject to demographic changes and reforms. For expats, understanding how your contributions here interact with any pension rights you have in your home country is important.

Exploring Private Pension Options

Because the state pension might not cover all your needs, private pensions are a popular way to top up your retirement income. There are various products available, like Riester-Rente (state-subsidised) and Rürup-Rente (often for self-employed or high earners), as well as private insurance policies. Choosing the right one depends on your personal circumstances and tax situation. It's worth looking into different investment strategies to see how they can support your private pension goals.

Company Pension Schemes in Germany

Many German employers offer company pension schemes, known as 'betriebliche Altersvorsorge' (bAV). These are often a very attractive option because employers usually contribute to them as well, effectively giving you 'free money' towards your retirement. It's definitely worth asking your employer about any bAV options they provide and understanding how they work.

Addressing the Pension Gap for Expats

The 'pension gap' is the difference between what you'll need in retirement and what your state and company pensions will provide. For expats, this gap can sometimes be wider due to factors like international career paths or less time contributing to the German system. Proactive planning is key to closing this gap.

Transferring Pensions When Leaving Germany

If you plan to move to another country before retirement, you might wonder about your pension. In many cases, you can transfer your German pension contributions to another EU country under social security agreements. If you're leaving the EU, the rules can be more complex, and it's wise to get specific advice on transferring your pension.

Maximising Your Retirement Income

Ultimately, the goal is to have a comfortable retirement. This involves not just saving enough but also making smart decisions about where your money is invested and how you draw it down. Combining state, company, and private pension sources, alongside a well-thought-out investment strategy, is usually the best approach to ensure you have sufficient income throughout your retirement years.

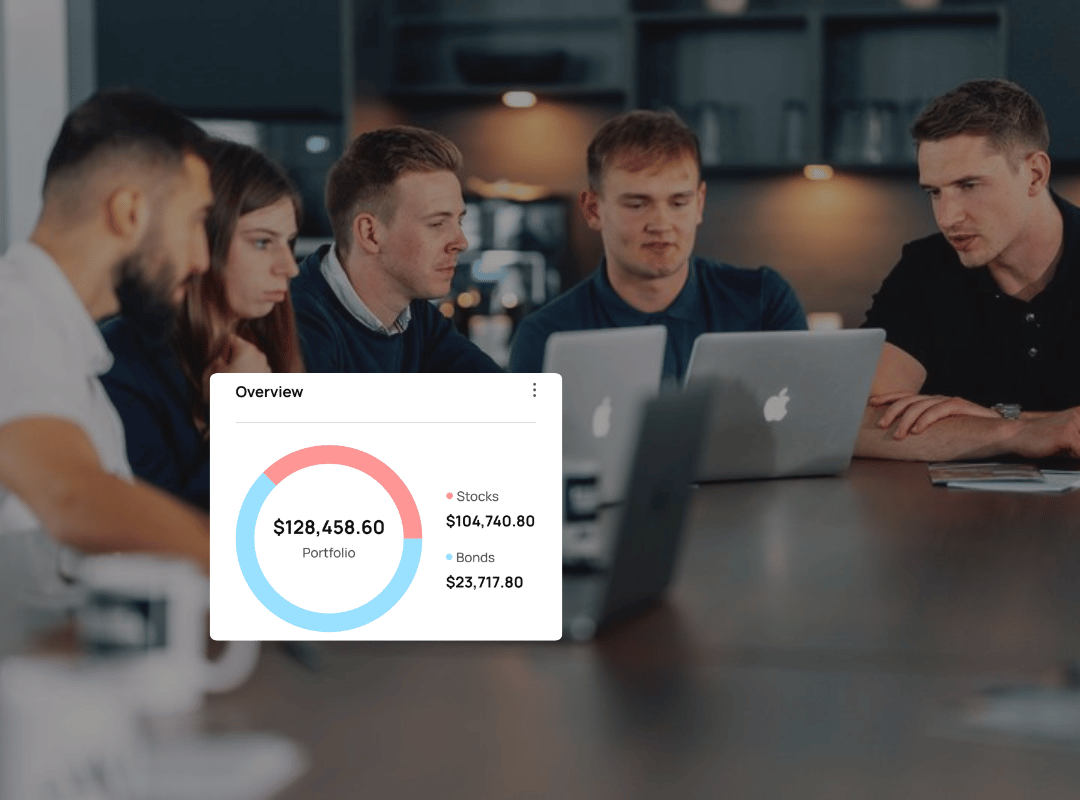

Expert Investment Consulting for Growth

Exploring Investment Options in Germany

Germany offers a varied landscape for those looking to grow their money. It's not just about the usual savings accounts; there's a whole world of possibilities out there. Think about stocks, bonds, and even property. Each has its own way of working and its own potential upsides and downsides. Getting a handle on these different avenues is the first step to making your money work harder for you. It’s about finding what fits your personal situation and your comfort level with risk.

Understanding the German Stock Market

The German stock market, often represented by the DAX index, can seem a bit complex at first. It's made up of some of the biggest German companies. Investing here means you're essentially buying a small piece of these businesses. When they do well, your investment can grow. However, like any stock market, it has its ups and downs. It's important to remember that past performance doesn't guarantee future results. Doing a bit of homework on individual companies or market trends can help you make more informed choices.

Strategies for Dividend Investing

Dividend investing is a strategy where you focus on companies that share a portion of their profits with shareholders. These payments, called dividends, can provide a regular income stream. It’s a way to earn money from your investments even if the stock price itself isn't changing much. For many, this is a key part of building wealth over the long term, offering a steady return that can be reinvested or used as income.

Investing During Periods of Inflation

When inflation is high, the money in your savings account loses purchasing power over time. This is where smart investing comes in. Certain types of investments tend to hold their value or even grow faster than the rate of inflation. Think about assets like real estate or certain commodities. Even some stocks can perform well during inflationary times. The trick is to understand which assets are more resistant to inflation and how to include them in your plan.

Selecting the Best ETFs for Investment

Exchange-Traded Funds, or ETFs, have become quite popular, and for good reason. They allow you to invest in a whole basket of assets, like stocks or bonds, with a single purchase. This spreads your risk automatically. For beginners, ETFs are often a good starting point because they are generally low-cost and easy to understand. Picking the right ETF depends on what you want to invest in – whether it's a broad market index or a specific sector.

Sustainable and Ethical Investing Approaches

More and more people want their investments to align with their values. Sustainable and ethical investing, sometimes called ESG (Environmental, Social, and Governance) investing, focuses on companies that perform well in these areas. It’s about investing in a way that aims for both financial returns and a positive impact on the world. This approach is growing, with more funds and options becoming available for investors who care about more than just profit.

Building a Long-Term Investment Strategy

A solid long-term investment strategy is built on clear goals and consistent action. It’s not about trying to get rich quick. Instead, it’s about planning for the future, whether that’s retirement, buying a home, or funding education. This involves deciding how much risk you’re comfortable with, how long you plan to invest for, and how you’ll spread your money across different types of investments. Regular reviews and adjustments are also part of the process to keep your strategy on track as your life changes.

Navigating Financial Advice for Expats

Moving to a new country like Germany brings a lot of changes, and sorting out your finances is a big part of that. It's not always straightforward, especially when you're dealing with a different system and language. That's where getting the right advice comes in. Finding trustworthy financial guidance is key to settling in smoothly.

Finding Trustworthy Financial Advisors

When you're looking for someone to help with your money matters, it's important to know who to trust. In Germany, you'll want to look for advisors who are independent. This means they aren't tied to selling you specific products from one bank or insurance company. They should also be clear about their fees. Checking if they are registered with BaFin, the German financial regulator, is a good step. Many expats find it much easier to work with advisors who speak English and understand the unique challenges of moving to Germany.

English-Speaking Financial Support

Language can be a barrier, and when it comes to your finances, you want to be absolutely sure you understand everything. Thankfully, there are financial consultants in Germany who specialise in helping expats and offer their services in English. This makes discussing complex topics like insurance, investments, and pension planning much less stressful. Having someone who can explain things clearly in your own language makes a huge difference.

Understanding International Tax Implications

Germany has its own tax rules, and these can affect your income, investments, and savings. If you've just arrived or are planning to move, understanding how your new tax situation works is vital. This includes things like income tax, capital gains tax, and potentially inheritance tax. Getting advice on these matters can help you avoid unexpected bills and make sure you're compliant with German law. It's a good idea to look into expat financial planning Germany early on.

Relocation Financial Planning

Moving countries involves more than just packing boxes. There are financial aspects to consider before, during, and after your move. This could involve setting up a German bank account, understanding the costs of living, arranging health insurance, and planning for initial expenses. Good relocation financial planning helps you hit the ground running without financial worries.

Adapting Your Financial Strategy

What worked for your finances back home might not be the best approach in Germany. You'll need to look at things like your savings goals, investment strategy, and retirement plans with a fresh perspective. This might mean adjusting your savings rate, exploring different investment products available in Germany, or rethinking your pension contributions. It's all about making your money work for you in your new environment.

Building Financial Security Abroad

Setting up a secure financial future in a new country takes time and planning. It involves understanding the local financial landscape, making informed decisions about your money, and building a solid foundation for the long term. This could mean setting up a robust savings plan, investing wisely, and making sure you have adequate insurance cover. The goal is to feel confident about your financial situation, no matter where you are in the world.

Common Expat Financial Challenges

Expats often face a few common hurdles. These can include understanding the German pension system, figuring out the best health insurance options, and dealing with different banking and investment products. Currency exchange rates can also play a role if you're sending money back home or receiving payments from abroad. Being aware of these potential issues helps you prepare and seek the right advice.

Optimising Your Financial Health in Germany

Getting your finances in order when you're in a new country can feel like a big task. It's not just about earning money; it's about making that money work for you, both now and in the future. This section looks at how you can get a better handle on your financial situation here in Germany, with a little help from services like Finanz2Go.

Assessing Your Current Financial Situation

Before you can improve your financial health, you need to know where you stand. This means taking a good, honest look at your income, your expenses, and what you own versus what you owe. It's like taking a snapshot of your finances. You might be surprised by what you find. Think about your regular bills, any debts you have, and your savings. Understanding your cash flow is the first step to making positive changes.

Setting Realistic Financial Goals

What do you want your money to do for you? Maybe you want to buy a home, save for retirement, or just have a bit more breathing room each month. Setting clear goals gives your financial planning direction. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

Here are some common financial goals:

- Saving for a down payment on a property.

- Building an emergency fund to cover unexpected costs.

- Planning for retirement income.

- Paying off outstanding debts.

- Investing for long-term growth.

Developing Personalised Financial Plans

Once you have your goals, you need a plan to reach them. This is where professional advice can be really helpful. A financial consultant can look at your personal circumstances and help create a roadmap. They consider things like your income, your family situation, and your tolerance for risk. For expats, this might involve understanding how your income from abroad or future plans to move affect your strategy. You can find advisors who specialise in helping people like you, for example, Feller Financial Advisory.

Strategies for Wealth Accumulation

Building wealth isn't just about saving; it's about making your money grow. This often involves investing. There are many ways to invest in Germany, from stocks and bonds to property. The key is to choose investments that match your goals and how much risk you're comfortable with. Diversification is also important – don't put all your eggs in one basket. A good strategy might involve regular, consistent investments over time.

Managing Debt Effectively

Debt can be a major hurdle to financial health. While some debt, like a mortgage, can be a tool, high-interest debt like credit cards can be a drain. It's important to have a plan to manage and reduce any debts that are costing you a lot in interest. Prioritising high-interest debts first is usually a smart move. Sometimes, consolidating debts can simplify payments and potentially lower interest rates.

Budgeting and Saving Techniques

Budgeting is simply tracking where your money goes. It helps you see where you can cut back and save more. There are many ways to budget, from simple spreadsheets to apps. The goal is to spend less than you earn and put the difference towards your financial goals. Small, consistent savings can add up significantly over time. Even saving a small percentage of your income regularly can make a big difference. For instance, optimising your working capital can free up funds for savings and investments. Learn more about working capital.

Financial Planning for Different Life Stages

Your financial needs change as you get older. What's right for someone starting their career might not be right for someone nearing retirement. A good financial plan should adapt to these changes. This means reviewing your goals and strategies regularly. For example, as you get closer to retirement, you might shift your investments to be less risky. Similarly, if your family grows, your insurance needs might change. Working with a consultant can help you stay on track through all of life's stages.

The Role of BaFin in Financial Services

When you're dealing with financial matters in Germany, especially as an expat, you'll likely come across the name BaFin. This is the Federal Financial Supervisory Authority, and it's a pretty big deal. Think of them as the main watchdog for the German financial market. Their job is to make sure everything runs smoothly and fairly, protecting both consumers and the stability of the financial system itself.

Understanding BaFin's Regulatory Authority

BaFin has a wide reach. They oversee banks, insurance companies, investment firms, and even pension funds. This means they set the rules and make sure companies are following them. It's all about keeping the financial world in Germany trustworthy and reliable. They're the ones who grant licenses and keep an eye on how these institutions operate day-to-day. For anyone looking for financial advice, knowing that an authority like BaFin is involved can bring a sense of security. They also play a role in regulating specific markets, like the energy derivatives market, where they plan to implement position limits for certain contracts [2b6f].

Ensuring Advisor Compliance

For financial consultants, being registered with BaFin is a significant marker of legitimacy. It means they've met certain standards and are subject to oversight. This is particularly important when you're seeking advice on investments, insurance, or pensions. You want to know that the person guiding your financial decisions is operating within the law and adhering to professional conduct. It's not just about having a license; it's about ongoing compliance and accountability.

Investor Protection Measures

One of BaFin's primary goals is to protect investors. They do this through various means, including setting disclosure requirements for financial products and ensuring that financial services providers act in the best interests of their clients. If something goes wrong, BaFin provides channels for reporting misconduct. This regulatory framework is designed to build confidence in the German financial sector.

Licensing Requirements for Consultants

To operate legally as a financial advisor or consultant in Germany, professionals often need to be registered with BaFin. This involves meeting specific criteria related to their qualifications, financial standing, and professional indemnity insurance. The licensing process is designed to filter out those who aren't equipped to provide sound financial advice. It's a good idea to check if your advisor is properly registered.

Reporting Financial Misconduct

If you encounter any suspicious activity or believe a financial service provider is not acting appropriately, BaFin provides a mechanism for reporting such issues. This helps them identify problems early and take action. It's a way for the public to contribute to maintaining the integrity of the financial market.

The Importance of Registered Advisors

When choosing a financial advisor, looking for one who is registered with BaFin is a sensible step. It signifies that they are authorised to provide financial services and are subject to regulatory supervision. This registration is a key indicator of a professional's legitimacy and commitment to operating within the established legal and ethical guidelines in Germany.

BaFin's Role in Market Stability

Beyond individual investor protection, BaFin also works to maintain the overall stability of the financial markets. This involves monitoring systemic risks and taking preventative measures. A stable financial market is beneficial for everyone, from large institutions to individual savers and investors. It creates a more predictable environment for financial planning and wealth building.

Building Long-Term Financial Security

Achieving long-term financial security is about more than just saving money; it's about building a solid plan that can weather life's ups and downs. It requires a clear vision of your future and the steps needed to get there. This isn't a quick fix, but a steady process that pays off over time.

Creating a Robust Financial Foundation

Think of your financial foundation as the base of a house. If it's weak, everything else is at risk. This means getting your debts in order, building an emergency fund, and understanding where your money is going. It’s about making sure you have a stable base before you start building upwards.

- Emergency Fund: Aim to have 3-6 months of living expenses saved. This fund is for unexpected events, not for planned purchases.

- Debt Management: Prioritise paying off high-interest debts. This frees up cash flow and reduces financial stress.

- Budgeting: Regularly track your income and expenses to identify areas where you can save more.

Diversifying Your Financial Portfolio

Putting all your eggs in one basket is rarely a good idea, especially with money. Diversification means spreading your investments across different types of assets. This helps to reduce risk. If one investment isn't doing well, others might be performing better, balancing things out. It’s a smart way to protect your wealth.

Asset Class | Example |

|---|---|

Equities | Stocks in various companies |

Fixed Income | Bonds from governments or corporations |

Real Estate | Property investments |

Alternatives | Commodities, private equity (with caution) |

Planning for Unexpected Events

Life throws curveballs. That's why planning for the unexpected is so important. This includes having adequate insurance coverage and a solid emergency fund. It’s about being prepared for things like job loss, illness, or unforeseen repairs. Being prepared means these events don't derail your long-term goals.

Estate Planning Considerations

Estate planning might sound like something for much later in life, but it's wise to think about it sooner rather than later. It involves deciding what happens to your assets after you're gone. This can include writing a will and considering how to pass on wealth to loved ones. It provides peace of mind and ensures your wishes are followed. For expats, this can involve international considerations too.

Reviewing and Adjusting Your Strategy

Your financial plan isn't a 'set it and forget it' thing. Life changes, markets shift, and your goals might evolve. It’s important to review your financial situation regularly, perhaps once a year. This allows you to make any necessary adjustments to your investments, savings, and insurance. Staying on track means being flexible.

Regular reviews help you adapt to changing economic conditions, such as the current challenges facing the German economy. High valuations in markets mean careful monitoring is key to maintaining stability.

Achieving Financial Independence

Financial independence is the goal for many – having enough income from investments or other sources to live without needing to work. It's a journey that requires discipline, smart planning, and consistent effort. It's about having the freedom to make choices based on your desires, not just financial necessity. Building this takes time and a well-thought-out strategy, potentially involving investment options in Germany.

Securing Your Financial Future

Ultimately, building long-term financial security is about creating a future where you feel confident and protected. It involves a combination of smart saving, wise investing, and careful planning. By taking these steps, you can build a strong financial future for yourself and your family.

Understanding Financial Products in Germany

When you're living in Germany, getting a handle on the local financial products is a big step towards managing your money well. It’s not just about knowing what’s available, but understanding how each one fits into your personal financial picture. Think of it like choosing the right tools for a job; you wouldn't use a hammer to screw in a bolt, right? The German financial landscape has a variety of options, each with its own purpose and characteristics.

Overview of Savings Accounts

Savings accounts, or 'Sparkonto', are pretty straightforward. They're a safe place to keep money you might need soon or for unexpected expenses. Interest rates are generally low, but the main benefit is easy access and security. They are not designed for significant growth but for preserving capital. For expats, understanding how to open and manage a German bank account is usually the first financial task.

Exploring Fixed-Term Deposits

Fixed-term deposits, known as 'Festgeld', are like savings accounts but with a commitment to leave your money untouched for a set period, usually from a few months to several years. In return, you typically get a slightly higher interest rate than a regular savings account. This is a good option if you know you won't need the money for a while and want a bit more return than a standard savings account. It’s a low-risk way to earn a predictable income on your savings.

Understanding Bonds and Fixed Income

Bonds are essentially loans you make to a government or a company. In return, they promise to pay you back the principal amount on a specific date, along with regular interest payments. German bonds, like 'Staatsanleihen' (government bonds) or 'Unternehmensanleihen' (corporate bonds), are generally considered relatively safe, especially those issued by the German government. They can be a good way to add stability to an investment portfolio, offering a more predictable income stream compared to stocks. However, they do carry some risk, including interest rate risk and the possibility of the issuer defaulting.

Mutual Funds and Their Benefits

Mutual funds pool money from many investors to buy a diversified portfolio of stocks, bonds, or other securities. This diversification is a key advantage, as it spreads risk across many different assets. For someone new to investing in Germany, mutual funds can be a simpler way to get exposure to various markets without having to pick individual stocks or bonds yourself. There are many types of funds, including those that focus on specific sectors or regions. You can find a wide range of funds available through German banks and independent investment platforms.

Real Estate Investment Opportunities

Investing in property in Germany can be attractive, but it requires a significant amount of capital and a good understanding of the local market. Property prices can vary greatly depending on the city and region. While it can offer rental income and potential capital appreciation, it's also less liquid than other investments, meaning it can take time to sell if you need the cash. It's worth looking into the different types of property ownership and the associated costs, such as taxes and maintenance.

Alternative Investment Avenues

Beyond the traditional options, Germany also offers alternative investments. These might include things like commodities, private equity, or even art and collectibles. These can sometimes offer different risk and return profiles compared to stocks and bonds. However, they often come with higher risks, require specialised knowledge, and may be less regulated. It’s important to do thorough research and perhaps seek advice before considering these.

Choosing Products Aligned with Goals

Ultimately, the best financial products for you depend entirely on your personal circumstances and what you want to achieve. Are you saving for a house deposit in the next five years? Or are you planning for retirement in thirty years? Your goals, your tolerance for risk, and how long you plan to invest all play a role. It’s about matching the product's features to your specific needs. For instance, a short-term savings goal might suit a fixed-term deposit, while a long-term goal could benefit from investing in diversified funds. Understanding these products is the first step to making informed financial decisions in Germany. European Union rules protect your fundamental rights when engaging with financial services, which is a good baseline to remember. Financial services are regulated to provide consumer protection.

Key Considerations for Financial Planning

When you're thinking about your finances in Germany, it's not just about the day-to-day. You've got to look at the bigger picture, the long game. This means really sitting down and figuring out what you want your money to do for you, not just now, but years down the line. It sounds simple, but it's easy to get caught up in the immediate and forget about the future. Setting clear objectives is the first step to making any financial plan work.

Defining Your Financial Objectives

What are you actually trying to achieve? Is it buying a house, saving for your children's education, or perhaps ensuring a comfortable retirement? Without knowing your goals, any financial plan is just a shot in the dark. It's like setting off on a journey without a destination. You need to be specific. Instead of 'save more money', try 'save €5,000 for a down payment on a car within two years'. This makes it measurable and gives you something concrete to aim for.

Assessing Risk Tolerance

How much risk are you comfortable with? This is a really personal thing. Some people are happy to take on more risk for the chance of higher returns, while others prefer a safer, more predictable path. Your risk tolerance will heavily influence the types of investments you consider. Are you okay with the value of your investments going up and down significantly, or would that keep you awake at night? Understanding this helps avoid making decisions you'll later regret.

Time Horizon for Investments

When do you need the money? This is closely linked to your objectives. If you're saving for a house deposit in three years, you'll likely choose different investments than someone saving for retirement in thirty years. Short-term goals usually mean lower-risk investments, while longer horizons allow for potentially higher-risk, higher-reward options. It's about matching your money's growth potential to when you'll need access to it.

Tax Implications of Financial Decisions

Germany has its own tax system, and it's important to know how your financial activities are affected. This includes income tax, capital gains tax, and inheritance tax. Making decisions without considering the tax impact can significantly reduce your overall returns. For example, certain investment vehicles might be more tax-efficient than others. It's worth looking into how things like capital gains tax work here.

Inflationary Pressures on Savings

Inflation is that sneaky thing that erodes the purchasing power of your money over time. If your savings are just sitting in a low-interest account, inflation can mean that, in real terms, you're actually losing money. A good financial plan needs to account for this. It means looking for ways to invest your money so that its growth outpaces inflation. This is where understanding different investment options becomes important.

Liquidity Needs and Emergency Funds

Life happens, and unexpected expenses pop up. That's why having an emergency fund is so important. This is money set aside for unforeseen events, like a job loss, medical emergency, or urgent home repairs. It should be easily accessible and separate from your long-term investments. A common recommendation is to have three to six months' worth of living expenses saved. This fund acts as a safety net, preventing you from having to dip into your investments or go into debt when something unexpected occurs.

Regular Financial Reviews

Your financial plan isn't a 'set it and forget it' kind of thing. Life changes, markets move, and your goals might shift. It's a good idea to review your financial situation and plan at least once a year, or whenever a major life event occurs (like a new job, marriage, or having a child). This ensures your plan stays relevant and continues to work towards your objectives. It's about staying on track and making adjustments as needed.

Professionalism in Financial Consulting

When you're looking for help with your finances in Germany, professionalism from your consultant is key. It's not just about knowing the numbers; it's about how they conduct themselves and manage your financial journey. This means they should always act in your best interest, putting your needs ahead of their own.

Ethical Standards for Advisors

Ethical behaviour forms the bedrock of good financial advice. This involves honesty, integrity, and a commitment to doing what's right for the client. It means avoiding situations where the advisor might benefit more than you do from a particular recommendation. Think of it like a doctor prescribing medicine – they should choose what works best for the patient, not what gives them the biggest commission.

Maintaining Client Confidentiality

Your financial details are private. A professional consultant understands this and treats all information you share with the utmost discretion. They won't be gossiping about your portfolio or sharing your personal circumstances with others. This trust is vital for building a strong working relationship.

Transparency in Fee Structures

How a consultant gets paid should be clear from the start. There shouldn't be any hidden charges or surprises. Whether they charge a flat fee, an hourly rate, or a percentage of assets managed, you should know exactly what you're paying for. This transparency helps you understand the value you're receiving.

Continuous Professional Development

Financial markets and regulations change. A professional consultant stays up-to-date with these changes. They regularly attend training, read industry publications, and perhaps even hold certifications from bodies like the European Financial Planning Association. This commitment to learning means they can provide advice that's relevant and current.

Adherence to German Financial Regulations

Germany has specific rules for financial services, overseen by BaFin. Professional consultants know these rules and follow them. This includes things like licensing requirements and how they must present information to clients. It's a sign that they operate within the law and are accountable.

Building Trust and Rapport

Financial planning can feel personal and sometimes a bit daunting. A good consultant takes the time to build a relationship with you. They listen to your concerns, explain things clearly, and make you feel comfortable. It’s about more than just transactions; it’s about partnership.

Delivering Value-Added Services

Professionalism also means going beyond the basic. This could involve providing regular updates, offering educational resources, or proactively suggesting adjustments to your plan as your life circumstances change. It’s about providing a service that genuinely helps you achieve your financial goals.

Investment Strategies for Expats

Moving to a new country like Germany often means rethinking your financial plans. For expats, this includes how you invest your money. It's not just about where you live now, but also about your future, wherever that might be. Getting your investments right can make a big difference to your financial security.

Tailoring Investments to Expat Needs

When you're an expat, your investment strategy needs to consider a few unique factors. You might have financial ties to your home country, or perhaps you plan to return there eventually. This means your investments need to be flexible. It's about building wealth here in Germany while keeping an eye on potential future moves or goals. We look at what you want to achieve and build a plan around that.

Understanding Currency Exchange Risks

If you're earning in Euros but have savings or investments in another currency, or vice versa, you're exposed to currency fluctuations. This can affect the real value of your money. For example, if the Euro strengthens significantly against your home currency, your repatriated funds might be worth less than you expected. It's a risk that needs careful management, especially if you're planning to move money across borders.

Repatriation of Funds Planning

Thinking about moving your money back home, or to another country, is a common concern for expats. There are rules and tax implications to consider. Planning this in advance can save you a lot of hassle and potential costs. We help you understand the best ways to move your funds when the time comes, making sure you comply with all regulations.

Tax-Efficient Investment Structures

Germany has its own tax system, and it applies to your investments too. Understanding how different investments are taxed here is key to making sure you keep as much of your returns as possible. This might involve choosing specific types of accounts or investment products that offer tax advantages for residents. It's a complex area, but getting it right means more money in your pocket over the long term. You can find more information on stock trading in Germany.

Balancing Global and Local Investments

Should you invest only in Germany, or spread your money across different countries? A balanced approach is often best. Investing locally can be simpler and more tax-efficient, but global diversification can reduce risk and open up more growth opportunities. We help you find that sweet spot, creating a portfolio that works for your specific situation.

Leveraging International Investment Platforms

There are many platforms available for investing, both within Germany and internationally. Some expats find it easier to use platforms they are familiar with from their home country, while others prefer to use German-based services. We can guide you on which platforms might be most suitable, considering factors like fees, available products, and ease of use for expats.

Seeking Advice on Cross-Border Investments

Investing across borders adds another layer of complexity. You need to consider not just German regulations, but also those of other countries where you might invest or hold assets. Getting professional advice is vital to avoid costly mistakes. This is where an independent financial advisor can really help, providing clarity and a strategy that fits your international life.

Here are some key areas we focus on:

- Risk Assessment: Understanding your comfort level with different types of investment risk.

- Goal Alignment: Making sure your investments are geared towards your specific financial objectives, whether that's buying property, saving for retirement, or something else.

- Product Selection: Choosing the right mix of investments, such as stocks, bonds, ETFs, or funds, that suit your profile and the German market.

- Regular Reviews: Checking in on your portfolio periodically to make sure it's still on track and making adjustments as needed.

Retirement Planning for a Secure Future

Planning for retirement in Germany requires a clear picture of your future financial needs and the resources available to meet them. It's not just about saving money; it's about building a strategy that accounts for various income streams and potential expenses.

Estimating Retirement Expenses

Figuring out how much you'll need in retirement is the first step. Think about your current lifestyle and what you'd like your retirement to look like. Will you travel? Pursue hobbies? Downsize your home? These activities have different costs.

- Housing: Rent, mortgage, property taxes, maintenance.

- Healthcare: Contributions to health insurance, potential long-term care costs.

- Daily Living: Food, utilities, transportation.

- Leisure: Hobbies, travel, social activities.

Sources of Retirement Income

In Germany, retirement income typically comes from a few main areas:

- State Pension (Gesetzliche Rentenversicherung): This is the basic pension provided by the government, based on your contributions during your working life. It's important to understand how your contributions translate into future benefits.

- Company Pensions (Betriebliche Altersvorsorge): Many employers offer supplementary pension schemes. These can be a valuable addition to your retirement savings.

- Private Pensions: This includes personal savings, investments, and private pension plans you set up yourself. This is where individual planning plays a significant role.

The Role of Private Savings

While the state pension provides a foundation, it's often not enough to maintain your pre-retirement standard of living. This is where private savings and investments become really important. Building up a personal nest egg gives you more control and flexibility over your retirement years. It's about making your money work for you over the long term. For expats, understanding how to build these savings within the German financial system is key. You might consider various investment options in Germany to grow your capital.

Understanding Annuities

Annuities are a common way to convert a lump sum of savings into a guaranteed stream of income for life. They can offer peace of mind, knowing you'll have a regular payment. However, it's important to understand the terms, potential returns, and how inflation might affect the value of these payments over time.

Planning for Healthcare Costs in Retirement

Healthcare needs can increase with age. In Germany, health insurance is mandatory. You'll need to factor in ongoing health insurance contributions, potential out-of-pocket medical expenses, and the possibility of needing long-term care. Planning for these costs is a vital part of a secure retirement.

Adjusting Plans for Longevity

People are living longer, which is great news! But it also means your retirement savings need to last longer. This is why a robust retirement plan considers a longer lifespan. It means not just saving enough, but also investing wisely to ensure your funds can support you for potentially 20, 30, or even more years after you stop working.

Ensuring Financial Comfort in Later Life

Ultimately, retirement planning is about achieving financial security and comfort. It's about having the freedom to enjoy your later years without constant financial worry. A well-structured retirement plan, tailored to your individual circumstances and the German system, is the best way to achieve this. This involves regular reviews and adjustments as your life and financial situation change.

Insurance Solutions for Comprehensive Protection

Assessing Your Insurance Requirements

Figuring out what insurance you actually need can feel like a puzzle. It’s not just about ticking boxes; it’s about looking at your life in Germany and thinking about what could go wrong and how you’d cope. Are you renting or owning a place? Do you have dependents? What’s your job like? Answering these questions helps pinpoint the types of cover that make sense for you. It’s about being realistic about potential risks.

Understanding Policy Exclusions

Every insurance policy has fine print, and that's where exclusions live. These are the situations or events that the insurance company won't pay out for. It’s really important to know what these are before you sign up. For example, some travel insurance might not cover pre-existing medical conditions, or home insurance might not cover damage from floods if you live in a high-risk area. Reading these sections carefully can save a lot of heartache later.

Claims Process Guidance

When you need to make a claim, the process can sometimes be a bit confusing. Knowing the steps involved beforehand makes it smoother. Generally, you’ll need to report the incident promptly, provide all necessary documentation (like police reports or medical records), and cooperate with the insurer. Having a clear understanding of the claims procedure can significantly reduce stress during a difficult time.

Reviewing Existing Policies

It’s easy to set up insurance and then forget about it. But your circumstances change, and so do insurance products. It’s a good idea to look over your policies every year or two. Are you still paying for cover you don’t need? Has your situation changed, meaning you need more or less cover? For instance, if you’ve bought a new car, you’ll need to update your vehicle insurance details.

The Importance of Adequate Coverage

Having insurance is one thing, but having enough insurance is another. Underinsurance means that if something happens, the payout won't be enough to cover the full cost. This is common with things like home contents insurance, where people underestimate the value of their belongings. It’s also relevant for disability insurance, where the payout needs to be sufficient to replace your income.

Protecting Against Financial Loss

At its heart, insurance is about protecting yourself from a big financial hit. Think about major events: a serious illness, a car accident, or damage to your home. Without the right insurance, these events could lead to significant debt or even bankruptcy. Insurance acts as a safety net, allowing you to recover without facing financial ruin.

Specialised Insurance Needs

Beyond the common types like health and car insurance, there are more specialised products. For freelancers, professional indemnity insurance might be vital. If you own valuable items like art or jewellery, you might need specific cover for those. For expats, understanding how international health insurance or travel insurance works is also key. Identifying these specific needs ensures you’re not left exposed.

Investment Vehicles in the German Market

When you're looking at how to invest in Germany, you'll find a variety of options available. It's not just about picking one thing; it's about understanding what fits your personal financial situation and your goals. Many people, including expats, are turning to Exchange Traded Funds (ETFs) because they offer a simple way to spread your money across many different companies or sectors. This approach can help manage risk. You can find information on the best ETFs for beginners if that sounds like a good starting point.

Equity Funds and Their Performance

Equity funds, often called stock funds, pool money from many investors to buy shares in various companies. The idea is that by owning a piece of many businesses, you're less exposed if one company doesn't do well. Their performance can vary a lot depending on the market and the specific companies the fund invests in. Some funds focus on large, established German companies like Volkswagen or BMW, while others might look at smaller, growing businesses. Keeping an eye on how these funds have performed over time is important, but remember that past performance doesn't guarantee future results.

Bond Funds for Stability

Bond funds are generally seen as a more stable option compared to equity funds. They invest in bonds, which are essentially loans made to governments or corporations. When you invest in a bond fund, you're lending money to multiple entities. These funds typically offer a more predictable income stream through interest payments, though the value can still fluctuate with interest rate changes. They can be a good way to balance out the riskier parts of your investment portfolio.

Index Funds and Tracking Performance

Index funds are a type of fund that aims to mirror the performance of a specific market index, like the DAX (the German stock index). They don't try to pick individual winning stocks; they just aim to replicate the overall movement of the index. This passive approach often means lower management fees compared to actively managed funds. For many, this is a straightforward way to get broad market exposure. Many investors, including expatriates, find ETFs a useful tool for diversification.

Real Estate Investment Trusts (REITs)

REITs allow you to invest in real estate without actually buying property yourself. They own, operate, or finance income-generating real estate. Investing in REITs can provide income through dividends and potential capital appreciation. However, like any investment, they come with their own set of risks, including market fluctuations and interest rate sensitivity.

Venture Capital and Private Equity

These are typically for more sophisticated investors and involve investing in private companies that are not listed on public stock exchanges. Venture capital usually targets start-ups with high growth potential, while private equity often involves investing in more established companies. These investments can offer high returns but also carry significant risk and often require a longer-term commitment.

Commodities and Their Role

Commodities are raw materials like gold, oil, or agricultural products. Investing in commodities can be done through various means, such as futures contracts or commodity-backed ETFs. They can sometimes act as a hedge against inflation, meaning their value might increase when the general cost of goods and services rises. However, commodity prices can be very volatile.

Choosing Appropriate Investment Vehicles

When deciding which investment vehicles are best for you in Germany, consider these points:

- Your Goals: Are you saving for retirement, a house deposit, or something else?

- Your Risk Tolerance: How comfortable are you with the possibility of losing money?

- Your Time Horizon: How long do you plan to keep your money invested?

Understanding these factors will help you select the right mix of investments. It's often wise to seek advice on best investment strategies Germany to ensure your choices align with your financial plan.

Making informed decisions about investment vehicles is key to building wealth. It's about finding a balance that suits your individual circumstances and financial aspirations.

Financial Goal Setting and Achievement

Setting clear financial goals is like having a map for your money. Without one, you might wander aimlessly, never quite reaching where you want to be. In Germany, as anywhere else, having a plan makes a big difference. It's not just about saving money; it's about directing your funds towards things that matter to you, whether that's buying a home, travelling, or securing a comfortable retirement.

Defining Short-Term Goals

These are the goals you want to achieve within the next year or so. They're often the most tangible and can give you a quick sense of accomplishment. Think about things like building up an emergency fund, paying off a small debt, or saving for a specific purchase, like a new laptop or a holiday.

- Emergency Fund: Aim to save 3-6 months of living expenses.

- Debt Reduction: Focus on paying off high-interest debts first.

- Specific Purchase: Save a set amount for a desired item or experience.

Establishing Medium-Term Objectives

These goals typically fall within a 1-5 year timeframe. They require a bit more planning and consistent effort. Examples include saving for a down payment on a property, funding further education, or starting a significant investment.

Planning for Long-Term Aspirations

These are your big-picture goals, often spanning 5 years or more. Retirement planning, saving for your children's education, or achieving financial independence fall into this category. These goals require a sustained strategy and often involve more complex financial products like investments and pensions.

SMART Goal Setting Framework

To make your goals effective, use the SMART framework:

- Specific: Clearly define what you want to achieve.

- Measurable: How will you track your progress?

- Achievable: Is the goal realistic given your resources?

- Relevant: Does the goal align with your values and overall financial plan?

- Time-bound: Set a deadline for achieving the goal.

Tracking Progress Towards Goals

Regularly checking in on your progress is key. This helps you stay motivated and make adjustments if needed. You can use spreadsheets, budgeting apps, or simply a notebook to keep track. Seeing how far you've come can be a great motivator.

Overcoming Financial Obstacles

Life happens, and sometimes unexpected expenses or setbacks can derail your plans. It's important to have a strategy for dealing with these. This might involve dipping into your emergency fund, temporarily adjusting your savings rate, or re-evaluating your goals. The key is not to give up, but to adapt.

Celebrating Milestones

Don't forget to acknowledge your successes along the way! Reaching a savings target or paying off a debt is a big deal. Celebrating these milestones, even in small ways, helps maintain momentum and makes the financial journey more enjoyable.

The Importance of Independent Advice

When you're looking at your finances, especially in a new country like Germany, it's easy to feel a bit lost. You might be tempted to go with the first bank or insurance company that seems helpful. But here's the thing: not all advice is created equal.

Benefits of Unbiased Recommendations

Independent advisors aren't tied to selling specific products from one company. This means their suggestions are based on what's genuinely best for you, not on commission targets. They can look across the whole market to find the right fit for your situation. This is particularly helpful for expats who have unique needs, like understanding how their pension plans might work or what insurance is really necessary. They can also help you figure out the best way to manage things like your health insurance, which can be quite complex here.

Avoiding Conflicts of Interest

Think about it: if an advisor gets a bonus for selling you a particular investment or insurance policy, are they really looking out for your best interests? An independent advisor doesn't have that pressure. Their focus is on building a long-term relationship with you, based on trust. This means they'll be more likely to recommend solutions that align with your goals, even if it means a less profitable product for them in the short term. It's about finding the right fit, not just the easiest sale.

Focus on Client Best Interests

An independent advisor's primary duty is to you, the client. They'll take the time to understand your financial picture, your goals, and your comfort level with risk. This personalised approach is key. They'll help you understand options like different types of investments or how to plan for retirement, considering your specific circumstances as someone living abroad. For example, they can explain the nuances of the German pension system and how it might interact with any pensions you have from your home country.

Freedom from Product Bias

This freedom means they can recommend products from a wide range of providers. Whether you need help with savings accounts, investments, or specific insurance policies like disability insurance, they can shop around. This is a big advantage when you're trying to get your finances sorted in Germany, especially if you're new to the system. They can compare different options and explain the pros and cons clearly.

Building Long-Term Relationships

Because their advice is unbiased, independent advisors aim to build lasting relationships. They're not just there for a one-off transaction. They want to be your go-to person as your financial life evolves. This means they'll be there to review your plans, make adjustments as needed, and help you stay on track towards your goals, whether that's buying a home, planning for retirement, or simply building wealth over time. This kind of ongoing support is invaluable, particularly for expats who might face changing circumstances.

Empowering Informed Decisions

Ultimately, independent advice helps you make better decisions. Instead of feeling pressured or confused, you'll have a clear understanding of your options and why certain choices are recommended for you. This clarity allows you to feel more confident about your financial future. It's about making sure you're in control and understand the path you're taking.

The Value of Objective Guidance

Getting objective guidance is incredibly important. It means you're getting advice that's free from the influence of product sales targets or company affiliations. This objective perspective can save you money and stress in the long run. It's about having someone in your corner who is solely focused on your financial well-being. For expats, finding this kind of trusted advisor can make a significant difference in settling in and building a secure financial life in Germany. You can find advisors who specialise in expat financial advice and understand the unique challenges you might face.

Managing Risk in Financial Planning

When you're planning your finances, it's easy to get caught up in the excitement of growing your money or securing your future. But what about the things that could go wrong? Thinking about potential problems isn't about being negative; it's about being prepared. It's about making sure that unexpected events don't derail your long-term plans.

Identifying Potential Financial Risks

First off, what are we even talking about when we say 'financial risks'? These are basically anything that could negatively impact your financial situation. For individuals and families in Germany, this could include things like:

- Job loss or a significant reduction in income.

- Unexpected major medical expenses that aren't fully covered by insurance.

- Economic downturns that affect investments or property values.

- Changes in tax laws that alter your financial obligations.

- Personal emergencies, like needing to make urgent repairs to your home or car.

Understanding these possibilities is the first step. It's like looking at a weather forecast before a trip – you wouldn't cancel the holiday, but you might pack an umbrella.

Strategies for Risk Mitigation

Once you know what could happen, you can start thinking about how to lessen the impact. This is where risk mitigation comes in. It's not about eliminating risk entirely – that's often impossible – but about reducing the likelihood of it happening or softening the blow if it does. For instance, having a solid emergency fund is a classic way to handle unexpected expenses without touching your long-term investments. This fund should ideally cover three to six months of living costs. It's a buffer, plain and simple.

Diversification as a Risk Management Tool

One of the most talked-about strategies is diversification. You've probably heard the saying 'don't put all your eggs in one basket', and it's very true for finance. Spreading your money across different types of investments means that if one area performs poorly, others might still be doing well, balancing things out. This applies to different asset classes (like stocks, bonds, and property), different industries, and even different geographical regions. A well-diversified portfolio is less likely to suffer a catastrophic loss from a single event. It's a key part of Financial Risk Management.

Insurance as Risk Transfer

Insurance is another major player in managing risk. Essentially, you're transferring the risk of a large, potentially devastating financial loss to an insurance company in exchange for regular payments (premiums). Think about health insurance, which covers medical costs, or liability insurance, which protects you if you accidentally cause damage to someone else's property or injure them. For expats, understanding the local insurance landscape is vital. Getting the right coverage, like disability insurance (BU), can protect your income if you're unable to work. It's about making sure that a single unfortunate event doesn't lead to financial ruin.

Understanding Market Volatility

Markets, whether for stocks, bonds, or property, can be unpredictable. Prices go up and down, sometimes quite dramatically. This is known as volatility. While it can be unsettling, understanding that it's a normal part of investing is important. Trying to time the market by buying low and selling high is incredibly difficult, and often leads to worse outcomes. A long-term perspective, combined with diversification, helps you ride out these ups and downs. It's about staying the course rather than panicking when prices dip.

Contingency Planning

Beyond day-to-day risks, it's wise to think about bigger 'what ifs'. This could involve having a will in place to ensure your assets are distributed according to your wishes after you're gone, or planning for long-term care needs. For expats, this might also include thinking about what would happen if you needed to move back home suddenly or if your circumstances in Germany changed unexpectedly. Having a plan B, or even a plan C, can provide significant peace of mind. Professionals focused on Risk Management often help clients develop these kinds of forward-thinking strategies.

Preparing for financial risks isn't about predicting the future perfectly. It's about building a financial structure that can withstand shocks and adapt to change. It involves a mix of saving, investing wisely, and protecting yourself with appropriate insurance. This proactive approach is what separates financial stability from financial vulnerability.

Financial Consulting Process Explained

So, you're thinking about getting some financial advice in Germany? It's not as complicated as it might sound. The whole process is designed to be pretty straightforward, moving from understanding where you are now to figuring out where you want to be. It's all about making your money work for you, whether that's for saving, investing, or planning for the future.

Initial Consultation and Assessment

This is where it all begins. You'll have a chat with a consultant, usually for free, to talk about your current financial situation. They'll ask about your income, your expenses, any savings you have, and what your immediate concerns are. It’s a bit like a check-up for your finances. They want to get a clear picture of your financial health before suggesting anything. This is also your chance to ask questions and see if you feel comfortable with the advisor. Finding the right person is key, after all.

Information Gathering and Analysis

After the initial chat, the advisor will need more details. This might involve looking at bank statements, investment portfolios, insurance policies, and pension statements. They'll take all this information and analyse it. They're looking for patterns, opportunities, and potential risks. It’s a bit like a detective job, piecing together all the financial clues to understand the full story. This step is really important for making sure any advice given is based on solid facts.

Developing Personalised Recommendations

Once they've crunched the numbers and understood your situation, the advisor will come up with a plan. This isn't a one-size-fits-all approach; it's tailored specifically to you. They'll explain their recommendations clearly, covering things like:

- Investment strategies to grow your wealth.

- Insurance options to protect you and your family.

- Pension planning for a secure retirement.

- Budgeting and saving techniques.

The goal is to create a clear roadmap that aligns with your personal financial objectives. They should explain why they're suggesting certain products or strategies and what the potential outcomes are. It’s about making informed choices together.

Implementation of Financial Strategies

Having a plan is one thing, but putting it into action is another. This stage involves actually setting up the accounts, buying the investments, or adjusting your insurance policies as recommended. Your advisor will guide you through this, making sure everything is done correctly and efficiently. For example, they might help you open a new investment account or switch to a more suitable insurance policy. This is where the advice starts to become reality.

Ongoing Monitoring and Review

Your financial life isn't static, and neither should your financial plan be. Regular check-ins are vital. Your advisor will monitor your investments, review your insurance coverage, and see how you're progressing towards your goals. Life changes – you might get a new job, have a child, or decide to buy a house. The plan needs to adapt to these changes. This continuous oversight helps to keep your finances on track and make adjustments as needed. It’s a partnership that continues long after the initial plan is made. You can even get a personalised wealth accumulation plan here.

Client Communication and Support

Throughout the entire process, good communication is key. You should feel informed and supported at every step. This means clear explanations, prompt responses to your questions, and regular updates. It’s important to build a relationship based on trust and transparency. Your advisor should be accessible and willing to discuss any concerns you might have. This ongoing dialogue helps to ensure you remain confident and comfortable with your financial decisions.

Adapting to Changing Circumstances

Life throws curveballs, and financial plans need to be flexible. Whether it's a change in the economic climate, a shift in personal circumstances, or new financial goals, your advisor should help you adapt. This might mean rebalancing your investment portfolio, updating your insurance, or revising your retirement timeline. The aim is to ensure your financial strategy remains relevant and effective, no matter what life brings. It’s about long-term financial resilience.

Understanding how we work is the first step to smart money choices. Our financial consulting process is designed to be clear and straightforward, helping you make sense of your investments. We break down each stage so you know exactly what to expect. Ready to take control of your financial future? Visit our website to learn more about our step-by-step approach.

Wrapping Up Your Financial Journey in Germany