Step 1 — Understanding Your Goals

Every successful financial plan begins with clarity. During our first online meeting, we focus entirely on understanding your goals, priorities, and lifestyle as an expat in Germany.

Book an appointmentStep 2 — Data Collection & Analysis

Once we understand your goals, we move into structured data collection. All information is handled under strict GDPR compliance, ensuring privacy and security.

Read ReviewsStep 3 — Personalized Financial Strategy

After analysing your data, our experts design a custom financial strategy built around your objectives and tolerance for risk.

Book an appointmentStep 4 — Digital Strategy Presentation

Once your personalized plan is ready, we schedule a live online session via video call to present your complete financial roadmap.

Book an appointmentStep 4 — Digital Strategy Presentation

Once your personalized plan is ready, we schedule a live online session via video call to present your complete financial roadmap.

Book an appointmentStep 5 — Implementation & Ongoing Support

Once you’re comfortable with your personalized strategy, we help you implement every element seamlessly

Our Digital Consulting Process for Expats in Germany

Finanz2Go Consulting provides a modern, transparent, and fully digital approach to independent financial consulting for expats across Germany. Our goal is simple: make high-quality financial advice understandable, accessible, and efficient—without hidden costs or complex jargon.

In a country known for strong regulation and a variety of financial products, expats often struggle with questions like:

- 💶 How can I invest efficiently under German tax laws?

- 🧓 Will my pension be enough when I retire?

- 💼 Which insurance policies are necessary—and which are optional?

That’s why we developed the Finanz2Go 5-Step Digital Consulting Process—a structured system combining human expertise with smart digital tools. It’s designed for clarity, flexibility, and long-term success.

Why Our Digital Consulting Process Works

Our consulting process brings together the advantages of BaFin-regulated transparency and cutting-edge digital convenience. Every stage—from your first online meeting to the implementation of your plan—is focused on your goals, not on selling financial products.

- ✅ Independent: We are fee-based advisors, not product brokers.

- 📊 Data-driven: Each recommendation relies on quantitative analysis.

- 🌍 Tailored for expats: All calculations follow German regulations but are explained in English.

- 💡 Holistic: Covers investments, pensions, and insurance within one coordinated strategy.

Before we dive into each step, you can preview related resources:

Step 1 — Understanding Your Goals

Every successful financial plan begins with clarity. During our first online meeting, we focus entirely on understanding your goals, priorities, and lifestyle as an expat in Germany.

Examples of what we explore together:

- 🏡 Do you plan to stay long-term in Germany or move abroad later?

- 🎯 What financial milestones matter most—property purchase, education fund, or early retirement?

- 🧭 How comfortable are you with investment risk and market volatility?

This conversation is not about numbers; it’s about you. Only after understanding your personal and professional situation do we begin designing the financial framework.

Tip: Before this meeting, use our Investment Goal Calculator and Portfolio Risk Calculator to clarify your expectations.

By aligning your financial aspirations with measurable outcomes, we ensure that your strategy reflects your real-world needs—not generic benchmarks.

Step 2 — Data Collection & Analysis

Once we understand your goals, we move into structured data collection. All information is handled under strict GDPR compliance, ensuring privacy and security.

We gather and analyze:

- 💶 Current income, savings, and investment holdings

- 🏦 Existing pension entitlements in Germany or abroad

- 🛡️ Current insurance coverage and potential overlaps

- 💳 Tax residency status and fiscal optimization opportunities

Using proprietary modeling and official assumptions from Destatis and the European Central Bank, we calculate realistic projections of your future wealth and risk exposure.

This quantitative foundation allows us to identify:

- 🔍 Pension or insurance gaps

- 📉 Inefficient investment allocations

- 💰 Tax-optimization opportunities (e.g., Teilfreistellung on equity ETFs)

- ⚖️ Liquidity management improvements

At this stage, we often connect clients to our specialized calculators for cross-checking numbers:

These tools make the process transparent—you can verify every figure yourself.

Step 3 — Personalized Financial Strategy

After analysing your data, our experts design a custom financial strategy built around your objectives and tolerance for risk. This step translates insights into a clear, actionable plan—covering investments, pension planning, and insurance protection.

Our approach is both analytical and personal: we combine quantitative modelling with qualitative understanding of your goals. Each recommendation includes detailed reasoning and transparent cost comparison.

- 📈 Investment Strategy: Portfolio allocation across ETFs, funds, and other BaFin-approved instruments.

- 🧓 Pension Optimization: Balancing statutory, occupational, and private pension layers.

- 🛡️ Risk Management: Aligning insurance policies with genuine financial needs—avoiding overlap.

- 💰 Tax Efficiency: Using Germany’s Abgeltungsteuer structure and ETF partial exemptions for better net returns.

Every plan comes with a transparent overview of fees and expected results. We use the Fee Transparency Tool to show the impact of different service models—helping you make informed, confident choices.

Case Study: International Professional in Frankfurt

Alex, 36, from Australia, works as a consultant in Frankfurt. He wanted to balance savings for a home purchase with long-term retirement investing. After analysing his salary, tax status, and company pension, our model recommended:

- 60 % equity ETF exposure through a global savings plan

- 20 % German pension contribution optimization

- 20 % liquidity reserve in euro-denominated bonds

This approach created a realistic pathway to financial independence—without unnecessary risk or excessive fees. Alex now tracks his progress using our Investment Goal Calculator every six months.

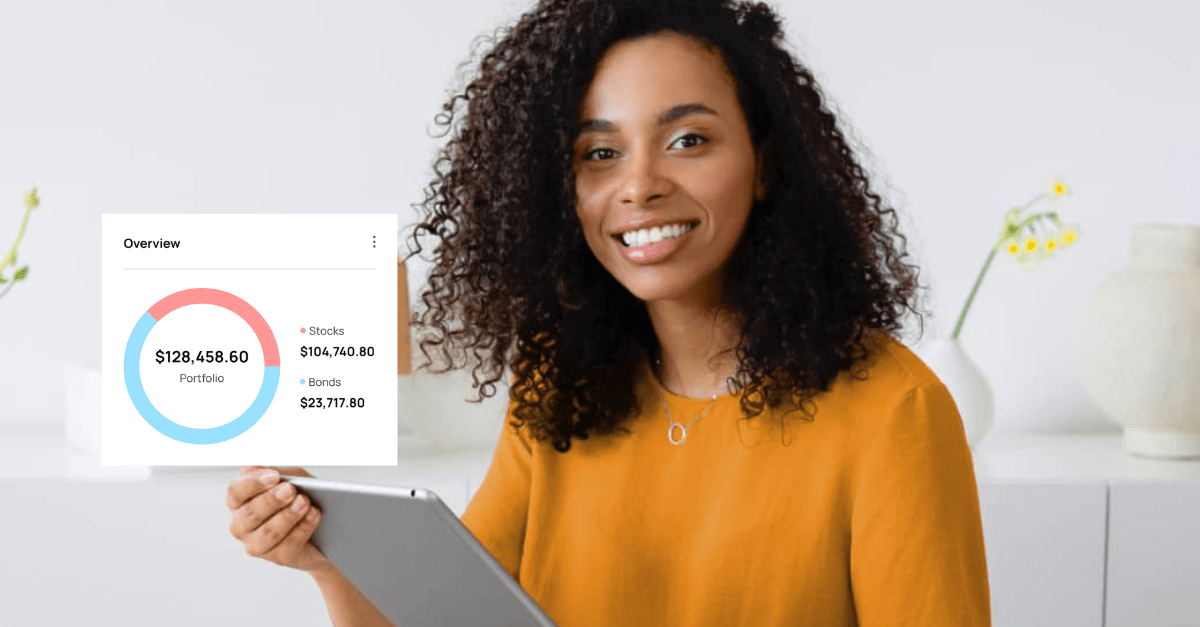

Transparent, Measurable Results

Your personalized strategy includes clear KPIs: expected annual returns, volatility range, and projected portfolio growth. These benchmarks allow continuous monitoring through our digital client portal, powered by secure cloud-based analytics in line with GDPR and BaFin standards.

Pro Tip: Re-evaluate your plan once a year using the Portfolio Risk Calculator to stay aligned with changing markets or career moves.

Step 4 — Digital Strategy Presentation

Once your personalized plan is ready, we schedule a live online session via video call to present your complete financial roadmap. This stage ensures full understanding before any implementation.

During this meeting, we walk you through:

- 📊 Your portfolio projection and retirement gap analysis

- 📑 Tax and cost transparency summary

- 📆 Implementation timeline

- 💬 Open Q&A about assumptions and product details

Every report includes visual charts and scenario analyses illustrating best- and worst-case outcomes. We believe in data transparency, so you’ll see exactly how numbers are calculated.

Educational Approach

Finanz2Go emphasizes financial literacy—helping clients make informed decisions rather than simply following recommendations. We link to independent resources such as:

By combining local expertise with global knowledge, we ensure every expat client understands both the German framework and the international context of their finances.

Interactive & Paperless

All presentations are 100 % paperless. You’ll receive secure access to your personalized dashboard—containing:

- Your financial plan (PDF + interactive version)

- Simulated ETF and pension projections

- Access to relevant calculators for updates

- Direct scheduling link for review meetings

This digital structure reduces complexity and environmental footprint while allowing faster updates and remote access from anywhere in the world.

Step 5 — Implementation & Ongoing Support

This is where your financial plan becomes reality. Once you’re comfortable with your personalized strategy, we help you implement every element seamlessly — from investment setup to pension optimization and insurance alignment.

Our implementation process is 100 % digital, paperless, and compliant with German financial regulations. We coordinate with licensed partners and institutions to execute all agreed steps efficiently, while you stay fully in control.

What Happens During Implementation

- 📄 Setting up or optimizing ETF saving plans with BaFin-regulated providers

- 🏦 Adjusting pension schemes (private and occupational)

- 🛡️ Aligning insurance protection with your income and family situation

- 💶 Ensuring all financial actions meet German tax and reporting standards

Our digital platform ensures every transaction is secure and traceable. You’ll receive real-time updates through our encrypted client dashboard.

Ongoing Monitoring & Annual Review

Financial planning doesn’t end once a portfolio is created—it evolves with you. Markets change, regulations shift, and your personal goals may grow. That’s why Finanz2Go offers continuous portfolio and pension monitoring as part of our long-term service model.

Each year, we perform a full review of your progress:

- 📈 Investment performance vs. plan targets

- 📉 Adjustments for inflation or tax changes

- 🧭 Updates to your retirement projections

- 🔁 Risk rebalancing based on age and market cycle

Using tools like our Portfolio Risk Calculator and Pension Gap Calculator, we help you stay aligned with your evolving goals.

Transparent Communication

We believe transparency builds trust. Throughout our relationship, you’ll have ongoing access to your dedicated consultant via video call or secure chat. All advice remains independent, commission-free, and in plain English—so you always know exactly what’s happening with your finances.

If you move to another country or start a new job, we adapt your plan accordingly, ensuring your asset management and pension planning continue without interruption.

Frequently Asked Questions

How long does the Finanz2Go consulting process take?

Most clients complete the full process within 2–3 weeks, depending on complexity and document availability.

Is the process suitable for expats outside Germany?

Yes. We provide online consulting for residents and remote expats planning to move to or invest in Germany.

Are meetings held in English?

Absolutely. All consultations and documents are available in English, making the process simple for international clients.

How often will my financial plan be reviewed?

We recommend a yearly review, but clients can schedule additional check-ins anytime via our Calendly link.

What makes Finanz2Go different from other consultants?

We combine independent advice, expat specialization, and advanced digital tools—offering a holistic, transparent approach that fits the global lifestyle of our clients.

Ready to Start Your Financial Journey?

Every expat deserves clarity and control over their financial future in Germany. Our consulting process empowers you with structured guidance, transparent numbers, and personal accountability.

Whether you’re optimizing your pension, building an ETF portfolio, or improving insurance coverage—our five-step process ensures every decision is based on facts, not assumptions.

Prefer to explore first? Visit our Financial Hub for Expats or try our Financial Tools to calculate your investment potential.