ETF Investing for Expats in Germany

For many expats living in Germany, the financial world can feel like a maze of unfamiliar rules, taxes, and products. But when it comes to growing your wealth steadily and efficiently, few tools are as powerful as ETFs — Exchange-Traded Funds. They’re cost-effective, transparent, and remarkably simple to manage, even across borders. This guide explains how expats can use ETFs to build a smart, flexible investment strategy while living and working in Germany.

Note: This article is part of the Financial Hub for Expats — a resource created by Finanz2Go Consulting to help internationals master investing, retirement planning, and tax optimization in Germany.

Understanding ETFs: Simple, Transparent, and Global

An ETF (Exchange-Traded Fund) is an investment fund that tracks an index — such as the MSCI World or the FTSE All-World — giving you exposure to hundreds or even thousands of companies in a single investment. Instead of guessing which stock will perform best, you invest in the market as a whole.

This approach works particularly well for expats who want long-term growth without having to constantly monitor their portfolios. It’s passive investing — professional, disciplined, and built on data, not emotion.

- Low annual fees (often 0.1–0.3%)

- Diversification across countries and sectors

- Liquidity — buy or sell any trading day

- Transparency — holdings published regularly

All major ETFs in Europe are regulated under the EU’s UCITS framework, which guarantees strict investor protection, liquidity, and diversification standards.

Why ETFs Are Perfect for Expats

Expats often lead mobile lives — changing jobs, cities, or even countries every few years. ETFs are portable, flexible, and ideal for this lifestyle. They let you stay invested globally, regardless of where you move next, while keeping your financial plan simple and cost-efficient.

Consider this example: investing €300 per month into a global ETF such as the MSCI World with an average return of 5% annually could grow to nearly €174,000 in 25 years. That’s the beauty of compounding — small, consistent steps can lead to meaningful long-term results.

Pro Tip: Time in the market beats timing the market. Starting early, even with modest monthly contributions, makes a bigger difference than trying to pick the “perfect” entry point.

Here’s how ETFs compare to other common investment types in Germany:

| Investment Type | Average Annual Cost | Tax Efficiency | Liquidity & Flexibility |

|---|---|---|---|

| ETF Portfolio | 0.2–0.3 % | High — accumulating ETFs defer taxation | Fully liquid and adjustable |

| Active Mutual Fund | 1.5–2.0 % | Medium — frequent trading increases taxes | Less flexible, higher management costs |

| Insurance Product | 2.0–3.0 % | Good (if structured as a tax wrapper) | Limited access before maturity |

ETF Taxation in Germany

Taxes in Germany can be complex, but ETFs are relatively straightforward. Investment income is subject to a flat 25% capital gains tax (plus solidarity surcharge and, if applicable, church tax). However, part of your ETF gains may be tax-free thanks to the Teilfreistellung rule, which exempts a portion of income depending on the ETF type.

| ETF Category | Tax-Free Portion | Reason |

|---|---|---|

| Equity ETF (stocks) | 30 % | Dividends already taxed at company level |

| Mixed ETF (stocks + bonds) | 15 % | Partial exemption |

| Bond ETF | 0 % | No exemption |

For more detailed information, visit the official resources of BaFin and the German Federal Ministry of Finance. To estimate your net returns, try our ETF Saving Plan Calculator.

Getting Started with ETF Investing

Opening an ETF saving plan in Germany is simple and can be done entirely online. Most expats start small — even €25 per month — and increase contributions as income grows. Here’s how to begin:

- Choose a reputable online broker such as Trade Republic, Scalable Capital, or Comdirect.

- Select one or more global ETFs that fit your goals — for example, MSCI World or S&P 500.

- Decide your monthly contribution amount and automate your savings plan.

- Review your strategy annually using our Portfolio Risk Calculator.

At Finanz2Go, we help expats define clear investment goals and structure personalized ETF portfolios that align with risk tolerance, tax efficiency, and time horizon.

Building Wealth with ETF Saving Plans in Germany

One of the most effective ways for expats to invest in Germany is through an ETF saving plan (ETF-Sparplan). These automated investment plans allow you to buy small portions of ETFs monthly — making long-term investing simple, consistent, and affordable.

Instead of timing the market or saving up large lump sums, ETF saving plans turn investing into a habit. Most brokers offer commission-free or low-cost plans starting at just €25 per month.

Tip: The key to success is automation. Once you’ve set up your monthly ETF contribution, let it run and avoid checking your account too often. Long-term consistency beats short-term emotion.

Benefits of ETF Saving Plans

- Automatic monthly investment — no need to manually buy ETFs

- Cost averaging: buy more shares when prices are low and fewer when high

- Low entry point (as little as €25 per month)

- Accessible for residents and expats with a local bank account

- Full transparency through your broker account

You can compare potential results over time using our Investment Goal Calculator or simulate long-term growth with the ETF Saving Plan Calculator.

Accumulating vs. Distributing ETFs

When choosing ETFs in Germany, one of the most common decisions is between accumulating (thesaurierend) and distributing (ausschüttend) funds.

| Type | Description | Tax Impact | Best For |

|---|---|---|---|

| Accumulating (Thesaurierend) | Automatically reinvests dividends into the fund. | More tax-efficient for long-term growth due to deferred taxation. | Expats focused on compounding and long-term wealth. |

| Distributing (Ausschüttend) | Pays out dividends to your account. | Income taxed annually when received. | Expats seeking passive income or retirees. |

For most working professionals and younger investors, accumulating ETFs tend to perform better over time due to the compounding effect and delayed taxation. However, both structures can play a role in a diversified portfolio — for example, combining a global accumulating ETF with a dividend-distributing European ETF.

Common Mistakes Expats Make When Investing in ETFs

Even though ETFs are straightforward, many expats unknowingly make avoidable mistakes. Being aware of these can significantly improve your long-term returns and reduce stress.

- 1. Over-diversifying: Holding too many ETFs that track similar markets leads to unnecessary overlap and complexity.

- 2. Ignoring currency exposure: Global ETFs often hold USD-denominated assets. Currency fluctuations can impact euro-based investors.

- 3. Focusing only on short-term returns: Markets move daily, but successful investing focuses on years — not months.

- 4. Forgetting about taxation: Different ETF structures and residency statuses can affect how gains are taxed in Germany.

- 5. Not aligning risk with goals: A 25-year-old and a 55-year-old should not have identical ETF allocations.

Our Portfolio Risk Calculator can help you assess your ideal risk/return balance. If you’re unsure, book a free consultation with our advisors to tailor your investment strategy.

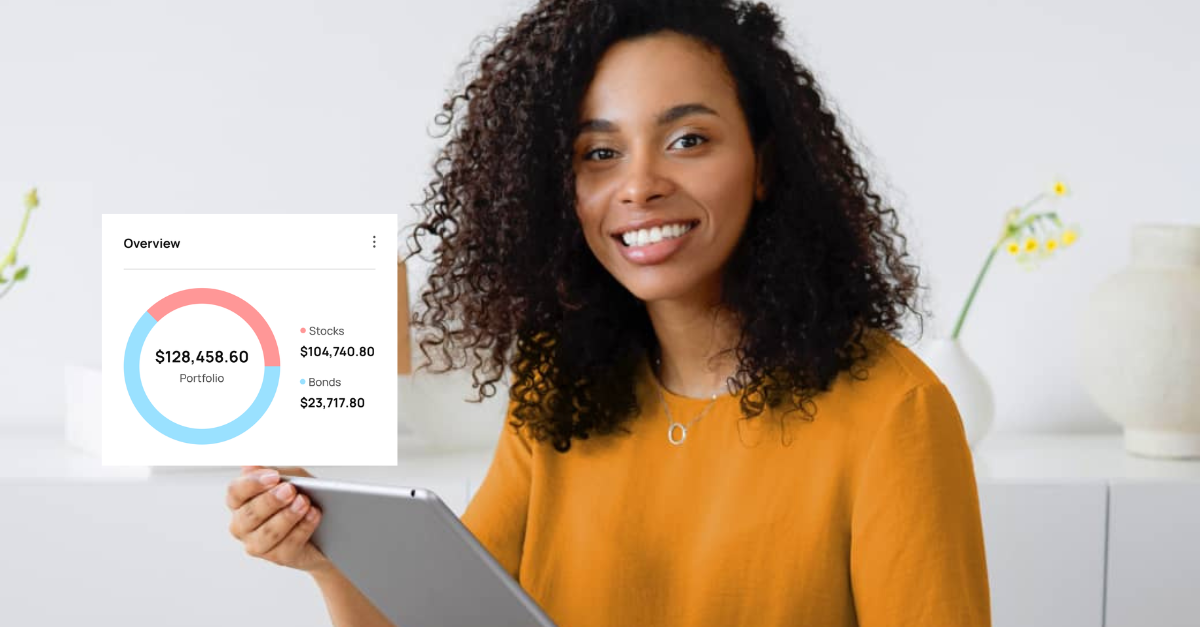

Sample ETF Portfolio Strategies

To make ETF investing more tangible, here are a few illustrative portfolio examples based on different goals and time horizons. These are not personal investment recommendations but general examples of how expats might structure their portfolios.

| Investor Profile | ETF Allocation | Investment Horizon | Goal |

|---|---|---|---|

| Young Professional (30) | 80% Global Equity ETF (e.g. MSCI World), 20% Emerging Markets ETF | 20+ years | Long-term wealth accumulation |

| Mid-Career Expat (45) | 60% Global Equity ETF, 20% European Bonds ETF, 20% Dividend ETF | 10–15 years | Balanced growth and stability |

| Pre-Retiree (55) | 40% Global Equity ETF, 40% Bonds ETF, 20% Real Estate ETF | 5–10 years | Preserve capital while earning steady income |

ETFs for these strategies can include global index trackers like the MSCI World, emerging markets through MSCI Emerging Markets, and bond exposure via providers such as iShares or Xtrackers.

Tracking and Reviewing Your ETF Performance

Once your ETF portfolio is set up, it’s important to monitor progress — but not obsess over it. Quarterly or semi-annual check-ins are usually sufficient to make sure your allocations still fit your goals and market conditions.

- Use our Financial Tools page for calculators and portfolio tracking ideas.

- Review your investment statements at least once a year.

- Rebalance your ETF allocations if one category grows disproportionately.

- Stay updated with market trends through reliable sources like Morningstar or Deutsche Börse.

At Finanz2Go, our goal is to simplify this process for you — helping expats make informed, evidence-based investment decisions that lead to long-term financial independence.

Advanced ETF Strategies for Expats in Germany

Once you understand the basics, it’s worth exploring how to optimize your ETF portfolio for your specific financial situation as an expat. This includes managing taxation, rebalancing strategically, and aligning investments with your long-term goals or ethical preferences.

Tax Optimization

Because Germany applies a 25% flat capital-gains tax, optimizing your ETF structure can save thousands over time. Consider these tax-efficient strategies:

- Prefer accumulating ETFs to benefit from compounding before taxation.

- Hold ETFs under your personal allowance (Sparer-Pauschbetrag), currently €1,000 per person (€2,000 for married couples).

- Invest via a German brokerage account to ensure automatic tax reporting and simplified declarations.

- Review double-tax treaties if you plan to move abroad — Germany has agreements with more than 50 countries (official list).

Tip: Use Finanz2Go’s Pension Gap Calculator and Investment Goal Calculator to see how tax-efficient ETF savings align with your retirement targets.

Sustainable and ESG ETF Investing

Many expats want to grow wealth responsibly by investing in companies that meet high environmental, social, and governance (ESG) standards. Sustainable ETFs make this possible without sacrificing diversification or performance.

Popular ESG indices include:

These ETFs exclude controversial industries, emphasize renewable energy and diversity, and remain fully transparent. Germany’s regulator BaFin provides strict guidelines for ESG labeling to avoid “greenwashing.”

Finanz2Go can help you integrate ESG-compliant ETFs into your broader financial plan, balancing sustainability with long-term returns.

Frequently Asked Questions (FAQ)

How do I start investing in ETFs as an expat in Germany?

Open an account with a regulated broker, select one or two diversified ETFs (for example, MSCI World or S&P 500), set up a monthly saving plan, and automate contributions.

You can compare options using the Finanz2Go Tools section.

Are ETFs safe?

Yes. UCITS-regulated ETFs are segregated from the provider’s balance sheet, so even if a fund company fails, your assets remain protected under EU law.

Can non-EU citizens invest in ETFs in Germany?

Absolutely. As long as you have a German tax ID and bank account, you can open a brokerage account and invest in ETFs. Some brokers may require residence documentation.

Are ETF gains taxed when I move out of Germany?

Normally yes, until you become tax-resident elsewhere. Check the double-tax treaty between Germany and your next country for specific exemptions or credits.

What’s the best ETF for expats?

There is no universal “best.” A simple, globally diversified ETF such as MSCI World or FTSE All-World is suitable for most expats seeking long-term growth.

The optimal choice depends on your income, goals, and risk profile — all of which Finanz2Go advisors can help define.

Putting It All Together

ETF investing gives expats in Germany a straightforward path to financial independence — combining global diversification, low costs, and long-term stability. With a well-structured plan and consistent contributions, you can build real wealth while focusing on your career and life abroad.

For professional support, book a free consultation with one of our English-speaking financial advisors. We’ll help you choose the right ETFs, optimize taxation, and integrate your investments with your retirement and insurance strategy.

Return to the Financial Hub for Expats