Investment Consulting

We help you build an investment portfolio that suits your goals.

Book an appointment

1. Investment Strategy Development

We create a long-term plan designed for stability and growth.

Book an appointment

2. A fair all-in-one fee of only approx. 0.7% p.a.*

No performance-based fees, no front-end or back-end loads, very low transaction costs, automated rebalancing & regime change.

Book an appointment

3. Ongoing Portfolio Review & Optimization

We’ll analyze your investment portfolio for diversification, costs, and performance.

Book an appointmentAt Finanz2Go, we are 100% client-focused, working solely in your best interest.

We’re officially licensed by the IHK (Industrie- und Handelskammer) under §34f GewO, guaranteeing full compliance and transparency.

What Makes Us Different:

- Independent: We receive no commissions from banks or fund providers.

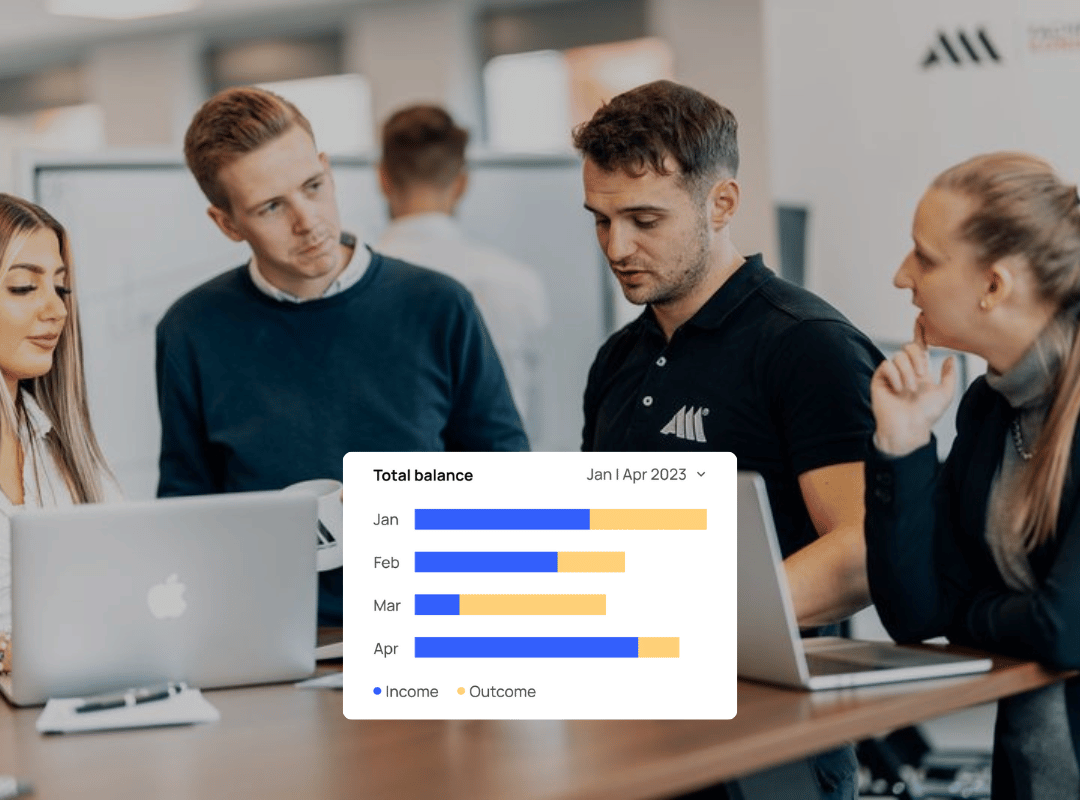

- Data-driven: Your investment plan is built using modern analysis tools.

- Transparent: You see every cost and projection clearly.

- Digital-first: Consult online, from anywhere in Germany or abroad.

- Sustainable options: ESG and ethical portfolios available.

Alright, so we're looking at 2026 and wondering where to put our money, specifically in Germany. It feels like a bit of a crossroads, doesn't it? We've got these big, traditional things like property, and then we've got the newer, more flexible Exchange Traded Funds (ETFs).

Both have their fans, and both seem to be doing different things depending on what's happening in the economy. This article is going to break down the ETFs vs real estate Germany debate for next year, trying to make sense of it all without getting too bogged down in jargon. Let's see what makes sense for your wallet.

Key Takeaways

- In 2026, the German investment scene shows a split. Property markets are seeing shifts, with a focus on quality buildings and specific areas like industrial spaces. Meanwhile, ETFs offer a way to get broad market exposure, including to real estate and infrastructure, often with more flexibility.

- ETFs provide a simple way to spread your money across different assets, including property-related ones. Think of them as a basket of investments you can buy or sell easily.

- German real estate in 2026 is expected to be influenced by factors like rising insurance costs and changes in how properties are valued. Some areas, like industrial and logistics, might do better than others.

- When comparing ETFs and real estate in Germany, consider how easy it is to buy and sell (liquidity), the tax rules, and the costs involved. Real estate might let you use borrowed money (leverage), which can boost returns but also increases risk.

- Certain sectors within real estate and infrastructure, like logistics and renewable energy projects, are seen as strong bets for 2026 due to steady demand and growth potential.

- Performance in 2026 will likely be measured differently for ETFs and real estate. ETFs track market indexes or specific strategies, while real estate performance includes rental income and property value changes.

- There are risks with both options. Market ups and downs, rising costs, and economic policy changes can affect your investments. It's smart to have a plan to deal with these issues.

- Deciding between ETFs and real estate depends on your personal goals. Long-term investors might lean towards certain ETFs or specific real estate types, while short-term traders might look for different opportunities.

Navigating the 2026 Investment Landscape

Post-Recessionary Asset Class Divergence

The economic climate of 2026 presents a complex picture for investors. Following a period of recessionary pressures, different asset classes are showing varied performance. While some sectors are experiencing a robust rebound, others are lagging, creating a fragmented market. This divergence means that a one-size-fits-all approach to investing is unlikely to yield the best results. Careful consideration of individual asset class dynamics is more important than ever. For instance, while the broader economy might show signs of improvement, specific markets could still be facing headwinds. Understanding these differences is key to making informed decisions.

Investor Sentiment and Market Fragmentation

Investor sentiment in 2026 is a mixed bag. There's a general cautiousness, even as economic indicators suggest a potential upturn. This caution is partly due to the fragmented nature of the market, where performance can vary significantly from one sector to another. This fragmentation means that opportunities exist, but they require a more discerning eye. It's not just about picking winners; it's about understanding the underlying reasons for success or failure in different parts of the market. This environment calls for a strategic approach, rather than simply following broad market trends. The consensus forecast for 2026 GDP growth has been upgraded, but this doesn't translate to uniform gains across all investments.

The Role of Real Assets in a Shifting Economy

Real assets, such as property and infrastructure, are taking on a more significant role in investment portfolios during this shifting economic period. As investors seek stability and tangible value, these assets can offer a degree of resilience. However, even within real assets, there are significant differences. For example, industrial and logistics properties might be performing differently than traditional retail spaces. The demand for certain types of real estate, like those supporting e-commerce, remains strong. Similarly, infrastructure projects, particularly those related to energy security and technological advancement, are attracting attention. The focus is increasingly on assets that provide steady cash flows and are less susceptible to economic downturns.

Opportunities Amidst Economic Uncertainty

Despite the uncertainties, 2026 offers notable opportunities for investors. The market's fragmentation, while challenging, also creates pockets of value. For those willing to conduct thorough research, there are chances to invest in sectors poised for growth. This could include areas benefiting from long-term trends like the energy transition or the increasing demand for digital infrastructure. Identifying these opportunities requires a deep dive into specific market segments and an understanding of the factors driving their performance. It’s about finding those areas that are well-positioned to thrive, regardless of broader economic fluctuations. The European real estate debt market, for example, is experiencing volatility, which can present unique entry points for astute investors.

Adapting to Evolving Investor Preferences

Investor preferences are clearly evolving in 2026. There's a growing demand for diversification and income generation, leading many to look beyond traditional stock and bond markets. Exchange-traded funds (ETFs) that offer exposure to real assets, infrastructure, and global dividends are gaining traction. Similarly, within real estate, there's a shift towards properties that offer flexibility and sustainability. Investors are also showing more interest in active management strategies that can adapt to changing market conditions. This adaptability is becoming a key factor in investment selection, as investors look for vehicles that can respond effectively to market shifts. The ability to generate consistent income is a major draw for many.

The Nuances of Asset Performance in 2026

Asset performance in 2026 is far from uniform. We're seeing a clear divergence, with some asset classes outperforming significantly while others struggle. For instance, while technology stocks might be experiencing a surge driven by AI, traditional sectors could be facing different challenges. Real estate, in particular, shows a complex performance landscape, with some segments like industrial and logistics properties faring better than others. This nuanced performance means that investors need to look beyond headline figures and examine the specific drivers of returns within each asset class. Understanding the underlying factors influencing performance is more critical than ever.

Strategic Pivots in Investment Management

Investment managers are making strategic pivots to adapt to the 2026 landscape. Many are leaning into active management, seeking to capitalise on market dislocations and offer differentiated products. There's also a notable focus on real assets, with firms repositioning portfolios to align with trends like the 'flight to quality' in commercial properties. This involves a more selective approach, prioritising assets with strong fundamentals and long-term growth potential. The goal is to build portfolios that are resilient and can generate consistent returns, even in a volatile environment. This strategic shift reflects a broader recognition of the changing dynamics of the investment world.

The Intersection of Active and Passive Strategies

The interplay between active and passive investment strategies is a key theme for 2026. While passive investing, particularly through ETFs, remains popular for its cost-effectiveness and diversification, active management is seeing renewed interest. This is especially true in sectors like real assets, where specialised knowledge can uncover unique opportunities. Some firms are blending these approaches, using passive vehicles for broad market exposure while employing active strategies for specific segments. This hybrid approach allows investors to benefit from the efficiency of passive funds while still capitalising on the potential alpha generation of active management. The challenge lies in finding the right balance for individual investment goals.

Exchange Traded Funds: A Diversified Approach

Understanding ETF Investment Strategies

Exchange Traded Funds, or ETFs, have become a popular choice for investors looking for a straightforward way to diversify their portfolios. Think of them as baskets of assets, like stocks or bonds, that trade on an exchange just like individual shares. This means you can buy and sell them throughout the trading day. The strategies behind ETFs are varied, aiming to track specific market indexes, sectors, or even investment styles. For instance, a DAX ETF provides a simple way to get exposure to Germany's 40 largest publicly traded companies, trading it like any other stock.

Real Estate Exposure Through ETFs

While direct property investment has its appeal, ETFs offer a more accessible route to real estate exposure. You can find ETFs that focus on real estate investment trusts (REITs) or companies involved in property development and management. This allows investors to gain a stake in the property market without the complexities of direct ownership, such as tenant management or property maintenance. It's a way to tap into the property market's potential returns with greater ease.

Infrastructure and Global Dividend ETFs

Beyond real estate, ETFs provide access to other key sectors. Infrastructure ETFs, for example, invest in companies that build and maintain essential services like utilities, transportation, and energy networks. These can offer stable, long-term returns. Similarly, global dividend ETFs focus on companies worldwide that have a history of paying out regular dividends. These can be particularly attractive for investors seeking a steady income stream from their investments. The 2026 investment outlook suggests these areas could be strong performers.

The Appeal of Active ETFs

While many ETFs passively track an index, active ETFs are managed by professionals who make decisions about which assets to include. The idea here is to try and outperform a benchmark index. This approach can be beneficial in more complex or volatile markets where skilled management might identify opportunities that a passive index would miss. For investors who want professional management but still desire the flexibility of an ETF structure, active ETFs present an interesting option.

ETFs for Income and Diversification

ETFs are often lauded for their ability to provide both income and diversification. Many ETFs are designed to hold dividend-paying stocks or bonds, generating a regular income for investors. At the same time, by holding a wide array of assets, ETFs help spread risk across different companies, industries, and even countries. This diversification is a cornerstone of sound investment strategy, helping to smooth out the inevitable ups and downs of the market. Investing in single-country ETFs can also be a way to diversify global investments.

Performance of ETF Proxies in 2026

Looking at 2026, the performance of ETF proxies – those ETFs that aim to replicate the performance of a specific asset class or index – will be closely watched. Factors like interest rate movements, inflation data, and geopolitical events will all play a role. For example, ETFs tracking German equities, like a DAX ETF, will be influenced by the health of the German economy and global trade relations. Investors will be comparing these ETF performances against their underlying benchmarks and against other asset classes.

Year-to-Date ETF Performance Analysis

Analysing year-to-date performance is a standard practice for investors. It helps gauge how well an ETF has performed relative to its objectives and its peers. This analysis often involves looking at total returns, which include both price appreciation and any income generated, such as dividends. Understanding these figures can inform decisions about whether to hold, buy, or sell an ETF. It's a snapshot of recent market behaviour.

Global Market Index as a Benchmark

When evaluating an ETF's performance, a benchmark index is essential. For broad market ETFs, a global market index might serve as the yardstick. For sector-specific ETFs, a relevant industry index is used. This comparison allows investors to see if the ETF is achieving its stated goal of tracking or outperforming its target market. Without a benchmark, it's difficult to objectively assess an ETF's success.

ETFs offer a flexible and often cost-effective way to gain exposure to a wide range of asset classes. Their transparency and ease of trading make them a popular choice for both new and experienced investors looking to build diversified portfolios in the current economic climate.

| ETF Type | Example Strategy | Potential Benefit |

|---|---|---|

| Equity Index | Tracks S&P 500 | Broad market exposure |

| Sector Specific | Focuses on Technology | Targeted growth potential |

| Fixed Income | Invests in Government Bonds | Capital preservation and income |

| Real Estate | Holds REITs | Diversified property market access |

Real Estate Investment in Germany: A 2026 Outlook

The German Real Estate Market Dynamics

The German property market in 2026 is showing signs of a gradual stabilisation after a period of adjustment. While the days of rapid price increases seem to be behind us for now, a more balanced environment is emerging. We're seeing a noticeable shift in transaction volumes, with a decrease in large-scale deals compared to the previous year. For instance, the first three quarters of 2026 recorded 33 deals exceeding €100 million, a dip from the 42 such transactions seen in the same period of 2024. This suggests a more cautious approach from major investors, perhaps waiting for clearer economic signals or more attractive entry points. However, this doesn't mean opportunities are scarce; it simply means investors need to be more discerning.

Flight to Quality in Commercial Properties

In the commercial sector, a distinct 'flight to quality' is underway. Tenants are increasingly prioritising modern, well-located properties with excellent amenities. This trend means that older, less desirable buildings are facing greater pressure, while prime assets are holding their value more effectively. Landlords who invest in upgrading their properties to meet these higher standards are likely to be rewarded with stronger occupancy rates and more stable rental income. This focus on quality is a key theme for anyone looking to invest in German commercial real estate next year.

Industrial and Logistics Property Trends

The industrial and logistics sector continues to be a bright spot. Demand remains robust, driven by e-commerce growth and the ongoing need for efficient supply chains. Properties in well-connected locations, particularly those supporting last-mile delivery, are in high demand. We're seeing sustained interest in warehouses and distribution centres, making this a sector worth watching for investors seeking resilience.

Navigating Rising Capitalisation Rates

Capitalisation rates, a key metric for property valuation, have been on the rise. This means that for a given level of rental income, the price of a property is effectively lower. While this might sound like a negative, it can present opportunities for savvy investors. A rising cap rate environment can signal a market correction, potentially leading to more attractive entry prices for long-term investments. It's a complex picture, and understanding how cap rates are moving in different sub-sectors is vital for making informed decisions. For those interested in the broader market, looking at German property indices can offer valuable context.

The Impact of Insurance Costs on Valuations

Insurance costs are becoming a more significant factor in property valuations. With increasing climate-related risks and general inflation, premiums are rising. This added expense can impact the net operating income of a property, and consequently, its overall valuation. Investors need to factor these rising insurance costs into their calculations when assessing potential acquisitions or the performance of existing holdings.

Trophy Assets Versus Broader Market Devaluations

There's a growing divergence between the performance of 'trophy' assets – prime, iconic properties in top locations – and the broader market. While trophy assets may continue to attract significant capital and maintain their value, many other properties are experiencing devaluations. This bifurcation means that a blanket approach to real estate investment is unlikely to be successful. Investors must carefully select their targets, distinguishing between assets that are genuinely resilient and those that are more vulnerable to market pressures.

Projecting Real Estate Recovery Trajectories

Predicting the exact timing of a full market recovery is challenging. However, several factors suggest a gradual upward trend. Falling inflation and the potential for interest rate cuts in the future could provide a tailwind. The industrial and logistics sectors are likely to lead the way, followed by well-located residential and prime commercial spaces. The key for investors will be patience and a focus on fundamentally sound assets.

Strategic Repositioning of Real Estate Portfolios

Given the current market dynamics, a strategic repositioning of real estate portfolios is advisable. This might involve:

- Divesting from underperforming or outdated assets.

- Increasing exposure to resilient sectors like logistics and high-quality commercial spaces.

- Investing in property upgrades to meet evolving tenant demands.

- Exploring opportunities in niche markets that show strong growth potential.

The German real estate market in 2026 is not a simple story of boom or bust. It's a market that rewards careful analysis, a focus on quality, and a willingness to adapt to changing economic conditions. Investors who understand these nuances will be best placed to succeed.

Comparing ETFs and Real Estate for German Investors

When looking at investment options in Germany for 2026, two big players often come up: Exchange Traded Funds (ETFs) and direct real estate. They're quite different beasts, and understanding those differences is key to making smart choices.

Assessing Risk and Return Profiles

ETFs, especially those tracking broad market indices, tend to offer a more predictable risk-return profile. They spread your money across many companies or assets, which generally smooths out the bumps. Think of it like this: if one company in the ETF has a bad day, it doesn't usually tank your whole investment. Real estate, on the other hand, can be a bit more of a rollercoaster. A single property's value can swing quite a bit based on local market conditions, tenant issues, or even just the general economic climate. While a well-chosen property can offer strong returns, the risk is often concentrated in that one asset. For instance, US real estate investment trusts (REITs) saw a robust gain in November 2026, but year-to-date performance showed them as one of the weaker markets compared to other asset classes. This shows how performance can vary.

Liquidity Considerations for Both Asset Classes

This is a big one. ETFs are generally very liquid. You can usually buy or sell shares on a stock exchange within minutes during trading hours. This flexibility is a major plus if you might need access to your cash quickly. Real estate? Not so much. Selling a property can take months, involving agents, viewings, negotiations, and legal processes. If you need money fast, tying it up in bricks and mortar can be a real problem. It's a trade-off between potential long-term gains and immediate access to your funds.

Tax Implications for German Investors

Tax rules in Germany can be complex for both ETFs and real estate. For ETFs, capital gains and dividends are typically subject to a flat tax rate (Abgeltungsteuer), though there are some allowances and exemptions, especially for long-term holdings. Real estate tax is different. You'll face property transfer tax (Grunderwerbsteuer), ongoing property tax (Grundsteuer), and taxes on rental income. If you sell a property after a certain holding period (usually 10 years for rental properties), you might avoid capital gains tax on the profit. It’s really important to get professional tax advice tailored to your specific situation before investing in either asset class.

Management Fees and Associated Costs

ETFs are often praised for their low fees. Many index-tracking ETFs have very low annual management fees, sometimes less than 0.20%. This means more of your investment returns stay in your pocket. Some newer active ETFs might have slightly higher fees, but they are still generally competitive. Real estate investment comes with a different cost structure. You have purchase costs like notary fees and property transfer tax, ongoing costs like maintenance, insurance, and property management fees (if you're not managing it yourself), and potentially financing costs if you take out a mortgage. These costs can add up significantly over the life of the investment.

The Role of Leverage in Real Estate Investment

One of the main attractions of real estate is the ability to use leverage, typically through a mortgage. Borrowing money to buy a property can amplify your returns if the property value increases. For example, if you buy a property for €200,000 with a €50,000 deposit and a €150,000 mortgage, and the property value rises by 10% to €220,000, your return on the initial €50,000 deposit is 40% (before costs). ETFs generally don't offer this kind of direct leverage to retail investors, although some complex derivative-based ETFs might. However, leverage also magnifies losses if the property value falls, making it a double-edged sword.

Diversification Benefits of ETFs

ETFs are fantastic for diversification. A single ETF can give you exposure to hundreds or even thousands of different stocks, bonds, or other assets. This spreads risk widely. For example, an ETF focused on global infrastructure or renewable energy projects can provide exposure to sectors that might be less correlated with traditional stock markets. This is a key advantage for building a balanced portfolio. While you can diversify a real estate portfolio by owning multiple properties in different locations and types, this requires significantly more capital and management effort.

Potential for Income Generation

Both ETFs and real estate can generate income. Many ETFs distribute dividends from the underlying companies or interest from bonds. Some ETFs are specifically designed for income generation, focusing on dividend-paying stocks or real estate investment trusts (REITs). Real estate generates income primarily through rental payments from tenants. For investors seeking a steady income stream, both can be suitable, but the nature of the income and its reliability can differ. For instance, some real estate funds focus on steady cash flows from regulated utilities, offering a contrast to more volatile traditional property markets.

Long-Term Investment Horizons

When considering a long-term investment horizon, both ETFs and real estate can play a role. Historically, real estate has been a solid long-term investment, appreciating in value and providing rental income. Similarly, broad-based stock market ETFs have also shown strong long-term growth potential. The choice often depends on an investor's personal circumstances, risk tolerance, and desire for active involvement. For those who prefer a hands-off approach and broad market exposure, ETFs might be more appealing. For those willing to actively manage property and potentially use leverage for amplified returns, real estate could be the preferred route. It's worth noting that some investors choose to combine both, using ETFs for diversification and liquidity while holding specific real estate assets for their unique return potential. This approach can be supported by tools that help decide whether investing in a home or purchasing ETFs is a better financial choice, and how to integrate ETFs into a home-buying strategy [e68d].

Key Sectors Within Real Estate and Infrastructure

The Resilience of Industrial and Logistics

When we look at the German property market in 2026, industrial and logistics spaces are really standing out. After a bit of a wobble, these areas are showing they've got staying power. Demand is still pretty strong, especially for modern, well-located facilities. Think about e-commerce, which isn't going anywhere, and the need for efficient supply chains. Companies are willing to pay for places that help them move goods quickly and cheaply. This sector seems to be less affected by the general market ups and downs compared to, say, office buildings or retail.

Opportunities in Renewable Energy Projects

Renewable energy is another big area to watch. With Germany pushing hard for greener power, there's a lot of investment going into solar farms, wind parks, and the infrastructure that supports them. These projects often come with long-term contracts, which means a more predictable income stream for investors. It’s not just about building new facilities; it’s also about upgrading existing ones to be more energy-efficient. This is a trend that’s likely to continue for years to come.

Steady Cash Flows from Regulated Utilities

Regulated utilities, like water and electricity providers, are often seen as safe havens. Because their prices and operations are overseen by regulators, they tend to offer more stable returns. In uncertain economic times, investors often look for these kinds of steady cash flows. While they might not offer the explosive growth of other sectors, their reliability is a big plus for portfolio diversification. The German real estate investment market achieved a transaction volume of €22.4 billion in the first three quarters of 2026, showing continued activity despite fewer large deals [9167].

Infrastructure Development and Investment

Infrastructure is a broad category, but it's vital for any economy. This includes everything from roads and bridges to telecommunications networks and public transport. Governments and private companies are investing heavily in upgrading and expanding these networks. The need for better infrastructure is driven by economic growth, population changes, and technological advancements. Private infrastructure fundraising experienced a significant rebound in the first half of 2026, raising $134 billion [aed5].

The Role of Energy Infrastructure

Energy infrastructure is particularly important right now. With global energy security concerns and the shift towards cleaner sources, there's a lot of focus on pipelines, storage facilities, and power grids. Canada, for instance, is looking to increase its LNG exports, with Germany showing strong interest in securing long-term partnerships. This highlights the critical role energy infrastructure plays in international trade and national security.

Critical Minerals Infrastructure Needs

As the world transitions to new technologies, the demand for critical minerals like lithium, cobalt, and rare earth elements is soaring. This means significant investment is needed in the infrastructure to extract, process, and transport these materials. Countries are looking to secure their supply chains, and developing this infrastructure is a key part of that strategy.

LNG Export Discussions and German Demand

Discussions around Liquefied Natural Gas (LNG) exports are gaining traction, especially between Canada and European nations like Germany. Germany's energy needs are projected to remain high due to energy security concerns and increasing electricity demands linked to industrialisation and AI. This situation creates opportunities for countries that can supply reliable, low-carbon fuels.

Streamlining Approvals for Major Projects

To keep pace with the demand for new infrastructure and energy projects, governments are looking at ways to speed up the approval process. Canada, for example, has established a Major Projects Office to help streamline approvals and coordinate stakeholders. This focus on efficiency is crucial for getting these large-scale, nation-building initiatives off the ground and completed on time.

Performance Metrics and Investment Vehicles

Revenue and Earnings Per Share Analysis

When looking at how investments are doing, it's useful to check the numbers. For a company or a fund, revenue is the total money it brings in. Earnings Per Share (EPS) is a bit more specific – it's the portion of a company's profit allocated to each outstanding share of common stock. In Q2 2025, one firm saw its revenue beat expectations by a small margin, but its EPS actually fell short. This happened because investment performance wasn't as strong as hoped, and costs, like staff pay, went up. This meant the operating margin, which shows how much profit is made from sales after covering direct costs, dipped slightly compared to the previous quarter.

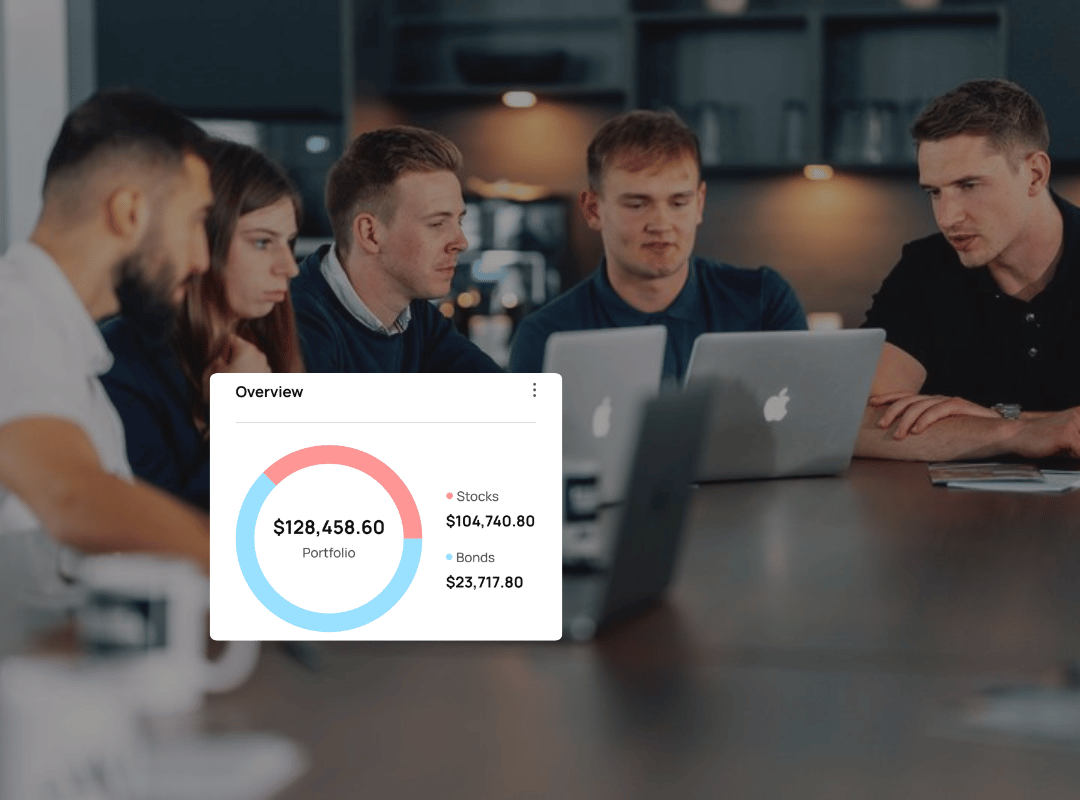

Assets Under Management Growth

Assets Under Management (AUM) is a key figure, especially for investment firms and funds. It represents the total market value of all the financial assets that a firm manages on behalf of its clients. An increase in AUM generally signals that the firm is attracting new money and/or that its existing investments are growing in value. In the same period, the firm's AUM did grow, reaching a significant sum. This growth was helped by a small rise in revenue and also by market appreciation, meaning the investments themselves increased in value.

Net Inflows Versus Outflows

This metric tells us about the movement of money into and out of investment funds. Net inflows happen when more money comes into funds than leaves them. Conversely, net outflows occur when more money is withdrawn than invested. In 2026, we're seeing a bit of a mixed picture. While some institutional accounts experienced money leaving, this was balanced out by money coming into ETFs and open-end funds. This shows that investors are shifting their preferences, perhaps moving towards more accessible or specific types of investment vehicles.

Market Appreciation and Its Drivers

Market appreciation is simply the increase in the value of an asset or a portfolio over time. It's what happens when investments grow. This appreciation can be driven by many things, like a company performing well, a sector becoming more popular, or even just general economic growth. In the second quarter of 2026, market appreciation contributed positively to the growth of AUM, showing that the investments held by the firm were increasing in value.

Dividend Streaks and Income Generation

For many investors, especially those looking for regular income, dividends are very important. A dividend streak refers to a company consistently paying out dividends over a long period. Funds that focus on dividend-paying stocks or real estate often highlight these streaks as a sign of stability and reliable income. This is a key consideration for investors seeking steady returns, particularly in uncertain economic times.

Total Returns in Real Estate Markets

Total return in real estate isn't just about the property's price going up. It includes all the income generated, like rent, plus any capital gains when the property is sold. In 2026, the real estate market has shown varied performance. While some areas might be struggling, others, particularly those focused on quality or specific sectors like logistics, have seen better results. Understanding the total return helps paint a clearer picture of an investment's actual performance.

Year-to-Date Performance Comparisons

Comparing performance from the start of the year up to the current date (Year-to-Date or YTD) is a standard way to track progress. In 2026, we've seen different asset classes perform quite differently. For example, some broad market indices have shown strong gains, while others, like certain segments of the real estate market, have lagged. Looking at YTD figures helps investors see which strategies or asset types are currently working best.

Fund Performance and Strategy Alignment

It's vital that a fund's performance lines up with its stated strategy. If a fund aims to provide income through dividends, its performance should reflect that. If it's meant to track a specific index, it should do so closely. In 2026, with a fragmented market, investors are paying close attention to whether funds are sticking to their plans and delivering results consistent with their objectives. Active ETFs, for instance, are being watched to see if their specific strategies are outperforming broader market trends.

Risk Factors and Mitigation Strategies

Even with careful planning, investments aren't without their bumps. For 2026, we're seeing a few key areas that investors in both ETFs and German real estate need to keep an eye on. It's not all doom and gloom, though; there are ways to prepare.

Navigating Market Volatility

Markets can swing, and 2026 is no exception. Economic shifts, geopolitical events, or even unexpected news can cause prices to move quickly. For ETFs, this means the value of your holdings can change daily. With real estate, it might mean slower sales or difficulty finding tenants if the market sentiment turns negative. The key is not to panic when these swings happen.

- Diversification: Holding a mix of different assets, both within ETFs and across your broader portfolio, is the first line of defence. Don't put all your eggs in one basket.

- Long-Term View: Remember why you invested in the first place. Short-term dips are often just that – short-term. Focusing on your long-term goals can help you ride out the volatility.

- Stay Informed: Keep up with general economic news, but try not to react to every headline. Understand the macroeconomic trends affecting your investments.

Addressing Elevated Insurance Costs

Insurance is becoming a bigger expense, especially for property owners. Higher premiums can eat into rental income and affect property valuations. For ETFs that hold real estate companies, this could indirectly impact their performance. It’s a growing concern that’s making property owners rethink their budgets and risk management.

Understanding Real Estate Devaluations

While some parts of the German property market are showing resilience, others are facing downward pressure. Factors like changing demand, higher interest rates, and increased construction costs can lead to properties being worth less than before. This is particularly true for older buildings or those in less desirable locations. Investors need to be realistic about current valuations and avoid assuming past growth will continue indefinitely.

Mitigating Risks in Cyclical Markets

Certain sectors, like industrial or logistics properties, might be less affected by economic cycles than others. However, even these can face challenges. For instance, oversupply or shifts in global trade could impact industrial demand. For ETFs focused on these areas, understanding the specific drivers of demand and supply is important. It’s about picking the right segments within these cycles.

The Impact of Monetary Policy Shifts

Changes in interest rates by the European Central Bank have a direct effect on borrowing costs for real estate and can influence investor appetite for riskier assets like stocks (which ETFs often track). If rates go up, borrowing becomes more expensive, potentially slowing down property transactions and making some investments less attractive. Conversely, lower rates can stimulate activity. Investors need to watch central bank communications closely.

Managing Operational Efficiency Amidst Expansion

For property owners and companies that manage real estate assets, keeping costs under control while expanding is a balancing act. Rising labour costs, maintenance expenses, and the need for upgrades can all add up. Efficient operations are key to maintaining profitability, especially when dealing with older properties or large portfolios. This is also relevant for ETFs that invest in companies focused on property management.

The Influence of Seasonal Market Trends

While less pronounced than in some other markets, seasonal patterns can still play a role. For example, the summer months might see slower activity in the property market, while the autumn can bring a renewed push before the year-end. For ETFs, these trends are usually smoothed out, but for direct real estate investors, timing can matter for transactions and rental agreements.

Forward-Looking Statements and Their Caveats

Many investment reports and company statements include projections about the future. These "forward-looking statements" are based on current information and assumptions, but they aren't guarantees. Unexpected events can easily alter outcomes. It's wise to treat these projections with a degree of caution and focus on the underlying strategies and risk management practices being discussed. For example, a projection for real estate recovery trajectories might be overly optimistic if insurance costs continue to climb unexpectedly.

When assessing investments, it's important to look beyond the headline figures. Consider the underlying assumptions, the management's approach to risk, and how adaptable the strategy is to changing conditions. A solid plan accounts for potential downsides, not just the best-case scenarios.

Strategic Considerations for Investment Allocation

Active Management Versus Passive Strategies

When thinking about where to put your money in 2026, a big question is whether to go with active or passive investment strategies. Passive investing, often done through Exchange Traded Funds (ETFs), aims to match the performance of a market index. It's generally seen as a lower-cost way to get broad market exposure. On the other hand, active management involves a fund manager making decisions about which assets to buy and sell, trying to beat the market. This approach can be more costly due to higher fees, but it also offers the potential for greater returns if the manager makes good calls. For instance, a firm like Cohen & Steers has been leaning into active ETFs, using its specific knowledge of real assets to create products that aim to outperform. This is a shift from the general trend towards passive investing, suggesting that active strategies might find new favour in certain specialised areas.

The Value of Differentiated Investment Products

In today's market, simply tracking an index might not be enough. Investors are looking for more specific ways to gain exposure to certain sectors or themes. This is where differentiated investment products come in. Think about ETFs that focus on niche areas like renewable energy infrastructure or global dividend growers. These products allow investors to target specific growth areas or income streams that might be missed by broader market funds. For example, Middlefield offers a range of ETFs and mutual funds covering areas from real estate to global infrastructure, providing investors with choices beyond the standard market-tracking options. Having these specialised products can help tailor a portfolio to individual goals, whether that's income generation or exposure to high-growth sectors.

Capitalising on Market Dislocations

Market dislocations, which are essentially periods where asset prices move significantly away from their fundamental values, can present unique opportunities. These events, often triggered by economic shocks or shifts in investor sentiment, can create temporary mispricings. Active managers, in particular, can try to profit from these situations by buying undervalued assets or selling overvalued ones. For example, if a particular real estate sector is unfairly punished due to broader market fears, an active investor might see a chance to buy in at a discount, expecting a recovery. This requires a keen eye and the ability to act quickly, often supported by deep research into specific asset classes. It's about finding value where others might be hesitant to look.

Tactical Asset Allocation in Volatile Times

When the economic outlook is uncertain, simply sticking to a long-term plan might not be enough. Tactical asset allocation involves making shorter-term adjustments to a portfolio's mix of assets based on current market conditions. This could mean shifting more money into defensive assets during a downturn or increasing exposure to growth assets when the economy looks set to improve. For example, if interest rate policy is expected to change, an investor might adjust their holdings in bonds or real estate accordingly. This approach requires constant monitoring of economic signals and a willingness to change course as needed. It's about being nimble and responsive to the ever-changing financial landscape.

Balancing Risk and Return

At the heart of any investment strategy is the trade-off between risk and return. Generally, assets with the potential for higher returns also come with higher risk. The goal is to find a balance that suits your personal comfort level and financial objectives. ETFs can offer diversification, which helps spread risk across many assets, potentially lowering the overall risk of a portfolio. Real estate, on the other hand, can offer significant returns but often comes with higher risks, such as illiquidity and market downturns. For German investors looking at their options in 2026, understanding this balance is key. It's about building a portfolio that aligns with your risk tolerance while still aiming for satisfactory growth. You can find a good overview of investment opportunities in Germany for 2025 here.

The Importance of Global Diversification

Putting all your eggs in one basket is rarely a good idea, and that applies to investments too. Global diversification means spreading your investments across different countries and regions. This helps to reduce the impact of any single country's economic problems on your overall portfolio. For instance, if the German market is struggling, strong performance in the US or Asian markets could help offset those losses. Many ETFs are designed to provide global exposure automatically, making diversification easier for investors. This approach is particularly relevant in 2026, given the varied economic recovery paths different countries are taking.

Disciplined Capital Management

Effective capital management is about making sure your money is working as hard as possible for you. This involves making smart decisions about when to invest, when to hold back, and when to rebalance your portfolio. It means sticking to your investment plan even when markets get choppy. For example, if your strategy involves regular investments, it's important to keep making those investments, regardless of short-term market noise. Disciplined capital management also means understanding your costs, like management fees and transaction costs, and trying to keep them as low as possible. This methodical approach helps to maximise long-term returns.

Adapting to Macroeconomic Signals

Macroeconomic signals – things like inflation rates, interest rate changes, and employment figures – can have a big impact on investment performance. Staying aware of these signals is vital for making informed allocation decisions. For example, rising inflation might prompt a shift towards assets that tend to perform better in such environments, like commodities or certain types of real estate. Conversely, falling interest rates could make bonds and dividend-paying stocks more attractive. Being able to interpret these signals and adjust your investment strategy accordingly is a hallmark of a successful investor, especially in the dynamic economic climate expected for 2026.

The Future of Real Asset Investments

The Evolving Alternative Investment Landscape

The world of alternative investments is certainly changing, and real assets are right in the middle of it. Back in 2026, we saw a real shift. Investors are looking for more than just standard stocks and bonds. They want things that feel more solid, more tangible. This means things like infrastructure, property, and even natural resources are getting a closer look. It’s not just about chasing the highest returns anymore; it’s about finding investments that can weather different economic storms. The European real estate market, for instance, is showing signs of life, with investment volumes expected to rise. This suggests a growing confidence in physical assets.

Demand for Income and Diversification

Many investors are still keen on finding reliable income streams and spreading their risk. After a period of economic uncertainty, the appeal of assets that can provide steady cash flow, like regulated utilities or infrastructure projects, is quite strong. Diversification remains a key theme, and real assets offer a way to achieve this, often moving differently to traditional financial markets. This is why we're seeing more interest in things like global dividend ETFs, which can offer a blend of income and broader market exposure.

The Role of Technology in Real Estate

Technology is starting to play a bigger part in how we think about real estate. Things like smart buildings, data centres, and the use of AI in property management are becoming more important. This isn't just about making buildings more efficient; it's about creating new types of real estate that meet modern demands. For example, the growth of e-commerce continues to drive demand for industrial and logistics properties, which are less prone to the ups and downs of other property types. This sector is proving to be quite resilient.

Sustainability in Investment Portfolios

There's a growing push for investments that are not only profitable but also good for the planet and society. This means looking at renewable energy projects and other sustainable infrastructure. Investors are increasingly asking about the environmental, social, and governance (ESG) aspects of their investments. This trend is likely to continue shaping how capital is allocated in the real asset space.

Long-Term Growth Prospects

Despite some bumps along the road, the long-term outlook for many real assets remains positive. Public investment in Germany, for example, is projected to increase gradually over the next few years, driven by the need for infrastructure development. While specific sectors might face challenges, the underlying demand for housing, energy, and transportation infrastructure suggests continued growth opportunities. The ability to adapt to changing economic conditions and investor preferences will be key.

The Influence of AI Adoption on Energy Needs

As artificial intelligence becomes more widespread, its impact on energy consumption is a topic worth noting. The increased demand for computing power could spur further investment in energy infrastructure, particularly in areas related to data centres and the power grids that support them. This creates a new dynamic for energy-focused real asset investments.

Corporate Confidence and M&A Activity

We've seen a pickup in merger and acquisition (M&A) activity, which often signals renewed corporate confidence. This can be a healthy sign for markets, as it validates undervalued assets and can lead to capital being recycled into new opportunities. This kind of activity can create positive momentum across various sectors, including real estate and infrastructure.

Capital Recycling and Market Catalysts

Capital recycling, where proceeds from asset sales are reinvested, is an important mechanism for market health. When deals happen, like the acquisition of Dream Residential REIT, it not only benefits the investors involved but can also set higher valuation benchmarks for similar assets. This process helps keep capital flowing and can act as a catalyst for further market performance and investment.

Investment Advice for Different Investor Types

Guidance for Long-Term Holders

For those with a long-term investment horizon, the focus should be on building a resilient portfolio that can weather market fluctuations and generate steady growth. Consider investments that offer consistent income streams and exposure to sectors with durable demand. For instance, infrastructure and renewable energy projects often provide predictable cash flows, making them attractive for patient investors. Diversification across different real asset classes, such as industrial properties and regulated utilities, can also help mitigate risks. A consistent dividend payout history is a strong indicator of a company's financial health and its ability to return value to shareholders over time.

Considerations for Short-Term Traders

Short-term traders will need to be more agile, closely monitoring macroeconomic signals and market dislocations. Events like shifts in monetary policy, stabilisation in real estate valuations, or significant infrastructure spending announcements can create trading opportunities. It's important to have a clear strategy for entering and exiting positions, and to be prepared for increased volatility. Understanding the drivers of market appreciation, whether it's driven by economic recovery or specific sector growth, is key. Be mindful of the potential for rapid price swings in less liquid markets.

The Benefits of Portfolio Diversification

Diversification remains a cornerstone of sound investment strategy, regardless of your investment style. Spreading your capital across different asset classes, geographies, and sectors can significantly reduce overall portfolio risk. For example, combining exposure to real estate ETFs with traditional fixed-income assets can create a more balanced risk-return profile. This approach helps to cushion the impact of poor performance in any single investment. European ETFs, in particular, are seeing strong inflows, suggesting a growing investor appetite for diversified, accessible investment vehicles [c586].

Pairing ETFs with Traditional Fixed Income

A common strategy for balancing risk and return, especially in volatile times, involves pairing Exchange Traded Funds (ETFs) with traditional fixed-income investments. ETFs can provide broad market exposure and diversification, while fixed income can offer stability and a predictable income stream. This combination can be particularly effective when navigating uncertain economic conditions, such as those experienced in the third quarter of 2026, which presented a balanced market environment [8f98].

Monitoring Key Economic Indicators

Staying informed about key economic indicators is vital for all investors. Data points such as inflation rates, interest rate movements, GDP growth, and employment figures can significantly influence asset prices. For example, a moderation in inflation might signal a more favourable environment for real assets. Keeping an eye on these trends allows investors to make more informed decisions about asset allocation and timing.

Understanding Dividend Reliability

For investors focused on income generation, understanding dividend reliability is paramount. Look for companies and funds with a proven track record of consistent dividend payments, ideally with a history of dividend growth. This reliability often points to strong underlying businesses with stable cash flows. Some firms have demonstrated impressive dividend streaks, offering a degree of confidence in their income-generating capabilities.

Exposure to High-Demand Sectors

Identifying and gaining exposure to high-demand sectors can be a strategic move for investors. Areas like industrial and logistics properties, driven by e-commerce growth, or renewable energy projects, supported by global sustainability trends, are often resilient. These sectors may offer more stable returns compared to more cyclical markets. Investing in funds that specialise in these areas can provide targeted exposure.

Strategic Focus on Resilient Sectors

A strategic focus on resilient sectors is advisable for investors aiming for stability. This includes areas less susceptible to economic downturns, such as infrastructure, regulated utilities, and certain segments of the real estate market like industrial and logistics. These sectors tend to exhibit steadier performance and can provide a solid foundation for a diversified investment portfolio. The "Investment Barometer 2026" indicates that tangible assets like gold, alongside funds and ETFs, are gaining trust among investors [98eb].

Finding the right investment path can feel tricky, especially when you're just starting out or have specific goals. Whether you're saving for a rainy day, planning for retirement, or aiming to grow your money over time, there's a strategy that fits you. We break down how different people can approach investing to make smart choices for their future. Ready to figure out what works best for you? Visit our website to explore tailored advice.

The Final Word: ETFs vs. Real Estate in Germany for 2026

So, where does this leave us as we look towards 2026? It’s clear that both ETFs and direct real estate investment in Germany have their own paths. ETFs, especially those focusing on specific sectors like infrastructure or global dividends, offer a way to get broad exposure without the hands-on hassle. They’ve shown resilience, even when markets get a bit choppy, and can be a good bet for steady growth. Real estate, on the other hand, is a bit more complex. While it can offer solid returns, especially in areas like logistics or utilities that are less sensitive to economic swings, it also comes with more direct risks. Things like rising costs and market shifts mean you really need to know what you're doing. For most people looking for a simpler, more hands-off approach to growing their money, ETFs might be the easier choice. But if you're willing to put in the work and understand the local market dynamics, direct property ownership could still be a winner. It really boils down to your own comfort level with risk and how much time you've got to manage your investments.

Frequently Asked Questions

What's the main difference between ETFs and real estate for investors in Germany in 2026?

Think of ETFs as baskets of many different investments, like stocks or bonds, all bundled together in one package you can easily buy and sell. Real estate is about owning physical property, like a house or an office building. ETFs offer a simple way to spread your money across many things at once, while real estate is a single, big investment in property.

Are ETFs a good way to invest in real estate in Germany?

Yes, you can! Some ETFs are designed to invest in real estate companies or property funds. This means you can get a piece of the real estate market through an ETF without having to buy a whole building yourself. It's a way to get exposure to property with the ease of an ETF.

What kind of real estate is doing well in Germany right now?

In 2026, places like warehouses and buildings for online shopping deliveries (industrial and logistics) are quite popular. Also, buildings that are in top locations and have lots of good features are in demand. Some older types of property might be losing value, so it's important to pick wisely.

Are ETFs or real estate generally riskier?

It really depends. ETFs can be less risky because they spread your money across many investments. Owning a single property can be riskier because if that one property has problems, your whole investment is affected. However, some ETFs can be very risky if they focus on very specific or new types of investments.

Is it easy to sell ETFs or German real estate if I need cash quickly?

ETFs are generally very easy to sell because they are traded on stock exchanges, like shares. Selling a physical property, like a house, can take a long time, sometimes months, and it's not always easy to get the price you want.

How do taxes work for ETFs and real estate in Germany?

Taxes can be complicated for both. For ETFs, there are taxes on any profits you make when you sell them, and sometimes on the money they pay out. For real estate, you'll pay taxes on rental income and also when you sell the property. It's best to talk to a tax expert to understand the specifics for your situation.

What are management fees and how do they differ?

Management fees are like yearly charges for looking after your investment. ETFs usually have very low management fees because they often track a market index automatically. Owning property directly means you might pay for property managers, and some real estate funds also have fees, which can sometimes be higher than ETF fees.

Can I use borrowed money (leverage) to invest in German real estate?

Yes, you can often use loans, or leverage, to buy real estate. This means you borrow money to buy a property, which can help you make bigger profits if the property value goes up. But, it also means you could lose more money if the value goes down. Using leverage with ETFs is less common for individual investors.

Which is better for making money over a long time: ETFs or real estate?

Both can be good for long-term growth. Historically, real estate in good locations has often increased in value over many years. ETFs that track broad markets have also shown strong long-term growth. The best choice depends on your personal goals, how much risk you're comfortable with, and the specific market conditions in Germany.

What are some growing areas within German real estate and infrastructure?

Besides warehouses, areas like renewable energy projects (solar, wind farms) and essential services like power and water companies (regulated utilities) are seen as stable and growing. Investing in new infrastructure, like roads or energy networks, is also a focus.

What are the biggest risks to watch out for with these investments?

For real estate, risks include rising insurance costs, property values dropping, and general economic slowdowns. For ETFs, risks can come from market ups and downs, changes in interest rates set by banks, and the specific markets the ETF invests in. It's important to spread your investments to reduce these risks.

Should I choose active management or passive strategies for my investments?

Passive strategies, often used by ETFs, aim to match the performance of a market index. Active management involves a manager trying to beat the market by picking specific investments. Some investors prefer the low cost and simplicity of passive ETFs, while others believe active management, especially in areas like real estate, can lead to better returns if done well.