Your Trusted Financial Advisor in Berlin

You are working in Berlin and are looking for a independent financial advisor? We helped +500 expats in Germany with their finances.

Read our Google Reviews

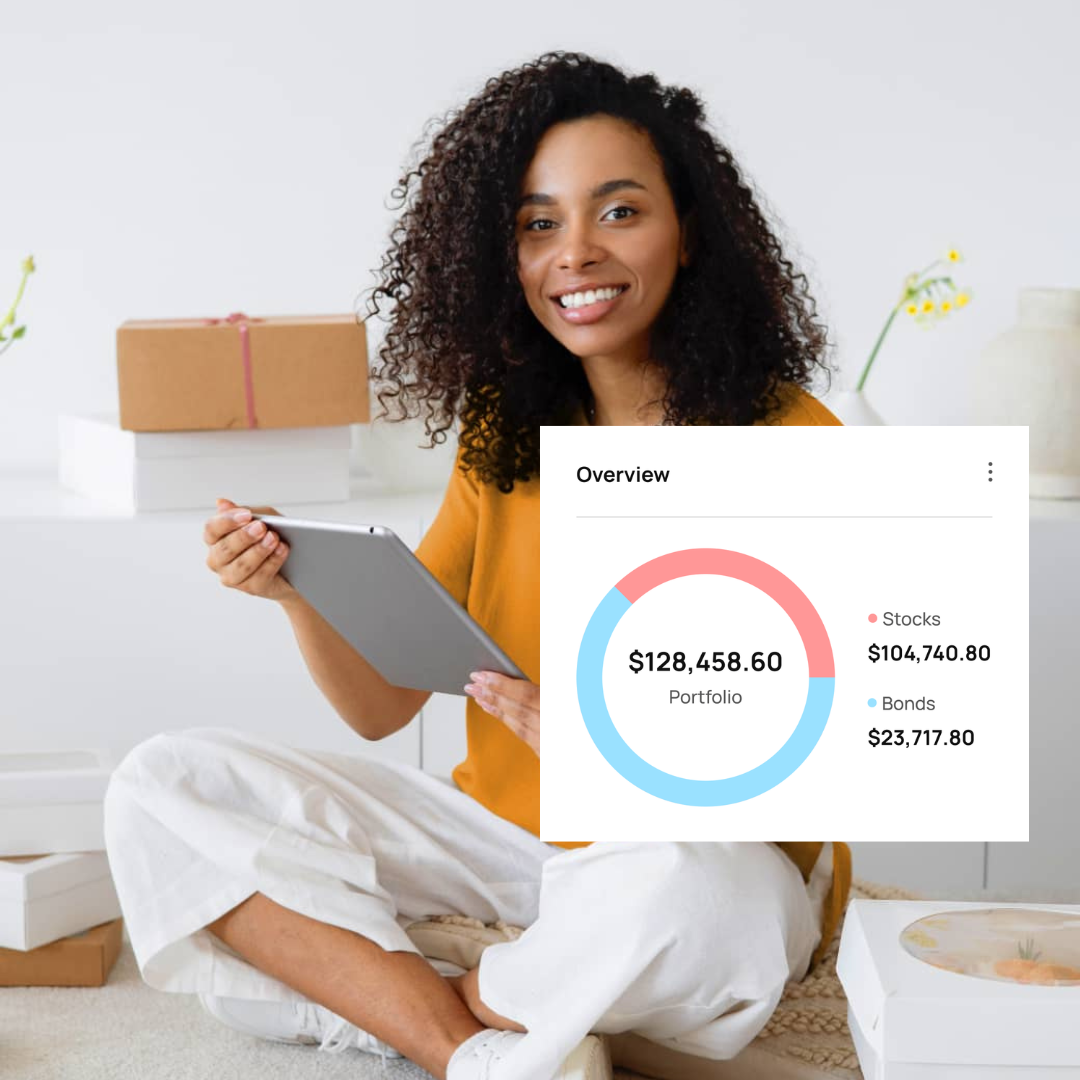

01. Investment Portfolio

We help you create a professional investment portfolio that suits your personal goals.

Book an appointment✅ One fair all-in-one fee of 0.7% p.a.,

✅ No hidden costs,

✅ No performance or exit fees.

02. Retirement Planning

Next to your investment portfolio, we try to close your pension gap. As independent financial advisors, we compare over 100 companies to help you find the most suitable pension plan.

Book an appointment

03. Asset Management

Do you already have an investment portfolio? Great! We objectively review your portfolio and manage it for you if you like.

Book an appointmentVerified client feedback

Google Reviews Overview

A few highlights from expats we’ve supported in Germany.

About Finanz2Go Consulting

At Finanz2Go Consulting, we believe that financial advisory in Berlin should be independent, transparent, and data-driven — never guided by sales targets or provider commissions.

Our mission is simple: to help expats and international professionals build long-term financial security through smart investment, pension, and insurance strategies tailored to the German market.

We are licensed under §34d and §34f GewO by IHK, we operate as independent brokers with a clear free model of 0.7% p.a. — ensuring that our incentives align with your financial goals, not with financial institutions.

Financial Advisor Munich – Independent, Fee-Only Consulting for Expats

Relocating to Munich and looking for a trusted financial advisor who speaks English and understands the challenges internationals face in Germany? At Finanz2Go Consulting, we specialize in independent investment advice, pension planning, and insurance optimization for expats living and working in Munich and across Germany.

Unlike banks or commission-based brokers, our firm operates on a fee-only, fully transparent model. Every recommendation we make is designed exclusively around your objectives—not product sales. With our IHK certification under §34d & §34f GewO and registration in the Vermittlerregister, you can be confident that your financial planning complies with German and EU regulations.

Munich is one of Europe’s leading financial and technology centers, attracting thousands of international professionals each year. Whether you’re an engineer at BMW, a consultant at Deloitte, or an entrepreneur launching your startup, you need a structured plan to build long-term wealth, reduce taxes, and secure your pension future in Germany.

Why Munich Professionals Choose Independent Financial Advice

Munich’s dynamic job market and high cost of living make financial planning a priority for many expats. Unfortunately, most newcomers encounter a sales-driven environment where banks and insurance companies promote commission-based products. Independent advisors like Finanz2Go remove this conflict of interest by providing evidence-based, unbiased consulting that prioritizes transparency and education.

Our clients appreciate that every plan we design integrates tax optimization, investment diversification, and pension security. We use advanced analytical tools such as the Investment Goal Calculator and Portfolio Risk Calculator to ensure your portfolio matches your goals, time horizon, and risk tolerance.

Our approach follows international standards from the CFA Institute Code of Ethics and local guidance from the BaFin – Federal Financial Supervisory Authority. Each recommendation undergoes a rigorous compliance check to guarantee neutrality and consistency with both German Ministry of Finance (BMF) and EU Sustainable Finance (SFDR) frameworks.

Financial Planning for Expats in Munich

Living in Munich as an expat often means navigating complex systems—taxes, pensions, and insurances—while managing savings across multiple currencies. Our mission is to simplify that complexity. We begin every engagement with a free initial consultation where we define your financial goals, risk appetite, and current asset structure. From there, we build a customized plan that fits your life in Germany.

We frequently work with:

- Professionals relocating from the UK, US, and EU who need help with taxes on investments in Germany.

- Entrepreneurs balancing business income and personal pension contributions.

- International families saving for children’s education through ETF portfolios.

- Remote employees who require portable, flexible investment accounts.

By combining the independence of an English-speaking financial advisor in Munich with in-depth knowledge of the German market, we make wealth management accessible and transparent. Our Financial Hub for Expats provides free guides, calculators, and learning materials inspired by the OECD Financial Education Initiative.

Why Choose Finanz2Go as Your Financial Advisor in Munich

We combine German regulatory precision with global investment experience. Our IHK-certified consultants provide full transparency and bilingual communication, ensuring you understand every detail of your financial plan.

- Independence & Objectivity: 100 % commission-free—our motivation is your success, not product sales.

- English-Speaking Advisors: Clear communication and educational explanations for international clients.

- Certified & Regulated: Licensed under IHK Berlin with registration in the official Vermittlerregister.

- Evidence-Based Strategy: Guided by global research from Morningstar and the IMF Global Financial Stability Report.

- Transparent Fees: Flat-rate or hourly billing with no hidden commissions or trailing costs.

- Lifecycle Support: From relocation to retirement, our comprehensive services cover investment, pension, and insurance consulting.

For an in-depth comparison of fee-only vs. commission-based advice, read Neobroker vs Finanz2Go. It explains how transparent fees create measurable value and long-term trust.

Independent vs Traditional Financial Advisors in Munich

Choosing a financial advisor in Munich can be confusing for expats. Traditional bank consultants often earn commissions from product sales — insurance policies, mutual funds, or investment-linked savings plans. This sales structure can limit your options and create potential conflicts of interest.

Finanz2Go Consulting follows a different approach: fee-only, commission-free advice. Our income comes exclusively from clients, not from financial institutions. This ensures that every recommendation is 100 % independent and transparent. We are certified by the IHK Berlin and officially listed under Vermittlerregister No. D-FZH5-4AMPC-84.

Our consulting process aligns with global best practices from the CFA Institute Research Foundation and the BaFin – Federal Financial Supervisory Authority. Each plan is based on your personal goals — not product quotas — ensuring objectivity and measurable results.

Key Benefits of Working with an Independent Financial Advisor in Munich

- Transparency: Flat, pre-agreed fees — no commissions, no hidden costs.

- Cross-Border Expertise: English-language advice for internationals managing assets across borders.

- Tax Optimization: Insights based on our Taxes on Investments in Germany guide and the Bundeszentralamt für Steuern (BZSt).

- Evidence-Based Portfolios: ETF strategies informed by ESMA and OECD research.

- Lifecycle Partnership: Continuous support from relocation to retirement, with digital tools for portfolio tracking and pension planning.

Financial Challenges Expats Face in Munich

International professionals in Munich often encounter complex taxation, pension fragmentation, and insurance overlaps. Without impartial advice, it’s easy to overpay or invest inefficiently.

Our pension consulting explains how the three pillars — statutory, company, and private — work together. We clarify the advantages of a Rürup (Base) Pension for freelancers and the structure of company pension plans (bAV), following guidance from the Deutsche Rentenversicherung (DRV) and the EU Sustainable Finance Disclosure Regulation (SFDR).

For investors, our article on ETF Investment in Germany 2026 highlights how diversified, low-cost ETFs outperform traditional funds — aligning with guidance from the German Ministry of Finance (BMF) and the European Central Bank (ECB).

What Our Clients Say – Verified Reviews from Expats

These are authentic client testimonials published on our official reviews page and verified on Google Reviews.

⭐️⭐️⭐️⭐️⭐️ “Björn is top-notch. I’m an experienced investor, but since moving to Germany I had many questions. He was meticulous and detailed in explaining how the system works and recommending great investment options. Highly recommended for expats.” — Verified Client

⭐️⭐️⭐️⭐️⭐️ “Fabian is very professional but also warm and friendly. He explained the basics of investing clearly and gave me a personal perspective on my situation. Looking forward to a fruitful relationship.” — Verified Client

⭐️⭐️⭐️⭐️⭐️ “Fabian is a great advisor – transparent, patient and honest. We just started investing with him and totally recommend him. He also helped with different types of insurance.” — Verified Client

⭐️⭐️⭐️⭐️⭐️ “Fabian, Dennis and the team are excellent to work with! They actually listen to your needs and formulate great plans for short-, mid- and long-term growth. Their English is excellent too.” — Verified Client

⭐️⭐️⭐️⭐️⭐️ “Björn consulted my husband and me and helped shape our financial strategy. He listened carefully and suggested solutions that fit our needs – no pressure, just expert guidance.” — Verified Client

A Holistic Approach to Financial Planning in Munich

Our comprehensive services integrate investment consulting, pension optimization, and insurance analysis into one coherent strategy. We apply Modern Portfolio Theory (MPT) principles to manage risk and maximize long-term returns.

Our Pension Gap Calculator helps quantify your retirement readiness, while our Financial Hub for Expats provides educational tools for continuous learning. Every recommendation is data-driven, independent, and aligned with your goals in Germany.

Financial Education and Transparency – The Core of Our Advisory Approach

At Finanz2Go Consulting, we believe that education is the foundation of sustainable wealth. Our goal is not just to manage your investments — it’s to help you understand them. That’s why every client conversation includes a learning component: we explain how your portfolio works, what each instrument means, and how different asset classes respond to market cycles.

This approach is inspired by international research from the OECD Financial Education Framework and the CFA Institute Code of Ethics. Studies consistently show that financially educated investors achieve stronger long-term outcomes and greater confidence in decision-making.

Our Financial Hub for Expats provides ongoing learning resources — from guides on ETF taxation in Germany to tutorials about building globally diversified portfolios. Whether you’re new to investing or experienced, we make complex topics simple and actionable.

We also use verified data from OECD Financial Market Statistics and Morningstar Research to back up every strategy we recommend. This ensures that all decisions are evidence-based and aligned with current financial trends.

Our Certification and Regulatory Transparency

Finanz2Go operates under strict German and EU financial regulations. We are certified and licensed according to §§ 34d and 34f of the German Trade Regulation Act (GewO) through the IHK Berlin. You can verify our registration directly in the official Vermittlerregister (No. D-FZH5-4AMPC-84).

All of our advisors follow the ethical guidelines of the CFA Institute Code of Ethics and operate independently of financial institutions or insurance companies. This independence guarantees that our recommendations are driven solely by your interests — not by commissions or product partnerships.

We are proud to align with research and compliance frameworks from the BaFin – Federal Financial Supervisory Authority and the IHK Berlin, ensuring full transparency and data protection under the GDPR (General Data Protection Regulation).

Our Erstinformation document provides complete details about our regulatory responsibilities, fee structure, and professional indemnity coverage. We encourage all clients to review it before engagement — because clarity builds trust.

- Registered entity: Finanz2Go Consulting

- Authorized by: IHK Berlin

- Registration number: D-FZH5-4AMPC-84 (verify)

- Regulatory framework: §§ 34d, 34f GewO, BaFin & EU SFDR

- Languages offered: English & German

Frequently Asked Questions (FAQ)

1. How does Finanz2Go differ from traditional bank advisors?

Unlike banks, we are independent and fee-only. We do not earn commissions on any product we recommend. Our focus is to provide transparent, unbiased consulting tailored to expats living in Germany. This independence gives us access to the entire market, including ETFs, private pensions, and ESG portfolios.

2. Are you certified and regulated in Germany?

Yes. Finanz2Go is officially registered under IHK Berlin and listed in the Vermittlerregister with certification under §§ 34d & 34f GewO. Our work complies with BaFin supervision and GDPR data protection rules.

3. Can expats work with Finanz2Go remotely?

Absolutely. We serve clients across Europe and worldwide through secure video calls. You can schedule a free consultation using our online booking tool. All documentation and reports are provided in English.

4. What is a fee-only advisor, and why does it matter?

A fee-only advisor charges directly for time and expertise — not commissions. This model ensures objectivity and removes the incentive to sell products. You know exactly what you’re paying for and why, which fosters trust and long-term transparency.

5. How can I prepare for my first consultation?

We recommend visiting our Consulting Process page to understand how we work. Bring an overview of your income, savings, and goals. If you’re already investing, we’ll review your existing portfolio and evaluate cost-efficiency and diversification.

6. Do you help with pensions and retirement in Germany?

Yes — our Pension Consulting service helps expats integrate their German, company, and private pension systems into one clear plan. We also explain how to optimize pension gaps and use ETF-based strategies for retirement planning.

7. Is my personal data protected?

All client data is stored on encrypted, EU-based servers and handled according to GDPR. We never share or sell information. Read more in our Privacy Policy.

Your Local Independent Financial Advisor in Munich

Finanz2Go proudly supports the international community in Munich with fully independent, English-speaking financial advice. Whether you’re relocating to Bavaria for work, managing global investments, or planning your retirement in Germany, our goal is to provide clarity, transparency, and structure in every aspect of your financial life.

Munich’s economy — driven by finance, technology, and engineering — offers many opportunities for wealth creation. Yet, navigating the German system of taxation, pensions, and investment regulation can be daunting without local expertise. That’s where Finanz2Go Consulting comes in: a partner that combines data-driven portfolio construction with a deep understanding of Germany’s financial, legal, and regulatory framework.

We work closely with regulatory authorities such as the BaFin (Federal Financial Supervisory Authority) and the Bundeszentralamt für Steuern (BZSt) to ensure full compliance and client protection. Our investment philosophy aligns with international research from Morningstar and the European Securities and Markets Authority (ESMA).

For long-term financial sustainability, we also incorporate principles from the EU Sustainable Finance Disclosure Regulation (SFDR) and support socially responsible investing (SRI). Whether you’re a professional in Munich’s booming tech sector, a consultant, or a family planning for the future — we’ll help you build a transparent and tax-efficient plan tailored to your goals.

Book Your Free Initial Consultation Today

Take the first step toward financial independence and peace of mind. Schedule your free introductory meeting with a certified financial advisor in Munich. During this session, we’ll analyze your current situation, discuss your short- and long-term objectives, and outline a personalized roadmap for success in Germany.

Use our online booking tool to choose a convenient time for your consultation. Meetings are available in English or German and can be conducted either in person in Munich or online via secure video call.

After your consultation, you’ll receive a detailed follow-up report summarizing your investment and pension structure — along with clear recommendations for next steps. This no-obligation session is designed to give you full transparency and actionable insight before you make any commitments.

Contact Finanz2Go Consulting

Our advisory office serves clients across Germany and beyond. We are based in Berlin but regularly consult clients living in Munich, Hamburg, Stuttgart, and Frankfurt.

- Company: Finanz2Go Consulting

- Address: Warschauer Platz 11–13, 10245 Berlin, Germany

- Phone: +49 30 60984297

- Email: contact@finanz2go.com

- Website: www.finanz2go-consulting.com

We offer personal consultations at our Berlin office and regular video consultations for Munich-based clients. You can also find verified reviews and more client experiences on our Reviews page.

Find Us on Google Maps

Why Expats in Munich Trust Finanz2Go

Thousands of international professionals have already chosen Finanz2Go for their independent financial planning needs in Germany. What makes us different is not only our expertise but our philosophy: education, transparency, and independence. We’re not here to sell products — we’re here to help you build long-term financial freedom.

Our comprehensive services include investment consulting, pension planning, insurance optimization, and asset management — all customized for expats in Munich, Berlin, and across Europe.

We also partner with trusted institutions such as Deutsche Rentenversicherung for pension frameworks and consult the German Federal Ministry of Finance for tax updates to ensure our strategies remain compliant and up to date.

Ready to get started? Book your free consultation today and join hundreds of expats who already trust Finanz2Go for their financial advisory in Munich.